Vacancy Advertising & Tenant Screening

Want higher ROI on your rentals? Fill your vacant rental unit with the best possible renters, ASAP.

Have a vacant rental unit on your hands?

Vacancies are expensive, and they’re time-consuming to fill. Lucky you! But unless you want to be right back in this position in six months, an eviction later, get it right the first time.

Advertise on multiple rental listing websites. Give every person who expresses interest a rental application (ours is free, emailable and e-signable – hint hint).

Then run tenant screening reports on all applicants. Get a full credit report, nationwide criminal background check, and nationwide eviction report. Have the applicant pay the fee for these (our screening reports can be charged directly to the applicant).

Then it’s calls, calls calls. Supervisors. HR departments. Personal references. Current landlords. Prior landlords. If that sounds like a lot of work, it’s nothing compared to unpaid rent, serving eviction notices, filing in rent court, appearing in front of a judge, meeting the sheriff at the property, and then spending thousands of dollars to get the property back in rental shape.

Here are a few fundamental articles to get you started, and from there, you can explore our other articles in the Advertising & Tenant Screening category to make sure you get the perfect long-term tenant, every vacancy!

“Required Reading” – Start Here First!

Still hungry after eating those up? Well, we won’t let you down. There’s plenty of rental advertising and resident screening articles to sink your teeth into!

Full Library of Advertising & Tenant Screening Articles:

What Are Squatters Rights? State-by-State Guide to Squatters Rights

The Big Picture On Squatters Rights: Squatters rights, or adverse possession laws, govern how landlords and property owners can remove trespassers after establishing residency. Squatters' rights vary by state law. Trespassers can become squatters if they stay long...

Eviction Process: How to Evict a Tenant (Infographic)

The Big Picture On The Eviction Process: Despite running a tight ship, landlords will eventually have to deal with eviction. Documentation is crucial when enacting the eviction process, as it helps the landlord's case in the long run. Landlords should always stay on...

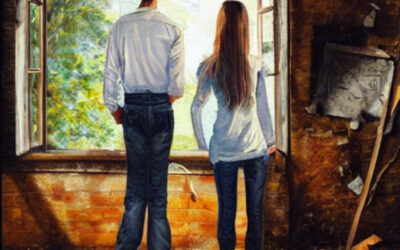

How to Buy a Fixer-Upper Without Getting Burned

The Big Picture On How To Buy A Fixer-Upper Fixer-uppers are properties that need a little TLC before being ready for occupancy or sale. Buying fixer-uppers presents investors with several notable advantages, like the potential of a massive payday. However, the...

Housing Market Corrections: How to Invest Throughout the Real Estate Cycle

The Big Picture On The Real Estate Cycle: Understanding the real estate market cycle is an important guide for informed investment decisions. Investors should focus on generating positive cash flow during recessions or uncertainties as a safer strategy, rather than...

How to Get Investment Property Loans with Bad Credit

The Big Picture On How To Get Investment Property Loans With Bad Credit: Despite bad credit, people interested in getting investment property loans have several options available to them. Options to get investment property loans even with bad credit scores range from...

The BRRRR Method in Real Estate: Invest with No Money (Infographic)

The Big Picture On The BRRRR Method: The BRRRR method (buy, rehab, rent, refinance, repeat) is an effective strategy used for building real estate portfolio rapidly. Like with anything, the BRRRR method comes with its own set of risks and advantages. That said, there...