Remember the heady real estate price jumps over 50% in a single year that some markets saw in the pandemic?

In early 2024, those days seem like a lifetime ago. While year-over-year home price growth still looks hearty in many counties, others have seen home prices fall over the last 12 months.

Strap in, because the bumpy ride in real estate values hasn’t smoothed out yet.

The 100 Hottest Real Estate Markets in 2023

Using data from Zillow, we calculated and mapped the top 100 hottest real estate markets in the US.

Notice any patterns?

You’ll probably spot first that they’re largely concentrated in the Eastern side of the country. The coastal Western states got shut out completely.

Nearly all of these hot markets are smaller cities rather than major metropolises. For example, the fastest growing real estate market over the last year was Oxford, MS with a 14.75% jump in home prices. Rounding out the top five are Dodge City, KS (12.65%), Clewiston, FL (12.39%), Statesboro, GA (11.86%), and Hartford, CT (11.73%).

Hearty as those numbers are though, they represent a sharp drop from the top five markets’ appreciation last year, and an even sharper drop from the year before that.

Only a few large-ish cities made the list in early 2024: El Paso, TX, Hartford, CT, Milwaukee, WI, and Rochester, NY. But nearly all of the fastest appreciating cities in 2024 are secondary or tertiary markets.

If you’re looking to invest in real estate long-distance, consider researching these markets. But beware that higher prices don’t necessarily mean higher rents, and you could just find yourself with weaker cash flow. Make sure you do your due diligence, and consider buying turnkey properties if you’re out of state. You can even potentially buy properties with tenants already paying rent, particularly if you use a platform like Roofstock. For a more tailored turnkey property buying experience, try Norada Real Estate.

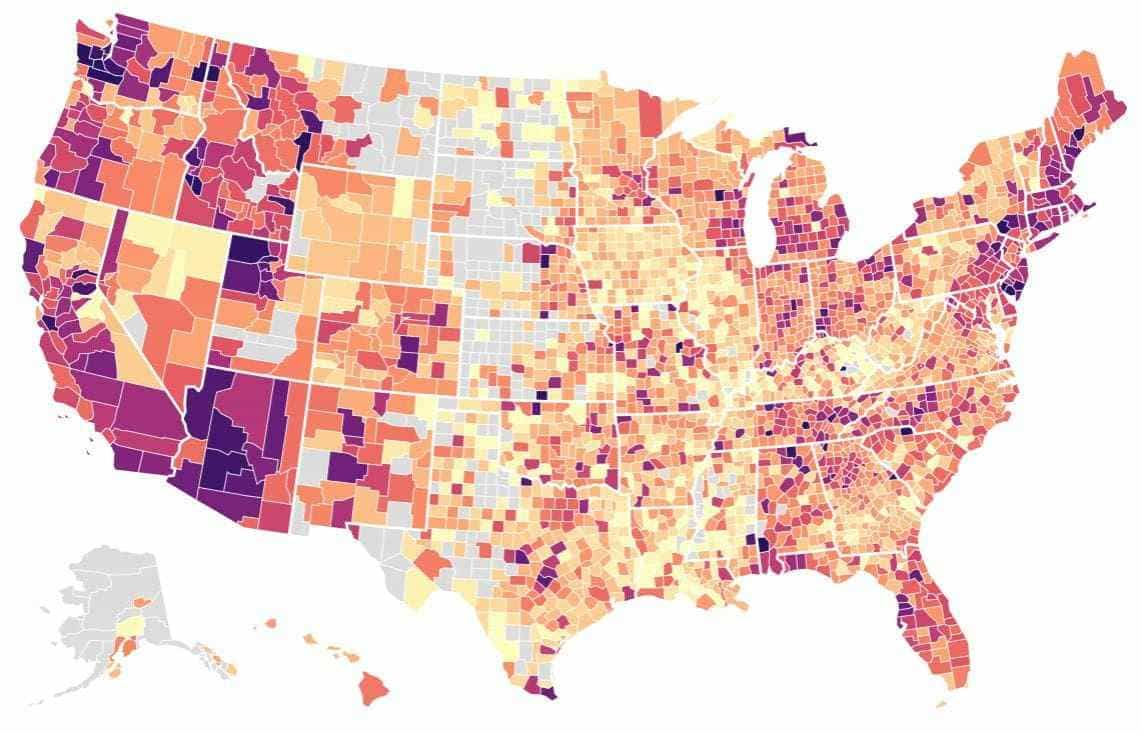

Heat Map: Fastest Appreciating Counties

Cities are all well and good, but I like the depth that county-level data provides.

