The Big Picture On The BRRRR Method:

-

- The BRRRR method (buy, rehab, rent, refinance, repeat) is an effective strategy used for building real estate portfolio rapidly.

- Like with anything, the BRRRR method comes with its own set of risks and advantages. That said, there are only a handful of strategies that can build portfolio faster than BRRRR.

- Certain subset of investors, like ones that aren’t necessarily stoked with real estate rehabilitation as an investment thesis, may be better off with other strategies.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

If you’re new to real estate investing, chances are you’ve come across the “BRRRR strategy” and immediately thought of cold (there’s no shame in that; we all thought about it.)

BRRRR—with four Rs— is an effective strategy in real estate investing, building upon concepts of compounded returns. Here’s everything investors need to know about the BRRRR real estate investing strategy to start rolling your snowball.

What Is the BRRRR Method?

Besides sounding like you’re shivering, the BRRRR method of real estate investing is an acronym standing for buy, renovate, rent, refinance, repeat. Some investors refer to it as the BRRR method, skipping the “rent” portion as self-explanatory. Whatever; semantics.

The giant, glaring advantage of the BRRRR strategy is that you get your down payment back within a few months, freeing it up for another property purchase. This strategy lets you snowball your rental portfolio and passive income quickly and with little cash.

Follow these steps to use the BRRRR method to invest in real estate without money—or rather, without any of your own money tied up in the property after refinancing.

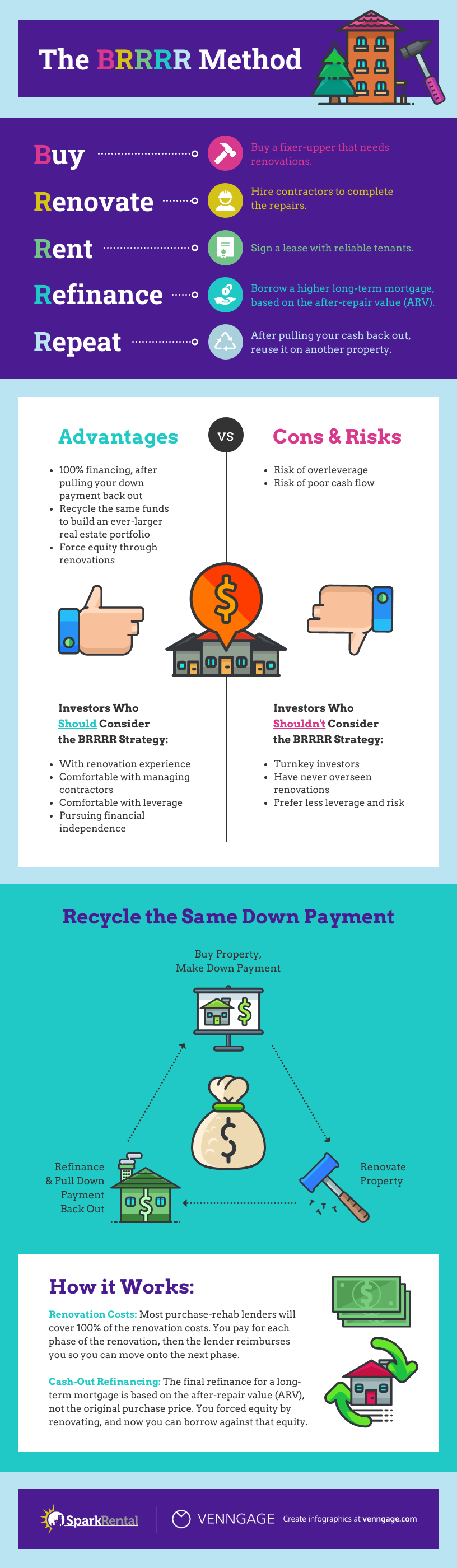

Infographic by Venngage Infographic Maker

Step 1: Buy

First, you buy a property that needs work. And not just a coat of paint, either — the property needs enough room for improvement for you to significantly raise the value (also known as forcing equity).

Most BRRRR investors take out a purchase-renovation loan: see our Investment Property Loans page for a comparison chart for purchase-rehab loans. The good news is most hard money lenders (including LendingOne and Kiavi) allow you to borrow 100% of the renovation costs.

