Best Real Estate Crowdfunding Platforms to Diversify Your Portfolio

Which real estate crowdfunding investments are legit, and which ones should you steer clear of?

Want to diversify into real estate, but don’t have $50,000 for a down payment on an investment property?

Consider real estate crowdfunding platforms, which let you invest with as little as a few dollars.

You also avoid the labor and expertise required to both find good deals on properties and manage them once bought. Real estate crowdfunding investments are truly passive, as opposed the headaches that landlords take on.

Before we dive deeper into the 17 most prominent real estate crowdfunding investments, here’s a “cheat sheet” table comparing eight of the best real estate crowdfunding platforms in 2024 — at least the ones that allow middle-class investors (not just wealthy accredited investors):

| Concreit | Fundrise | Groundfloor | Ark7 | Lofty | Arrived | Streitwise | Yieldstreet | |

|---|---|---|---|---|---|---|---|---|

| Min. Investment | $1 | $10 | $10/loan ($1,000 minimum opening transfer) | $20 | $50 | $100 | $5,000 | $10,000 |

| Investment Format | Pooled Fund of Loans, Fractional Ownership in Rentals | Pooled Funds & REITs | Secured Loans | Fractional Ownership in Rentals | Fractional Ownership in Rentals | Fractional Ownership in Rentals | REIT | Pooled Fund |

| Real Estate Type | Hard Money Loans & Apartment Buildings | Residential & Commercial | Residential (Short-Term Loans) | Single-Family Rentals (Long-Term & Airbnb), Multifamily | Single-Family Rentals, Mixed-Use, Commercial | Single-Family Rentals (Long-Term & Airbnb), Multifamily | Commercial Office Buildings | Real Estate, Art, Debt, Vehicles, Legal |

| Dividend Freq. | Weekly | Quarterly | N/A | Monthly | Daily | Quarterly | Quarterly | Quarterly |

| Dividend Yield Last Year | 5.5% (more with referrals) | 2.17% | N/A | Avg. ~5% | Varies by property | 2.0-7.9% (long-term rentals), 3.6-5.2% (short-term rentals) | 7.8% | 8.0% |

| Total Return Last Year | 5.5% (more with referrals) | 1.50% | 9.83% | Avg. 11.35% | Varies by property | 21.6% (incomplete for the year though) | 7.8% | 5.0% |

| Hold Time w/o Penalty | 1 Year (but no principal penalty) | 5 Years | 2-18 Months | 3 Months | None | 5 Years | 5 Years | 3+ Months |

| Built-In IRA | No | Yes | Yes | Yes | No | No | No | Yes |

| Year Launched | 2018 | 2012 | 2013 | 2019 | 2018 | 2021 | 2017 | 2014 |

| Brian Invests Personally | Yes | Yes | Yes | Yes | Not Yet | Yes | Yes | Not Yet |

| Learn More | Concreit | Fundrise | Groundfloor | Ark7 | Lofty | Arrived | Streitwise | Yieldstreet |

What Are Real Estate Crowdfunding Investments?

Crowdfunded real estate platforms come in several broad categories. Before choosing platforms to invest with, make sure you understand the variations between and within real estate crowdfunding investments.

Crowdfunded REITs & Pooled Funds

A real estate investment trust or REIT is a fund that owns a pool of real estate-related investments. Other pooled funds work similarly, but don’t qualify as REITs under the Securities and Exchange Commission’s (SEC’s) rules. More on that distinction shortly.

Those pooled crowdfunding projects might include properties directly owned by the fund, known as an equity REIT. In contrast, a debt or mortgage REIT owns debts secured by real property.

Equity REITs tend to offer more long-term growth potential. After all, they own properties, and real estate usually appreciates in value over time.

Debt REITs tend to offer better cash flow, paid out to investors in the form of dividends. Both long-term growth and ongoing cash flow and dividends play a huge role in reaching financial independence and retiring early.

Some REITs combine both direct ownership and loan investment strategies for a bit of both, such as Fundrise.

You can buy and sell shares in publicly-traded REITs through your regular brokerage account. But private crowdfunded REITs work differently: you buy shares directly from the company. That makes share prices far less volatile, since they don’t trade in real time on stock exchanges. But it also makes them less liquid, and difficult to sell. If you want to sell within the first few years of buying shares, many real estate crowdfunding platforms buy them back at a discount from what you paid.

Note that not all pooled funds operate as REITs. Real estate investment trusts must pay out at least 90% of their profits each year in the form of dividends. While that sounds peachy on paper, it prevents them from growing their portfolio by reinvesting profits in new properties. That severely limits their growth potential.

Pooled funds that don’t get taxed as REITs fall under no such restrictions. That gives them more flexibility to reinvest profits and grow their funds’ portfolios, and therefore grow share values.

Fractional Ownership in Individual Properties

Instead of investing in a pooled fund that owns many properties, you can buy fractional ownership in a single property.