Here’s how real estate performed in (nearly) every county in the US over the last year:

Some counties saw year-over-year home price increases of more than 20%. Others saw home prices plummet. The West Coast in particular saw property prices drop in many counties (see all that pale yellow?).

One trend we witnessed back in 2020-2022 was an acceleration of the de-urbanization trend, particularly in the largest, most expensive cities. But in many cases, residents simply moved out to the suburbs surrounding the same city, and therefore stayed in the same county. And 2023-2024 saw a return to major cities for many residents.

We also keep an eye on nationwide migration trends, particularly the extent to which Americans are leaving high-tax states in favor of lower-tax states. But these migration trends can’t perfectly explain the hottest real estate markets in 2020-2024.

Take New Jersey, one of the states with the highest taxes and greatest outbound migration. Many counties in the Garden State still saw year-over-year home price growth, even as California watches prices thud.

Note: The gray counties didn’t have sufficient MLS sales data for Zillow to provide median home values.

At the moment however, annual real estate appreciation doesn’t tell the whole story.

Quarterly Home Price Changes

Two years ago, housing started 2022 with a bang But as interest rates lifted off to the moon, property prices came back down to earth from late 2022 through 2024.

In this volatile real estate market, annual price changes don’t fully showcase that sharp downturn.

To get a clearer picture of current trends, here’s the quarterly home price changes by county:

As you can see, some counties are still going strong. Others are in the hole, showing negative price growth: shrinking home values. In the third quarter of 2023, 790 counties experienced falling real estate prices over the previous quarter. Compare that to 502 counties in the second quarter, 720 counties in the first quarter, and 758 counties in the fourth quarter of 2022.

In other words, while property prices had appeared to start recovering in Q2, many markets dipped again in Q3.

That doesn’t spell great news for existing property owners. But bottoming out real estate markets spell opportunity for investors to find good deals on real estate.

Best Cities for Investing Based on GRM & Cap Rates

Appreciation isn’t everything, of course. You still need the property to cash flow well, or you end up coming out of pocket.

If you’re looking for the best housing markets in the US for cash flow, here’s a map of the 300 largest cities in the U.S., contrasting their gross rent multiplier (GRM). Remember, lower is better!

The average gross rent multiplier across the U.S. dropped from over 15.10 at the end of 2022 to 14.60 over the last quarter. That indicates that rents rose faster than home prices, marking a better deal for investors. In fact, rents went up in many cities even as home prices dropped.

Alternatively, see this list of the cities with the best cap rates. (If you’re not familiar with them, here’s an overview of how cap rates work).

Before buying a rental property, always run the numbers through a rental income calculator. Most new real estate investors underestimate expenses and fail to calculate real estate cash flow property.

Rent Changes

Real estate values aren’t the only thing cooling. Rent growth has slowed in most U.S. cities nationwide, and a growing minority of cities have seen rents decline in the last quarter, per Rentometer’s quarterly rent report.

But don’t panic just yet. Nearly three-quarters (73%) of U.S. cities saw rents increase over the last year, and 19% of cities saw rents rise by double digits.

Even so, those numbers are down sharply from last quarter, when 52% of cities saw double-digit rent growth and 95% saw rents rise.

Landlords and rental investors should keep an eye on rents over the next year, as they may stagnate or dip in many markets.

What Drives Hot Housing Markets?

Real estate prices rise for many reasons. But at their core, they rise because demand for homes outstrips a limited supply of available housing.

As you scout for the best cities for real estate investing, keep the following trends in mind.

Population Growth

It sounds obvious, and it is. But where there’s strong population growth, there’s nearly always strong real estate appreciation.

Unfortunately, official Census Bureau data on population growth lags by a year or two. That leaves investors relying on less official data to try to track population trends.

Economic & Job Growth

What drives population growth? Job growth, at least traditionally. A booming local economy attracts people to move from all over the country. In fact, job growth often serves as a leading indicator of population growth.

However, in an age of greater telecommuting, inherent amenities like shoreline or a historic vibe can draw inbound migration even without abundant local jobs.

Increase in First-Time Homebuyers

When a homeowner goes to move, and simultaneously sells their old home while buying a new one, it doesn’t change the total housing inventory available. They add their own home to the inventory for sale, and they take their new home off the market.

First-time homebuyers, however, don’t have an existing home to sell. So they take a home off the market by buying it, without adding to the available inventory.

In other words, they add to the demand for housing, but not the supply. Which drives up home prices.

What Happens When Hot Real Estate Markets Cool?

Even the best housing markets in the US, the hottest real estate markets, eventually cool off. It can happen gradually, or it can happen (relatively) suddenly, such as we saw in the housing bubble collapse after 2008.

