When Deni and I poll new real estate investors about their greatest challenges, two answers pop up again and again: coming up with a down payment and finding good deals on real estate.

So we talk about those two challenges a lot.

And while “driving for dollars” has been around for decades, it remains an effective way to find off-market properties. It’s classic — nay, timeless — even in today’s world of high-tech investing platforms.

If you like the idea of off-market real estate deals that let you force equity through renovations, consider the driving for dollars strategy.

What Are Off-Market Properties?

The more visible the deal is, the worse it tends to be. On the far end of the spectrum lie properties listed publicly on the MLS. Anyone can view them at any time; they’re advertised for sale on the open market.

Which by definition means you pay market pricing for them.

On the opposite end of the spectrum lie properties that no other buyers know about. They’re not on the market for sale, either publicly on the MLS or privately through wholesalers’ or turnkey sellers’ email lists. Hence the term “off-market properties.”

Even the owner may not know they want to sell. But when you reach out to them, the light bulb often goes off that they’re losing money on the property, and suddenly selling the property looks more attractive.

They could even be on the clock to sell distressed properties. You’d be surprised how people procrastinate on tedious tasks like selling real estate.

Your mission: to find owners who are willing to sell inexpensively, but who haven’t listed their property with a real estate agent yet.

What Is Driving for Dollars?

One way to find potential sellers who haven’t advertised their home for sale is to find vacant or dilapidated properties. Because every month that goes by, vacant properties cost the owner more money.

Which raises another question: how do you find vacant properties?

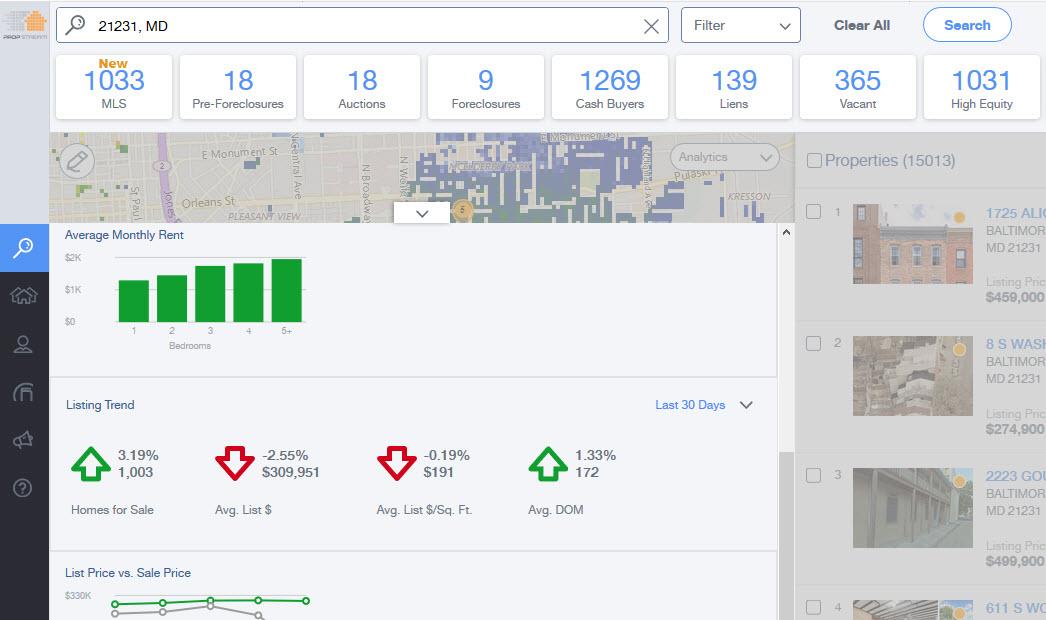

There are online real estate investing tools like Propstream that make it almost unfairly easy to find distressed sellers. They’re not free, but they’re often worth every penny (see Deni’s full Propstream review for pros, cons, and pricing).

