Rental Property Accounting

Simple, automated accounting for your rental units

Real Estate Accounting Doesn’t Have to Be Hard

Our accounting software for landlords automatically adds income and expenses, and lets you categorize each with a single click. No, really — connect your bank account to import all past and ongoing transactions in real time.

Alternatively, upload your existing spreadsheets to import your accounting that way.

You can also track your mileage as a real estate investor, generate instant cash flow reports, and even generate Schedule E tax statements with a click.

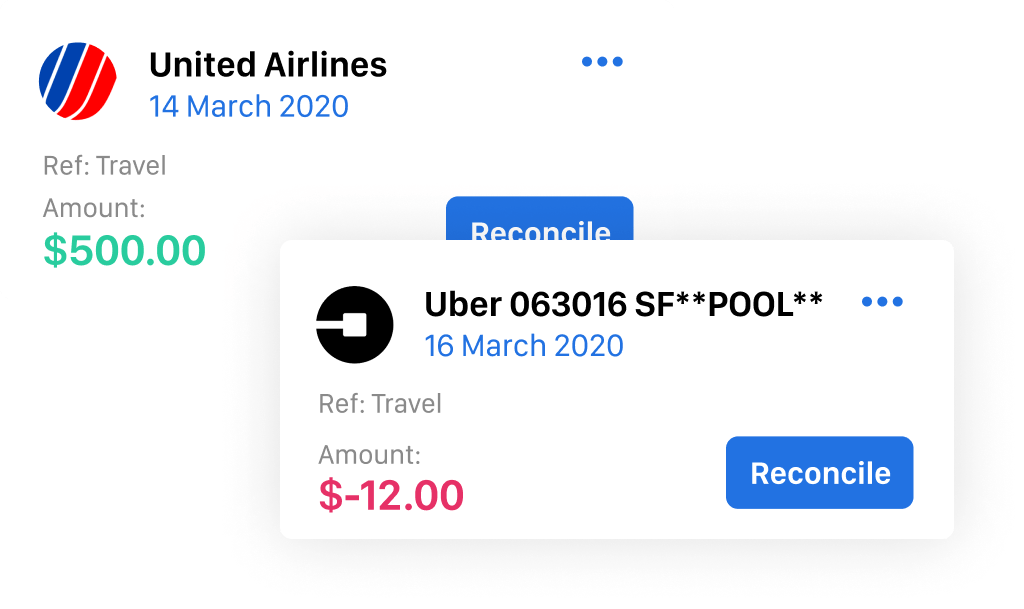

Automated Bank Feeds

Connect your bank account to your SparkRental landlord software account and we’ll automatically import your income and expenses: past, present, and future.

Auto-Match: We’ll automatically suggest matching transactions — all you have to do is confirm.

Create Rules: You can create your own custom rules for categorizing expenses.

Attach Receipts: Upload receipts to pair with transactions so you never wonder “What was that for?” again.

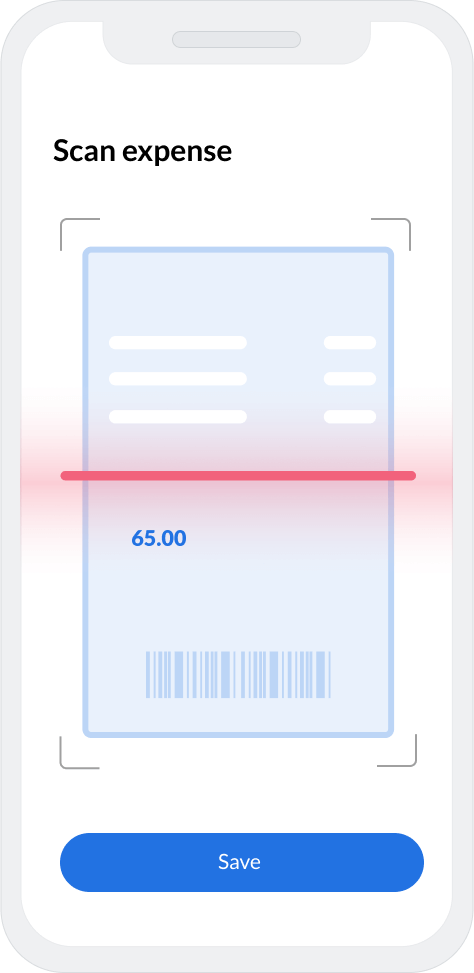

Digitize: Receipt Scanner

No one likes organizing paper receipts. If an overflowing file folder can ever be said to be “organized,” that is.

Instead, just use our mobile app to scan your paper receipt. Our landlord software digitizes it and enters it as an expense. All you have to do is select the expense category.

At any time in the future, you can click on that expense to pull up the scanned receipt. Easy peasy.

Mileage Tracker

Travel mileage is one of many outstanding rental property tax deductions. But if you’re ever audited, you need to account for every… single… mile.

Which is easy when you track your mileage in our mobile app for landlords. All you do is open the app and click “Start,” and it uses your phone’s GPS to track your mileage until you hit “Stop” and enter the trip purpose and any notes.

It’s literally that easy.

Fast, Easy Tax Prep

With a single click, you can generate Schedule E tax statements.

If you or your accountant use Xero’s accounting software, you can also sync your SparkRental landlord accounting data directly with your Xero account.

You can even offer your accountant direct access to your transaction data for a stress-free tax time.

Pricing

Choose your plan

- Units

- Prescreening interviewOnline Rental Application

- includes full credit, nationwide criminal, and nationwide eviction history reportsTenant Screening Reports

- Online Rent Collection

- Fully integrated with online rent collection system, with manual entry features too. Income & Expense Tracking

- GPS Mileage Tracking

- Maintenance Tracking

- Detailed financial reporting including: Schedule E tax reports, Income & Expense Reports, Live E-Payment Tracking, and Upcoming Scheduled Payment Reports.Financial & Tax Reports

- Automated Bank Feeds & Sync

- Receipts & Document Storage

- Recurring Expenses

- Multi-User Access

- Xero Integration

- Full Data Export

Free

$0

per month

- Up to 3

- $40, chargeable to either applicant or landlord

- Tenant pays $2.50/payment

- Manual

- Basic

Pro

$12

per month ($15 if paid monthly)

- 3 included, then $1/month apiece

- $40, chargeable to either applicant or landlord

- Tenant pays $2.50/payment

- Automated

- Advanced

FAQs About Automated Rental Unit Accounting

How do I track income & expenses with SparkRental's landlord app?

You’ve got several options:

-

- Spreadsheet uploading: You can upload a spreadsheet to import your past accounting data.

- Bank feed: Connect your bank account directly to sync transactions in real time.

- Receipt scanner: Scan paper receipts to import expenses directly into your account. The receipt gets automatically saved and attached to that expense.

- Enter manually: A last resort, but available.

How do I know the bank feed is secure?

We use Plaid, the biggest name in bank feeds, to integrate your bank account data.

In fact, your banking login details never even touch our servers. It goes directly through Plaid’s ironclad security.

Does your receipt scanning actually "read" and import my receipts?

Yes, our Smart Receipt Scan transcribes your receipt into text and enters it in your books. You select the expense category and can custom label it if you like.

How do I generate reports?

You can generate several types of landlord accounting reports with the click of a button.

They include income & expense reports, Schedule E tax statements, cash flow reports, and more.

How does the bank feed integration work?

You sync your rental property bank account with SparkRental through Plaid, the most secure and trusted name in bank feed integrations.

Your transaction data automatically imports to SparkRental’s landlord app, and you can reconcile and label income and expenses with the click of a button. You can also set up custom rules for categorizing certain expenses.