Collect Rent Online

Rent deposited directly in your bank account, every month.

Rent shows up in your bank account. The end.

It’s quick, it’s simple: after entering your banking information and verifying your identity one time, you can collect rent online.

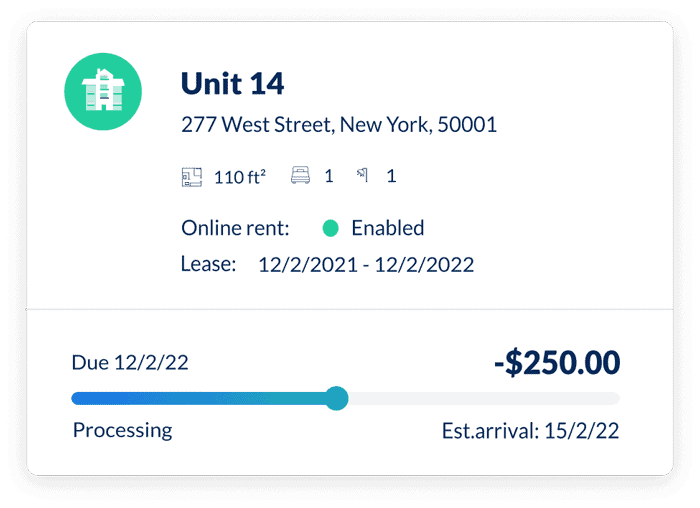

The renter pays rent online, and it transfers to your bank account. Total transfer time takes 3-5 business days, the norm for ACH bank transfers. That’s less time than it takes to mail a check, deposit it, and have the funds appear in your bank account.

And you don’t have to walk around with envelopes full of cash, either.

Tenants can pay rent manually each month or set up automated recurring payments.

Automated Invoicing & Payments

You can set up automated rent invoicing to go out on the first each month (or whenever you like). Your renter receives reminders by email, with links to pay rent with a click.

Better yet, they can set up automated recurring payments. They avoid late fees, you avoid chasing them down for rents each month.

Plus, our landlord software automatically tracks and reconciles these payments in your online rent ledger. With the click of a button, you can generate income and expense reports, and even Schedule E tax reports.

Bank-Level Security, Full PCI Compliance

We don’t mess around when it comes to digital security.

Between our partnership with Dwolla to utilize their powerful, proprietary security, our Level 1 PCI Compliance, and our 100% SSL-secured website, we’ve got you covered where it counts: your money’s security.

Oh, and did we mention that your renters never, ever see your banking details? For that matter, neither do we: our partner bank handles your secure online rent collection.

Flexible Collections

You can collect late fees, tenant-billed utilities, pet rent, security deposits, and more.

Plus, you select whether you want to accept partial payments or not.

Coming Soon: Rent Reporting to Credit Bureaus

Ever wish you could report your tenants’ rent payments to the credit bureaus every month?

We’re teaming up with credit bureau Equifax, so when your tenants pay rent online, the payments appear in their credit history.

It’s both a carrot and a stick: we report on-time payment to help your renters build their credit. And we report every late payment too, incentivizing them to not just pay rent online, but also on time!

No Cost to You

Both Free and Pro members can our automated rent collection service.

Your tenant pays a flat $2.50 fee for each payment, which you can opt to pay on their behalf if you choose.

See our pricing table below for details – we’re big on transparency.

Pricing

Choose your plan

- Units

- Prescreening interviewOnline Rental Application

- includes full credit, nationwide criminal, and nationwide eviction history reportsTenant Screening Reports

- Online Rent Collection

- Fully integrated with online rent collection system, with manual entry features too. Income & Expense Tracking

- GPS Mileage Tracking

- Maintenance Tracking

- Detailed financial reporting including: Schedule E tax reports, Income & Expense Reports, Live E-Payment Tracking, and Upcoming Scheduled Payment Reports.Financial & Tax Reports

- Automated Bank Feeds & Sync

- Receipts & Document Storage

- Recurring Expenses

- Multi-User Access

- Xero Integration

- Full Data Export

Free

$0

per month

- Up to 3

- $40, chargeable to either applicant or landlord

- Tenant pays $2.50/payment

- Manual

- Basic

Pro

$12

per month ($15 if paid monthly)

- 3 included, then $1/month apiece

- $40, chargeable to either applicant or landlord

- Tenant pays $2.50/payment

- Automated

- Advanced

Frequently Asked Questions About Online Rent Collection

When using SparkRental Landlord App's automatic rent collection, will the rent be added to the ledger automatically?

