Vet & Invest in Real Estate Deals as a Community

Meet monthly to vet group investments

Full cash flow, appreciation, & tax benefits

(without becoming a landlord)

Co-Investing Club

Passive Real Estate Investment Club

Attend club meetings

Once or twice a month, our Co-Investing Club meets to vet deals together. No experience necessary, recordings available.

Invest $5K+ (or skip it)

Invest $5,000 or more in any investments you like, instead of the typical $50-100K. Non-accredited investors welcome.

Enjoy cash flow, appreciation, tax breaks

As a fractional investor, you get full real estate benefits. We vet deals targeting 15%+ returns — together, as a club.

In the Co-Investing Club, we believe:

1. Vetting investments as a group reduces risk. More eyeballs reviewing deals = better risk analysis.

2. Dollar cost averaging beats trying to be “clever”. Outsized returns come from small, steady, diversified investments (not trying to pick the next hot market or asset type).

3. Our community is the best in the world at vetting investments together. Together, the hundreds of Co-Investing Club members have a vast collective knowledge of real estate investing.

What kinds of investments do we review as a club?

Multifamily

Hotels & Airbnbs

Secured Loans

Mobile Home Parks

Self-Storage

Retail

Don’t take our word for it. In our members words:

Not ready for private equity real estate? Compare real estate crowdfunding options

If you’re just curious about passive real estate investments, start with $10 in a real estate crowdfunding platform.

Of course, not all real estate crowdfunding platforms are created equal. Some we love and invest our personal money in. Others… not so much.

To demystify the world of real estate crowdfunding, we compiled a list of the 17 most popular real estate crowdfunding platforms, along with “At a Glance” highlights to help you decide which ones are a good fit for you. They include short-term real estate investments like Concreit and long-term investments like Arrived. Real estate equity investments (Fundrise) and secured debt investments (Groundfloor). Fractional ownership in individual properties (Ark7) and pooled funds (Streitwise). And every combination in between.

Unlike most reviewers, we actually invest in most of these ourselves. Our money is where our mouth is.

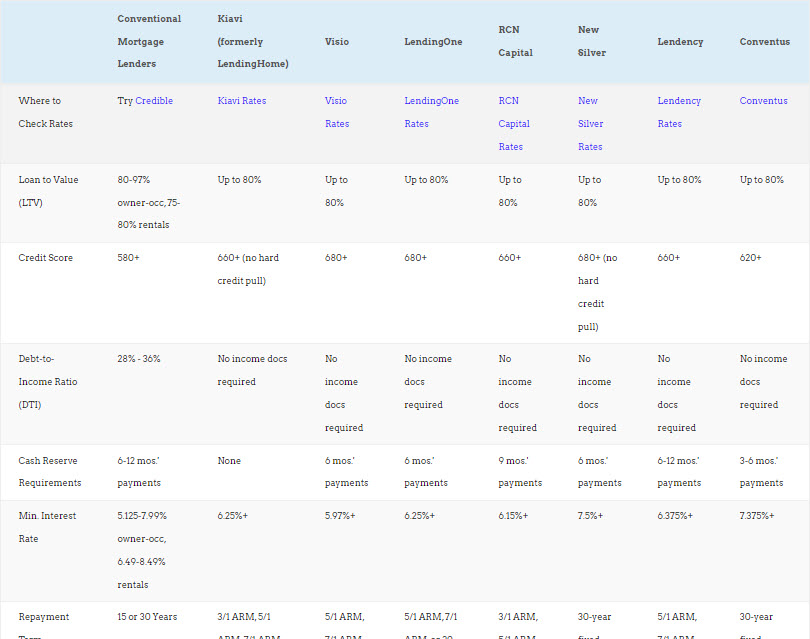

Active investor? Compare loans for investment properties

We’ve vetted rental property lenders for you.

From interest rates to loan-to-value ratios (LTV), we’ve put together several comparison charts for investment property loans.