If you’re not ready yet for online tools like Propstream, “driving for dollars” refers to driving your target neighborhoods and physically looking for vacant or run-down homes that the owner clearly can’t afford to maintain. That gives you a list of potential properties, which you can use to contact the owners about selling.

It costs little besides time and gas, and helps you familiarize yourself with your target neighborhoods. But make no mistake: it’s a numbers game. You may contact 80 owners, and only come out with one deal.

Get Organized Before Hitting the Road

It’s all too easy to meander aimlessly and waste time driving for dollars. Which means you need a plan before you ever step out your front door.

Here’s what you need to know about organizing your campaign with a driving for dollars spreadsheet. (I’m a huge spreadsheet nerd, if you couldn’t tell.)

Choose Your Neighborhoods Carefully

Not all cities, towns, or neighborhoods are created equal for real estate investing. Some have better cap rates, others have better market fundamentals like population growth and job growth, while others have more investor-friendly laws.

Not all cities, towns, or neighborhoods are created equal for real estate investing. Some have better cap rates, others have better market fundamentals like population growth and job growth, while others have more investor-friendly laws.

Check out our interactive map of the best cities for real estate investing by rent/price ratio for some ideas for new real estate markets.

At the neighborhood level, aim for neighborhoods with extremely low vacancy rates, low turnover rates, low crime rates, and moderate homeownership rates. Some homeowners are good, but too many makes it difficult to find rentals that cash flow well. Generally speaking, solid working- and middle-class neighborhoods work out well for rental investing.

Once you’ve chosen your target neighborhoods, map out a route in advance to hit every street, every block in those neighborhoods. Either write out the route, or just print a map and mark it up with a highlighter (or a crayon to satisfy your inner five-year-old).

Schedule When to Drive for Dollars

The best day of the week to drive for dollars is trash day, before collection. That way, you can spot the rare house with no trash out front.

Time your visits during daylight hours, so you can see well and take photos (more on that shortly). Avoid the busiest times of day in these neighborhoods, so you can drive slowly without a horde of road-raging drivers honking at your rear bumper.

Halloween and the holidays make particularly great times of year for driving for dollars. The lack of decorations helps vacant and dilapidated homes stand out even more.

But most important of all, by scheduling your driving for dollars in your calendar, you can make sure you actually do it.

What to Bring When Driving for Dollars

You could create your own driving for dollars spreadsheet… or you could just download our free one. It’s super simple, but it works. You can download a free copy of our driving for dollars spreadsheet without signing up for our mailing list because we’re cool like that, but we still think you should take our free masterclass on retiring early with real estate.

Print out a few copies to bring with you, along with several pens. Yes, you could bring your laptop or tablet and use your spreadsheet on that, but it tends to be unwieldy. You have to pull out your device, open the app, and type out addresses and notes with your thumb. It just plain takes longer than jotting down addresses with a pen.

Ideally, you also want to print out a stack of notes to post on doors. The driving for dollars script for these notes goes something like this:

Hi, I stopped by today to see if you’re open to selling the house, and to make an offer on it. I live nearby and I’m working on other projects around the neighborhood.

Please call me at (111) 111-1111 to discuss the offer. I can settle quickly and cover all the closing costs, so you don’t have to pay anything out of pocket.

Looking forward to discussing!

(space for signature)

G. Brian Davis

(111) 111-1111

In a perfect world you should handwrite these. But if that sounds like too much work, print them in a font that looks like handwriting, and sign it with the same color ink. Lastly, bring along a roll of scotch tape so you can tape these notes to the doors of likely properties, and some business cards.

What to Do While Driving for Dollars

As you drive your pre-plotted route, look for vacant or run-down homes. Even if the property isn’t vacant, neglected repairs and upkeep often mean that the owner can’t afford to keep the property and would be open to a buyout offer.

Here are a few signs to look out for as you drive for dollars:

-

- violation notices posted on the door

- newspapers piled up

- overflowing mailboxes

- overgrown lawns and/or landscaping

- boarded up or broken windows

- deferred maintenance

- utility shutoff notices

- old door hangers on the doorknob

As you find these properties, go through a quick checklist. First, write down the property address, notes, and other details on your driving for dollars spreadsheet.

