Deni and I have a student named Maria in our FIRE from Real Estate course, who lives in the Bay Area.

Maria makes a good living, but when she looks at the cost to buy a rental property in the Bay Area, even she blanches. It’s a struggle to find any rentals under $600,000.

In fact, Maria said most of the people she knows who have tried their hand at real estate investing just want to break even. Their only goal is not to lose money every month to negative cash flow.

Because Maria has never bought a rental property before, she wanted to buy somewhat locally. But after an exasperating search in the Bay Area and Sacramento, she’s ready to throw in the towel and look elsewhere.

The Rise of Long-Distance Real Estate Investing

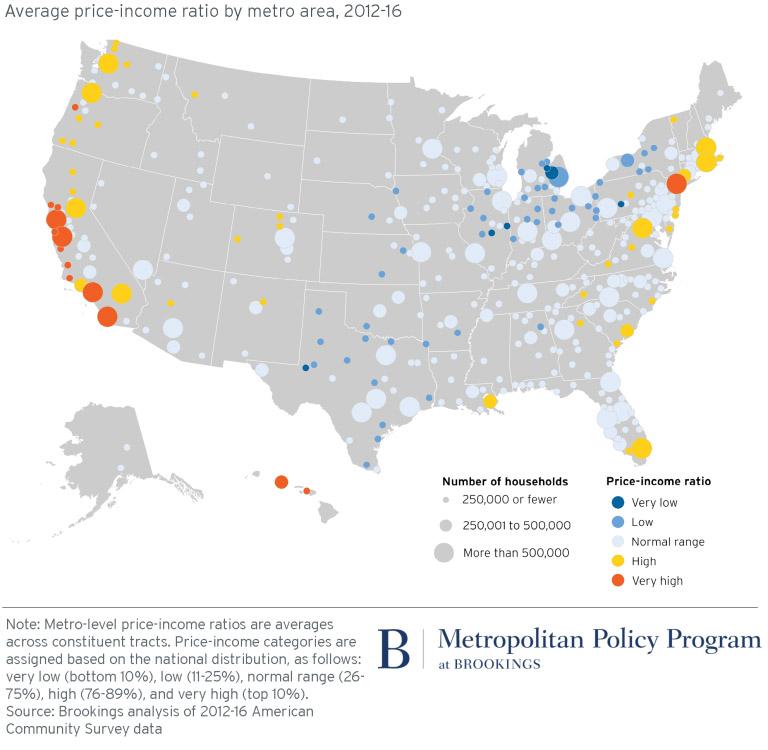

Maria is far from alone. It’s a common phenomenon – real estate investors from expensive coastal cities feel priced out, and turn inland for higher rental returns.

Here’s how cities across the US measure up, on real estate price-to-income ratios:

Long-distance real estate investing has skyrocketed in the last five years. From 2016 to 2020, the percent of buyers who made offers sight-unseen jumped from 19% to 63%, according to a study from Redfin.

Over a third of real estate purchases bought sight-unseen!

Redfin isn’t the only company to notice. Seemingly overnight, turnkey property sellers have risen from a cottage mom-and-pop industry to enterprise-level operations. Roofstock, the undisputed frontrunner in the turnkey rental property industry, revealed that 62% of their transactions were long-distance real estate investing deals, with buyers over 1,000 miles from their purchased property.

Real estate investing isn’t local anymore, Toto.

What Is a Turnkey Property?

A turnkey rental property is a property that needs little or no work to be rent-ready. In many cases, turnkey properties are already rented and producing cash flow.

Turnkey property sellers historically were individual real estate investors themselves. They bought a property that needed work, renovated it, and flipped it to a long-term rental investor, often off-market through their private mailing list.

While there are still tens of thousands of mom-and-pop turnkey rental property sellers in America today, the market has begun to shift. Some turnkey property sellers now go through for-sale-by-owner listing services, to publicly list their properties on the MLS without having to pay a full Realtor commission.

Others list through turnkey property investing marketplaces, such as Roofstock.

