Heard nothing but doom and gloom in the real estate headlines for the last 18 months?

The wild 50+% price jumps we saw during the pandemic are a distant memory, while 2022 through 2024 have seen real estate markets drop back down to earth. They did exactly what markets are supposed to do: they corrected.

So where are property prices dropping? Because we love you, we keep updating our interactive maps of falling real estate values each quarter.

Cities with Dropping Home Prices

If a picture is worth a thousand words, how much is an interactive map worth?

Of the roughly 900 U.S. cities tracked by Zillow, 342 of them saw a fall in house prices in the fourth quarter of 2023. That’s a worrying increase from the third quarter (153 falling markets).

Without further ado, the U.S. cities seeing quarterly home value declines are:

Clearly, some previously ebullient housing markets are still correcting to more sustainable levels. But how do these quarterly changes compare to annual home price trends?

156 Cities Saw Prices Fall Annually

Looking back over the last year, 156 U.S. cities experienced a decline in home values:

Again, that’s out of roughly 900 U.S. cities and towns that Zillow tracks.

It marks an drop from the third quarter of 2023, when 244 markets saw year-over-year price declines.

Keep your finger on the pulse of real estate markets and housing corrections nationwide as you navigate investing in this weird economy.

What About Declining Rents?

The headlines about rent declines are even more overblown than property price declines.

Of the roughly 350 U.S. cities that Zillow consistently tracks rent data for, 256 saw rents decline in the fourth quarter of 2023. That number more than tripled from the fourth quarter. Still, most of those rent declines were under 1%.

Take a look at the interactive map:

Year over year, just 18 cities have seen rents fall. That’s steady from the third quarter, and the annual rent declines were lower than the third quarter.

The worst annual decline in rents clocked in at -3.64% (Key West, FL). Hardly the collapse in rents that many activists wanted.

Check out those 18 cities on the map below:

Rentometer’s quarterly rent report show 73% of U.S. cities saw rising rents over the last year, around a fifth (19%) by double digits. Unfortunately for real estate investors, that marks a sharp drop from earlier this year, when 96% of cities had experienced rent growth with over half (52%) seeing double-digit growth.

Still, rents rarely fall by more than a few percent, even during recessions. In this particular case, rents in some cities overshot the local market fundamentals. They rose too far, too fast, just like property values in some cities.

That’s led to a few rental market corrections. But not many.

Why Did House Prices Decline in the First Place?

Two hundred of the formerly hottest housing markets in the pandemic fell back down to earth over the last year. It doesn’t take a senior economist to understand that they shot up too far, too fast, and now they’re correcting back to what local incomes can support.

“Monetary stimulus during COVID distorted the real estate market,” explains Andrew Lokenauth, founder of Fluent in Finance. “Interest rates were at historic lows. Now with monetary stimulus being withdrawn, home prices will gradually decline. Areas that saw the greatest speculation and increase in prices will see the greatest decrease in prices. Areas that saw moderate price increases will see prices flatten out or decrease slightly.”

Because, ultimately, people have to be able to afford their homes. When housing prices stray too far from local median incomes, expect real estate prices to drop. Mark Zandi, the chief economist for Moody’s Analytics, warned that 97% of the nation’s cities are “overvalued” compared to local incomes. Of the 392 markets they analyzed, 149 are overvalued by at least 25%. Zandi expects the most overpriced housing markets to fall as much as 10% over the next year.

But a disconnect from local fundamentals isn’t the only reason median prices are dipping in some markets.

The Role of Rising Interest Rates

When the Federal Reserve raises interest rates, it puts upward pressure on mortgage rates. That, in turn, drives up the cost to own real estate in the form of higher monthly payments for the same loan amount.

Which means people just can’t afford to pay as much for properties.

Mortgage interest rates started 2022 at around 3%, then more than doubled to close the year around 6.5%. Over 2023, mortgage rates have hovered between 6-7.5%.

