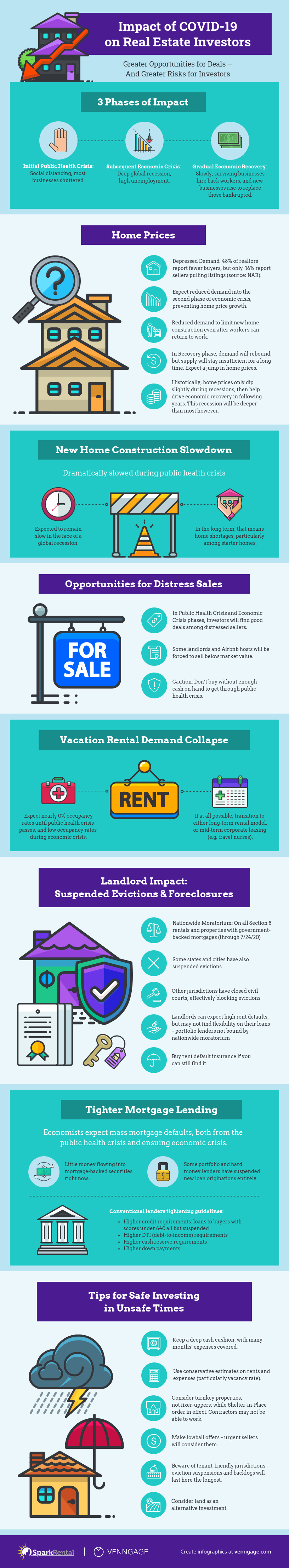

As the coronavirus continues rattling investors and shuttering businesses around the world, people keep asking me the same question over and over: What will the impact on real estate be?

Because no one knows how long the global pandemic will last, no one can know how long businesses like hotels and airlines and restaurants will suffer. Or, therefore, how long any recession or downturn will last.

Even so, real estate is inherently far more stable than stocks. Because it’s much less liquid – it takes months to sell a property, not fractions of a second – it can’t gyrate wildly in value like stocks.

And even more relevantly to real estate investors, people still need housing even in a recession. They don’t need to hold onto their stocks.

As you mull over your next financial move in this moment of fear, keep two truths in mind. First, real estate is a long-term investment. Second, as Warren Buffett so frequently reminds us, “Be fearful when others are greedy and greedy when others are fearful.”

The last time people were this financially fearful was the Great Recession. Which created the greatest buying opportunity in the modern era, for both stocks and real estate.

Infographic courtesy of Venngage Infographic Maker

Would your readers enjoy this infographic on the impact of COVID-19 on real estate? Click here for the embed code.

Share this Image On Your Site

Please include attribution to SparkRental with this infographic.The Risk of Recession

Before diving into some of the economic forces impacting real estate investors during the coronavirus pandemic, the elephant (or bear) in the room is the risk of global recession.

Economists surveyed by The Wall Street Journal lowered their economic forecasts for 2020. Most foresee at least two quarters of contraction, which meets the definition of a recession. Many expect a deep, prolonged global recession.

We’re already seeing the impact. The travel industry has been slammed, with airlines cutting route coverage, hotels cutting employee hours, and many hourly employees being let go. The hospitality and entertainment sectors have seen similar pain, with theaters closing, concerts canceling, and restaurants and bars closing and letting most staff go. Most gyms have shuttered.

Business owners are struggling to make their rent payments, as are cut or reduced employees. Which means their landlords will struggle to make their mortgage payments.

But this isn’t 2008. The underlying fundamentals of the economy were strong leading up to the pandemic, with unemployment nearing record lows and corporate profits pushing record highs. Banks have more liquidity than they did in 2008. Americans hold less relative household debt: 96% of gross domestic product, compared to 134% in 2008.

Still, havoc in a few sectors of the economy inevitably spill over into others. If one group of businesses and employees suffers, they stop spending and investing in other areas too.

