The last time I had to evict a tenant in Baltimore, it took me 11 months to get him out.

Over that time, he took advantage of Baltimore’s extremely tenant-friendly laws to keep prolonging the eviction. When I finally got him out nearly a year later, he punched holes in every kitchen cabinet, broke the bathroom door, and tore up the flooring purely out of spite.

I tell this story any time I hear naive landlords say that landlord-tenant laws don’t matter “as long as landlords treat people fairly.” Think of that argument as the landlord equivalent of “Only guilty people worry about privacy or police misconduct.”

So Deni and I put together a list of the worst cities and states for landlords, at least from a rules and regulations standpoint. I no longer invest in any of these cities — and I recommend you avoid them as well.

State Landlord-Tenant Law Rankings

All states have their own landlord-tenant act, which creates the rules by which landlords and tenants must follow. Some favor property owners, while others tilt heavily in favor of tenants.

Landlord-tenant regulations cover items like:

- Security deposit rules and limits

- Late fee limits and mandatory grace periods

- Returned payment fee (NSF fee) limits

- Eviction warning notice periods

- Advance notice required before landlords can enter their properties

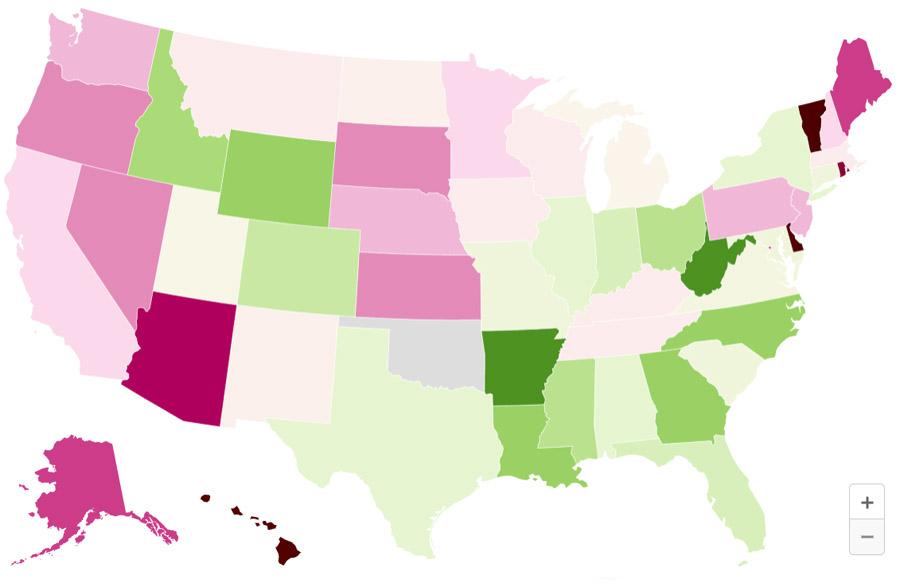

Unlike cities (more on them momentarily), state landlord-tenant laws fall along a continuum. Our friends over RENTCafe helped us put together this interactive map of the US, to visually showcase which states are landlord-friendly, neutral, or tenant-friendly.

Note that red indicates tenant-tilted laws, while green indicates laws more friendly to investors and landlords. For each state, we have a quick reference summary of landlord-tenant laws.

And if you need a reminder of how landlord regulations can impact your bottom line, look no further than federal and state eviction moratoriums.

Personally, I avoid investing in all states that have regulations that favor renters, and stick with states that are at least neutral, and preferably investor-friendly.

10 Worst Cities with Anti-Landlord Laws

Most towns and cities don’t impose their own additional landlord-tenant rules on top of state laws. But a few particularly tenant-friendly cities feel the need to put harsher restrictions on landlords.

As you review our list of the best cities for real estate investing by rent/price ratio, consider too the state and local laws. In some cases, there’s a reason why some cities offer high cap rates — landlords still struggle to make money there.

Without further ado, here are ten cities to avoid as a rental investor.

1. Portland, OR

Oregon already imposes extremely tenant-friendly laws. Portland piles even stricter regulations on top, making it the worst city in the country for landlords.

Portland bans “no-cause evictions,” an intentional misnomer that refers to landlords opting not to renew a tenant’s lease agreement. That also applies to “substantial” changes in lease terms, and rent increases of 10% or more in a 12-month period.

If the landlord does any of these, they must pay the tenant relocation assistance in the following amounts:

- Studio or Single Room Occupancy (SRO): $2,900

- 1 Bedroom: $3,300

- 2-Bedroom: $4,200

- 3 Bedroom or larger: $4,500

Additionally, landlords must give renters at least 90 days notice of any rent increases, along with a detailed explanation of tenants’ rights, plus an outline of relocation assistance amounts if applicable.

