As someone who teaches people how to invest in rental properties, should I be worried about how easy Arrived makes it to invest without any knowledge or skill?

Arrived (formerly Arrived Homes) is a real estate crowdfunding platform that lets you buy fractional shares in rental properties. You can invest as little as $100 per property to become a partial owner.

Backed by some huge names like Jeff Bezos, Marc Beinoff (CEO of Salesforce), Spencer Rascoff (Former CEO of Zillow) and Dara Khosrowshahi (CEO of Uber), Arrived makes it easy to diversify your real estate portfolio. Here’s everything you need to know about Arrived — and why I invest in them myself.

Arrived At a Glance

Minimum Investment: $100

Prospective Returns: 4-7% annual cash flow, 0-8% annual equity appreciation

Fees:

-

- One-Time Sourcing Fee: Currently 4-6% of the purchase price; exact amount disclosed for each property as you browse. Soon to switch to a fixed 3.5% fee.

- Annual Asset Management Fee: 1% of the equity raised from investors.

- Ongoing Property Management Fees (paid to a third-party manager): 8% of rents collected plus one month’s rent for placing new tenants.

My Take: Arrived is such a passive and easy way to diversify your rental investments that it’s irresistible — at least for spreading small amounts among many properties.

How Arrived Works

Arrived buys properties with a rental property mortgage, performs any needed repairs or updates, then recovers the money from the down payment, closing costs, and repairs by selling ownership shares.

For example, say Arrived buys a $200,000 property. They borrow $140,000 of it as a rental property mortgage, pay another $10,000 in closing costs, and let’s say another $10,000 in repairs. That puts them $80,000 out of pocket, so they turn around and sell $80,000 worth of shares to the public. Because they break down shares in $10 increments, that comes to 8,000 shares.

Actually, that example fails to include their one-time sourcing fee. But more on Arrived’s fees shortly.

For you as an investor, buying shares in rental homes on Arrived’s platform works like this:

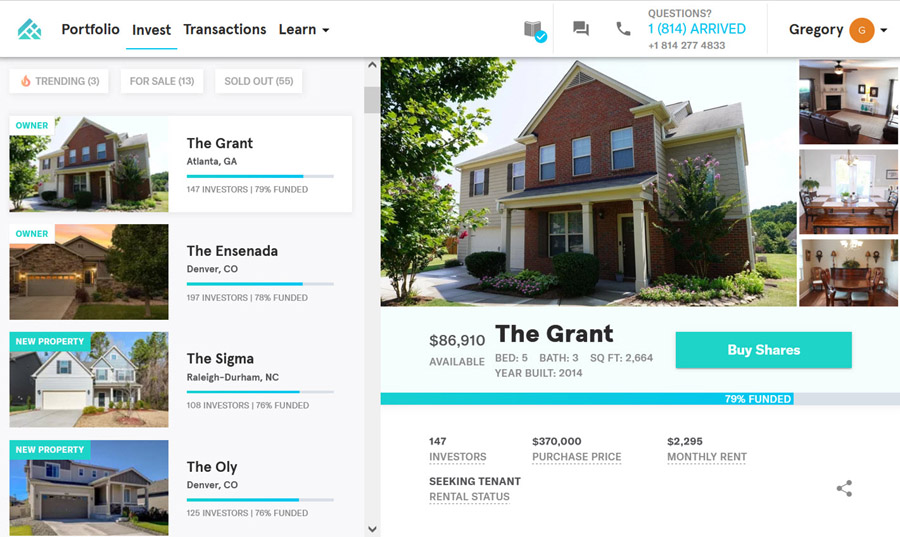

- Browse available properties: You browse a list of individual properties that Arrived has recently bought. You can see all the details from the market rent, purchase price, closing costs, repair costs, Arrived’s fees, and details about the local housing market.

- Buy shares: When you buy shares in your first property, you enter your bank account information to transfer funds. Arrived can store your banking details so you don’t have to do this again. After selecting a property, you simply select the number of shares you want to buy, sign the ownership agreement by typing your name, select your saved bank account (or enter a different one), and click “Buy.” Easy peasy.

