The Big Picture On Fair Housing Lawsuits:

-

- There’s a notable increase in fair housing lawsuits across the nation, reflecting heightened vigilance and readiness to challenge discriminatory practices within the housing sector through legal avenues.

- Recent legislative changes and regulatory adjustments significantly influence these trends. Changes in the legal framework, both at the federal and state levels, play a pivotal role in shaping the landscape of fair housing litigation.

- There’s a critical need for landlords and property managers to stay informed and compliant with fair housing laws. Failing to adhere to these regulations not only poses legal risks but also carries substantial financial repercussions.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Here’s a pop quiz: is it illegal to reject applicants because they have a criminal record?

There was a time that the answer to that question was fairly cut and dry: it was left to the landlord to decide.

Those days are long gone.

No one thinks they’re violating Fair Housing laws. Even now, you’re probably sitting there thinking, “Me? I would never discriminate; I’m open-minded and tolerant!”

And yet, 2022 saw the highest number of Fair Housing lawsuits ever. Have American landlords suddenly become intolerant bigots?

Of course not (although I’m sure there are some out there).

However, Fair Housing laws are extremely complex and easily violated inadvertently.

Fair Housing Discrimination Complaints Explained

The Fair Housing Act covers a lot of ground, but when it comes to discrimination, there are seven protected groups that landlords need to consider.

| Protected Class | Description |

|---|---|

| Race | Protection against discrimination based on race, ensuring all individuals are treated equally in housing opportunities regardless of their racial identity. |

| Color | Protection against discrimination based on skin color, ensuring individuals are not treated differently due to the color of their skin. |

| Religion | Protection against discrimination based on religious beliefs, allowing individuals to choose housing without bias toward their religious practices or affiliations. |

| National Origin | Protection against discrimination based on a person’s country of origin or ethnic background, ensuring equitable treatment in housing regardless of national ties. |

| Sex | Protection against discrimination based on sex, including gender identity and sexual orientation, promoting equality in housing irrespective of gender or orientation. |

| Disability | Protection against discrimination for individuals with disabilities, mandating reasonable accommodations in housing and access to facilities. |

| Familial Status | Protection against discrimination towards families with children under 18, including pregnant women, ensuring families can secure housing without bias. |

This may all seem straightforward. Yet tenants can sue their landlords for oh so many reasons.

For example, advertising a property with explicit language that excludes certain races is an immediate violation.

But, say, a landlord runs a rental property predominantly occupied by a specific race, not because of racial profiling but because that’s just how it ended up.

Then, an applicant of another race applied and was denied for failing the credit score screening. This rejection could potentially cause the applicant to initiate a lawsuit.

Does that sound too much like fantasy to you? Believe me, it happens.

Nationwide Crackdown

HUD means business; over the last five years, rental discrimination lawsuits and cases have dramatically increased. They want to make very public examples of people and send a stern message. More than ten years ago, they even released a mobile app to make it easier for renters to report cases of discrimination.

In 2022, cases revolving around disability made up most of the complaints, clocking in at 53.26%.

The US experienced a rollback in fair housing protection under the previous administration, although certain steps have been taken to put protections back to where they were. These changes could explain the notable 5.78% rise in fair housing lawsuits (or at least it could explain it better than thinking that a lot more people have become racists after the pandemic.)

Additionally, the rise of algorithm-based screening has ruffled some feathers. Just last year, a screening solution named SafeRent came under fire as a lawsuit claimed that its algorithm was causing (or encouraging) discrimination by unfairly favoring certain races in its results.

