Going to work every day and getting a paycheck every two weeks? That’s active income.

Being self-employed? Freelance work and side gigs? All active income too.

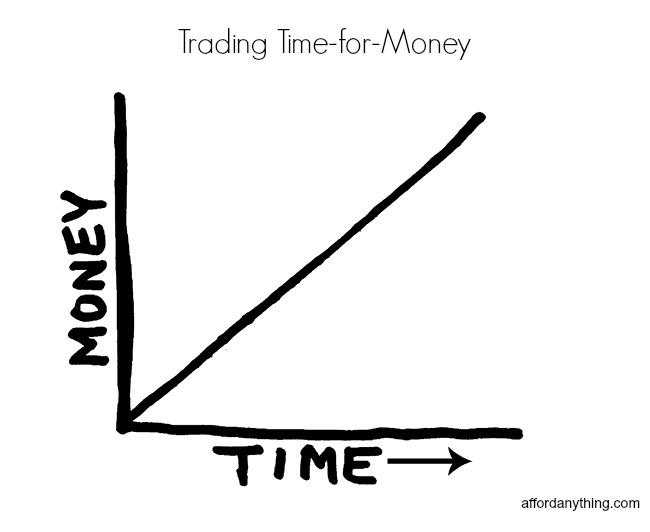

Active income is money that you have to work in order to earn, on an ongoing basis. It’s trading time for money.

I don’t know about you, but I don’t want to do that for the rest of my life. Enter: passive income.

What Does Passive Income Mean?

Passive income is money that you earn without having to actively work for it. You earn it while you’re sleeping, or playing with your kids, or relaxing on the beach, playing golf, sipping a nice cabernet, or doing whatever it is you’d rather do than work.

Sounds pretty terrific — so why isn’t everyone out building passive income?

They are, sort of. When people save and invest for retirement, their nest egg usually includes stocks that pay dividends, and perhaps bonds. Retirement income is passive income.

But retirement is a distant, nebulous idea for most people. It’s something they do because everyone tells them they “should,” not because they’re trying to build passive income streams to change their life here and now.

Also, most types of passive incomes take a great deal of work up front. It requires you to invest time and/or money up front, often with no immediate results.

Passive Income Types

Just because you understand the passive income definition doesn’t mean you know how to create passive income.

While it comes in many shapes in sizes, five passive income types cover most sources of passive income. As a broad overview, the most common types of passive incomes include:

-

- Dividends: Stocks tend to be better vehicles for appreciation than income, but some do produce income (or “yield”) in the form of regular dividends.

- Bonds: When you buy a bond, you effectively lend money and earn interest payments over the life of the bond, then get your original investment back at the end. Bonds tend to make better investments when inflation is low and interest rates are high (which they haven’t been in this century).

- Business Income: You can also create cash flows of passive income by starting a business, then letting others manage it. Business owners must still keep an eye on the business’s direction however, if they want it to survive and thrive in the long term.

- Rents & Rent Distributions: You already understand rental income from investment properties, but more on this shortly. They typically require a high initial investment, then serve as an ongoing passive income source thereafter. If you own fractional ownership in a group real estate investment, you collect regular distributions of rental income as well.

- Royalties: Artists often earn royalties from songs, books, art, and other creative works more of us should be putting out into the world.

These aren’t the only passive income types of course. Let’s dig deeper into these and other best sources of passive income.

Best Sources of Passive Income

So how do you invest to start collecting these different types of passive incomes?

Start with these best sources of passive income.

High-Yield Stocks & Funds

With a regular brokerage account, you can buy dividend-paying stocks, mutual funds, and exchange-traded funds (ETFs). You can also buy publicly-traded real estate investment trusts (REITs), which by law must pay out at least 90% of their annual profits to shareholders in the form of dividends.

Check out NOBL as a fund that includes all “dividend aristocrats”: companies that have raised their dividend every year for at least the last 25 years. You can also look up “dividend achievers,” that have raised their dividends for at least 10 years in a row. For more lists of high-yield dividend stocks, particularly undervalued stocks paying high dividends, check out Sure Dividend.

As a final thought, read up on the role of dividends for retiring early.

Rental Properties

You get the premise behind rental properties: you buy an investment property and collect rents on it forever after.

Many skeptics question how passive rental income is, as landlords must still advertise vacant units, screen rental applications, sign lease agreements, and collect rents. Good thing SparkRental’s landlord software can do all those things for you (shameless plug!).

