If you’ve ever bought a home to live in, you probably think buying investment properties works similarly. However, you should be aware of the important differences between a home loan and investor loan.

Most notably: higher credit requirements.

Can you still get an investment property loan? Are there options available for financing an investment property if you have bad credit?

While the answers to these questions are nuanced and vary based on multiple factors, the general answers are that yes, you may be able to get an investment property loan with bad credit, and yes, there are many options available to you.

Conventional Mortgage Lenders & Investment Properties

Not all conventional mortgage lenders offer investment property loans.

Even among those that do, they require greater financial stability for investment property loans than owner-occupied property loans. Many lenders require a down payment of at least 15-20%, in addition to high closing costs and fees. Plus, they typically require good to excellent credit (700+), since investment properties pose a greater risk for lenders.

After all, if a landlord gets into trouble financially and defaults on a loan, which will they default on first: their rental property loan or their home mortgage? Their investment property loan, every time.

Options for Investment Property Loans with Bad Credit

Let’s be clear: your credit history matters. The higher your credit score, the more options you’ll have for investment property loans.

If your credit score hangs below 640, you’re going to struggle to find financing. Consider house hacking (more on that shortly) while you work on improving your credit score.

For borrowers with credit ranging between 640-700, you have a few options, but expect to pay higher interest rates and higher points and closing costs than borrowers with sterling credit. Try these options if you have fair or good credit, rather than excellent credit.

Hard Money Loans

Hard money loans are short-term loans for buying and renovating a fixer-upper. The lender typically charges interest-only rather than amortizing the loan, and they expect you to repay the loan in full within 6-24 months.

How? By either selling it (flipping the property) or refinancing it (keeping it a rental, following the BRRRR strategy).

The good news is that hard money lenders focus more on the collateral — the property — and less on your creditworthiness. The bad news: if you want to keep the property as a rental, you need to refinance for a long-term mortgage, and that second lender will certainly scrutinize your credit.

Hard money loans have many pros and cons. Among the pros, you can expect speed and flexibility in the loan process because you’re not dealing with a bank or lender that uses a standardized underwriting process. And, since your property is being used as collateral, your lender can just take your property if you are unable to make payments, resulting in a less rigid approval process.

Try Civic Financial as a purchase-rehab lender that doesn’t have a minimum credit score. Alternatively, Lendency requires a minimum credit score of only 575, and RCN Capital requires credit of 650 or higher. If your credit is a little better, try Kiavi or LendingOne, both of which require scores of 680 or higher.

Portfolio Loans

Investors looking for long-term rental property mortgages typically need better credit than those just looking for short-term purchase-rehab loans.

Portfolio lenders keep their loans on their own books (within their own portfolio) rather than bundling them and selling them in bulk to multinational corporations like conventional lenders do. They’re usually private companies or local community banks.

They do scrutinize your credit, although some allow weaker credit scores. The most flexible I know of is Civic Financial, which allows borrowers with credit as low as 600. Other options, such as Visio, Kiavi, LendingOne, and RCN Capital all require credit scores of 680 or higher.

Apply with a Partner

One simple way to get an investment property loan with bad credit is to apply with a partner or co-borrower. In this case, both parties’ credit scores will be taken into consideration, and you will both be responsible for the loan and making payments. This offers your lender additional assurance that they’ll receive their monthly payments consistently, making it easier to get approved.

Just make sure that your partner/co-borrower is creditworthy, as it would defeat the purpose of applying jointly if you both have bad credit.

House Hack

One other option you could try is multifamily house hacking, a simple concept in which you buy a small multifamily property and move into one of the units and rent out the others. This way you could qualify for low-credit, low down payment mortgage options, such as a Fannie Mae HomeReady loan used for a rental. On top of that, your renters will essentially cover your mortgage payments through their own rent payments.

That’s not the only way to house hack however. Review these options to house hack a single-family home.

Because you’re taking out an owner-occupied loan in all house hacking cases, you can minimize your down payment, or even buy a property with no down payment at all. (Try house hacking with a VA loan for an investment property, for 100% financing.)

After living in the property for one year, you can move out and keep it as a rental, leaving your owner-occupied mortgage in place.

Borrow Private Money

The terms “hard money lender,” “portfolio lender,” and “private lender” confuse many borrowers. But private money in this context comes from friends and family members: people who don’t lend money as a business.

