by G. Brian Davis | Last updated Mar 4, 2026 | Personal Finance, Property Management, Spark Blog |

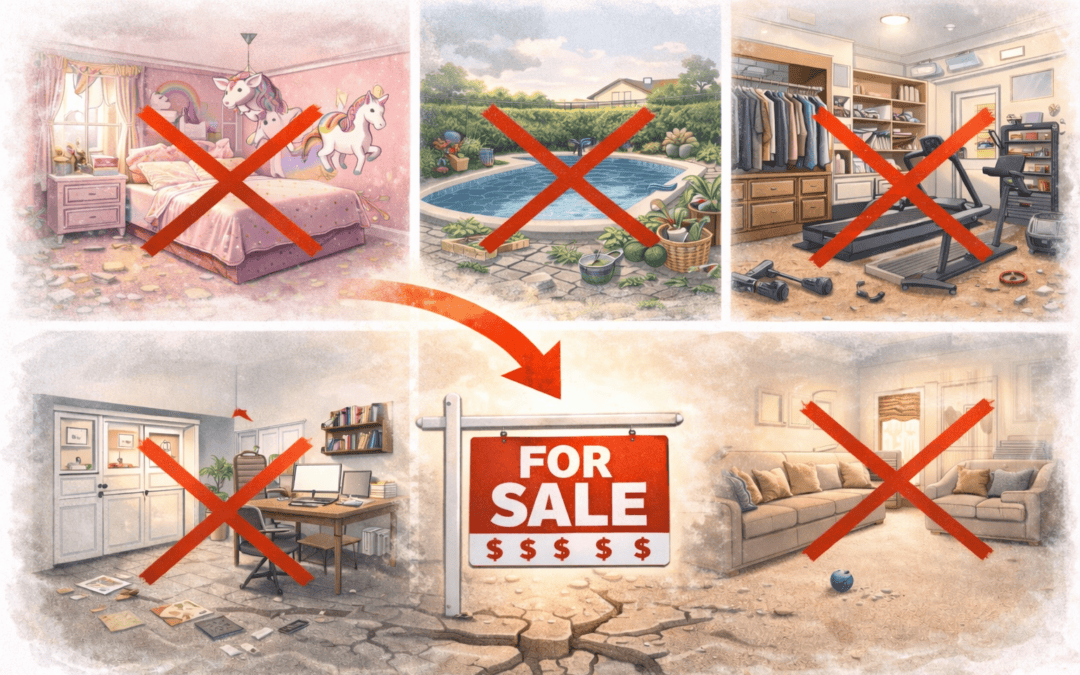

The Short Version: Not every home improvement is actually an improvement. Some upgrades shrink your buyer pool and drag down your resale value. Over-personalization, high-maintenance features, and garage conversions are common culprits. Buyers see the cost of undoing...

by G. Brian Davis | Last updated Mar 3, 2026 | Personal Finance, Spark Blog |

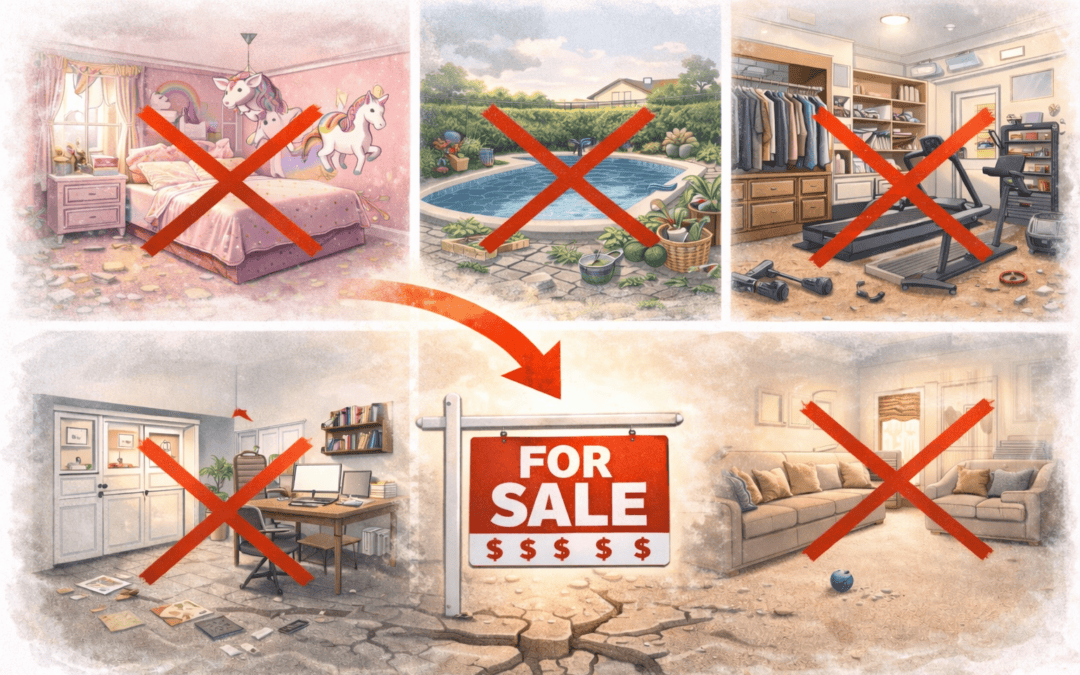

The Short Version: I bought about a dozen rental properties in the mid-2000s. I overleveraged, bought in rough neighborhoods, and had no idea how to actually forecast cash flow. I made every rookie mistake in the book. When 2008 hit, I got crushed from both...

by G. Brian Davis | Last updated Feb 28, 2026 | Personal Finance, Spark Blog |

The Short Version: The expenses that derail most people’s finances aren’t the big, obvious ones. They’re the small recurring charges that slip through unnoticed month after month. Subscriptions you forgot about, food delivery fees, snack runs, daily...

by G. Brian Davis | Last updated Feb 23, 2026 | Personal Finance, Spark Blog |

The Short Version: The most profitable real estate opportunities often exist in corners of the market that rarely get attention. Property tax abatements, mobile home parks, raw land, niche industrial, and bedroom boost flips are all strategies that consistently...

by G. Brian Davis | Last updated Feb 20, 2026 | Personal Finance, Spark Blog |

The Short Version: You bought a house, maxed out your 401(k), funded the HSA and 529. On paper, you’re doing great. But when you actually need money… you can’t touch any of it. Most middle-class wealth is locked in illiquid assets, retirement...

by G. Brian Davis | Last updated Feb 16, 2026 | Personal Finance, Spark Blog |

The Short Version: Depreciation is one of real estate’s biggest tax advantages but the IRS wants that money back when you sell. It’s called depreciation recapture, and it catches a lot of investors off guard. The depreciation recapture portion is taxed at...