Landlords can alternatively rent out their properties as short-term rentals, rather than to long-term tenants.

Rental properties produce ongoing income, forever. You can raise rents over time, making properties a good hedge against inflation.

They also usually appreciate in value, and come with dozens of rental property tax deductions, including paper expenses like property depreciation.

While a big down payment helps, you can explore ways to buy a rental property with no money down.

For that matter, these days you don’t have to do any of the work of finding a property yourself. Buy fractional ownership in a rental property for $50 through Lofty or for $100 through Arrived.

And if you want to go a little bigger than a single-family rental, you can earn even higher returns on group investments in apartment buildings.

Distributions from Real Estate Syndications

Distributions from Real Estate Syndications

Passive income opportunities from real estate go far beyond rental properties.

If you love the idea of portfolio income and capital gains building over time, consider investing in real estate syndications. You buy fractional ownership in a commercial property, such as an apartment complex, and collect income distributions on a regular basis (monthly or quarterly) while you own an interest in the property. A property manager oversees the day-to-day operations of collecting rents and property maintenance, making it a truly passive investment.

When it sells, you and all the other fractional owners get a hefty paycheck. Alternatively, some syndicators refinance the property after renovating it, returning some or all of your original investment back to you. But you keep your ownership interest, earning high returns on your remaining equity investment (or even infinite returns). Think of it like the BRRRR strategy, but on steroids.

Between the distribution income and the capital gains payout at the end, syndications often pay 15-50% annualized returns. Check out our free class on real estate syndications for a breakdown of how they work.

Uh, 15-50% returns on a completely passive source of income? What’s the catch?

There are several reasons why not everyone and their mother is out there putting every penny in real estate syndications. First, many syndications only allow accredited investors. Second, most middle class investors have never heard of them, and if they have, they don’t know how to find or vet syndicators. Finally, the minimum investment is usually $50-100K, similar to a down payment on a rental property.

Fortunately, there’s a way around all of those challenges: join an investment club. For example, our Co-Investing Club invests in group real estate investments every month, and members can invest as little as $5,000 per syndication deal rather than $50,000 or $100,000.

Crowdfunded REITs

If you don’t want the headaches that come with owning properties directly, you can still invest in real estate. In fact, some real estate crowdfunding platforms allow you to invest with as little as $10. You can literally skip two lattes this week to come up with the extra cash needed to start investing in real estate.

Crowdfunded REITs work similarly to publicly-traded REITs, in that they represent pooled real estate funds that own various residential and commercial properties, or sometimes debt secured against real estate. But rather than buying and selling shares instantly on stock exchanges, you buy shares directly from the crowdfunding platform. That eliminates the volatility of the stock market, but it also makes shares hard to sell. Most crowdfunding platforms expect you to leave your money invested for at least five years.

Check out Fundrise as a reputable platform for residential and apartment buildings, and Streitwise for commercial properties.

Crowdfunded Loans Secured by Real Estate

You can also invest money toward loans secured by real property.

My favorite of these is Groundfloor, a hard money lender that issues short-term loans. These are purchase-rehab loans for real estate investors, usually 6-18 months in length. After the borrower finishes renovating the property, they sell it as a flip or refinance it using the BRRRR strategy.

Since 2013, Groundfloor has consistently returned around 10% as an average across their loans. If you prefer liquidity over returns, try their Stairs fund instead: you earn 4-6% returns and can pull out your money at any time with no penalty. Or try their competitor Concreit, which uses the same model of a pooled fund of short-term loans. You collect weekly interest income, all completely passive.

Crowdfunded real estate loans offer one more option for passive streams of income from real estate.

Bonds

I don’t love bonds personally, given their performance compared to stocks over the last few decades. But they have their place in retirement planning, particularly for older adults with lower risk tolerance.

Even so, I find ways to replace bonds with real estate in my investment portfolio. I earn higher returns, both on active real estate activities (such as rental investing) and indirect ownership. Beyond the better returns, I also hedge against inflation, while scoring great tax breaks. In fact, “active participation” as a landlord lets you deduct paper losses on rental activities from your taxable income, up to $25,000 per year.

Business Income

Yes, businesses take an enormous upfront investment of work to start and grow. I should know, as a founder of SparkRental — it’s been exhausting!

But at a certain point, founders can start delegating the work of managing and growing their business. They can hire managers to take over most of the day-to-day business activities.