For example, Arrived, Ark7, Concreit, and Lofty all offer this type of investing. For $20-100, you can buy shares in a single-family rental property. You collect rental income from that property in the form of distributions, and when the property sells, you get a piece of the profits proportional to your ownership share.

Some platforms even let you sell you shares at any time on a secondary market. More details below when we drill deeper into specific real estate crowdfunding platforms.

Individual Secured Loans

If you prioritize cash flow over long-term appreciation, look to earn interest from secured real estate loans over equity ownership.

Some crowdfunded real estate platforms instead operate as investment property lenders, offering loans to real estate investors. They raise the money for these loans from the public: you. You can review the available loans to fund, and pick and choose which ones you like. You decide how much you want to invest toward any given loan; sometimes as little as $10 (such as Groundfloor).

These loans tend to be short-term, fix-and-flip loans. Loans to buy fixer-uppers, renovate them, and then either sell as flips or refinance as rentals (the BRRRR strategy).

That makes them short-term investments — a rarity in the world of real estate investing.

Secured loans offer strong passive income, but no long-term appreciation potential. You own debt, not equity investments in any real estate assets.

Accredited vs. Non-Accredited Investors

Because of the way real estate crowdfunding is regulated by the SEC, many crowdfunding platforms don’t allow retail investors — mom-and-pop investors like you and me.

Instead, they can only accept money from accredited investors. These are wealthy investors who must meet one of two criteria to qualify:

-

- A net worth over $1 million (not including equity in their primary residence) or

- Annual income over $200,000 for each of the last two years, and the expectation that you will earn at least that much again this year ($300,000 for married couples filing jointly).

At the risk of getting preachy, the SEC basically says, “We don’t think anyone but the rich is sophisticated enough to invest in high-risk, high-return investments, so we’re not going to let them invest how they see fit.” Good thing we have paternal Uncle Sam telling us what we can and can’t do with our own money.

So, in any discussion of the best real estate crowdfunding investments, you have to divide them into two camps: those available to accredited investors only and those available to all the rest of us.

Best Real Estate Crowdfunding Platforms in 2024 for Non-Accredited Investors

Since most of us don’t qualify as accredited investors, let’s start with the best crowdfunded real estate platforms for retail investors.

Note that nearly all of these offer long-term investments only. Most real estate crowdfunding sites expect you to leave your money invested for at least five years.

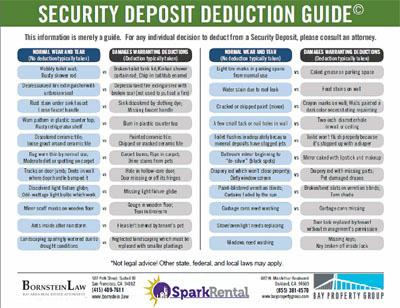

Rather than fixating on management fees for these crowdfunded real estate platforms, I focused on rate of return. The sad fact is that real estate investment platforms can hide fees easily, so their disclosed fees mean little. For example, if they do maintenance in-house, they can bill as much as they want as an hourly rate, to pad their profit margin.

Finally, we removed Roofstock One, LEX Markets and Rich Uncles/Modiv from this list. LEX Markets closed down their real estate crowdfunding platform in early 2023 due to lack of usage. And after NNN REIT bought crowdfunded real estate platform Rich Uncles and rebranded it as Modiv, they launched it as a publicly-traded REIT. Roofstock wound down their Roofstock One program in late 2023, so none of these count as a current real estate crowdfunding investment.

1. Groundfloor

1. Groundfloor

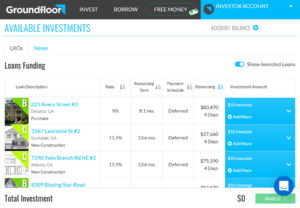

Groundfloor takes a unique approach to real estate crowdfunding investments.

Unlike pooled REITs such as Fundrise and Streitwise, Groundfloor is a hard money lender. They issue short-term fix-and-flip loans to real estate investors, and you can pick and choose which loans you want to invest in. Most loans are for 12 months, plus or minus a few months.

Best of all, you can invest as little as $10 toward any given loan. Although the minimum initial transfer to get started on the platform is $1,000.

When the borrower sells the property or refinances, you get paid back with interest. You can turn around and reinvest the money in new loans or pocket your money and walk away.

Of course, all loans come with risk of default. But because Groundfloor lends investment property loans, they aren’t subject to the regulation on homeowner mortgages. Groundfloor also lends a much lower loan-to-value ratio (LTV) than homeowner loans, usually in the 50-80% range. So if the borrower defaults, Groundfloor simply forecloses and sells the property to recover their — your — money.

I invest in Groundfloor myself and have been mostly happy with it so far. A few loans have had borrowers default, and I continue to watch how Groundfloor handles the process. But the overwhelming majority of their loans repay in full with interest.

The trick? To invest a little money in a lot of loans.

As for returns, Groundfloor grades each loan on risk, and charges borrowers accordingly. They pay between 7-15% interest on loans, depending on risk grade.