Next, photograph the property from several angles, being sure to clearly capture the street number. Then log which camera shot numbers were for which property. The last thing you want is to get home and wonder which photos were of which properties!

Consider a driving for dollars app like Deal Machine. You just snap a photo with it and it will automatically log it and pull up all the information for you. More on driving for dollars apps shortly.

Try to get at least one photo that really paints the property in a bad light, figuratively speaking. The more dilapidated looking the better, as you can use this photo later when you contact the owner.

As you’re out of the car taking photos, tape your “handwritten” note on the front door. Tape both the top and the bottom of it to keep it secured in place — you never know how long it will be before the owner comes back to check on the property.

Finally, keep an eye out for postal workers delivering mail in these neighborhoods. When you see one, stop and strike up a conversation. Introduce yourself as someone who buys and renovates run-down homes, and tell them that you pay a $500 referral fee for information about vacant homes that lead to closings. Postal workers tend to perk up when they hear that, because they know which homes are vacant at any given time on their routes.

Get their name and number as well, and check in with these “bird dogs” every 60 days or so.

Tech to Drive for Dollars More Efficiently

If all the steps above sound like a lot of work, well, no one says you have to do it yourself.

There are several ways you can automate with a driving for dollars app. First, you can automate the photography and spreadsheet tracking with Deal Machine or HomeSnap. When you take a photo of a property, these apps use your phone’s GPS location and the visual AI to automatically pull up the property address.

Deal Machine then pulls up the property owner’s contact information (often including phone and email), along with information about the property’s equity, transaction history, neighborhood data, and more. In other words, they handle all the research for you.

For an extra fee, they’ll even mail your postcards for you. You save a template to the app, and they mail your cards per your personal design and text.

Literally all you have to do is drive around and snap photos of vacant homes.

Don’t even feel like driving? That’s cool too. Use a tool like Propstream to pull up all the vacant properties in your target neighborhood, then just click a button to send postcards to the owners.

Don’t even feel like driving? That’s cool too. Use a tool like Propstream to pull up all the vacant properties in your target neighborhood, then just click a button to send postcards to the owners.

You can literally automate the entire process with these driving for dollars apps. If you spend 15 minutes once a week scouting vacant homes and mailing owners from the comfort of your couch, you’ll start seeing calls roll in almost instantly.

Researching Equity & Owner Information

You’ve found a few dozen vacant properties after driving for dollars. Now what?

In a word, research. The first thing you want to do is research the equity (or lack thereof) in each property. If you’re using a tool like Propstream or Deal Machine, they’ll give you an estimate of the property’s equity based on the address.

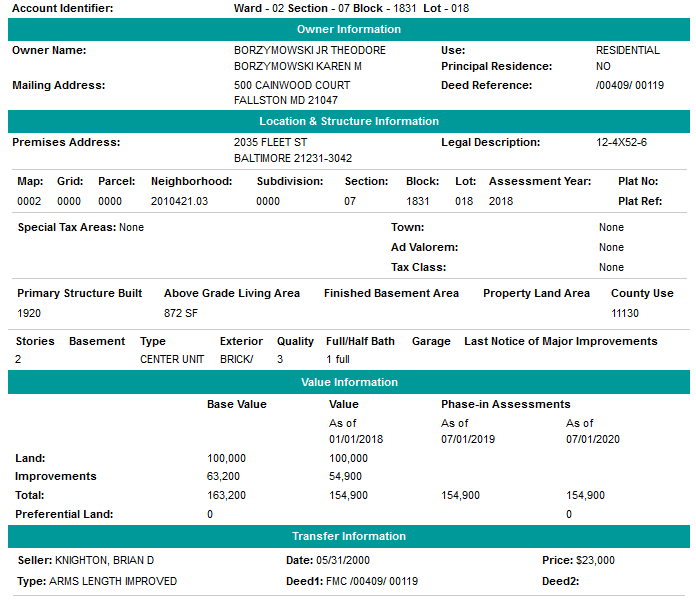

Without such a tool, you’re at the mercy of your state’s or municipality’s online records of liens. Some of these websites are easy to use, others not so much.