But purchase-rehab loans aren’t your only option for financing. Some investors use a rotating line of credit to buy and renovate properties, such as a HELOC against a rental property or your home.

Or you could open an unsecured business line of credit or business credit cards, which you qualify for as a real estate investor. If you’re new to that concept, check out Fund & Grow as a business credit concierge service. They open a series of business credit lines and unsecured business cards in your name, typically giving real estate investors access to $150,000-$250,000 in credit to use the BRRRR method with no money out of your own pocket.

Step 2: Renovate

Renovation could involve anything as minor as cosmetic updates up to a complete gut and rehab. Just make sure you don’t get in over your head; I did, when I bought my first few properties.

That said, the renovations need to push the property value much higher. You need to create enough equity that you can later borrow all the money you pumped into the property.

But we’re getting ahead of ourselves.

Step 3: Rent

After you finish the renovation work, Step 3 is screening tenants and leasing the property ASAP. Every month that goes by with a vacant property is lost money, after all.

Start advertising the unit for rent before every last detail is completed in the renovation. You want a tenant to sign a lease agreement and move in the moment the work is finished.

Step 4: Refinance

At this point, you can refinance to pay off your purchase-rehab loan in favor of a long-term mortgage. You can pull back out your initial investment and rehab costs… if you created enough equity in the property. As a general rule of thumb, the greater the renovation work, the greater the potential forced equity.

Keep in mind that lenders base the cash-out refinance loan on the property’s after-repair value (ARV), rather than your initial purchase price. (See our Loans page for long-term rental lenders, in addition to short-term purchase-rehab lenders.)

Just be careful not to borrow too much and over-leverage yourself. You don’t want to end up with negative cash flow with too high of a mortgage payment.

Step 5: Rinse & Repeat

That cash-out refi frees up your original cash for the final step: rinsing and repeating the process, to keep buying more rentals.

In this way, you can recycle the same down payment over and over again to build a portfolio of cash-flowing rental properties. You could theoretically reach financial independence and retire early on just $50,000, if you repeated this process enough times!

BRRRR Method Example

Imagine you buy a fixer-upper for $100,000 and put $50,000 in repairs into it. Add in $6,000 in closing costs and $4,000 in carrying costs for good measure. That leaves you with a total cost of $160,000.

Of that, you could probably borrow $70-80,000 for the purchase plus all $50,000 in renovation costs. So, let’s say you borrowed $130,000 and coughed up $30,000 of your own cash for this deal.

Upon completing the renovations, the property is now worth $200,000. So you refinance with an investment property mortgage for $160,000, or 80% of the property’s new value (the ARV).

Congratulations! You now have $0 of your own money tied up in the property. You can redeploy that $30,000 into new real estate investments.

Again, watch out for using too much real estate leverage and ending up with negative cash flow however. In the real world, you may end up leaving some cash tied up in each deal, to reduce your debt and stay cash-flow-positive.

Advantages of the BRRRR Strategy

The greatest advantage for the BRRRR strategy, of course, is you can invest in real estate with a zero-net investment of your own cash. Once you refinance, you have exactly $0 of your own money invested in the property.

That is not the same as buying a rental property with no money down. You still need cash for the initial down payment, even though you’ll get it back a few months later when you refinance through a private lender like Visio. Luckily for you, there are plenty of creative ways to come up with a down payment for your next property.

You’ll also need cash for the first round of work; while the purchase-rehab lender finances the property renovations, they only reimburse you after each round of work is completed.

But because the BRRRR method returns your original cash to you, it removes the restraint of cash. You can recycle your same down payment cash, over and over. All the while, your rental income grows with every property.

And because you’re forcing equity by renovating the properties, you (ideally) don’t end up overleveraged with negative cash flow, despite financing 100% of your purchase costs. At least if you calculate your cash flow accurately.

You also get all the real estate investing tax deductions that come with buying, renovating, and holding rental properties. Including mortgage interest and closing costs — without having to itemize your personal deductions, either.

The BRRRR strategy is precisely how many real estate investors reach financial independence from real estate at a young age, without needing millions of dollars following the 4% Rule for retirement with stocks. More on that shortly.