Notes, Advances, and Groundfloor Labs

Groundfloor also raises money by borrowing money directly in the form of private notes, with a minimum investment of $1,000. They currently offer one-month, three-month, and 12-month notes, having scrapped their two-year note in March 2024.

The other big change in March 2024? Groundfloor started offering rollover notes, that automatically reinvest your principal when the note matures and repays you. These offer slightly higher (25 basis points) interest rates than the standard one- and three-month notes.

I had been disappointed that Groundfloor discontinued their Stairs investment offering in 2023, but their one-month notes have replaced it. And if you want something virtually identical to the old Stairs fund, Concreit offers a liquid short-term real estate investment (more on Concreit shortly).

As a final thought, Groundfloor offers experimental investments through their Labs program. It’s invitation only, but reach out to them if you’re interested in investments like raw land, second lien loans, or equity advances.

Bottom Line: A high-yield, easy way to invest in real estate-secured debt without a long-term commitment. (Read our full Groundfloor review here.)

Minimum Investment: $10 per loan ($1,000 initial transfer to open an account)

Type: Individual short-term loans, private notes.

2. Fundrise

I invest in Fundrise myself, and have been largely happy with it so far.

They operate using the pooled fund model, like a REIT. Technically, they operate many REITs, and spread your money among them depending on your investment settings.

Fundrise invests in a combination of income-producing properties and secured loans. Their property portfolio includes single-family rental properties, apartment complexes, and commercial properties including office space and industrial real estate. Your money spreads among many of their real estate projects, which helps you diversify.

All investors can now choose between their Supplemental Income, Balanced Investing, and Long-Term Growth allocations, depending on your investing goals. Fundrise recently ditched the tiered account levels, based on how much you had invested. Now they simply offer one upgraded Pro plan, which lets you set your own asset allocation and choose individual investments within Fundrise’s platform.

They also offer some funds available only to accredited investors. This allows access to more private offerings, including fractional ownership in individual rental properties.

Fundrise allows you to set up automated monthly investments and automated dividend reinvestment. They’re also partnered with a custodian to allow investing through a self-directed IRA.

Fundrise paid an average return of 22.99% in 2021. Their Long-Term Growth fund earned 25.12%. In 2022, Fundrise earned a far lower return of 1.50% — but still delivered a positive return. Compare that to the S&P 500 (-18.11%) and publicly-traded REITs (-25.10%).

Read our full Fundrise review here for more information.

Bottom Line: A great starting point for diversified real estate investing.

Minimum Investment: $10

Type: Pooled funds holding residential & commercial real estate and secured debts.

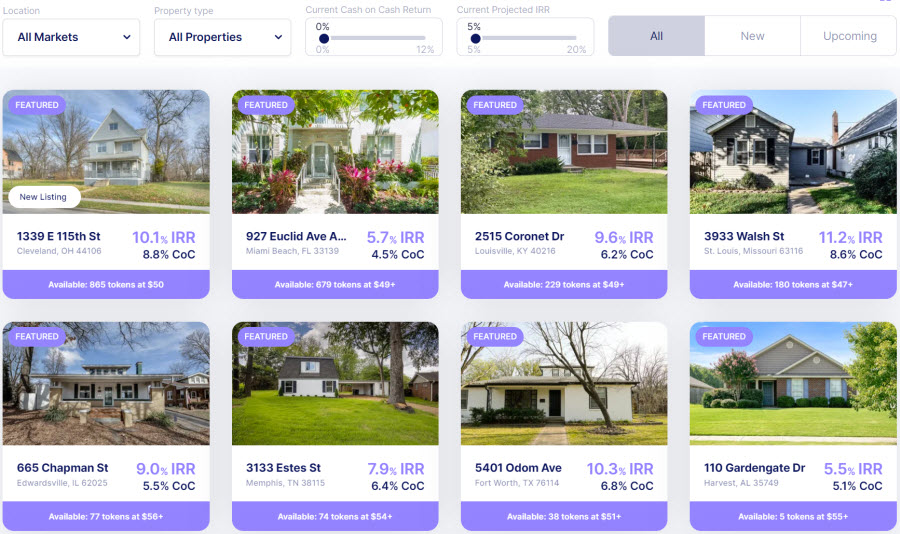

3. Ark7

Created in 2019, Ark7 works similarly to Arrived and Lofty: you buy fractional shares in single-family rental properties, short-term rentals (Airbnb), mid-term rentals (travel nurses and other corporate renters), and multifamily properties. I own property shares on Ark7 myself.

Shares start at $20, and after an initial holding period, you can sell your shares at any time through Ark7’s online marketplace. While the website urges a minimum holding period of one year, the platform may let you sell shares after just three months. That adds liquidity to a type of investment that historically has none — a huge advantage over Arrived.

Ark7 doesn’t charge transaction fees when you sell either, for a fast, free exit. When and if you sell shares, you also don’t have to mess around with receiving funds in cryptocurrency, unlike competitor Lofty.