That marks a huge leap in monthly costs for homebuyers and real estate investors alike. Consider that a 30-year $400,000 loan at 3% interest costs $1,686 per month, while the same loan at 6% costs $2,398. Interest alone added over $700 to the monthly mortgage payment!

At a 6% interest rate, a family could only borrow around $280,000 if they wanted a similar monthly payment ($1,679). So, rising interest rates force buyers to either pay cash, offer less, look at cheaper homes, or sit on the sidelines and continue renting.

None of which push up property prices. Quite the opposite, in fact.

Real Estate Prices to Drop Further?

In many markets, house price growth will likely just slow down and level off. High borrowing costs will continue suppressing demand for homes, and driving a drop in prices in some markets.

But in the cities where home prices skyrocketed by 40–50% annually during the pandemic? Those have already come back down to earth, some by between 10–25%. They overshot what local prospective buyers can afford, and the correction has come for them.

Remote work plays a role as well, in multiple ways. Some people (like me!) will never work in a traditional office again. “With the workforce moving increasingly towards hybrid and remote workplaces, many people are moving out of cities and into less dense areas, investing in more rural real estate,” explains Matt Woods, CEO of SOLD.com.

But the reversal of remote work is also at play. Plenty of employees are heading back to the office, which means that all those beach and mountain getaways where people holed up during the pandemic might surrender some of their price gains.

Underlying these population movements, the US still has a housing shortage, and it’s not evenly distributed. Don’t expect nationwide home prices to crash 20–35% as they did after the housing bubble of the Great Recession.

The (Continued) Housing Shortage

The statistics vary, depending on who you ask. But here are a few to chew on.

Moody’s Analytics estimates the housing shortage in the US at 1.6 million housing units. Mark Zandi put it like this: “It’s very difficult to know precisely what the shortage is. But the bottom line is, no matter what the estimate is, it’s a lot of homes that we’re undersupplied.”