Ultimately the recession risk comes down to how long the pandemic wave takes to crest and crash. If it passes within a few months, the economy should bounce back quickly. It drags onward through the summer and into the fall, expect considerably more economic damage.

Actionable Advice: Tighten your personal spending to boost your savings rate. In times of economic crisis, you want more cash on hand. That cash serves two purposes: first, it pads your emergency fund to protect against shocks like job loss. Second, it positions you to buy assets at a discount, in the midst of panic selling and distressed sales.

Home Prices During the COVID-19 Outbreak

As more sellers and prospective homebuyers feel the pinch of the epidemic, savvy investors should look for opportunities to find good deals on investment properties.

In the short term, home prices will likely dip nationwide, both in the initial public health crisis and the ensuing economic crisis. Already, far more buyers have pulled out of the market than sellers, tilting the balance of supply and demand. With fewer buyers and not a few urgent sellers, expect downward pressure on prices.

Beyond the market potentially slipping as a whole, investors should see better off-market deal opportunities during the crisis. The best deals on real estate come from distressed sellers, based on the “three D’s”: defaults, divorces, and deaths. The latter two certainly won’t slow down during the pandemic. And defaults? You can expect plenty more of those.

Use a software tool like Propstream to identify distressed sellers from divorces, foreclosures, tax liens, and estate sales. If you’ve always wondered how to buy foreclosures, now is as good a time as any to learn…

As more people look to boost their cash holdings, more property owners will become open to selling. Use strategies like driving for dollars to find owners especially open to taking a lowball offer and just cashing out.

Expect tourist towns to take a particularly hard hit real estate-wise. Areas that rely heavily on tourism and hospitality have already been hammered, creating a huge buying opportunity. With local businesses struggling and workers seeing slashed paychecks, expect to see more defaults. Local vacation rental owners and Airbnb landlords are suffering major losses as well, making them more likely sellers. These towns may see home prices drop quickly.

Finally, note that housing starts declined in February, before COVID-19 was even a major concern in the US. In March, they plummeted 22% nationwide per CNN. Expect them to drop even further in second quarter, choking supply, especially for starter homes. In the mid- and long-term, expect home values to rebound sharply after the public health and ensuing economic crises pass and the economy starts rebuilding. The US will miss months of new housing supply in 2020!

Actionable Advice: Identify distressed sellers who need to sell urgently. While overall home prices may or may not eventually dip, you should see more opportunities for off-market distressed sales.

Focus on the Fundamentals – In Crisis More than Ever

Remember, rental properties are a long-term investment. Score a good deal once, and enjoy the ongoing passive income forever.

Or buy a bad deal and suffer until you eventually sell for a loss.

Times of crisis make an excellent opportunity for buying long-term investments. It goes for stocks, and it goes for rental properties.

First and foremost, focus on cash flow. Learn how to predict a rental property’s cash flow, and get comfortable using a rental cash flow calculator to forecast returns. If you master that skill, you’ll never buy a bad deal on a rental property.

Second, think holistically about the markets where you invest. The coronavirus pandemic highlights exactly why you only want to invest in markets with diverse economies. If you invest in a steel mill town that loses its steel mill, you’re screwed. If you invest in a tourist town that relies solely on the hospitality industry, what happens when tourism dries up?

Look for cities with strong job growth, population growth, and diversified economies. When we run the numbers each year on the best cities for real estate investing, we don’t just look at cap rates – we look at economic fundamentals.

Actionable Advice: As you look for deals, avoid “widow-makers” – deals that could end up losing you money based on a single risk. For example, if the deal only generates positive cash flow as a vacation rental – but not as a long-term rental – then it becomes a losing deal if the local city government bans Airbnb, or the town loses its cachet as a hot destination. Or, of course, when a global pandemic halts all travel.