Disadvantages & Risks of the BRRRR Method

Before you go on a buying spree, beware of the BRRRR strategy’s risks and downsides.

You incur two rounds of closing costs, each of which costs thousands of dollars. Even if you use the same lender for both the purchase-rehab loan and the refinance to a long-term mortgage (LendingOne offers both), they still require a fresh round of title searches, appraisals, lending fees, and other settlement charges. Don’t be surprised to spend $5,000-$10,000 on each settlement in non-refundable, lost-money fees.

As mentioned above, it normally takes major renovations to create enough equity to pull your original cash back out. That means months of overseeing contractors and repairs, pulling permits, and the other attendant headaches of renovating real estate.

Then there’s the risk of overleveraging. You need to make damn sure the property will cash flow well — use this free rental ROI calculator to forecast the property’s eventual cash flow. Remember to build in the extra expenses of the second round of closing costs, in your long-term refinance loan numbers.

Some long-term mortgage lenders also require a seasoning period. This refers to a minimum period of time that you must have owned the property, before the lender will work with you. However you’ll likely only see seasoning requirements from conventional mortgage lenders.

Like any property, rental properties bought through the BRRRR method come with risks. Always ask yourself these nine questions before buying any rental property to evaluate risks accurately.

How the BRRRR Method Fits into Your Financial Independence & Retirement Strategy

The BRRRR strategy is ideal for reaching financial independence and retiring early (FIRE). How’s that for an alphabet soup of acronyms?

Most people’s instinctive reaction when I ask them how much they need to retire is “Huh? A lot, I guess. Over a million dollars, maybe several million.”

When I ask them if they think they’ll be able to reach financial independence and optionally retire at 40 or some other young age, most doubt it. These reactions make sense — if you’re following the 20th Century model of retirement. Save up a huge nest egg, retire at 65, then gradually draw it down over the next 20-30 years.

To do that, most people follow the 4% Rule for retirement. In short, it says you need 25 times your annual spending in order to retire, so that you can withdraw 4% a year. Thus, if you want $40,000 in annual income in retirement, you need $1,000,000 saved.

And let’s be honest, it’s not easy to save up a million dollars.

I love stocks, don’t get me wrong. I invest in them for diversification and long-term growth. But the math changes dramatically, when you look at real estate vs. stocks for financial independence and early retirement.

How Much You Need to Save Up for Retiring with Rentals

The BRRRR strategy throws that old 20th Century model out the window.

Say you have $30,000, and you use it as a down payment to buy, renovate, and refinance a duplex rental property over the course of several months. After refinancing, your new property generates $300/month in net passive income.

You repeat that process twice more that year, for a total acquisition of three properties for the year. Each property generates $300/month in net income.

At the end of the year, you have your original $30,000 back in your pocket, plus $900/month in passive rental income. That’s $10,800/year, and you don’t have a dime of your own money tied up in the properties.

Even if you never saved another cent, and only re-used that same $30,000 to repeat the process, you’d have $43,200 in annual rental income after just three more years. Just imagine if you put that additional income to work buying more properties, or bigger properties that cash flowed better?

Real-Life Examples

And it doesn’t just work in theory. This is exactly how the Hoeflers reached financial independence in under five years (see our free masterclass we hosted with Scott Hoefler, breaking down exactly how they did it).

Nor are they unique; we’ve interviewed dozens of people who have reached FIRE with real estate in five years or less. For another example, here’s how Leif reached FIRE from real estate by 32.

(Spoiler: The key to Leif’s success was a strategic approach to property investment, which covers initial implementation, scaling, effective leveraging, and management. All this allowed him to retire early and enjoy a financially secure lifestyle well before the typical retirement age—something he wouldn’t have been able to achieve if he’d continued working in a lab. But you should read the full blow-by-blow, as he has a lot of great things to say about strategic real estate investments.)

(article continues below)

The Risks Of BRRRR Strategy (And What To Do About Them)

I’ve alluded to how I got into hot water when I first used the BRRRR strategy. Unfortunately, that’s not the only way you can screw up with it.