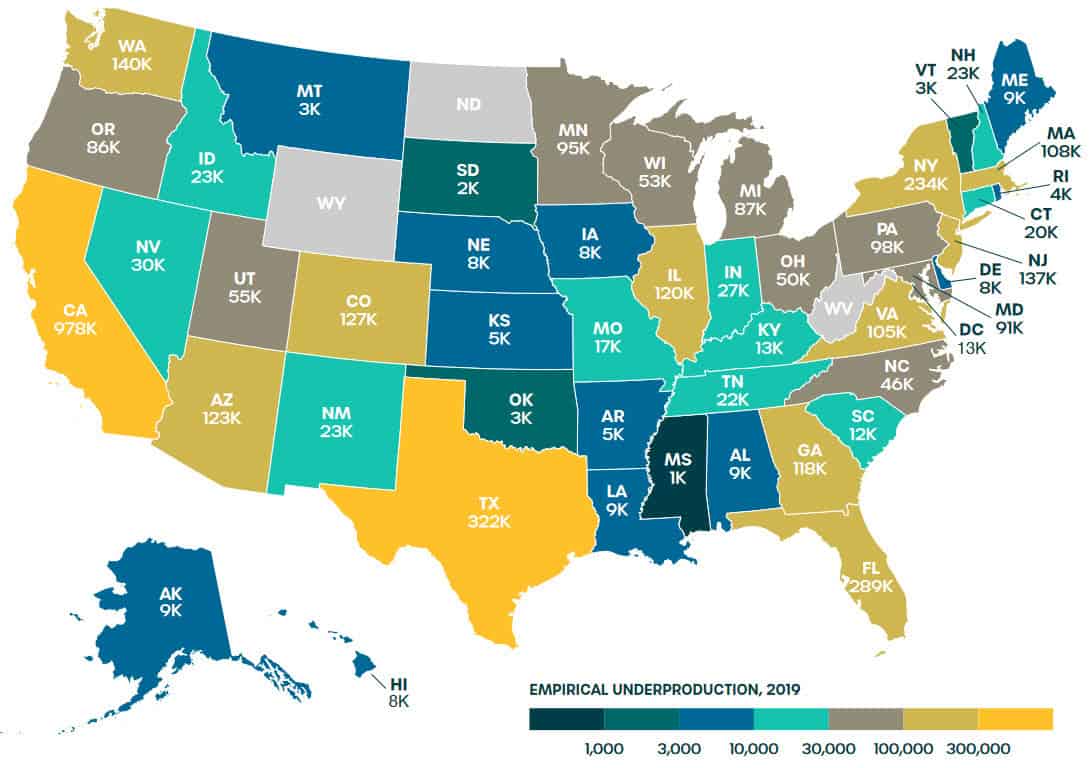

A report by Up for Growth calculated the housing shortage at more than double that figure, at 3.79 million housing units. But that shortage isn’t evenly distributed across the US. Some markets have plenty of housing to meet local demand, while others have nowhere near enough. Check out this map breaking down housing undersupply by state:

Real estate platform Homelight notes that 12.3 million households were formed between January 2012 and June 2021, but only 7 million new housing units were built. That leaves a shortfall of over five million homes. (For more details, check out their breakdown of why the US has a housing shortage.)

Don’t expect housing supply to jump any time soon, either. Housing starts have declined for five consecutive months, entering 2023 near their lowest level since August 2020.

Fret Over the Fall in House Prices?

The US still needs more housing, so don’t expect declining home prices to freefall into a 2008-style housing crash nationwide. Still, some markets saw home prices spike too far, too fast, and are now adjusting back to reality.

One piece of good news? Rents seldom dip, so rental properties are largely recession-proof. Rent growth has slowed, but don’t expect rents to collapse any time soon.

Keep an eye on your home real estate market’s trends. But most of all, watch out for flipping houses right now, and stick with a long-term buy and hold strategy. You can forecast long-term cash flow accurately with a rental income calculator — the same can’t be said for predicting appreciation.♦

Where do you expect real estate prices to drop? Why?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.

No wonder realtors are rowdy nowadays! Thanks for the update.

Haha, good point Arthur!

Oh dear, it’s like we’re back in 2007 again! It’s time to go back to the drawing board…

Haha, fortunately not, this real estate market has an inventory shortage, compared to an inventory glut in 2007. But some housing markets do need to come back down to earth.

I see. Any thoughts of the next cities that would market crash as well?

My crystal ball is broken 😉

But watch out for any cities that rose at double digit appreciation during the pandemic.

Thanks for the update!

Glad it was helpful Maricel!

Excellent article Brian! You really do your homework and add a ton of value.

Thanks Chad, much appreciated, especially coming from someone who does quite a bit of his own homework in this space!

As a new real estate investing, this makes me nervous! So far my properties are not affected, yet! I will bookmark this and look forward to the next update.

Glad to hear your properties are doing well Lia!

No doubt, we’re in for a difficult market ahead. But, there will always be buyers and sellers no matter how good or bad the market is.

Very true Gabe!

Worrying trend for property owners, but it could mean some opportunities for investors to scoop up better deals in the coming months.

Agreed Marcus!

I am currently in possession of several properties, and based on my calculations, I would earn a profit if I were to hold onto them for a year. However, I am becoming increasingly concerned about the ongoing expenses associated with maintaining ownership of these assets. In light of this, I’m thinking about selling and reinvesting the money in another market long-distance. Thoughts?

That can work, if you have a solid understanding of a long-distance market. Alternatively, you could always invest the money passively in real estate syndications or real estate crowdfunding. Check out our Co-Investing Club if you want to invest passively in syndications as a member of a club that reviews a new deal each month.

The mortgage rates are discouraging for buying rental properties. I am shopping now for a good rate and is far different from a year ago.

Absolutely Maura! It’s a far cry from the ultra-low-interest financing available for most of the last two decades.