Rental property loans are inherently different from short-term fix-and flip loans, so we broke them down into two separate charts for easy loan comparisons.

And if you’re cash-strapped, read up on 17 Clever Ways to Come Up with a Down Payment for a Rental Property.

Never worry again about how you’ll finance your next investment property!

Learn Real Estate Investing

We invest a ton of time in making our articles and free real estate tools awesome, from our free real estate investing calculators to our interactive maps to our how-to tutorials.

Enjoy the latest from our real estate investing blog!

How the Ultra-Wealthy Spend Differently Than Everyone Else

The Short Version: The ultra-wealthy aren't just a richer version of the upper-middle class. Their budgets are structurally different. Housing often makes up just 10-20% of their spending... even when the home costs $10 million. Their income is so high that a $65,000...

5 Home “Upgrades” That Can Actually Hurt Your Resale Value

The Short Version: Not every home improvement is actually an improvement. Some upgrades shrink your buyer pool and drag down your resale value. Over-personalization, high-maintenance features, and garage conversions are common culprits. Buyers see the cost of undoing...

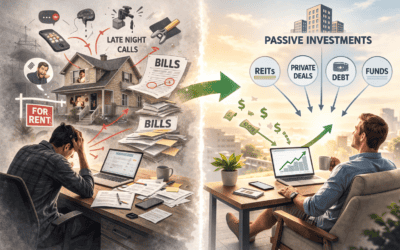

Why I Stopped Buying Rental Properties and Went Passive

The Short Version: I bought about a dozen rental properties in the mid-2000s. I overleveraged, bought in rough neighborhoods, and had no idea how to actually forecast cash flow. I made every rookie mistake in the book. When 2008 hit, I got crushed from both sides......

5 Invisible Expenses That Are Quietly Draining Your Wealth

The Short Version: The expenses that derail most people's finances aren't the big, obvious ones. They're the small recurring charges that slip through unnoticed month after month. Subscriptions you forgot about, food delivery fees, snack runs, daily coffees, and...

5 Real Estate Niches Most Investors Overlook (Huge Returns)

The Short Version: The most profitable real estate opportunities often exist in corners of the market that rarely get attention. Property tax abatements, mobile home parks, raw land, niche industrial, and bedroom boost flips are all strategies that consistently...

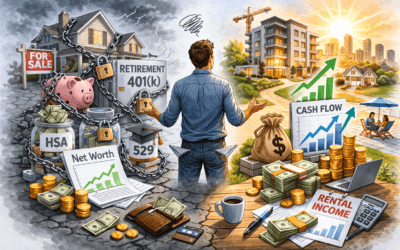

Why You’re Wealthy on Paper But Broke in Reality

The Short Version: You bought a house, maxed out your 401(k), funded the HSA and 529. On paper, you're doing great. But when you actually need money... you can't touch any of it. Most middle-class wealth is locked in illiquid assets, retirement accounts with...

Our Founders Are Every-freakin’-where

Deni Supplee and G. Brian Davis, our quirky and brilliant founders, show up just about everywhere in the world of real estate investing. Every week we appear somewhere in the press or other media appearances such as:

Because we’re real estate investors, not faceless corporate hacks.

Deni Supplee and G. Brian Davis love real estate, passive income, lifestyle design, and teaching.

So we combined all those together in SparkRental.

Some people just want the high returns and tax benefits of real estate investments, but don’t want the headaches of becoming a landlord. For them, we created our Co-Investing Club to help them invest passively in real estate.

In fact, Brian’s now one of those passive investors, after spending ten years traveling overseas with his wife Katie and daughter Millie.

Other investors want the control of owning individual properties directly. For them, we created free landlord software, free calculators (such as a free rental income calculator and free depreciation calculator), and interactive maps such as the best cities for rentals and real estate heat maps.

With enough passive income from real estate, you reach financial independence. You can live off your rents and distributions — and your day job becomes optional.

Want to connect? Drop us a line below, or check out our Facebook page and YouTube channel!