Yes, all rents get added automatically to your Income & Expense ledger when you collect rent electronically through our landlord software.

What is the first step to collect rent electronically?

Once logged into SparkRental’s landlord dashboard, you fill out a short form to apply for a merchant account. It takes around two minutes to apply to collect rent electronically!

Is my information safe with SparkRental?

SparkRental doesn’t store any sensitive payment information. Our banking partner is a PCI-DSS compliant and SAS 70 Type II Certified processor who has a data center located in Houston, TX and has been certified by an independent auditor to be SAS 70 Type II compliant.

Which all means is your data is as safe and secure as it gets when you collect rent electronically!

Can I collect rent online with a free account, or do I need to pay a monthly subscription?

You can collect rent online with a free account. Period.

Your renter might pay a small convenience fee, if they pay rent by credit card rather than ACH (bank transfer).

What's the application process like for my renter?

Inviting an applicant to fill out an electronic rental application is your first step. Many landlords ask what information will be collected from an applicant. An applicant’s rental application consists of Personal Information, Contact Information, Address History, Employers, Other Income, Assets, Liabilities, Questionnaire, References, Pets/Vehicles/Occupants, Documents, Authorization, and Electronic Signature.

What is the tenant portal and what features are available?

A number of additional features are included within the Tenant Portal, such as:

Online Payments

After inviting a tenant to the Tenant Portal, they will see an option to “Make a Payment”. If you have activated online rent collection, you have the ability to collect rent electronically from your tenants. You must also activate Online Rent Collection before a tenant is able to make E-Payments.

Statements

With the Tenant Portal, an electronic statement outlining the lease terms, payment terms, and other relevant information are available to the tenant each month. New charges are added to the electronic Statement monthly for Rent Due and Outstanding Balances. Your tenants are automatically kept informed of what they owe.

Payments Accounts

After you enable Online Rent Collection, your tenant has the ability to setup individual payment accounts for making the monthly rent.

Maintenance Requests

Our mobile-friendly platform gives you the freedom to accept maintenance requests on your Smart Phone. Every landlord is on-the-go and it is sometimes easier to categorize maintenance requests and keep a running log by receiving them electronically. We make it easy for you to do so. Your tenants can submit maintenance requests directly from the Tenant Portal.

Secure Messaging

Communicating with your tenants is more important than ever in the highly litigious business of being a landlord. E-mail is insecure and can be misinterpreted. To protect yourself legally while projecting a professional image, we offer a fully secure messaging system. You can communicate important information to your tenant through our system while resting assured that your communication is saved forever in our highly secure databases. If you ever find yourself in court about a tenant dispute, you can easily pull all communication from the messaging system.

How do I use the accounting ledger feature?

To add income to the ledger go to your home screen in the Landlord App, then click on “financials”. You will see a tab titled “Income & Expense Ledger”. You will have several choices on the left. Click on “Add Income”.

TIP: Either use the “Add Income” or the “Rent Received” function to manually enter the collection of rent received to your income & expense ledger. The only difference between the two actions is that the “Rent Received” function automatically categorizes the income as rent to your ledger. The difference is that the “Add Income” feature permits you to choose what type of income (category).)”.

Can I invite my accountant to take a look or have access to the ledger?

You can export your income and expense ledger and send it to your accountant. For that matter, you could give them your login information so they can acces your account directly, although we don’t recommend it.