Then there are the security deposit restrictions. If landlords collect the last month’s rent upon lease signing, they can collect a maximum of half a month’s rent for the security deposit. If they don’t collect the last month’s rent up front, they can collect a maximum of one month’s rent for the security deposit. Landlords must pay the tenant interest on their security deposit, must provide them an accounting of all deductions within one week of move out, plus a full rental history report and a detailed list of the tenant’s legal rights. See the full rules here.

Given the low cap rates and returns in Portland anyway, it’s no surprise that most landlords are either local or legacy landlords who bought a long time ago. Invest elsewhere.

2. New York, NY

Surprising no one, New York City also makes life extremely difficult for landlords.

It enforces the largest and most complicated system of rent control and rent stabilization in the country. And removing a rental unit from rent control to charge market rates is both difficult and far from certain.

Landlords may not charge late fees over $50 or 5% of the rent, which is higher. Late fees cannot come into effect without a minimum five-day grace period.

In the event of evictions, the City gives all tenants free access to legal aid services to help them fight landlords in court. Compounding matters, landlords who fail to dot every I and cross every T in the eviction process now face criminal prosecution and a fine of at least $1,000.

When tenants violate their lease agreement, landlords can’t start the eviction process for at least 30 days while tenants are allowed to cure the violation.

During the pandemic, the City froze all rent increases. Never mind that real estate prices jumped — rents were locked.

Again, don’t buy rental properties in New York City.

3. Washington, DC

The nation’s capital is another terrible place to be a landlord.

Landlords must obtain not only a housing business license but also a certificate of occupancy. And register the property with the Rental Accommodation Division (RAD) which is part of the Department of Housing and Community Development (DHCD), among other red tape.

Then come the disclosure requirements. Landlords must deliver a pamphlet published by the Rent Administrator that explains, in detail, the laws and regulations governing the implementation of rent increases and petitions permitted to be filed by housing providers and by tenants. Plus a copy of the Tenants Bill of Rights published by the Office of the Tenant Advocate. Then at the end of every calendar year, the owner must post where the tenants’ security deposits are held and the interest rate for the preceding six months.

The District also limits the amount that landlords can raise the rent each year. And mandates a minimum grace period of five days before landlords can charge a late rent fee.

Finally, DC limits how many people can occupy bedrooms of certain sizes — and puts on the onus on the landlord to enforce their rules. For a single person to occupy a bedroom, it must have at least 70 square feet. For each additional occupant, the room must have at least another 50 feet.

4. Baltimore, MD

I grew up in Baltimore and owned 15 properties there at one time. I will never own real estate in Baltimore again.

To begin with, landlords must register all rental units with both the City of Baltimore and the State of Maryland — and pay both of them fees for each unit. And get a use and occupancy permit. And have each rental unit tested and inspected for lead-based paint in between every single tenancy. With the lease agreement, landlords must provide a copy of the lead inspection certificate.

If the property is located in a flood zone, landlords must provide notice to the tenants upon signing a lease.

Landlords must give tenants a minimum ten-day grace period before charging a late fee. A late fee capped at 5% of the rent.

Non-paying tenants have many ways to delay evictions. A few examples include:

o Lack of functional and sufficient laundry, cooking, or dishwashing facilities,

o Lack of functional refrigeration or air conditioning,

o Lack of proper maintenance, or

o Lack of specified recreational facilities.

I’ve had more encounters with “professional tenants” than I can count. In that 11-month eviction, the tenant themselves broke the equipment in the property to delay the eviction.

Making matters worse, Baltimore recently banned “no fault evictions” like some of the other cities on this list. Landlords can’t non-renew a tenant without “just cause,” such as moving into the property themselves, making major renovations, or removing the property from the rental market permanently.

Baltimore also now requires landlords who own ten or more units who charge a security deposit of at least 60% of the rent to offer one of two alternatives to paying a traditional security deposit: pay the deposit in three monthly installments or purchase “rental security insurance.”

I don’t invest here anymore, and you shouldn’t either.

5. Detroit, MI

Detroit requires all rental properties with one or two units to be inspected by a third-party company licensed by the City of Detroit. And pass lead paint inspections between each tenancy, and be registered with the City, and obtain a Certificate of Compliance.

In other words, endless red tape just to rent out a property. No thanks.

If it sounds like fun to you, enjoy reading Detroit’s 25-page instruction manual for landlord compliance.