- Earn rental income while the property appreciates: Every quarter, Arrived transfers your portion of the rental cash flow to your saved bank account. Arrived typically holds rental properties for at least 5-7 years, during which the property appreciates in value. When you eventually sell your shares, or Arrived sells the property, you get paid out according to your ownership interest.

Arrived Demo Video

If a picture is worth a thousand words, how many words is a video worth?

Here’s a 90-second demo video showing me buying shares on the Arrived platform:

Arrived Fund

In late 2023, Arrived launched a fund that owns many properties. You can buy shares in the fund for the same minimum investment of $100, but instead of owning a share of a single property, you own a smaller share in many.

The fund offers two advantages of Arrived’s traditional model. First, as outlined above, is instant diversification. Second, the Arrived fund offers liquidity: you can sell your shares without waiting for an individual property sell.

With some caveats, that is. You can’t sell shares within the first six months of buying them, and if you sell in under five years, you pay a penalty. That penalty comes to 2% of your sold shares if you sell within 6-12 months of investing, and 1% if you sell within 1-5 years.

Arrived also redeems those shares quarterly, with some restrictions on the number that they’re willing to sell each quarter. Redeeming your shares is not guaranteed.

Still, that liquidity offers far more flexibility than typical real estate investments, and a great way to spread $100 across many properties.

Arrived Homes Returns

Landlords earn money in two ways: rental cash flow and property appreciation.

On the rental cash flow side, Arrives asserts “historically Arrived rental properties have paid cash dividends from rental income that translate to 5.4% – 7.0% annual returns on investment.” That’s pure passive income: you don’t have to lift a finger. Arrived Homes pays out cash flow every quarter.

On the property appreciation side, Arrived displays the average annual appreciation in each property’s local market over the last 20 years. They also chart the local zip code’s Zillow home price changes over the last decade.

Arrived puts it this way: “Over the last 20 years, single family homes in the United States have appreciated an average of 3.9% per year. This means that for a property with a 65% mortgage loan, the home equity value increased an average of 6.1% per year. This return includes transaction fees and assumes the investment is held for 10 years.”

The combination of rental cash flow and appreciation therefore comes to around 12% total. At least based on historical averages — but past performance does not guarantee future results, yada yada yada.

Arrived Fees

The real estate investment platform earns money in three ways.

First, as licensed real estate agents themselves, they earn money in the form of a “rebate” from the commission on the purchase transaction. In other words, they get the buyer’s commission, paid by the seller.

Second, they charge a one-time sourcing fee to find the deal, do their real estate due diligence, find a rental property mortgage, repair the property, and the other headaches that come along with buying an investment property. As of right now they charge 4-6% of the purchase price, although they tell me they’re about to change that to a fixed 3.5% fee. You can see the sourcing fee for each property as you browse through them.

Finally, they charge an annual management fee to cover their administrative costs. This amounts to 1% of the equity raised from investors. In the example above, where they raise $80,000 in shares from the public, that would mean an $800 annual management fee.

Don’t confuse Arrived annual management fee with property management fees however. Arrived hires property managers to handle tasks like advertising vacant units, tenant screening, signing rental agreements, and collecting rents. These third-party property management companies charge 8% of collected rents, plus one month’s rent to sign a rental agreement with new tenants.

Advantages of Arrived Crowdfunding

Arrived comes with a slew of benefits and advantages. Enough so that even experienced real estate investors like myself invest money with them.

Low Minimum Investment

At $100, anyone can invest.

Skip that next dinner out or new jacket you’ve been eyeing, and buy shares in a rental property instead.

Available to Non-Accredited Investors

There’d be little point of such a low minimum investment if they restricted access to wealthy accredited investors.

Like I said, anyone can invest — even your broke self.

Easy Diversification

I can hear the skeptical remarks now:

“Brian since you’re always running your mouth about how great you are at real estate investing, why do you invest in someone else’s real estate deals?