I also like that Ark7 maintains some ownership interest in each property, to maintain skin in the game. Ark7 holds onto 1-20% ownership, depending on the property. They keep their fees extremely transparent: they charge a 3% acquisition fee when they buy the property, and that’s it. No annual asset management fees, no liquidation fees, nothing. Ark7 manages around three-quarters of their properties directly, and charges 8-15% in property management fees (vacation rentals cost more to manage).

One drawback to Ark7? They’re still relatively small. They own 25 properties in six states, although they’re expanding quickly.

Ark7 pays out monthly distributions on the fractional shares in rental properties that you own, for a steady source of passive income. Read our full Ark7 review for more details.

Bottom Line: A simple, transparent, liquid way to buy shares in rental properties with just $20.

Minimum Investment: $20

Type: Fractional ownership in single-family rentals, short-term rentals, medium-term rentals, and multifamily properties.

4. Concreit

4. Concreit

As a better-paying alternative to a CD, money market account, or high-yield savings account, consider Concreit. Unlike nearly any other real estate investment, you can sell and withdraw your money at any time with no penalty to your principal. But make no mistake: it’s still an investment, not a deposit at a bank guaranteed by the FDIC.

That kind of liquidity is nearly unheard of among other real estate crowdfunding platforms. While there’s no early withdrawal penalty on your principal, if you pull money out within the first year, they ding your dividend payout by 20%.

Concreit pays a fixed 6.5% annual dividend yield. But they pay those dividends every single week, making it another strong investment for compound interest. So, even if you withdraw your money in the first year and take the 20% dividend penalty, that still leaves you with a dividend yield of 5.2%.

Most of Concreit’s portfolio consists of loans secured by real property. Because these are short-term loans, they turn over quickly and leave Concreit with plenty of liquidity. You can pull your money out whenever you feel like it, although Concreit can’t guarantee instant liquidity because they’re not an FDIC-insured bank. When you go to withdraw funds, Concreit flashes a warning that it can take 30 days to actually hit your bank account.

That said, Concreit also owns equity in some multifamily properties. And in late 2023, they launched a Home Shares program similar to Arrived and Ark7, letting you buy fractional ownership in single-family rental properties.

It’s a beginner-friendly crowdfunding platform, and you can start investing with as little as $1.

Bottom Line: A reliable, relatively liquid way to invest in real estate short-term, with a 6.5% dividend yield. (Read our full Concreit review here.)

Minimum Investment: $1

Type: Pooled fund owning short-term real estate-secured loans.

5. Arrived (Formerly Arrived Homes)

Rather than pooled REIT funds or loans, Arrived buys single-family rentals, and sells fractional shares in them.

You can buy fractional ownership in a rental property for as little as $100. That’s pretty spectacular for buying into an individual property, and beaten only by Ark7 and Lofty (more on them shortly).

Investors earn both rental cash flow and property appreciation. Arrived pays out rental cash flow quarterly to all investors, proportionate to their ownership percentage. And when they sell the property, typically after five to seven years, the profits get split proportionally among all investors. For each property, they show a city-level average of both historic appreciation and annual cash flow, to provide a sense for expected returns on each.

They do charge a one-time, up-front fee for finding the deal, plus a 1% asset management fee each year.

In 2022, Arrived started offering short-term Airbnb rental properties in addition to long-term rentals. That helps you further diversify your real estate portfolio.

In late 2023, Arrived launched a fund for instant diversification and more liquidity. Like buying shares in individual properties, you can invest with a minimum of just $100. Unlike individual property shares, you can sell your fund shares, with some caveats. You can’t sell within the first six months, and if you sell within the first five years, Arrived dings you with a penalty. That penalty comes to 2% of your investment if you sell between 6-12 months after buying, and 1% for selling between 1-5 years after buying.

See the 90-second demo video below for how buying shares on Arrived works.

Bottom Line: A simple and affordable way to buy partial ownership in individual rental properties. (Read our full Arrived review here.)

Minimum Investment: $100

Type: Fractional ownership in single-family rental properties (both long-term and short-term vacation rentals).

6. Lofty

6. Lofty

I just recently discovered Lofty.ai, and I confess I’m impressed.

They operate on a similar model as Arrived and Ark7: you buy fractional ownership in single-family rental properties. Lofty.ai prices newly issued shares at $50 apiece, for an even lower minimum investment. But they take the fractional ownership model a step further, assigning that ownership to blockchain tokens.

Why the high tech approach? Because it lets investors buy and sell shares in rental properties on a secondary market. In other words, you can buy or sell your shares to other investors at any time. That makes Lofty.ai shares a much more liquid investment than offered on most real estate crowdfunding site.

That all being said, selling shares comes with a few caveats. First, they charge a 2.5% fee when you sell shares on their secondary market. Second, you receive payment in one of several cryptocurrencies, which doesn’t exact rev every investor’s motor. However, one of those cryptocurrency options is USD Coin (USDC), a stablecoin backed 1:1 by cash and U.S. Treasuries. But you still have to convert it to U.S. dollars and transfer it to your bank account to, you know, actually spend or use it. Lofty.ai assures us that payout in U.S. dollars is coming soon.

