Heard the term “internal rate of return” or IRR thrown around, but not sure what it means?

Don’t sweat it. I worked in real estate investing for two decades before I completely understood it.

But don’t follow my example on that front — you should understand what internal rate of return is, how IRR is calculated, and how to use an IRR calculator online to evaluate real estate investments much sooner than I did.

Fortunately, it’s not as complicated as most explanations make it sound.

IRR Calculator

Internal rate of return is complicated enough that no one other than finance students actually calculate it by hand.

Which is precisely why we offer a free IRR calculator online.

A few quick notes:

-

- Enter your original investment plus any final year returns in the year when you expect to receive back your investment

- If that’s sooner than Year 5, just leave the later years blank

To get the feel for it, try entering the example numbers outlined above. That means an initial investment of $100, $0 in cash flow in Year 1, and $140 in cash flow in Year 2.

Happy number crunching!

What Is Internal Rate of Return?

In plain English, internal rate of return is the compound interest rate you can expect to earn on an investment.

Imagine you invest $100 and you expect to receive it back plus a $40 profit at the end of two years. The average annual return would be 20%: $40 net return divided by two years. But that simple average doesn’t take compounding into account: if you had received returns in the first year, and had been able to reinvest those returns, you’d have earned even more returns on your returns.

Internal rate of return takes compounding returns into account. If you’d invested $100 at 18.32%, you’d have received back $18.32 after the first year, and if you’d reinvested it at that same 18.32%, at the end of the second year, you’d receive back $21.68. That would leave you with a total net return of $40.

That’s how IRR works — it offers an “apples to apples” comparison between potential investments that pay returns on different timetables.

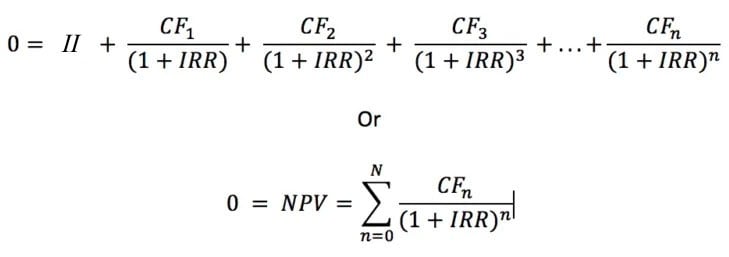

Technical Definition of IRR

The technical definition of internal rate of return is “The discount rate that makes the net present value (NPV) of an investment project equal zero, in a cash flow analysis.”

What a mouthful. Let’s break that down into plain English.

“Discount rate” refers to the rate of return you expect to receive. Simple enough.

As for “net present value,” that refers to the value of all future cash flows for an investment, based on a specific discount rate or return. It dictates what you should invest if you have a target end balance and return in mind.

You can also think of NPV as measuring the time value of money if you really want to geek out. Or, from a fundraising perspective, you can think of it as the cost of capital.

How to Use IRR in Real Estate Investing

Real estate investors typically use internal rate of return for evaluating real estate syndications and other commercial property investments. When evaluating single-family rentals or small multifamily properties like duplexes and triplexes, it usually makes more sense to simply calculate cash-on-cash return, monthly property cash flow, and cap rates. (Use our free rental cash flow calculator to run the numbers on any rental property.)

But for evaluating potential real estate syndications, IRR offers the most accurate measurement of returns. Each real estate syndication deal pays different levels of cash flow each year, and in many cases, investors get their big payday after 2–6 years when the property sells.

Calculating internal rate of return is not just academic. Every month in our group real estate investing club, we compare these numbers on prospective deals before investing. Let’s illustrate with a realistic example.

IRR Example

Imagine you want to compare two prospective real estate syndication deals. Property A pays a 10% preferred return for cash flow, and after five years, the sponsor expects to sell it for 1.7 equity multiple (70% above the purchase price and costs). Property B pays a 6% preferred return for cash flow, and they expect the same 1.7 equity multiple, but plan to sell after three years. (In this example, we assume each property pays the full preferred return each year for the sake of simplicity.)

Which pays a higher return?

If you run the numbers in the IRR calculator above, you get the following IRRs:

Property A: 18.33%

Property B: 23.09%

Purely based on returns, Property B is the better investment. But other factors might affect your decision — you might prefer steady cash flow from long-term buy-and-hold real estate investments, for example, and don’t want to worry about having to find a new investment in three years to redeploy the money. Or perhaps the risk profile for Property A is lower, if it is located in a better neighborhood or a city with faster population growth.

Internal rate of return doesn’t tell you everything you need to know about an investment, but it does offer a uniform yardstick to compare returns on multi-year investments.