Easy: so that I can spread my real estate investing dollars among dozens of properties and cities all over the country.

One property could see a nightmare like professional tenants. One city might stumble in job growth and population growth. But by spreading my money among many different locations, I protect against the risk of any one investment falling apart.

Passive Way to Invest in Rental Properties

Rental properties are a lot of work.

It’s work to find good deals on properties. Work to do all the due diligence in real estate investing. Work to arrange a rental property mortgage, to negotiate with contractors, to oversee repairs. And then a whole bunch more work to screen tenants, advertise vacant units, negotiate rental agreements, collect rents, evict bad tenants, and so forth.

Arrived does all that for you, making rental properties a truly passive investment.

Expert Dealfinding & Management

Historically, you had to learn the ropes of real estate investing to consistently make money in it. Today you can just outsource it through real estate crowdfunding.

For their fees, they find the deal for you, oversee financing and renovation, and hire an expert property manager to do all the icky stuff like fielding 3am phone calls from tenants complaining that a light bulb blew out.

You don’t have to become an expert real estate investor or landlord. You get all the perks of rental investing, without having to learn all the skills required to do it directly.

Full Tax Advantages

Your name gets added as a partial owner of the LLC that owns the property. As such, you get the full tax advantages that come with rental properties.

For example, all the rental property deductions happen “above the line” in accountant-speak. That means you can still take the standard deduction while deducting all the property’s expenses.

Arrived Homes simply sends you a 1099-DIV at the end of each year, so you don’t even have to file any extra tax forms. See Arrived’s full explanation of tax handling here.

Personal Onboarding Call & Customer Service

When I created an account with Arrived, they asked if I wanted to schedule a free 15-minute call with one of their team members to answer any questions I had. Intrigued, I took them up on it.

The man I spoke with was patient and informative, and didn’t even rush me off the phone after I exhausted my 15 minutes. He answered all my questions in full with no waffling.

Full kudos to them on amazing customer service.

No Personal Liability for Investors

I’ve been sued as a landlord several times. And let me tell you, it sucks.

People love to vilify and sue landlords. Apparently, providing totally unnecessary services like pet therapy is totally okay with the public, but if you provide a needed service like housing, you’re automatically a jerk.

But I digress. When you invest through Arrived, you’re shielded from lawsuits or personal liability.

Downsides of Arrived Homes

Like all investments, Arrived has its disadvantages. Make sure you understand them before you invest.

No Way to Sell Shares Early (Yet)

Arrived plans to hold each rental property for 5-7 years. And as of right now, they expect you to hold your shares for that period, only cashing out upon the property’s sale.

That said, they’re working on two different early selling options. First, they’re creating a share buyback program, where they offer to buy your shares early based on the current property value. They may, however, ding you with a penalty for selling early.

They’re also working on creating a secondary market for Arrived property shares. On it, you’d be able to buy or sell shares directly with other individual investors. You wouldn’t get hit with any penalties here, since you’d sell directly to other investors.

Inconsistent Availability

In some ways, Arrived is a victim of its own success.

When I first created an account in December 2021, there were six properties available. I logged in again the next day, and was shocked to find that three of those had sold out overnight, leaving only three properties left. I bought shares in two of those.

The next day I logged in again, planning to buy shares in the third property, but all had sold out. I then signed up to receive an email alert when they bought new properties, and for several weeks saw no new properties appear.

They later bought more properties of course, and I received an alert. But the new properties started selling out quickly too.

Clearly, there’s enormous demand for diversified, hands-off rental property investing. So much demand that Arrived has trouble meeting it.

No Skin in the Game

In my initial intro call with Arrived, I asked whether they keep any of their own money invested in the properties. The employee responded that they do not, to avoid any conflict of interest.

While I appreciate that they need to turn over their capital to keep buying new properties, I also like to see real estate partners have some of their own money invested, their own skin in the game. We certainly do, in our co-investing deals.

