Vet & Invest in Real Estate Deals as a Community

Meet monthly to vet group investments

Full cash flow, appreciation, & tax benefits

(without becoming a landlord)

Co-Investing Club

Passive Real Estate Investment Club

Attend club meetings

Once or twice a month, our Co-Investing Club meets to vet deals together. No experience necessary, recordings available.

Invest $5K+ (or skip it)

Invest $5,000 or more in any investments you like, instead of the typical $50-100K. Non-accredited investors welcome.

Enjoy cash flow, appreciation, tax breaks

As a fractional investor, you get full real estate benefits. We vet deals targeting 15%+ returns — together, as a club.

In the Co-Investing Club, we believe:

1. Vetting investments as a group reduces risk. More eyeballs reviewing deals = better risk analysis.

2. Dollar cost averaging beats trying to be “clever”. Outsized returns come from small, steady, diversified investments (not trying to pick the next hot market or asset type).

3. Our community is the best in the world at vetting investments together. Together, the hundreds of Co-Investing Club members have a vast collective knowledge of real estate investing.

What kinds of investments do we review as a club?

Multifamily

Hotels & Airbnbs

Secured Loans

Mobile Home Parks

Self-Storage

Retail

Don’t take our word for it. In our members words:

Not ready for private equity real estate? Compare real estate crowdfunding options

If you’re just curious about passive real estate investments, start with $10 in a real estate crowdfunding platform.

Of course, not all real estate crowdfunding platforms are created equal. Some we love and invest our personal money in. Others… not so much.

To demystify the world of real estate crowdfunding, we compiled a list of the 17 most popular real estate crowdfunding platforms, along with “At a Glance” highlights to help you decide which ones are a good fit for you. They include short-term real estate investments like Concreit and long-term investments like Arrived. Real estate equity investments (Fundrise) and secured debt investments (Groundfloor). Fractional ownership in individual properties (Ark7) and pooled funds (Streitwise). And every combination in between.

Unlike most reviewers, we actually invest in most of these ourselves. Our money is where our mouth is.

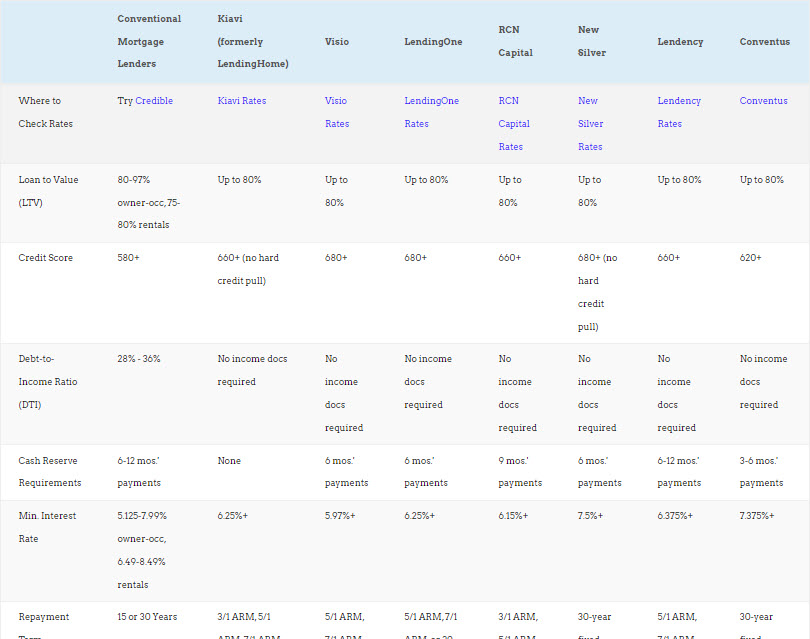

Active investor? Compare loans for investment properties

We’ve vetted rental property lenders for you.

From interest rates to loan-to-value ratios (LTV), we’ve put together several comparison charts for investment property loans.

Rental property loans are inherently different from short-term fix-and flip loans, so we broke them down into two separate charts for easy loan comparisons.

And if you’re cash-strapped, read up on 17 Clever Ways to Come Up with a Down Payment for a Rental Property.

Never worry again about how you’ll finance your next investment property!

Learn Real Estate Investing

We invest a ton of time in making our articles and free real estate tools awesome, from our free real estate investing calculators to our interactive maps to our how-to tutorials.

Enjoy the latest from our real estate investing blog!

Who counts as upper-middle class?

At a Glance: “Upper-middle class” is subjective, but two objective ways to measure it are net worth and income We used the 75th to 90th percentiles for both to define upper-middle class Real estate investing can help you get there faster here’s how The term...

“Back Door” Syndication Investments and $2,500 Minimums?

At a Glance: Sometimes operators back-fill deals to wrap up the last round of renovations That can reduce risk, since the operator already runs and knows the property inside and out The downside: the cap on how much you can invest Deni and I are constantly checking in...

Ultra-Niche Passive Real Estate Investments That Pay Ultra-Returns

At a Glance: In general, the deeper the niche, the higher the returns. We’ve had good experiences with these four niche investments over the last year. Ever hear the expression “the riches are in the niches”? Hokey rhymes aside, it’s true. Here are a few examples of...

Weakening Economy? How Should You Invest?

At a Glance: There are actually huge advantages to investing through a downturn especially in real estate Dollar cost averaging protects you from dangerous emotions like fear and greed I keep investing $5,000 a month no matter what happens in the economy The Labor...

U.S. Housing Market Outlook: Cities Facing the Steepest Home Price Declines

At a Glance National Home Prices Declining: Unlike most past recessions, U.S. home prices are projected to fall about 1% nationally, with some local markets facing much steeper drops of 5–15%. Key Drivers of the Decline: Rising insurance premiums, higher mortgage...

Who Counts as Middle Class and Upper-Middle Class in America Today?

At a Glance Income & Net Worth Benchmarks – The upper middle class is typically defined as households earning $145K–$235K annually or having a net worth of $658K–$1.9M, though exact ranges vary. Location Matters – What qualifies as upper middle class depends...

Our Founders Are Every-freakin’-where

Deni Supplee and G. Brian Davis, our quirky and brilliant founders, show up just about everywhere in the world of real estate investing. Every week we appear somewhere in the press or other media appearances such as:

Because we’re real estate investors, not faceless corporate hacks.

Deni Supplee and G. Brian Davis love real estate, passive income, lifestyle design, and teaching.

So we combined all those those together to create SparkRental.

Some people just want the high returns and tax benefits of real estate investments, but don’t want the headaches of becoming a landlord. For them, we created our Co-Investing Club to help them invest passively in real estate.

In fact, Brian’s now one of those passive investors, and he spends most of the year traveling overseas with his wife Katie and daughter Millie.

Other investors want the control of owning individual properties directly. For them, we created free landlord software, free calculators (such as a free rental income calculator and free depreciation calculator), and interactive maps such as the best cities for rentals and real estate heat maps.

With enough passive income from real estate, you reach financial independence. You can live off your rents and distributions — and your day job becomes optional.

Want to connect? Drop us a line below, or check out our Facebook page and YouTube channel!