Regardless, it’s still an outstanding platform for fractional investing in rental properties, with far more liquidity than most real estate crowdfunding platforms. As a special offer for our readers, you’ll get a $25 referral bonus from Lofty.ai after buying your first property share.

Bottom Line: Buy shares in single-family rental properties with just $50, earn daily rental income and sell at any time — if you don’t mind jumping through a few cryptocurrency hoops. (Read our full Lofty review here.)

Minimum Investment: $50

Type: Fractional ownership in single-family rental properties.

7. Streitwise

7. Streitwise

I also have money in Streitwise, which owns several commercial office buildings.

Specifically, Streitwise targets secondary markets including Indianapolis and St. Louis. The founders have over $5 million of their own money tied up in the investments, for skin in the game.

From 2017-2022, they paid out average dividends of 8.96%. However, in late 2022 the dividend yield dropped to 5.6%, and the net asset value (NAV or share price) dropped to $9.23. Then in 2023, the NAV dropped to $7.01, and the dividend yield dropped to 5.1%. In early 2024, they raised the NAV by two cents to $7.03.

That marks a roughly 30% drop in value from the original NAV of $10.

Why have the yield and the share price dropped? Because Streitwise’s flagship tenant opted not to renew their commercial lease, and Streitwise has not completely refilled the office space yet. And let’s be honest, there’s plenty of skepticism about office real estate and its future.

Regardless of their current struggles, Streitwise’s sponsor Tryperion Holdings has a strong track record. In late 2023, they purchased another building, the Midtown III Building in Carmel, IN. I expect Streitwise share prices to eventually recover, but how long that takes is anyone’s guess.

Like Fundrise and most other real estate crowdfunding investments, Streitwise expects you to leave your money in the pot for at least five years. If you sell early, they buy back your shares at a discount.

Unfortunately, Streitwise requires a high minimum investment of 500 shares (around $3,500 currently). That puts it out of reach for some investors and will spook away other crowdfunding-curious investors.

Bottom Line: A simple starting point for commercial office real estate investments with transparency around fees and returns. (Read our full Streitwise review here.)

Minimum Investment: $3,500

Type: Pooled REIT fund holding office space real estate.

8. Landa

Landa offers another platform for buying and selling fractional shares in rental properties.

As of early 2024, the platform boasts around 260 properties available. Landa concentrates in the Southeast, with properties in Florida, Georgia, Alabama, and North Carolina, although they have a few properties in New York City as well. Most shares sell in the $5-25 range, making Landa an affordable way to diversify small amounts across many properties.

Best of all, Landa features a secondary market for selling your shares at any time. That creates easy liquidity for your rental property investments. Just beware that buyers and sellers each pay a 2% transaction fee to Landa’s third-party broker partner for trading shares.

If you’d rather lend Landa money to buy more properties, they offer a pooled fund with a floating interest rate. As of early 2024, Landa pays 8.60% interest, and the interest rate periodically adjusts based on the current SOFR plus 3.5%. This fund is backed by liens against the underlying properties.

Unlike property shares however, the lending shares aren’t as liquid. You can’t redeem shares at all within the first year, and Landa buys them back at a discount if you redeem them within five years of buying.

Bottom Line: Buy shares in single- and small multifamily rental properties with $5-25, sell any time.

Minimum Investment: $5-25/share

Type: Fractional ownership in 1-4 unit rental properties.

9. RealtyMogul

9. RealtyMogul

RealtyMogul offers both private equity real estate syndications (for accredited investors) and two REITs for non-accredited investors.

The RealtyMogul Income REIT pays higher dividends with less emphasis on long-term growth. It currently pays a 6% annual dividend, distributed monthly. As of early 2024, it’s delivered an average annual return of 7.79%.

Their Growth REIT pays a lower dividend yield of 4.5%, with a greater emphasis on long-term appreciation. It hasn’t actually delivered beaten the Income REIT yet though, with an average return of 6.40% to date.

Both REITs hold multifamily real estate and commercial properties. The minimum investment remains high however at $5,000.

RealtyMogul also offers private placements, where you can buy fractional ownership in single properties. Investors can even take advantage of 1031 exchanges with some of these real estate syndications. However only accredited investors can participate in these, and the minimum investment ranges from $25,000 to $50,000. As of 2024, these private equity real estate investments have paid out an average internal rate of return (IRR, a measure of annualized return) of 20.7%.

Launched in 2013, RealtyMogul has a relatively long history in the real estate crowdfunding investment space, and has generated solid returns over that time. They enjoy a strong reputation among investors for their transparency and ease of use.

Bottom Line: A reliable crowdfunded real estate platform, with both income-oriented and growth-oriented options.

Minimum Investment: $5,000 for funds, $25-50K for private equity investments.

Type: Pooled REITs that buy and manage commercial and multifamily properties.

10. Yieldstreet

Yieldstreet offers a mix of many alternative investments. In addition to real estate, they provide access to art, consumer loans, commercial loans, vehicle loans, legal finance, cryptocurrencies, nonfungible tokens (NFTs), and more.