And there are also increasingly larger companies getting in on the turnkey property investing action.

Where Can I Find Turnkey Rental Properties?

If you’re interested in long-distance real estate investing, here are a few places to start the hunt in your turnkey property investing campaign.

Roofstock

There’s a reason why Roofstock has enjoyed a meteoric rise in popularity.

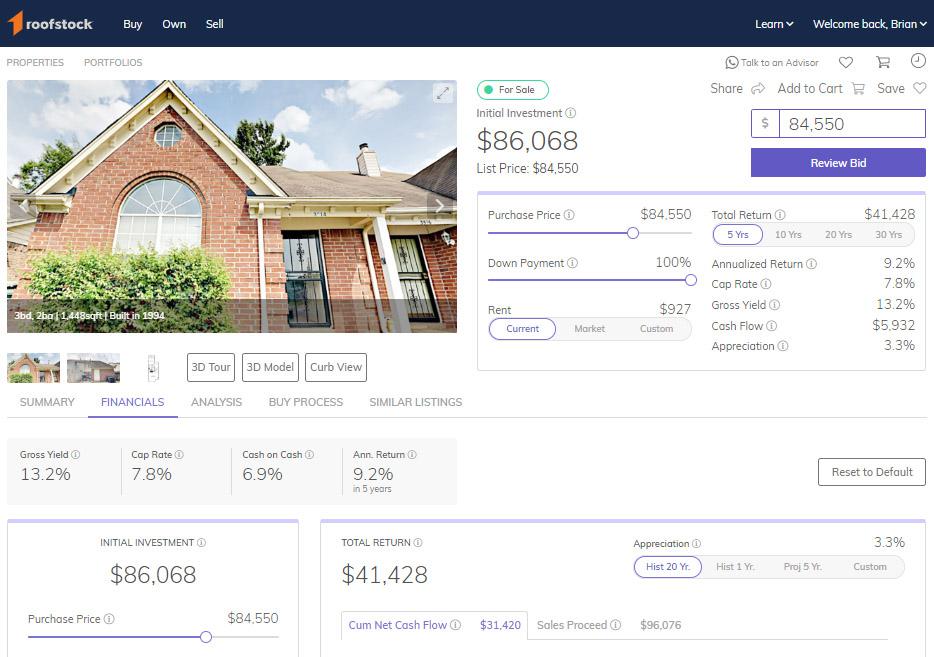

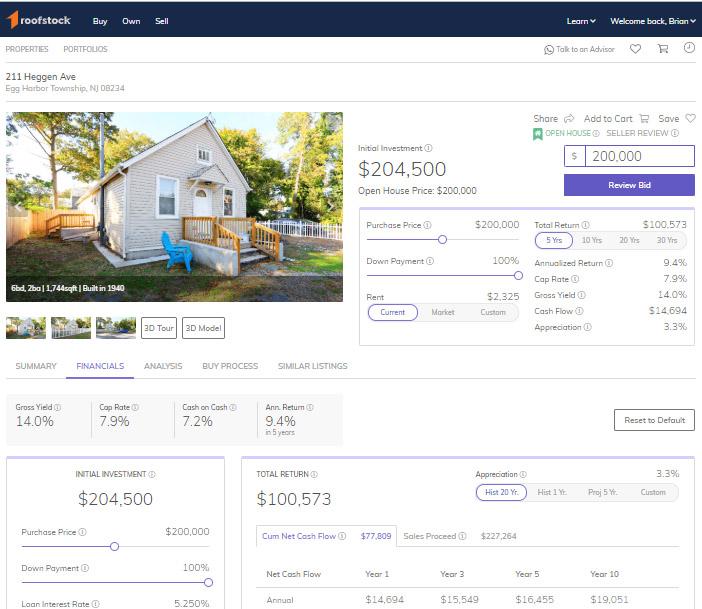

Roofstock makes it simple and convenient for anyone to start investing in real estate long-distance. They certify each property before listing it and include an incredible amount of detail for investors in each listing.