Mortgages, Loans, Leverage

Mortgages, Loans, Leverage

On the one hand, the Federal Reserve has cut interest rates to basically 0%. That’s driven mortgage interest rates lower, making it cheaper to borrow an investment property loan.

Cheaper, but not necessarily easier. After refinance applications soared roughly 225% in February, mortgage lenders tightened their criteria. They tightened loan standards because they can, in the face of all that demand, but also because investors are nervous to part with their cash in all the pandemonium and panic. Remember, most mortgage lenders don’t keep those loans on their books. They sell the loans to large, institutional investors.

As you look to buy real estate over the next few months, prepare for tighter lending standards. You may need a larger down payment, higher credit scores, or better-performing rental deals to qualify for a mortgage.

Actionable Advice: Set aside as much cash as you can for investing, consider alternate funding sources like unsecured business credit lines through Fund & Grow, and work on improving your credit. None of the portfolio lenders we work with are issuing landlord loans right now, although Lending Home is still originating short-term purchase-rehab loans.

Be careful not to overleverage yourself, especially if you structure your deals with the BRRRR method to minimize your cash investment.

Vacation Rentals

As touched on above, it’s a terrible time to own vacation rentals. Airbnb landlords have seen mass cancellations, as the whole world suspends their travel plans.

But just because they don’t have any revenue doesn’t mean they don’t have expenses. Vacation rental owners still need to pay their mortgages, to cover the costs of maintenance, repairs, property management, insurance, property taxes, and every other expense that comes with owning rental real estate.

The travel and hospitality industries will rebound, of course. People will resume traveling. But not within the next few months, and even after the pandemic passes, expect tourism to recover gradually, not overnight.

Which leaves vacation rental owners in a real bind. Not many can afford to keep paying their expenses for the next six months, with only minimum occupancy. So what are Airbnb landlords to do?

Actionable Advice: In many markets, Airbnb landlords can simply switch their business model. They can sign traditional long-term lease agreements, potentially even leaving the units furnished.

Alternatively, they can switch to a mid-term furnished corporate housing model. Believe you me, travel nurses are in higher demand than ever, and need places to live!

Of course, not all vacation rental owners can switch business models so easily. In towns where tourism dominates the economy, landlords may struggle to fill vacant units with traditional tenants or corporate renters. But get creative with it, and look for alternative uses for your property. Perhaps you can temporarily convert it to affordable housing for those who lost their jobs, subsidized by the local government. Or, if you’re telecommuting at the moment, perhaps you could move into the property yourself, freeing up your home to rent out to long-term or mid-term corporate renters.

(article continues below)

Suspended Evictions & Foreclosures

The CARES Act suspended all evictions and foreclosures at properties with government-backed mortgages nationwide, for a 120-day period beginning March 27 and ending July 24, 2020.

That includes all properties with FHA, VA, and USDA mortgages, and loans owned or serviced by Fannie Mae and Freddie Mac. In other words, the overwhelming majority of conventional mortgages. However the moratorium does not apply to portfolio loans, private loans, or commercial loans, which many landlords use to finance rental properties.

The CARES Act also suspended evictions for Section 8 tenants and landlords taking the Low-Income Housing Tax Credit (LIHTC).

Many states and counties have also suspended evictions. In most cases, landlords can’t even serve an eviction notice, which means they can’t even lay the groundwork to start the eviction process. In many states rent court sessions have also ceased, so even in some jurisdictions that haven’t expressly suspended evictions, landlords can’t schedule the court hearing and thus still can’t complete evictions.

Thus, there is no legal recourse, no consequences that landlords can enforce when a tenant fails to pay rent. Yet there are consequences if the landlord fails to make their mortgage payment, with many landlords still subject to foreclosure if they default.

Real Estate Investors Have Control Over Their Returns

One of the major differences in real estate versus stocks is that real estate investors keep control over their investments. When you buy a stock, you hope for the best based on historical performance. You have exactly one recourse if you don’t like the returns: sell your shares.