How Arrived Compares

Few real estate crowdfunding platforms let you invest with less than $100. In fact, I can only think of a few.

The closest competitor to Arrived is Lofty, which lets you buy fractional shares in rental properties with as little as $50. I love that Lofty offers a secondary market, where you can buy and sell your shares at any time. But I don’t love that when you sell shares on Lofty, you get paid in cryptocurrency and have to then convert it to fiat currency. For a full comparison of pros and cons, check out our Lofty review here.

Fundrise also lets you buy fractional ownership in real estate — if you’re an accredited investor. The rest of us can invest in their pooled real estate funds and eREITs, but we don’t get fine-tuned control over where each dollar goes. Still, Fundrise lets you start investing with just $10, and gives you instant exposure to dozens of properties. That makes for simple diversification across many real estate markets (read our full Fundrise review for more).

Another crowdfunding platform that lets you start investing with $10 is Groundfloor. But Groundfloor offers a different investing model: you invest in loans secured by real estate, rather than buying an equity interest in properties themselves. That doesn’t make it better or worse, it’s simply a different type of real estate investing than Arrived offers. Expect to collect 7-14% in interest, rather than fluctuating rental cash flow and appreciation (full Groundfloor review here).

Investors have another two options for real estate debt crowdfunding. Stairs by Groundfloor offers a pooled fund of secured loans, and it pays 4-6%. The perk? You can withdraw your money at any time, penalty-free. Concreit works similarly, paying 5.5% in annual interest, but it takes longer to withdraw funds (30-60 days) and there’s a small penalty on your collected interest if you withdraw funds within the first year.

Is Arrived a Good Investment?

I love that I can spread $1,000 across ten rental properties with Arrived. In ten different states, no less.

Arrived offers one more way to diversify your investments. I will continue investing in them, just as I invest in my own rental properties, in crowdfunded loans on Groundfloor, in private REITs with Fundrise and Streitwise, and of course in stocks.

With each investment I make, I add another stream of passive income. And with enough streams of passive income, I’ll reach financial independence and early retirement.

Which is, of course, the ultimate goal.♦

Have you invested money with Arrived Homes? Why or why not?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

A very interesting topic. I would love to try this.

Let me know how your experiences with Arrived Homes work out Ragor!

I Just made my first investment to learn the ropes. Starting with a meer $100.00. The only thing that I would like to see different so far, is that instead of the deposit going back to my bank account, Id like to see an option to where I can have those go into an investment account so that those funds can be used to purchase more properties. I know that I can choose to send the money back for my next purchase, but to have the funds sitting there already for an automatic purchase based on criteria that I set for my account when new properties come available, would make for a complete hands free experience.

Great point Michael!

Well, it’s an easy way to diversify your real estate investments. Looks like a win-win to me.

Agreed Jack!

4-5% annual return by just investing $100. Sounds amazing. Would love to hear about someone’s experience.

Should be in the 10-13% range, taking into account both rental cash flow yield and annual appreciation. But anything can happen!

Arrived Homes is another good avenue to diversify investment, been experimenting with them for the last six months and have liked them so far.

Glad you’ve had a positive experience with Arrived Joanna!

I want to know how to get $2000 or $5000 every three quarters payouts from arrived. How much do I need to invest to get this kind of out come?

Arrived Homes doesn’t pay huge yields in most cases. If you’re investing for passive income, consider investing in Streitwise or Fundrise’s Income portfolio, or look into Groundfloor. In your example, if you earn an 8% yield, you’d collect $4,000 per year on a $50,000 investment.

Can you tell me about had you did a review on masterworks.com. I would like your opinion. Do you know if you have to be an accredited investor or it is a for very rich people millionaires or billionaires only.

Hi Nickerson, we have not reviewed Masterworks, as it’s not a real estate investment. But I can tell you that they don’t require you to be an accredited investor. They do require you to apply for “membership” however, and require a phone interview. Let us know what you think of them!

Thank you for your help and example and suggestion.

Any time N.!