As you gain experience as a real estate investor and build your property portfolio, you establish a track record of success. Your friends and family members may express interest in what you’re doing, and you can offer to pay them interest if they want want to finance your next property.

No credit report necessary, and all interest and terms negotiable.

Wholesale Properties Instead

Especially for novice real estate investors, wholesaling offers another option. In the real estate wholesaling process an individual (the wholesaler) puts a property under contract with the seller, and then assigns that contract to another investor with a profit margin built in. Thus, wholesaling could be a good option for you if you have low credit since you aren’t the one buying the property — instead, the end buyer will undergo a credit check for funding the purchase.

If you’re new to the concept, read up on wholesaling real estate here.

(article continues below)

Improving Your Credit Score

One of the best ways to get an investment property loan with bad credit is simply to improve your credit score.

Here are some suggestions and tips that can help you improve your credit.

Make Every Payment on Time, Always

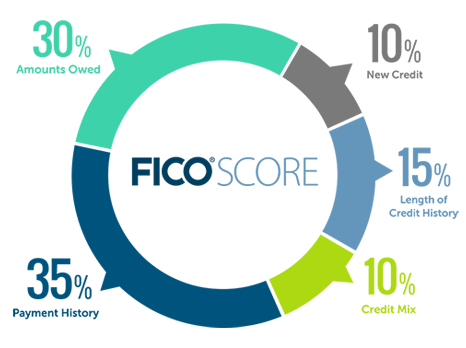

One of the best ways to improve your credit score is to make on-time payments on your credit cards or other forms of debt. Payment history is the largest factor that makes up your credit score per MyFICO (see the chart to the right), and so it is important to be responsible with your debt and to stay on top of your payments.

One of the best ways to improve your credit score is to make on-time payments on your credit cards or other forms of debt. Payment history is the largest factor that makes up your credit score per MyFICO (see the chart to the right), and so it is important to be responsible with your debt and to stay on top of your payments.

If you are unable to make on-time payments for any reason, contact your lender and find a solution, potentially saving you from any credit score stress later on.

Keep Your Credit Utilization Ratio Low

Your credit utilization ratio is another large factor that is taken into consideration for your credit score. In simple terms, your credit utilization ratio is how much credit you are using in relation to how much credit is available to you. Expressed as a percentage, you should keep it below 30 percent. If you end the month with a credit card balance over 30% of your available credit limit, the bureaus start dinging your score.

If you find that you are using the majority of the credit available to you, you can seek an increase to your credit limit.

Review Your Credit Report for Errors

G.I. Joe wasn’t wrong: knowing is half the battle. And when it comes to improving your credit score, know what your credit score is before trying to fix it.

Fixing errors on your credit report is the fastest way to boost your score. If errors exist, that is.

Use a Credit Repair Service

One easy way to improve your credit score is by using a credit repair service.

In most cases, credit repair companies charge a fee for removing negative marks from your credit reports by identifying inaccuracies in your reports that could be fixed.

Final Thoughts

Novice real estate investors just jump straight to conventional mortgage loans as their first thought to finance investment properties.

Instead, think in terms of building a “financing toolkit.” You want many options at your disposal for financing rental properties, and many lenders within each option.

Because the more options you have, the less you’ll pay in interest and fees, and the less likely you are to lose a great deal over lack of financing.♦

Have you taken out investment property loans with bad credit? How did you go about it?

More Real Estate Investing Reads:

About the Author

Kalicia Bateman is a personal finance editor at BestCompany.com, specializing in mortgages, personal loans, credit cards, and a variety of other finance topics. She is passionate about simplifying finance for a wide consumer base, and strives to combine complex information with authenticity, and even humor when possible.

Didn’t even know that you can still get a loan even with bad credit! This is very informative because I got to know how to improve your credit score.

Glad it was helpful J.!

This is very helpful, as well as the tips and ways on how to get a loan with a Bad credit. I also recommend this article to one of my friends!

Some great ideas, thanks!

You’re welcome Jenise 🙂

Been a struggle for me. Going to try some of the lenders you have listed on your Loans page and see how it goes.

Best of luck Natalia, keep us posted!

This was amazing! Thanks for making me aware of Civic!

Glad to help Daeshawn!

I have been researching this for quite a while now. Thanks for breaking down the options!

Glad it was useful Bendary!

It’s not the end when you have a bad credit score! Great article. Love it!

Thanks Jane!