However Yieldstreet only offers two funds for non-accredited investors: their Prism Fund and more recently their Growth & Income REIT. The Prism Fund is a mixed-asset fund that owns a blend of the assets outlined above. As the name suggests, the Growth & Income REIT only owns real estate investments, which include three multifamily properties (in Tucson, Dallas-Fort Worth, and Atlanta). Yieldstreet plans to expand the fund to include more properties in the near future.

Unfortunately, Yieldstreet raised the minimum investment in these funds from $500 to $5,000 in 2022, and again from $5,000 to $10,000 in 2023.

I like that Yieldstreet doesn’t charge an early share sale penalty. But they do limit share buybacks to 5% of their total outstanding shares per quarter, on a first-come, first-served basis.

Some of their other investment offerings available to accredited investors include:

-

- Art Equity Fund II: High-end art. Minimum Investment: $10,000

- Pantera Early Stage Token Fund I: Digital assets such as NFTs and cryptocurrencies. Minimum Investment: $25,000

- Dallas-Fort Worth Multifamily Equity I: A three-story apartment complex in the Dallas-Fort Worth metro area. Minimum Investment: $15,000

- North Shore Boston Multifamily Equity: A mid-rise apartment building on Revere Beach in Boston’s North Shore suburb. Minimum Investment: $5,000

- Harbor Group Multifamily Equity Portfolio II: A portfolio of 19 multifamily apartment buildings across several cities. Minimum Investment: $40,000

Yieldstreet also offers a series of structured note portfolios, funds which own loans to blue chip companies.

When you’re ready to diversify beyond real estate into even more alternative investments, start with the Yieldstreet Prism Fund.

Bottom Line: A broad range of asset classes for diversification, but only accredited investors can pick and choose individual funds and investments.

Minimum Investment: $10,000

Type: Funds owning real estate, art, digital assets, secured debt, and more.

11. DiversyFund

As a growth-driven REIT, DiversyFund takes a different approach, reinvesting all of their profits in new properties to build their real estate portfolio faster.

They estimate they can return 10-20% per year on investors’ money through their aggressive growth strategy. Impressive returns by any standard, if they deliver on their forecasts.

The drawback is that investors receive no dividends in the meantime. Investors must rely on long-term appreciation and growth to deliver their returns in 5-7 years.

Which raises a related issue: you can’t easily sell your shares early. DiversyFund is a long-term investment, hard stop.

I’ve also heard some negative comments about them from people who have invested with them. One common complaint centers around their poor communication, vague details, and lack of performance reporting. An investor also told me that in one of their funds, that had two years remaining on it, they took the proceeds from a property sale and invested it in another one of their funds with a five year timeline. When that investor questioned them about it, they gave him a vague reply about possibly recapitalizing the deal later on. Flash the red warning lights.

On the plus side, DiversyFund does allow a low minimum investment ($500), making it accessible to many individual investors. Their strategy centers around multifamily apartment buildings spread among many cities nationwide.

Bottom Line: A long-term investment focused on growth rather than dividends.

Minimum Investment: $500

Type: Pooled REIT that buys and manages multifamily properties.

12. HappyNest

A relative newcomer, HappyNest offers a fund owning seven commercial real estate-related investments. Sound vague? That’s because they own a mix of individual properties, fund shares, and loans secured by real estate.

Their portfolio isn’t huge, but it does include some name-brand businesses and tenants such as a FedEx Ground shipping center, United Healthcare, and Ford Motors. Over the last year, HappyNest has added fractional shares in larger investments such as apartment complexes to add diversity.

Their mobile app is undeniably slick, with a “round up your spare change” feature for automated saving and investing. Better yet, it works with your existing credit and debit cards. To cap off their pitch, they let you invest with as little as $10.

Beware that HappyNest doesn’t make it easy to sell shares. If you sell within the first three years, they hit you with a penalty. And they don’t guarantee they’ll buy back your shares — ever.

Worst of all, they hide their fee structure deep within their SEC circular, while advertising “No broker or platform fees!” all over their website. In reality, they pay 3% of gross money raised to the Sponsor, plus 3% in additional fees when they buy or sell a property. They charge a further 0.0417% monthly asset management fee to their Advisor. The thing is, they are the Sponsor and Advisor.

Not exactly a beacon of transparency in the world of real estate crowdfunding sites.

Bottom Line: A slick mobile app, but equally slick marketing tricks to hide fees on a relatively small property portfolio.

Minimum Investment: $10

Type: Fractional ownership in commercial real estate buildings.

Best Real Estate Crowdfunding Investments for Accredited Investors

Have more than a few nickels to rub together?

Wealthier investors have more options for real estate crowdfunding investments. Here are a few of the better ones.

1. EquityMultiple

EquityMultiple allows you to invest in either property-secured debt or equity in individual properties.