Consider online businesses and digital products for their low overhead and quick setup. You can explore information products, such as online courses. Or you can flip retail products, or earn money referring people to affiliate partners. In fact, affiliate links are the easiest way to start earning extra income from an online business.

There are endless business models out there, and not all of them require your active participation every day. To continue the affiliate marketer example, you could hire a writer to produce your blog content, while earning affiliate revenue or selling digital assets through that content.

Just know going in that you typically work twice as hard as employees work, in the upfront time investment of getting a business off the ground.

Alternative Types of Passive Income

You can get as creative as you want in exploring passive income ideas.

Different passive income types could include advertising on your car, or buying and installing vending machines or laundry machines. It could mean creating intellectual property such as art, stock photos, or music, and earning residual income from royalties from them.

Do some research on the good ol’ interwebs for more niche ideas for the best sources of passive income. The more diverse your types of income, the greater your financial security. One stream of income might suffer due to a market correction or change in the economy, but your other financial investments can keep pumping income to you month in and month out.

Thinking About Time & Money Differently

With active income, you get immediate gratification: you earn money right away, in exchange for labor.

This is how most of us think about money. Our parents raised us to think this way:

“If you do more chores you’ll earn more money.”

And then your first five jobs also reinforced this message:

“If you pick up the Saturday shift you’ll earn more money.”

We talk about this at length in how parents can raise their kids to be good entrepreneurs, rather than good employees. It starts with teaching your kids to think differently about money.

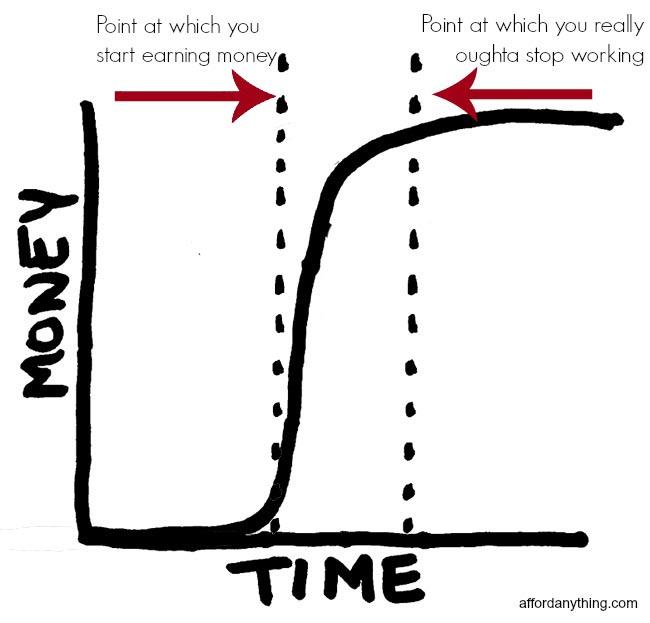

With passive income, you have to invest money, time, or both before you start seeing any results. Passive income requires more work than active income… at first.

Fun hand-drawn graph courtesy of AffordAnything.com

See all that investment of time put in, before the money starts coming in?

Yeah… most people aren’t all about that.

That graph above looks nothing like the traditional relationship between time and money. Passive income is about breaking out of that “time = money” mindset. The thinking goes more like this:

“If I spend the next 60 days scouting for potential rental investments, making offers, settling on a property, and placing a good long-term tenant in my new rental, I’ll earn $400/month in income for the rest of my life.”

You put in money and effort up front for a period of time, then you can stop working but continue to earn money.

(article continues below)

Stacking Different Types of Passive Income

One of the many problems with active income is that it comes with a limit: your time. You can only work so many hours in a given week.

There’s no such limit on passive income. You can own as many stocks or bonds or rental properties as you can afford, and every source of investment income you own makes it that much easier to buy the next one.

Thus, you can stack different forms of passive income up indefinitely. Ever hear the expression “The first million is the hardest”? Passive income is precisely why. As you build wealth and assets, more of your income comes from passive activities and investments, rather than active work. Your income increasingly becomes independent from your work, and the sky’s the limit on how much you can earn when your monthly income is untethered from your time.

“So you’re saying I put in a flurry of work & money on one passive income stream, let that start earning money, then put in another flurry of work & money on the next, and just keep going like that forever?”

No one said forever.

Financial Independence: Replacing Your Salary

You reach financial independence when you can cover your living expenses with your passive income from investments. In other words, working becomes optional — you can retire if you like, regardless of your age.