In the sample listing above, you can see details like market rent, tenant payment history (if the turnkey property is already rented), projected returns, internal rate of return, five-year cash flow projections, property appreciation data, and detailed information about the neighborhood itself.

It’s worth mentioning that Roofstock is a marketplace, not a seller. They don’t typically own any of the properties listed for sale – they are merely connecting turnkey property sellers with buyers.

Roofstock charges a commission of 2.5% (or $2,000, whichever is higher) to the seller, and 0.5% (or $500) to the buyer. With that buyer’s fee, they also include several guarantees – more on these shortly.

Corporate Turnkey Property Sellers

Increasingly larger operations are turning to turnkey property investing and catering to long-distance real estate investors.

One example is Norada Real Estate, which makes out-of-state real estate investing easy with properties in Florida, Georgia, Idaho, Texas, Mississippi, Ohio, and other Midwestern and Southern markets.

One perk that some of these corporate turnkey rental property sellers offer is seller financing. In many cases, Norada provides seller financing, for example.

Mom-and-Pop Turnkey Rental Property Sellers

Traditionally, most turnkey property sellers were real estate flippers. They would buy properties in strong rental neighborhoods, update them, and sell them to long-term rental investors.

Because these are individual investors, spread over thousands of cities in the US, they’re not as easy to find. Often you’ll find them in local real estate investing Facebook groups, or on local BiggerPockets forums, or in our nationwide landlords and real estate investors Facebook group.

Or better yet, you can find a directory of them in our Dealfinder Database, which we provide in our FIRE from Real Estate program.

Advantages of Turnkey Property Investing

Why buy turnkey rental properties?

Here are a few of the pros to turnkey property investing:

Pro 1: Convenience

Turnkey properties are easy. They need little or no renovation work to be rent-ready, so you can list them for rent immediately.

Which, in turn, means little or no vacancy carrying costs up front, and instant cash flow.

In the case of turnkey property marketplaces like Roofstock, or corporate turnkey property sellers, buyers can quickly sift through hundreds of turnkey properties all over the country.

That means easy long-distance real estate investing anywhere in the country, from your pajamas.

Here’s a quick overview of how Roofstock’s property listing system looks and feels:

Pro 2: Turnkey Properties Often Come Already Rented

While not always the case, many turnkey rental properties come with tenants. In these cases, turnkey property investors can review rent payment history data to get a sense for the tenant’s reliability.

Additionally, turnkey buyers can ask for the renters’ original tenant screening reports, to view their credit report, criminal history, eviction history, and rental application.

Pro 3: Possible Guarantees

One nice perk of Roofstock is that they include several guarantees to make turnkey property investing more comfortable, especially for long-distance real estate investors.

The first guarantee they include is a 30-day property guarantee. If you’re not happy with a turnkey property you’ve bought through their marketplace, you can re-list it for sale, with their commission waived, and they guarantee you will receive the full amount you paid for it.

If it fails to sell within 90 days, they buy it from you themselves.

The second guarantee that Roofstock offers is on rental income. They guarantee that you’ll rent the property within 45 days of buying it, for vacant turnkey properties. If the property doesn’t rent within 45 days, they will pay you 90% of the market rent until you sign a lease agreement with a tenant.

When was the last time you saw a Realtor offer that kind of service and guarantee?

One caveat for that rent guarantee – you have to work with one of their certified property managers.

Pro 4: Help with Local Vendors

One nice perk of going through a turnkey property seller in long-distance real estate investing is that they can refer you to excellent, investor-friendly local service providers.

As alluded to above, when Roofstock enters a new market, they vet the local property managers and choose the top two or three that meet their quality standards. These certified property managers are already screened, to boost your comfort with out-of-state real estate investing.

But Roofstock isn’t the only turnkey property seller that can refer you to a good local property manager. Local mom-and-pop turnkey rental property sellers almost always work closely with good local property management teams as well.

Similarly, turnkey sellers can help refer you to local title companies, local lenders, local insurance agents, and any other local services you require. Roofstock puts local insurance agents through a similar vetting process, and can recommend reliable and honest brokers.