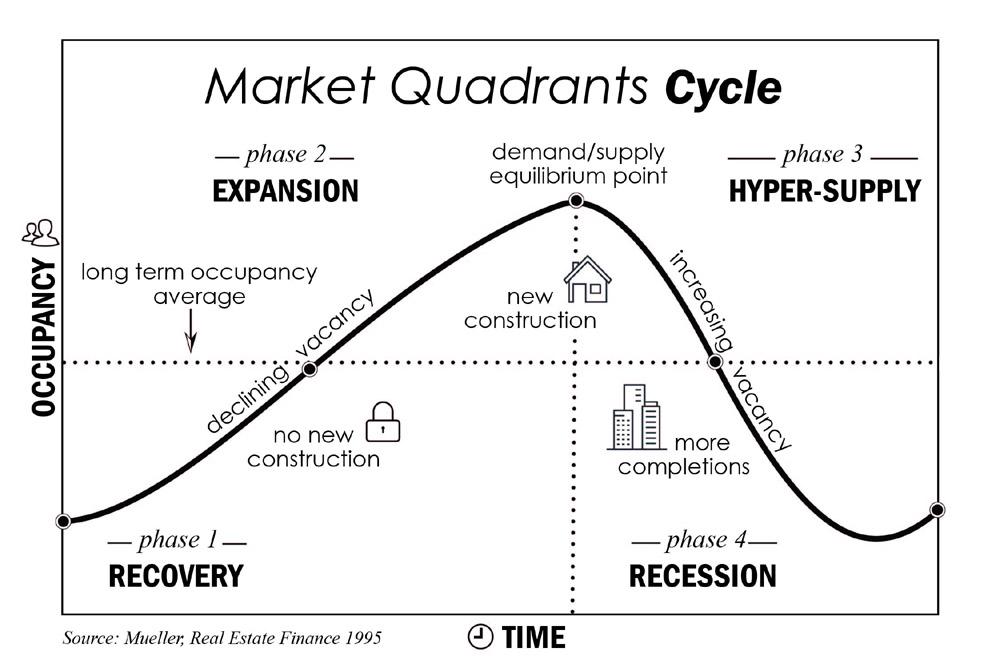

Housing markets go through predictable cycles. A dearth of housing supply spurs more new home construction. Home builders gradually build up a head of steam, as the process from finding sites through pulling permits to building the home to marketing and selling them all takes time. At a certain point, housing developers start building more homes than the local demand actually needs or wants, but by the time they discover that, they still have months or even years to go in order to finish existing construction projects.

At that point, supply exceeds demand, and you see a housing market correction. Developers stop building, and eventually supply gets pinched again, and the cycle repeats itself.

Here’s a handy visual aid for good measure:

Is the US in a Housing Bubble Currently?

While parts of the US clearly experienced a short but intense real estate bubble (I’m looking at you Boise), they’ve since corrected. Fewer cities are dropping in value now than earlier in 2023, indicating that many markets seem to have found their bottom and started recovering.

I didn’t see a nationwide real estate bubble in 2022, and I certainly don’t see one in 2023. To begin with, supply — particularly of starter homes — remains insufficient to cover demand, to put it mildly. Building material and labor costs hover around record highs, putting additional upward pressure on home prices.

Meanwhile, millennials have reached the “settle down in the suburbs and pop out some kids” phase in their lives. See above about the increase in first-time homebuyers supercharging demand for housing.

So no, I don’t see a real estate bubble, at least for most markets in the US.

Final Thoughts

At the moment, I see a great reshuffling of the deck taking place in real estate markets. While the largest, most expensive cities like New York and LA will never become irrelevant, even before the pandemic we saw rents and demand dipping. The rise in telecommuting should exacerbate that trend even after the pandemic is in the rearview mirror.

I see continued hot housing markets in areas with natural charm. Areas with beautiful beaches or lakes, with great skiing and hiking, with history and culture. Post-industrial cities will need to reinvent themselves if they want to retain high-income residents after they discover they can live anywhere and telecommute to work.

Keep an eye on all of the hottest real estate markets in 2023 showcased in the maps above. And note that the best housing markets in the US are mostly satellite towns, seeing astronomical growth.♦

Where are you currently investing in real estate? What do you consider the best housing markets in the US?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Wonderful interactive maps! I’ll probably use it on my website, as well. Very nice of you, Brian, to leave the embedded option!

Thanks Ray, much appreciated!

So how can I get this Home buyer Heat Map? I would like to have one on my new KV Core Website if possible.

Hi Lanre, you can click the “Embed” link beneath any of the interactive maps above to get the embed code for your website. Great to hear from you!