You can view their complete track record any time by logging into a free account. Since launching in 2015, they’ve delivered an average IRR of 15.01%, and that includes their savings alternative “Keep” bucket of investments (5.96% average IRR). Their income-oriented bucket, Earn, has averaged an 11.90% IRR, and their Grow bucket has averaged 28.4%.

The Grow bucket of investments require you to leave your money tied up for years, like most real estate crowdfunding investments. But the Keep investments offer nine-month notes, and the Earn investments typically range from one to two years. Compared to the typical five-year minimums, that smells like a breath of fresh air.

The minimum initial investment is technically $5,000, although most projects require a minimum of $10,000-20,000. Still, that proves more reasonable than most real estate crowdfunding investments catering to accredited investors.

The platform focuses on commercial real estate, but that umbrella includes everything from multifamily to mobile home parks, self-storage to industrial. They offer several tax-friendly ways to invest in real estate, including Opportunity Zones and 1031 exchanges.

Bottom Line: Strong long-term returns with multiple investing options and several tax-friendly structures available.

Minimum Investment: $5,000

Type: Secured debt or equity in individual properties.

2. CrowdStreet

CrowdStreet is considered by many to be the best real estate crowdfunding platform in the market.

They’ve consistently scored high returns for investors, ranging from 11.5-26.4%. Of the 473+ commercial real estate properties they’ve bought, they’ve sold 44 of them, with a strong track record on returns.

Accredited investors can invest in either a pooled portfolio of properties or individual deals, allowing plenty of flexibility. However investment minimums start at $25,000 — hardly chump change.

CrowdStreet also requires a long-term investment, with no easy options for selling shares early. Plan to leave your money invested in these real estate offerings for at least five years.

Bottom Line: Strong returns for accredited investors willing to leave their money tied up for years.

Minimum Investment: $25,000

Type: Both pooled funds and individual commercial and multifamily properties for syndication.

3. AcreTrader

To diversify even further, you can add farmland to your portfolio with AcreTrader.

AcreTrader buys farmland to lease to farmers. Each parcel goes into a unique LLC, and as an investor you buy shares in that LLC, making you a direct owner of the property. Each share equals one-tenth of an acre.

You collect annual dividends in the 3-5% range, and when AcreTrader sells the property after five or ten years, you of course get a proportional payout on the appreciation. AcreTrader aims for an IRR of at least 7-9%, but claims that the historical IRR on farmland is 12%.

The minimum investment varies based on the price per acre of the parcels AcreTrader buys. AcreTrader typically requires you to buy at least one to four acres. Expect a minimum investment in the $10,000 – $25,000 range.

Technically, you can sell your shares privately to other investors. But don’t expect easy liquidity — AcreTrader doesn’t offer a built-in secondary market for buying and selling shares.

Bottom Line: Another way to diversify further, adding agricultural land to your portfolio.

Minimum Investment: $10,000 – $25,000

Type: Fractional shares in farmland parcels.

4. HoneyBricks

A newer real estate crowdfunding platform launched in 2022, HoneyBricks offers an intriguing premise: trading tokenized shares of real estate syndications on a secondary market.

Token prices — share prices — are typically set at $1,000, and most sponsors allow you to buy a single token. That makes it the cheapest possible way to invest in real estate syndications.

After an initial holding period of at least one year, you can sell tokens on a secondary market hosted by HoneyBricks. That also makes it a far more liquid way to invest in syndication projects than traditional investing.

I appreciate that HoneyBricks earns its revenue by charging sponsors, and doesn’t charge any fees to investors. But take that with a grain of salt, as fees to sponsors tend to dilute investor returns as well.

Revisiting HoneyBricks in 2024, I’m impressed with how they’ve matured over the last year. Their website includes crucial information that was missing last year, such as details about the secondary market.

HoneyBricks comes with its share of downsides. They have a relatively small track record, having raised money for eight syndication projects by the start of 2024. Their website doesn’t highlight as many critical details as I would like, such as clearly marking sponsor fees and return waterfalls for individual investments. You can find this information for any given property investment, but you have to dig for it. I also couldn’t find any property shares listed on the secondary market after logging in.

And, of course, they only allow accredited investors.

Bottom Line: Low-minimum, high-liquidity way to invest in real estate syndications, but the platform remains young with a limited track record.

Minimum Investment: $1,000

Type: Fractional shares in multifamily properties (multifamily real estate syndications).

5. CityVest

CityVest works similarly to EquityMultiple and CrowdStreet: as a marketplace platform where investors can browse real estate syndications.

Technically, CityVest was founded in 2014, but they didn’t start operating in their current form until 2018. It doesn’t have an extensive track record like its competitors do — as of early 2024, CityVest lists 16 past deals on their website.

I couldn’t find a consolidated track record of those 16 deals, which I found disappointing. However CityVest does display each sponsor’s track record when you evaluate a specific deal from them.

Like most real estate syndications, the private equity investments on CityVest typically target 15-30% returns.

Bottom Line: An alternative to the more established real estate syndication platforms of EquityMultiple and CrowdStreet, with a shorter track record.