If the property has little or no equity, scratch it off your spreadsheet. If it looks like it does have equity, proceed to look up the owner’s information.

Again, tools like Propstream make this easy, as do driving for dollars apps like Deal Machine. But every state lists owner names and mailing addresses in their online public records. For example, here’s the real estate public record search in Maryland.

Again, tools like Propstream make this easy, as do driving for dollars apps like Deal Machine. But every state lists owner names and mailing addresses in their online public records. For example, here’s the real estate public record search in Maryland.

Don’t stop there though. Try to find the owner’s phone number by searching their name with the local area code in Google. Search for personal websites as well, and for their employment information.

Then try to track them down on social media as well, particularly Facebook and LinkedIn. Sending a letter works, but contacting by phone, email, or social media can lead to better response rates.

This is the hard part: creating marketing campaigns to reach property owners at scale.

Outreach: Direct Mail & More

After trying to reach out by phone, email, and social media, it’s time to send a letter or postcard.

If you use a driving for dollars app like Deal Machine, you can automate your direct mail campaigns. Otherwise, here are a few tips to improve your open rates and callback rates.

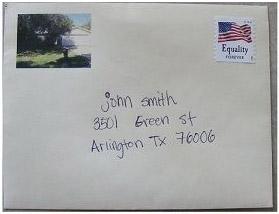

First things first: handwrite the mailing address on the envelope, if you send a letter. If you send a postcard, either hand write it or print in a handwriting font.

Image courtesy of Feltus Family Homes

But take it a step further and print a thumbnail of the property on the upper left-hand side of the envelope. Remember the especially ugly-looking photo you took of each property? Yeah – use that.

It piques the owner’s curiosity; they can’t help but open a letter with their own house printed on it.

The letter itself should be short and sweet and to the point. We include a template in our FIRE from Real Estate program (if you’re not familiar with it, check out our free course on retiring early with real estate).

In fact, you should ideally have two different letter templates: one for vacant properties and one for owner-occupied properties that are just run-down. But as you learn how to find motivated sellers, few tactics work better than reaching out to these two types of sellers.

Be sure to jot down the dates when you send mailings on your driving for dollars spreadsheet. Every three months, follow up with another letter, for homes that remain vacant or shabby. Often it’s your third, fourth, or fifth letter that finally catches the seller’s attention!

How to Find Off-Market Properties: Alternatives

As outlined above, you can use Deal Machine to streamline your driving for dollars excursions. But if you hate the idea of driving around physically, or you invest long-distance, what other options do you have to find off-market properties?

Contact Distressed Sellers

Foreclosures are an oldie-but-goodie, as extremely motivated sellers. Keep in mind that most foreclosures have very little equity, but the ones that do have equity can make for great deals.

And yes, Propstream displays all foreclosures in your target neighborhoods. As does Foreclosure.com, which offers an excellent alternative for finding distressed sellers. Here’s a quick snapshot of distressed homes in your market:

Read up on how to buy foreclosures, from short sales to pre-foreclosures. Or you can explore buying REO properties, but most get listed by a Realtor on the MLS. The exception: if you get chummy with REO managers who work for mortgage lenders, sometimes they keep private lists of investors to sell to when new properties hit their desk.

You can also reach out to owners with judgments against them, or with liens against their properties such as property tax liens. These often prove to be equally motivated sellers, and both Propstream and Foreclosure.com list them too.

Finally, check out Mashvisor’s property search as well, which includes its own range of off-market deals and motivated seller leads. From delinquent taxes to divorcing couples, all of these platforms can help you find investment properties at a discount.

Build a Network of Bird Dogs

As touched on above, you can enlist postal workers to notify you when homes sit vacant or unmaintained. Pay them a hefty finder’s fee to incentivize them, and stay in touch with them to remind them who you are and why they should reach out to you when they notice neglected properties.