Disadvantages of Turnkey Properties

Is turnkey property investing all sunshine and butterflies? Not exactly, or everyone would be doing it.

Here’s what to watch out for as you evaluate turnkey rental properties and consider long-distance real estate investing.

Con 1: Often Mediocre Returns

The nice thing about buying a property to fix up is that you can score a good deal on it, and force some equity and appreciation.

But with turnkey properties, someone’s already done that for you. They’ve already squeezed the juice out of the equity, and are selling it for top dollar.

My experience has been that rental investing returns on Roofstock hover in the 3-9% range. And properties at the high end of that range aren’t just lying around, either. When they’re listed, they tend to move quickly, so you’ll need to keep a close eye on listings.

Nor are these turnkey property returns unique to Roofstock. From corporate turnkey sellers to mom-and-pop turnkey specialists, they know what they’re doing, and are pricing the properties at full-market value.

Convenience comes at a cost!

If you’re looking to score better deals, check out our review of real estate investing tool PropStream.

Con 2: Often Lower-Quality Tenants

I knew an unscrupulous turnkey seller once, who didn’t even bother running tenant screening reports, he just put whichever applicant was willing to pay the most into his turnkey properties.

Why? So that he could charge the highest price for them, justified by the high rent.

Just because a turnkey rental property comes with a tenant doesn’t mean they’re a good tenant. You still need to do your own due diligence, to verify their tenant screening reports and rental application.

If the seller can’t provide those screening reports and the rental application, buyer beware!

Con 3: Long-Distance Real Estate Investing Makes Due Diligence Difficult

Captain Obvious here: it’s harder to do your due diligence on a property when you’re investing in real estate long-distance.

You can’t walk through the property yourself. You can’t tell if it smells like mold, or if the condition matches the photos.

Instead, you have to rely on others to inspect the property and report to you.

Granted, no one says your turnkey property investing has to be out-of-state. You can buy turnkey rental properties in your own hometown, which makes this con irrelevant for anyone not engaging in long-distance real estate investing.

Turnkey Property Management

As mentioned above, one advantage to out-of-state real estate investing through Roofstock is that they vet and certify local property managers to recommend.

But as the owner, you’re under no obligation to use one of their certified property managers. You can choose another property management firm, or forego property managers altogether and use our online landlord app to automate your management! (Shameless plug? Yeah, well, we are a business, after all!)

You can also have the rent deducted from the tenant’s paycheck, for even more assurance of on-time rents.

Of course, the inverse is also true. You don’t have to use Roofstock for your long-distance real estate investing, but you could still find out which property management firms they’ve certified in that local market.

Always nice to hire people that have already been vetted for you!

As a final note, it’s worth mentioning that Roofstock does not receive a commission or other financial gain from their certified property managers. There’s no conflict of interest – they truly want to work with the best in any given market.

Financing a Turnkey Property

One of the great advantages to turnkey property investing is that they’re easy to finance, since they typically don’t require repairs.

Instead of having to get a short-term renovation loan, then refinancing once the repairs are finished, you can buy the property with a permanent long-term mortgage.

We’ve vetted a handful of investment property lenders; see our investment property loans comparison chart for details. To compare today’s rates on conventional loans, check out Credible.

Roofstock also vets local and nationwide lenders, and can offer a few recommendations.

Firsthand Experiences with Roofstock

I have not yet bought a property through Roofstock. So to bring some firsthand perspectives, here are a few case studies from real estate investors on BiggerPockets:

“Overall, I would say the process has been pretty painless. I think that Roofstock has a really great tool/system and does a great job of what they have set out to do. I was a little frustrated by the miscommunication and phone tag at the end, but that isn’t Roofstock’s problem, and I know that generally, last minute changes right before closing aren’t terribly uncommon. I would definitely use Roofstock again – in fact I plan to.”