The lower your living expenses, the easier it is to cover them with passive income. But as intuitive as that sounds, most people don’t realize the extent to which “keeping up with the Joneses” hurts their finances.

For every dollar you want to spend with retirement income, for example, you need to save and invest $25, if you’re following the 4% Rule. Think about that for a second — every $100/month extra that you spend, you need another $30,000 in savings to reach financial independence.

Beyond simply being easier to cover with passive income, lower living expenses also helps you lift your savings rate. The lower the percentage of your income that you spend, the more you can save and invest to generate more passive income.

And the more passive income you earn, the more you can reinvest to keep snowballing your income.

Boost Your Savings Rate, Avoid Lifestyle Creep

Start looking for the greatest opportunities to save money. Most people spend 70% of their income on just three expenses: housing, transportation, and food. Because housing is the most expensive, start by asking:

“How can I reduce or eliminate my housing expenses?”

You could rent out a spare bedroom in your home to a housemate. Even better, you could segment off part of your home to be self-contained, and rent it either short-term (e.g. on Airbnb) or long-term as an income suite.

For a truly powerful solution, you could house hack a multifamily property. This form of house hacking involves buying a multi-unit building, moving into one of the units, and leasing out the other(s) to pay the mortgage, repairs, and other housing expenses. If you don’t think it’s possible, read how one ordinary insurance underwriter house hacked a suburban duplex.

Alternatively, try out these ideas to house hack a single-family home, from renting storage space to ADUs to even hosting a foreign exchange student.

As you save and invest more money and start building passive income — and as you earn more money from your job — freeze your living expenses to avoid lifestyle creep. Invest the extra money you save each month.

Because the alternative is continuing to run on the financial treadmill, working hard every month only to stay in the same place.

Do you want to spend the rest of your life trading hours for dollars? If your priority is driving a fancy SUV, going on regular shopping sprees, eating out frequently, and so forth, there’s nothing wrong with that, but understand that it comes at a cost. You will likely have to keep working for a long time to come, because you spend most of the money you bring in each month.

Tying Passive Income Types Together

Knowing the passive income definition doesn’t help you if you don’t act to begin building different types of passive income.

Start thinking about your “escape the rat race” number. How much passive income do you need, to cover your monthly expenses?

In other words, what will it take to reach financial independence?

Find ways to spend less and funnel more money toward your passive income investments. Start investing in dividend-paying stocks and rental properties, or other types of passive incomes. But in the beginning, just focus on one type of passive income strategy, rather than getting overwhelmed by many passive income types.

Ashley and Kevin Thompson reached financial independence in six years, all while traveling the world. At first it took an incredible amount of discipline, living on a fraction of their income. Later, it got easier, as they started earning more and more passive income from their rental properties. Today they have $60,000/year in passive income from their rentals, and growing.♦

What does passive income mean to you? What are your favorite passive income types?

Great intro to passive income! Very accessible (and even entertaining 🙂

Thanks Theo! We do what we can to keep things lively around here!

Ha! Love the graphs

Wish I could claim credit for them – shout out to Paula Pant of AffordAnything!

Great article, helped me understand passive income.

Thanks Betty! (And I can’t believe it took me so long to reply to you. Shame on me!)

I have a friend living in Colorado.. He is disabled and receives section eight housing. He would like to move to. Reno NV. I have a large mobil home, about 1600 sf. That I would like to share . Would I be able to offer him section 8 as a landlord?

I’d call up the local Section 8 housing office and talk to them about their requirements. I suspect you’ll have trouble if the home still has its wheels and could still be moved easily.

Best of luck!

Far too people bother to think about replacing their active income with passive income. Great introduction piece on it, and to the whole concept of financial independence!

This article is great. Passive income explained in the most simple way. Thanks a tonne Brian.

Glad it was helpful Alan!

I really love the concept of passive income, actually apartment rentals are a bit too passive. The way I see it, I’m either going to invest in the stock market to try to earn a decent return, or I’m going to find some unique opportunity and make something happen. Your blog is really good at helping people to understand these types of financial concepts, and for that I’m grateful.

That’s why I like to diversify and spread my money among many different types of investments!

Very interesting topic. Thanks for sharing.

Glad you enjoyed it Malce!

This hit me to the core, “Knowing the passive income definition doesn’t help you if you don’t act to begin building different types of passive income. ” haha! I guess the most difficult part is when to start.

Absolutely Hunter. Action is the most important part!