But postal workers are far from the only good potential bird dogs you can enlist. Start networking with local housing inspectors, baristas, bartenders, barbers and hairdressers. Anyone with a pulse on the neighborhood makes a great bird dog.

Each can bring you different types of off-market deals. County inspectors and postal workers might find you neglected homes, while bartenders and baristas can let you know who’s in financial trouble or divorcing and may be looking for a quick cash sale.

As a final thought, don’t be stingy with your referral fee. The better you pay, the more leads you’ll get. You only have to pay the referral fee on closed deals, so pay well.

Buy from Wholesalers & Turnkey Sellers

Nothing says you have to buy off-market homes directly from distressed sellers. If that all sounds like more work than you want to do, you can always buy a turnkey property. These properties are either ready to rent, or already have paying tenants in place. For an excellent database of turnkey properties, check out Roofstock. Alternatively, reach out to Norada Real Estate, one of the oldest and largest turnkey sellers in the U.S.

Lastly, you can always go old-school and buy through real estate wholesalers. These tend to operate locally, so just run a quick Google search for local wholesalers and sign up for their mailing list to be notified as they have new properties available for sale.

Check Expired MLS Listings

Sometimes sellers get frustrated after a period of time with no interest and they take their homes off the market. But that doesn’t necessarily mean they no longer have any interest in selling.

Try reaching out to these would-be sellers to see if they’re interested in a fast settlement. Many took their homes off the market because they were too picky on price, but others will be open to a low offer with a quick closing.

Final Thoughts

Driving for dollars is a classic tactic for finding off-market deals in your real estate business. And where once it was inherently labor-intensive, today’s tech tools make finding distressed sellers easy, fast, and almost completely automated.

Ultimately, you can do as much or as little work in driving for dollars as you like, based on how much you want to spend on automation through these apps.

Remember that finding motivated sellers is a numbers game. For every 50-100 mailers you send, you might close one property deal. But that one deal could involve buying a home for $50,000 below market value.♦

Have you ever tried driving for dollars? What other strategies do you like to find off-market properties?

More Savvy Real Estate Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.

Great information Brian! Love the term “Driving for dollars.” I will be checking out the Apps you suggested!

Thanks Heather! Keep us posted on how we can help 🙂

“Driving for dollars”, didn’t know what it is until this point. It seems exciting.

Haha, it can be profitable as well as exciting C.!

Brilliant blog. Some great tips and tricks.

Thanks Beldi!

A very well-written article. Thanks for sharing with us!

Thanks Faati, much appreciated!

This is great! Thanks! Any advice on how to create the right offer?

Just make sure you know your profit numbers, with a decent margin for error and the unexpected, before making an offer. It’s better to underbid and lose a deal than overbid and lose money on a deal.

I was planning this for so long! Thanks for the tips!

Keep us posted on how it goes Jeremy!

Now that the gas price is getting higher, I am wondering if anyone still does this inexpensively? I would rather sit on my couch and look for leads in the internet. By the way, thanks for suggesting Propstream! That’s much cheaper compared to gas prices, LOL

Assuming you invest locally, you could drive for dollars when you’re already in that part of town anyway. That saves you both time and gas.

I used to pay my friends and relatives to do the driving for dollars within the area. Some of these online tools like Propstream have let me do all my prospecting from home, even in different states! I’m disabled and it’s a great help to have that app.

Glad to hear the tech has been helpful Jessie!

As we move back to the old norms we also are back driving for dollars! However, we gather some data from the internet before we go. Google map is updated, guys!

Great to hear you’re back to doing some driving for dollars to find abandoned properties Anacleto!

There’s a certain excitement in exploring neighborhoods firsthand and connecting with the local community, allowing me to discover hidden opportunities that may be missed by those solely relying on digital platforms!

I hear you Zaraqiel!

Personally, I can attest to the effectiveness of driving for dollars in real estate investing. I have been able to overcome challenges, maximize profits, and find lucrative investment opportunities!

Glad to hear it Gillian!