Oh, and you can’t hold felonies against applicants when you screen tenants either. They call it the “Fair Chance Ordinance.” Which I’m sure is a comfort to the neighboring tenants, when violent felons move in next door.

Within 30 days of a structure becoming vacant, landlords must register the property with BSEED Property Maintenance. Cue more inspections and red tape.

Failure to comply with any of these complex landlord regulations means hefty fines, by the way.

Or you could just invest in any of the thousands of other cities and towns around the country.

6. Chicago, IL

When Chicago landlords sign a lease agreement with a tenant, they must provide a security deposit receipt, keep the deposit in an interest-bearing account, and pay the tenant interest which is set by the city comptroller. And which is probably way lower than what the bank pays you as a depositor.

Landlords must also provide tenants with a copy of the RLTO (Residential Landlord Tenant Ordinance).

Failure to provide any of this results in heavy fines for you as the landlord.

If the heat breaks in your property, you can face fines up to $500 per day that it remains broken. Landlords must also pay to eliminate all bed bug infestations, regardless of whether the tenants brought them into the property.

Worst of all, tenants can break their lease agreement and move out early, and the landlord must make a “good faith effort” to find a replacement tenant. If a “reasonable” sub-tenant is available to move in, the landlord must accept them without charging the early mover any fees for breaking the lease.

(article continues below)

7. Los Angeles, CA

Over 85% of LA’s rental units fall under rent control. Even I, cynical as I am about LA’s terrible landlord-tenant laws, was shocked at that figure. You can check a property’s rent control status here.

Currently, landlords may not raise the rent by more than 4% per year. This changes however, so landlords must check with the City of LA before raising the rent.

Tenants now have the right to sue landlords who violate the coronavirus protection regulations. If successful, tenants can win $10,000 per violation ($15,000 if the tenant is disabled or a senior). Before suing, a tenant must notify the landlord of an alleged violation, and the landlord has 15 days to address it.

If the tenant wants the landlord to perform repairs or upgrades, they can contact the Housing and Community Investment Department (HCID), which then initiates a city inspection process. This process is a nightmare for landlords, who can expect inspectors to have a field day pointing out changes they want landlords to make to their own properties.

And, of course, landlords can’t non-renew tenants at the end of their lease term without “just cause.”

8. San Francisco, CA

Is it just me or are none of these cities surprising in the slightest?

San Francisco also limits rent increases. The current increase is restricted to 0.7%, through February 28, 2022.

Landlords must register each rental unit with the Rent Board (which costs money, of course). Any failure in registration, licensing, or other red tape typically results in the landlord being unable to evict the tenant.

For that matter, landlords can’t non-renew tenants without “just cause,” just like several other anti-landlord cities on this list. If, for example, the landlord wants to move into their own property, and they non-renew the tenant, the landlord must move into the property within three months and continue living there for at least three years. If they fail to do either, they must offer the rental unit back to the old tenant for the original rent amount.

In a particularly quirky landlord law, landlords must reduce the rent if the view from their unit gets obstructed. So not only does the landlord’s property value plummet because someone else built a new building, but the rent changes mid-lease.

That all being said, San Francisco boasts the title of the worst cap rates and gross rent multiplier in the country. Just one more reason not to invest there.

9. Dekalb, IL

All right, I spoke too soon. There is a surprise on this list. Has anyone outside of Illinois ever heard of Dekalb? I certainly hadn’t.

Landlords must provide a copy of the lease agreement in writing at the time of lease signing. If tenants violate any local codes or ordinances, the landlord must send them written notice or confront them face-to-face. Failure to do either comes with fines for the landlord.

You can’t prohibit subletting either.

Landlords must register all units (with a fee, of course), and complete a mandatory training course before being granted a license. Further, they must designate a local resident agent who lives in Dekalb County. Their job: to be served lawsuits on your behalf.

Truly.

10. Philadelphia, PA

Rounding out the ten worst cities for landlords is the City of Brotherly Love. Who also doesn’t want you to buy rental properties there.

Like most of the cities on this list, landlords must register all units with the city’s Fair Housing Commission. Which:

o Ensures rental properties are safe, healthy, and in good condition.

o Verifies that landlords have necessary rental licenses and certificates.

o Educates tenants and landlords on their rights and responsibilities.

o Connects landlords and tenants to services and assistance.

And when tenants violate their lease agreement and you serve them with an eviction notice, the City appoints them a free attorney to defend against the eviction. Good luck getting them out of your property, no matter how they broke your lease’s rules.

Final Thoughts

I’ve heard many landlords shrug their shoulders at tenant-friendly rules and regulations. They glibly reply “If landlords follow the rules, they have nothing to fear from the law.”