I have lots of listings in Pennsylvania, it is really hot. I was wondering where else is good to invest… you really did great research! I have to ask! Are you planning to invest in one of the Top Cities or you’re working with other priorities right now?

Personally, I’m overseas at the moment. Working with a couple real estate investors I know and trust in the US, in markets where they operate. But hopefully these maps offer some insights into where real estate prices are surging most at the moment!

First of all, thanks for answering! I’m thinking about moving overseas as well and continue to invest in the US. I guess I need to get a lawyer and a trustworthy person to work with me on the grounds. Any tips on that?

This really helped me a lot! I am able to check where is the best City to invest with.

Glad you found it useful Jodi!

I love it. I read your other blog about the worst cities and now this one. It’s amazing how you write.

Thanks Ricardo, much appreciated!

What a brilliant guide! Do you guys have any forecast for 2022 hottest real estate market?

My crystal ball isn’t working too well but I think we’ll see even more dispersal to tertiary markets, smaller cities.

I’m currently investing in New Mexico and it’s been a good experience. I think it’s the best place to consider this 2022.

Glad to hear it Allen!

How would you characterize Cape Corral, FL? Tertiary? I’m building some homes there but I’m looking for other markets…

I would think tertiary, but to be honest I don’t know it very well. Keep us posted about your projects, curious to hear!

I’m planning to invest far away from home and I think this season is the best time to do in the east coast.

You can invest any time of year Marvy, so don’t hold back if you find the right real estate deal!

Thanks for the update! I need your expertise: how to invest in SE aside from buying rental properties? I want to put my money there but I’m not yet ready for long-distance rentals.

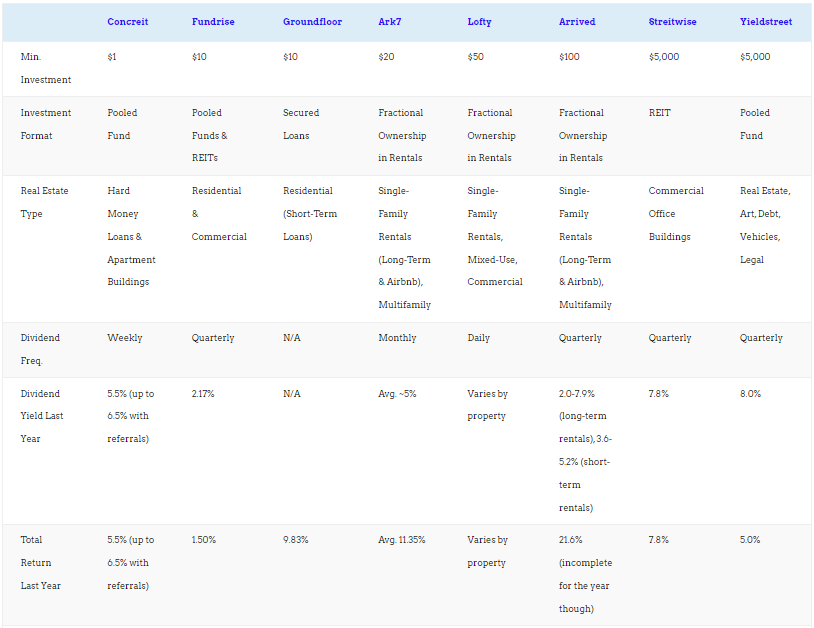

Hi Krystal, you can buy shares in rental properties in the Southeast through Arrived Homes.

In this map, Washington, NC is listed where Washington DC is.

We bought about 10 acres and a house in Vermont last year. We live in Texas, our Number 1 motivator was Climate Change. Recent data being published is showing Vermont and New England as being one of the best places to live considering potential climate impacts. Yet, I don’t see real estate folks talking about it as much. Your last map was VERY informative… Thank You!

Glad to hear the personal perspective Chrissie, on what is motivating you to buy real estate right now! It goes to show that everyone approaches real estate with different priorities and thought patterns. While I don’t believe “Miami will be underwater by 2030” or similar fearmongering headlines, you make a great case for thinking long-term about where the best places to live will be in the decades to come.

Love this kind of granular data

Me too Alexandra!

I’m always worried about a real estate bubble in my area due to my tight budget. I’ll watch the market closely and make informed decisions. Thanks for the update!

I hear you that it’s scary to enter the real estate market when you don’t have much room for error. I’d be careful not to try to time the market though, that’s a lot harder than it seems.

Definitely a fast-shifting landscape in the real estate market. Do you think now is a good market to buy?

I personally don’t believe in trying to time the market. I just invest a few thousand each month in deals through our Co-Investing Club, as a form of dollar cost averaging for real estate investments. Over time, I know I’ll come out ahead, without trying to time the market.