“Overall, I would say the process has been pretty painless. I think that Roofstock has a really great tool/system and does a great job of what they have set out to do. I was a little frustrated by the miscommunication and phone tag at the end, but that isn’t Roofstock’s problem, and I know that generally, last minute changes right before closing aren’t terribly uncommon. I would definitely use Roofstock again – in fact I plan to.”

Jon Krombein, Rental Property Investor from Seattle, WA

“A Roofstock representative was closely working with me while I placed the order and confirmed that the purchase went through fine and congratulated me on the first purchase. Following Monday, I got a one line text from Roofstock that the purchase was cancelled. Not sure what happened in between. In this case, I am guessing, the Seller did not act on any of the offers and after the review period ended the Seller went to Roofstock to allow him to pick previous offers. At least they should give a proper explanation instead of apologies.”

“A Roofstock representative was closely working with me while I placed the order and confirmed that the purchase went through fine and congratulated me on the first purchase. Following Monday, I got a one line text from Roofstock that the purchase was cancelled. Not sure what happened in between. In this case, I am guessing, the Seller did not act on any of the offers and after the review period ended the Seller went to Roofstock to allow him to pick previous offers. At least they should give a proper explanation instead of apologies.”

Anandakumar Elumalai, Rental Property Investor Torrance, California

“Would I Use Roofstock Again? Yes. I felt that even though I had issues with the certificate of compliance, the inspection/appraisal report, and closing, I would use Roofstock again and would recommend it to others. Obviously, that recommendation may change as we move forward and have more experiences with Roofstock, and become more experienced investors, but as of right now I have been pleased with the experience, communication, and ultimate result of using Roofstock for our first out-of-state rental purchase.”

“Would I Use Roofstock Again? Yes. I felt that even though I had issues with the certificate of compliance, the inspection/appraisal report, and closing, I would use Roofstock again and would recommend it to others. Obviously, that recommendation may change as we move forward and have more experiences with Roofstock, and become more experienced investors, but as of right now I have been pleased with the experience, communication, and ultimate result of using Roofstock for our first out-of-state rental purchase.”

Jason Gines, Turnkey Property Investor from Long Island, NY

Final Word

Whether you use a corporate turnkey property seller, a mom-and-pop seller, or Roofstock, turnkey rental properties can an excellent avenue for long-distance real estate investing.

It can also be convenient and simple way to buy your first rental property.

Always remember to be doubly careful with your due diligence when buying properties sigh-unseen. Out-of-state real estate investing can help you pursue more profitable markets, but it also puts you at risk for buying properties with unforeseen problems.

When in doubt, consider finding a local partner to serve as boots on the ground.

Alternatively, you could always go visit in person – and perhaps write off the trip as a real estate investing tax deduction!

I’ve only recently started considering investing in real estate long-distance. Historically I’ve bought properties and renovated them, and forced equity that way.

I’m considering a turnkey property out-of-state, just worried about finding a good deal like you pointed.

Very useful article, thanks Brian!

Yeah it’s definitely harder to find good deals on turnkey properties, especially as a long-distance investor.

I’m pretty sure long distance rental properties have become more popular when pandemic started until now. I”m just wondering what’s the figure. I hope to find my first long distance rental property myself!

It’s definitely become more popular over the last few years. Best of luck Jonathan!

Long distance investing piques my interest. It’s amazing how the real estate industry has evolved over the last few years.

Absolutely Sarah!

I’ll take the mediocre return anytime! Turnkey properties save you from all the hassles, undetected risks, and unwanted expenses.

I hear you Moises. The older I get, the more I appreciate passive investments.

Many investors are shifting to long distance investing and I figured out that it is convinient for tech savvy people! Physical assets but managed through online apps, virtual calls, and resource tools like this one. Fascinating!

Definitely a growing trend!

If you ever actually read Roofstocks terms and coditions, you should never do business with them. Yes some people actually read those things.

What specifically in their terms and conditions do you object to?

For long term investing, turnkey properties are excellent whether it’s long distance or short distance.

I’ve known many people who had success with turnkey rentals, and never picked up a wrench in their lives. The hard part is just finding good deals.