I can tell you firsthand that’s not true.

I follow landlord-tenant laws to the letter. And I’ve been burned by tenant-friendly laws time and again.

It’s your money, invest it wherever you like. But I will never invest in tenant-protective cities or states again, no matter how appealing the cap rates look on paper. It’s just not worth the headaches, red tape, and endless eviction process when the tenant breaks the rules and you pay the price.

In fact, consider investing in land as an additional way to invest in real estate. I now invest just as much in land as I do in rental properties, with no fears of tenant lawsuits, evictions, fines, registrations, or any regulation-related hassles.♦

What are your greatest concerns about landlord-tenant regulations? Have you been burned by them before? Where and how?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Great read, Brian and Deni! I love the visual map for Landlord-Friendliness. With many years of buying in Georgia, we appreciate the L/T law.

What score does Oklahoma get?

Thanks again!

Thanks Monique, much appreciated! Good catch on Oklahoma – not sure why that data point was missing, but I re-added it. It clocks in at 47.5 according to RENTCafe. We’re planning on running our own state law analysis soon, as we have our own take on state landlord laws.

Portland, Oregon recently enacted even more anti-landlord laws including:

1) First come first served application processing. The first eligible applicant must be approved.

2) Income to Rent ratio requirement may not exceed 2X (what!?)

3) Deposit is limited to 1X or 1.5X rent

+ too much more to document.

Due to this, I have decided to sell our 1 rental house in Portland. It’s sad. We are fair landlords and had provided a nice home for people to live in. That’s one more off the market.

I hear you Marina! And that’s exactly right: these laws turn away good mom-and-pop landlords, who end up selling their properties to homeowners, which simply removes rental housing from the market. Cities should be trying to attract rental investors, not repel them.

Very troubling as a real estate investor. Especially since I can’t find any other publishers talking about this issue anywhere else. Thank you for shining a light on this!

I agree Ibrahim, tenant activist groups have all the momentum and microphones, and no one’s bothering to talk about the market impact of repelling rental investors and landlords. Thanks for the comment!

Interesting information. Thank you for sharing with us!

Thanks for the comment Coman!

Yet again, a great blog. Always useful information. Thank you, Brian!

Thanks Fami, much appreciated!

I have a friend in Portland. His tenants were terrible. He then decided to sell his house and buy a new one somewhere else.

Yeah I no longer invest in these cities and states. It just adds more risk, work, and expenses as an investor. Plenty of easier places to invest your money!

Indeed, it’s better to invest in current hot market than those cities. If you are a rookie and want to make some terrible mistakes, I suggest do rentals on those cities!

Haha, I hear you!

Thank you for this list! I live in Oahu and won’t be investing in real estate here. Looking into the other states mentioned here. Such helpful information!

Glad to hear the list was helpful May!

Hey Brian,

We are a housing provider (apts, duplexes, single fam units, etc) in Grants Pass, Oregon. Most of them are free market units, but we do have a number of Section 8 tenants. We are dealing with Oregon’s terrible statewide rent control under SB608, the best we can. Do you have an update on Tina Kotek’s position on expanding Portlands horrendous rent control additions statewide, should she win the governor position over the Republican candidate?

Hi Skip, I confess I don’t know much about the Oregon market, other than its reputation for being tenant-friendly. I don’t invest there personally, in part because of the legal climate. Nowadays we’re mostly investing passively in real estate syndications in investor-friendly markets.

NYC is notorious for anti-landlord laws. It’s even gotten worse during COVID. There is a new program called ERAP, it basically pauses all evictions once the tenant applies. Even if the tenant is not approved due to missing information. My parenst have a tenant that have 10 months back rent. They deman all kinds of repairs, started renovation themselves, and refuse to pay rent. They violated the lease by having a dog while the lease states no pets allowed. We are stuck with thousands of dollards of repair bills, water bills, and over $20K in back rent.

I’m so sorry to hear that Jean. It’s stories like this that reinforce my commitment to only investing in landlord-friendly markets.

This is interesting information, but I think it’s important to also remember not just what the tenant/landlord situation is like, but increases in property value. While these cities are often the worst for landlords they also have had the highest property value appreciation in the country. A building in San Francisco that was worth $2 million in 2010 is now worth closer to $3 or $4 million. Something important to think about.

I hear you Janice. I personally don’t invest for long-term appreciation, as it’s speculative. And even if I did, I still don’t want the headaches of managing tenants in these anti-landlord cities.

Arizona is terrible? I owned rentals and was able to evict in a few days Maybe times have changed.