Fortunately for you and me, there are a few things you can do to avoid the fallout of a failed BRRRR implementation. Let’s take a look at them:

| Risk Scenario | Description | Risk Management Strategy |

|---|---|---|

| Overestimating Property Value | Investors might overestimate the after-repair value (ARV) of a property, leading to financial miscalculations. | Conduct thorough market research, utilize professional appraisals, and consider conservative estimates in calculations. |

| Underestimating Renovation Costs | Renovation costs can often exceed initial estimates due to unforeseen issues or price increases in materials. | Build a contingency budget of at least 10-20%, engage experienced contractors, and regularly review budgets. |

| Cash Flow Shortfalls | Rental income may not cover the mortgage and operating costs, particularly if market rental rates are overestimated. | Perform detailed cash flow analysis using conservative rental estimates, and maintain a cash reserve for vacancies and unexpected expenses. |

| Refinancing Challenges | Refinancing might not be approved on anticipated terms, affecting the ability to pull cash out of the property. | Establish relationships with multiple lenders, ensure the property meets all refinancing criteria, and maintain a good credit score. |

| Market Volatility | Real estate markets can fluctuate, impacting property values and rental demand. | Diversify investments across different markets or property types, and stay informed about local economic indicators. |

| Regulatory Changes | Changes in local or federal regulations (zoning, taxes, landlord laws) could impact profitability. | Stay updated on local regulations, possibly through real estate networks or professional advice, and adapt strategies as needed. |

| Seasoning Period Requirements | Some lenders require a property to be held for a certain period before allowing refinancing. | Verify lender requirements upfront and plan cash flows and investment timelines accordingly. |

Who’s a Good Fit for the BRRRR Method?

Clearly, the BRRRR strategy works wonders for anyone looking to reach financial independence young.

But it also works well for anyone looking to use real estate leverage to accelerate their passive income and wealth growth. You can compound your wealth and income quickly by funneling your additional rental income right back into fresh investments.

Nothing limits you to one property at a time, either. As you get more operating capital to work with, and as you build your real estate investing skill set, you can renovate multiple properties simultaneously.

Still, only people comfortable with renovation projects should use the BRRRR method—investors who love buying “ugly houses” in need of some serious TLC.

Estimating repair costs, managing contractors, keeping renovations in-budget and on-schedule? These aren’t trivial skills that you pick up in a day. It takes some time to get comfortable with each of these skills.

If you love buying fixer-uppers, check out our Propstream review, showcasing how to use Propstream to find deals (often on vacant and/or distressed properties).

For another tool to help you find sellers of run-down homes, check out DealMachine. They bring “driving for dollars” into the 21st Century.

Who’s Not a Good Fit for the BRRRR Strategy?

Not everyone is so comfortable with such aggressive real estate leverage.

If the idea of financing 100% of your property costs would keep you up at night, borrow less. Or buy and renovate properties with cash.

For that matter, not everyone is comfortable with real estate renovation projects, leveraged or not. You may decide that there’s nothing in this world you hate more than managing contractors.

I wouldn’t blame you; I’ve had more than my fair share of bad experiences with them, and most require consistent oversight to stay on-schedule and in-budget. I also don’t recommend a huge renovation when you buy your first rental property; there are just too many moving parts.

If you’d rather buy turnkey properties that need little or no work, check out Roofstock. You can scour rental properties from all over the US, many of which are already rented to reliable tenants.

This brings up another challenge with the BRRRR strategy: investing long-distance. It’s hard enough to buy properties and oversee renovations when you can visit the property in person. But managing renovations and contractors from 1,500 miles away? Fuhget about it.

Not everyone lives in a market that’s conducive to rental investing. If you don’t feel confident that you can find good real estate deals within an hour’s drive from home, consider turnkey property investing long-distance on Roofstock.