What’s the Difference Between IRR & ROI?

There are many ways to measure return on investment (ROI), and IRR is one of them.

Put another way, IRR is a type of ROI calculation. It’s just not the only one.

Other common ways to measure returns in real estate investing include cash-on-cash return, cap rates, monthly cash flow, and average annual returns for long-term investments.

Average annual returns are just the simple average of the total returns you earned, divided by the total number of years you owned the property. In the earlier example, where you invest $100 for two years and receive $140 at the end, your average annual return is 20%. But because this ignores the potential compound returns you’d have earned if you received the full return each year, it’s less accurate than IRR.

Difference Between IRR & Cash-on-Cash Return

In real estate syndications and single-family rentals alike, cash-on-cash (CoC) return refers to the annual income yield you earn while you hold the investment based on your actual cash investment.

If you invest $50,000 of your own money — whether as a down payment on a rental property or your total cash investment in a syndication — and you end up collecting $4,000 in net cash flow each year that you own the property, that means an 8% cash-on-cash return.

Often in real estate syndications, you’ll see a preferred return listed for cash-on-cash return. That means that the first returns go to you as the passive investor first, before the sponsor or general partner (GP) starts collecting returns.

For example, say the preferred return is 8% and after that there’s a 70/30 split for cash flow. If a property earns 12% in cash flow one year, the first 8% of that goes to you and the other limited partners, and the other 4% gets split 70/30 (70% to you, 30% to the GP).

How Is IRR Calculated Manually?

Are you sure you want to know?

All right, here’s the formula for IRR. Knock yourself out:

Where:

II = Initial investment

CF1, CF2, … CFn = Cash flows

n = Each period

N = Holding period

NPV = Net present value

Didn’t find that particularly useful? You can instead learn how to calculate IRR with Excel.

(article continues below)

How to Calculate IRR in Excel

Fortunately, there’s a built-in function to calculate internal rate of return on Excel.

To use it, you need a series of data fields showing first the initial investment (written as a negative number), then the cash flow generated each year thereafter. The last number can include the proceeds from a sale.

The Excel function is simply =IRR(cell range).

To continue our simple example from above, you would calculate IRR in Excel as:

| Initial Investment: | ($100) |

| Year 1 Cash Flow: | $0 |

| Year 2 Cash Flow: | 140 |

| IRR: | 18.32% |

The formula entered in the last box would be =IRR(B1:B3) if the three values on the right were in cells B1 through B3.

Easy peasy lemon squeezy.

Disadvantages of Internal Rate of Return

For all its strengths, IRR comes with a few limitations.

First, it doesn’t tell you anything about the time period that the investment is held. A project could offer astronomical returns, but most of them come at the end of a 20-year period and if you need passive income now, the high IRR won’t help you.

Internal rate of return also tells you nothing about risk. A property could appear to offer double the IRR, but come with triple the risk of a more conservative investment. Most investors wouldn’t make that trade off.

Finally, beware that as a measure of return, IRR provides no information about amounts. Imagine you need $200,000 in investment returns, and you’re considering a real estate syndication that pays a high 25% IRR. If they cap each person’s investment at $500,000, that won’t meet your needs (although it’ll at least get you the first $125,000).

Final Thoughts

The IRR of a potential investment represents its annual growth rate, over whatever period of time you plan on holding it. It measures the total return, including both positive cash flows and the capital gain from selling. In the case of businesses or real estate investments with capital calls, it could also include negative cash flows.

While the formula is a bear, you can use financial calculators like the online IRR calculator above or the internal rate of return Excel function to do the heavy lifting for you.

Use this annual rate of return to make investment decisions, knowing the potential return of various investment options. In particular, use it for an “apples to apples” way to compare rates of growth on different types of investments, such as stocks and real estate syndications.♦

What questions do you still have about using IRR to compare prospective investments? What other gauges do you use to evaluate investment opportunities?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

The online IRR calculator helps a lot with the learning the math. Good stuff!

Glad to hear it Mae!

Thanks for sharing! This is great for maintaining positive cash flow.

Glad to hear it was helpful Mike!

Explained direct and concise!

Much appreciated Ann!

At first IRR seemed unnecessarily complicated to me, compared to average annual return. But when you compare mid- and long-term real estate investments to investments that compound quarterly or annually, you have to include that in your calculation if you want a straight comparison of returns. Thanks for sharing!

Absolutely Ivan!

I bookmarked this for the online IRR calculator. Will definitely come in handy.

Glad to hear it was helpful Quinn!

Important to understand before investing in real estate syndications in particular

Agreed Chester!