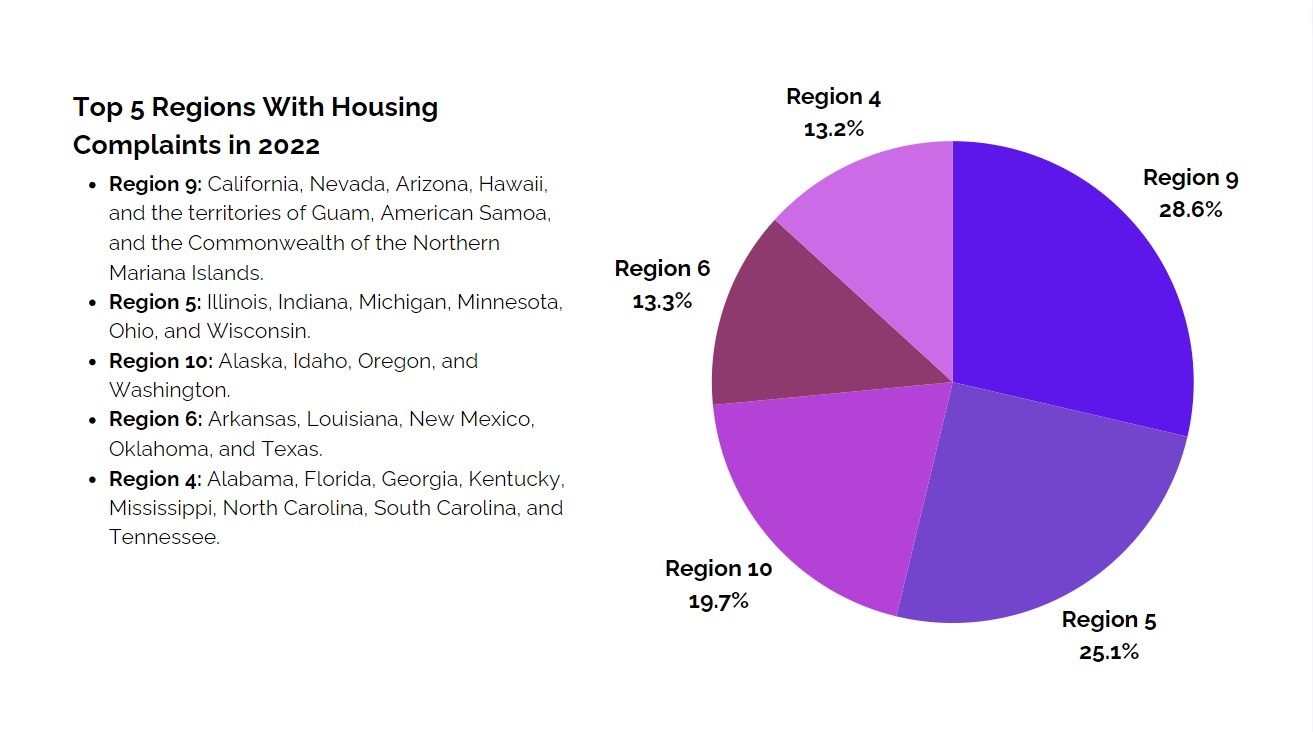

Cases By Region

Source: National Fair Housing Alliance’s 2023 Fair Housing Trend Report

HUD processes cases by region, so we have a rough idea of where all the lawsuits are happening.

In 2022, California, Nevada, and Arizona (HUD Region 9) had the largest number of fair housing complaints. This is followed by Minnesota, Wisconsin, Michigan, Illinois, Indiana, and Ohio (Region 5) and then Alaska, Idaho, Oregon, and Washington (Region 10).

Certain states and regions may have different laws that complement the FHA. California, for example, has the Fair Employment and Housing Act, which notably extends tenant protections and may cause elevated complaints.

Now, I’ve mentioned that discrimination suits are predominantly rooted in disability complaints, which is true for all regions above. The next two reasons are race and gender. Landlords need to be especially careful when conducting business pertaining to these protected groups.

Examples Of Fair Housing Lawsuits

The cases are not black and white (no pun intended), as most landlords assume. In a 2016 ruling, a property manager in Colorado was found guilty of discrimination because she tried to place tenants with children toward one end of the apartment complex and tenants without children in a different building.

The property manager had received many complaints from an older tenant about the noise caused by the family below her. When the family moved out, the manager tried to mollify the older neighbor by finding renters without children for the neighboring unit. She showed units in another building to prospective renters with children.