How BRRRR Measures Up To Other Strategies

For a deeper look at the BRRRR strategy, here it is compared to other well-known real estate hacks.

| Method | Strategy | Capital Requirement | Investment Horizon | Risk Level | Potential Returns |

|---|---|---|---|---|---|

| BRRRR | Buy, Rehab, Rent, Refinance, Repeat | High initial, lowers with refinancing | Long-term | Moderate to High | High, through equity and rental income |

| Flipping | Buy, renovate quickly, sell for profit | High | Short-term | High | Can be high, depends on market and costs |

| Buy and Hold | Buy property, rent it out, hold for appreciation | Moderate to High | Long-term | Moderate | Steady, through rental income and appreciation |

| Wholesaling | Contract a property, sell the contract to an investor | Low | Very short-term | Low | Lower, quick small profits |

| REITs | Invest in real estate through stock market | Low | Varies | Low | Moderate, through dividends and stock appreciation |

Do Real Estate Syndications Use the BRRRR Method?

As a matter of fact, many do!

If you’re not familiar with real estate syndications, they involve fractional ownership in large commercial properties. You invest passively as a partial owner (known as a “limited partner”), and you don’t have to do anything other than write a check.

That also means you surrender decision-making control to the syndicator or general partner.

But many syndicators love the BRRRR strategy just as much as single-family rental investors. After making repairs over the course of a couple years, they refinance the property and return most or even all of the passive investors’ money to them. But you still retain your ownership in the property.

You get your money back, and can reinvest it elsewhere to keep adding more cash flow — even as you keep earning cash flow from the original syndication.

In the jargon-filled world of real estate syndications, they refer to this as “infinite returns.” Which makes total sense, actually: after getting your money back, all additional returns are gravy.

Final Thoughts

If you want to build a real estate portfolio fast with little cash, and don’t mind renovation projects or 100% real estate leverage, the BRRRR method is for you.

Just be careful to calculate your cash flow figures carefully. It’s harder when you’re forecasting numbers for a post-renovation refinance based on projected costs, so use conservative figures.

And at the risk of sounding like a nag, don’t go on a buying spree of multiple properties in quick succession if you’re new to rental investing.

Most new real estate investors underestimate their expenses in both renovating properties and long-term ownership, and if you buy several properties in quick succession you might find yourself losing money on properties each month—a risk compounded by the 100% real estate leverage used in the BRRRR strategy.

I made that mistake myself. Learn from my mistakes, so you don’t have to make them yourself.

But as a fast-track to FIRE, there’s no easier path than the BRRRR method in real estate.♦

Have you ever tried the BRRRR strategy? How did it go for you? What’s your advice for other investors thinking about this aggressive form of real estate leverage?

This is a really great way to build a portfolio fast, but costs of renovations have to make the buy worth it. You can get in over your head with the amount of money and work a rehab will need. So this is definitely very risky but also could be worth it since having more properties means more tax benefits, more equity from getting a good deal, more cash flow (hopefully), more appreciation, and more diversification.

More leverage definitely accelerates your profits or losses. Important to know what you’re doing before you borrow too much money!

Glad it was useful for you Brian!

This is brilliant! I always see BRRR but never had a chance to know how good it really is until I read this article. Thanks for that!

Glad you got something out of it Missy!

Hi G. Brian Davis, thanks for such an informative write-up. Very helpful. The tax benefits of BRRRR investing are substantial. You can make a lot of money rapidly if you flip, but you will pay greater taxes. Even if you have decent experience in flipping houses, it can be an ideal time to take into account the BRRRR Strategy. And this article can be a great starting point!

Great point Calvin!

Love the infographic. BRRR method indeed is a great strategy for experienced investors, just be careful not to overextend yourself.

Absolutely Jackson!

Thanks for sharing!

You got it Jacob!

I like the BRRR method among all other financial strategy but reinvesting takes a long time and I think I can only do 1 to 3 BRRR cycle for my entire career. My goal is a minimum of 14 doors to acheive financial independence.I’m hoping I could do more BRRR.

I hear you Gianna!

How do you determine if the property is worth purchasing? How do you determine how much renovations will cost?

If you don’t have any experience estimating renovation costs, you need to bring in several contractors for quotes. Make sure you budget extra for unexpected costs (just don’t tell the contractors that, or they’ll make sure they find ways to use up every penny in your contingency budget).

It has been an incredible experience purchasing my second house using the BRRR method! Just three years ago, I was broke, but a stroke of fate has led me to become the proud owner of two properties!

Congratulations Faith!