Real estate investors can improve the property to attract better tenants and raise rents (not that we would recommend raising rents in this exact moment). They can modify their tenant screening practices to place better tenants. For example, at this moment landlords could opt to rent only to those in industries largely unaffected by the coronavirus, such as healthcare, IT, and ecommerce.

Landlords can also protect against rent defaults through rent default insurance. If the tenant stops paying rent, the insurance company starts paying it, until you replace them with a rent-paying tenant.

Actionable Advice: Tighten your tenant screening standards. Look for stable applicants with jobs not likely to suffer from the outbreak. As always, choose tenants most likely to stay long-term, as turnovers are where landlords lose the most money and time.

If you learn that your contractors are out of work, consider using this opportunity to make property upgrades and repairs. Now could make the perfect time to negotiate with contractors for better rates!

Final Thoughts

Stock and real estate investors alike should buy when others panic, to move opposite the herd mentality. If you’re looking for places to invest money during the pandemic, the COVID-19 crisis offers opportunity, not just damage and risk.

It’s caused major disruptions and a stock market crash, but not based on economic fundamentals. Analysts liken it more to a natural disaster – an external event that impacts the market temporarily.

As such, many economists believe the impact will be sharp but short. With the massive economic and social initiatives being taken around the world, I remain optimistic that the pandemic will largely pass by the end of the summer. It will leave plenty of economic damage in its wake, but the world will rebuild.

In other words, it makes an excellent buying opportunity, for investors willing and able to hunt for bargain properties.

How do you see the coronavirus impacting real estate? What do you plan to do about it, if anything?

More Unconventional Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Great coverage of the impact of the coronavirus on real estate investors and landlords! This has been on my mind a lot over the last few weeks (and probably every other landlord and real estate investor, too).

We live in strange times!

Thanks Allison, and ain’t that the truth that we live in strange times!

Good tips! I watched your last coverage about these events on your page and you mentioned what you mentioned here as well. Buy when others are not.

I agree when it comes to stocks to buy when others panic. There has been a lot of fear in stocks lately and for good reason but that does not mean pull out and stop investing.

Thanks Rich! And yeah, when others panic is the perfect time to buy. My personal plan involves dollar cost averaging extra money each week into stocks over the next three months. Also hoping to pick up an investment property, although that comes with some extra challenges at the moment, as outlined above.

You guys always take a wide-angle view on real estate investing and markets. Always appreciated that.

I’m setting aside some extra cash during the COVID-19 crisis for investing, hoping to pick up at least one new investment property!

Thanks Theo! Keep us posted on how we can help!

Very informative and simple info graphic. Loved it!!! I am considering in making a rental investment purchase but will wait to have a little more cash but hopefully purchase before demand increase. Thanks for the information.

Glad you found it useful Deeandrea, and keep us posted on how we can help!

These info graphics make conceptualizing the impact of the virus much easier to grasp. I’m curious what more long-term opportunities will arise? Lots of foreclosures down the road? It is tough to tell in the short-term sometimes. Will keep reading these!

I think in the short term there are opportunities for distressed sales, and among sellers who need to sell immediately, even if it means accepting a lowball offer. In the medium term I do think we’ll see a wave a of foreclosures as well.

Just be careful not to overextend yourself!

Cheers,

Brian

Nice infographic. For me if the tighter lending criteria and a price downturn happen it will create great opportunities to buy houses subject to the existing financing. More people will be upside in their mortgage so the subject to offer will help them get out from underneath it and you can then lease option it to homeowners who can’t get financing.

Way to bring a creative approach Steve!

Great observations!

“Be fearful when others are greedy and greedy when others are fearful.” this is the line investors should follow.

We are in a bad phase, so we investors should think properly before investing.

Yeah home prices have skyrocketed this year, makes investing in real estate a tricky proposition right now.

Very informative and simple info graphic. Thanks for the valuable information

Thanks Ryan!