Minimum Investment: $25,000

Type: Pooled funds and fractional shares in commercial properties (multifamily and other real estate syndications).

FAQs About Real Estate Crowdfunding Sites

Still not sure how to decide on the best real estate crowdfunding platforms in 2024?

If you have plenty of questions, you’re not alone. No one wants to invest their hard-earned money without feeling confident that they’ll actually get it back (hopefully with a hefty return). Here are a few common questions about real estate crowdfunding investments.

How Did You Choose the Best Real Estate Crowdfunding Sites?

We included all “mainstream” real estate crowdfunding sites in the list above. We don’t love all of them, as noted in our summaries for each. But we wanted to include information about all of the best-known crowdfunding platforms.

As for our favorites, that’s easy: we invest our own personal money in them, so we know the platforms well.

What Is Real Estate Crowdfunding?

Real estate crowdfunding falls under its own regulation by the SEC, as private investments that are registered with the SEC and allowed to be marketed to the public. The underlying investments vary, but most often include fractional ownership in properties (equity crowdfunding), loans secured against real property (debt crowdfunding), or a pooled fund that owns multiple properties or loans (or a combination).

How Does Crowdfunding Work in Real Estate?

Rather than buying shares on public stock exchanges (like a publicly-traded REIT), you buy shares directly from the crowdfunding company. Crowdfunding is not liquid — you can’t typically sell at a moment’s notice. Again, these are private investments, and in most cases you redeem your investment by selling it back to the platform. They may hit you with a penalty if you redeem your investment early.

How Can You Start in Real Estate Crowdfunding?

Visit each website directly, and there you can create an account and buy shares by entering your bank account information. Consider starting small with crowdfunding companies that let you invest with just $10 (such as Fundrise, Groundfloor, or Concreit) or $100 (such as Arrived).

Can You Crowdfund in Commercial Real Estate?

Most crowdfunded real estate involves commercial properties. That includes everything from office buildings to retail, multifamily apartment buildings to industrial.

But some real estate crowdfunding investments feature residential properties. For example, Arrived lets you buy fractional ownership in single-family rental properties. Groundfloor offers private loans secured mostly by single-family homes.

Can You Make Money from Crowdfunding?

Of course, or else no one would invest! I personally invest in and have collected money from many of the crowdfunding platforms above, including Fundrise, Groundfloor, Concreit, Streitwise, Arrived, and more.

Is Real Estate Crowdfunding Safe?

All investments come with risk, and real estate crowdfunding is no exception. The risk varies depending on the crowdfunding platform and the underlying investment, and the returns vary accordingly. For example, Concreit and Stairs by Groundfloor come with less risk and more liquidity than many investments, and pay moderate returns as a result. Other investments come with higher risk and higher returns. But one advantage to real estate is that the underlying investment can’t become worthless (unlike a stock). It might lose value, but the land and the building can’t disappear.

How Much Do I Need to Start Investing in Real Estate Crowdfunding?

As little as $10 or $100, for some platforms such as Fundrise, Groundfloor, Arrived, and Concreit. Other platforms require more, from $500 up to $25,000 or more.

What’s the Difference Between Public & Private REITs?

Publicly-traded REITs trade on public stock exchanges. You can buy and sell shares at any time, with no penalty. That provides great liquidity and lets you invest with little money, but it also comes with some downsides. Share prices tend to be volatile, and worse, they correlate with stock markets. That defeats much of the purpose of diversification.

In contrast, you buy shares in private REITs directly from the company, and typically sell them back to the company when you’re ready to redeem them. That makes for poor liquidity, but very little volatility or correlation with stock markets.

What Is an Accredited Investor?

A wealthy investor with either $1 million or higher in net worth or an income over $200,000 for the last two years ($300,000 for married couples).

What Are the Pros & Cons of Real Estate Crowdfunding?

Pros include low correlation to stock markets, potentially low investment minimums (especially compared to buying properties directly), often strong cash flow, and the potential for high long-term returns. Cons include weak liquidity, often long-term commitments, and sometimes difficulty in finding all the information you want to know about an investment. Also, some real estate crowdfunding platforms only allow accredited investors, another major drawback.

What Happened to PeerStreet?

In June 2023, PeerStreet went the way of the dodo and declared a Chapter 11 bankruptcy. Their investors will get hopefully get all their money back plus their expected returns, as their investments were and remain backed by loans secured by real estate.

Final Thoughts

I love real estate crowdfunding investments almost as much as I love buying rental properties myself. They offer a great way to diversify your portfolio, and therefore reduce risk, without sacrificing on returns.

In fact, I invest in real estate as an alternative to bonds. When you can earn similar annual returns on passive crowdfunding projects as you can from mutual funds or the stock market, while diversifying to a completely separate asset class, you reduce risk without sacrificing return on investment.

But no investment comes risk-free, and you need to fully understand the risks inherent in each real estate investment opportunity before committing your money. Do your due diligence, invest wisely, and come back and let me know about your experiences with crowdfunded real estate platforms!♦

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.