Hardly the stereotypical, frothing-at-the-mouth bigot.

In another case, a Pennsylvania property management company was indicted because it didn’t like to put tenants with children in one of its buildings, which had high stairs and minimal guardrails. For safety reasons, it put renters with children in other buildings with fewer obvious hazards.

The verdict? Also found guilty of discrimination.

Caution! Achtung! Cuidado!

By now, it should be growing clear that Fair Housing laws are not clear, obvious, or intuitive. Tolerant, everyday people like you and I can easily run afoul of them.

You can even be found guilty of discrimination for simply choosing not to renew a lease agreement. A Connecticut landlord did this last year—they opted not to renew a lease to a family and were sued successfully for $15,000.

Children can be noisy. They can play on the stairs, equipment, and common areas, getting hurt easily and often. They can eat paint chips and spark lead paint lawsuits. Or can draw all over the walls, carpets, and flooring or even break holes in the walls. They can also infuriate other tenants and cause complaints. In other words, they can be terrible occupants.

But you can’t discriminate against families with children or any of the other protected classes.

It doesn’t matter how many neighbors and other tenants complain; you can’t deny rental applications of families just because they have children. You can’t segregate families into different rental units. Nor can you charge higher rent. You can’t even collect a higher security deposit.

Legal Options

So, what can landlords and property managers do? There are a few things to implement on a widespread scale, such as:

| Strategy | Description |

|---|---|

| Use Standardized Screening Criteria | Apply the same set of rental criteria to all applicants, such as credit scores, rental history, and income verification. |

| Avoid Discriminatory Advertisements | Ensure that language in housing advertisements does not suggest preference or limitation based on protected classes. |

| Regular Fair Housing Training | Provide training for all employees on fair housing laws and updates to ensure compliance and awareness. |

| Keep Detailed Records | Maintain records of all tenant interactions and applications to defend against potential claims of discrimination. |

| Implement Reasonable Accommodations | Understand and fulfill legal obligations to provide reasonable accommodations for individuals with disabilities. |

| Review Policies Regularly | Periodically review and update rental and management policies to ensure they comply with fair housing laws. |

Additionally, you can charge higher rent for pets and a higher security deposit if the tenants have pets. That higher security deposit will help cover damage caused by the pets. Beware, however, that no extra fees or higher rent are permitted for service and assistant animals.

Landlords can require that rent payments be deducted from the tenant’s paycheck every two weeks to ensure on-time, in-full rent payments.

You can (and should) aggressively screen all applicants, from eviction history reports to credit reports to criminal reports. You should also verify their employment, income, and housing history.

However, even criminal history has limitations, as mentioned above.

Final Thoughts

Ultimately, landlords need to take a holistic view when screening tenants, taking everything into account and keeping records of why they rejected or accepted each rental application.

And remember: we were all children once, and we caused plenty of ruckus in our day. You don’t have to lease to every family that applies, just like you don’t have to lease to every ex-con. But you have to be prepared to justify every leasing decision with facts like credit history, eviction history, income, housing history, and the like.♦

Have you noticed an uptick in Fair Housing lawsuits in your city? What are your concerns, about HUD’s aggressive enforcement of Fair Housing laws?

This is scary stuff. In many places judges are very liberal about what they consider discrimination. Like somehow it’s racist to disqualify rental applications if the person has a felony? How can that not be read as the government saying “Minorities are more likely to be criminals”? Honestly I’d be offended if I were a minority and that was my government’s stance!

It is scary, and the standards of proof don’t always seem very high for these discrimination cases. Landlords aren’t a “politically popular” group, and need to CYA more than most when it comes to dotting their legal i’s and crossing their t’s. Most importantly of all, landlords have to be careful to request the exact same information from every single rental applicant, and run the same level of background checks.

Landlords need to tread more carefully than most professionals. I knew few who misstepped and it cost them dearly.

Agreed Billy!