Sound the air raid siren, because that investor’s dreams are going to end in flames.

How to calculate rental property cash flow goes far beyond the PITI of the mortgage payment. PITI stands for principal, interest, taxes and hazard insurance, and even those may not make up the entire mortgage payment.

If you borrowed more than 80% of the purchase price, you’ll likely have mortgage insurance. If your property is in a flood plain, you’ll have flood insurance.

And that’s just scraping along the surface. Rental properties come with a lot of expenses, and you need to understand and account for them all.

That’s the bad news. What’s the good news? Luckily for you, this is what makes real estate such a great investment: you can accurately forecast future returns.

In under five seconds, you can make a shorthand calculation to determine if a deal is in the ballpark (I’ll show you how shortly). In under five minutes, you can make a detailed cash flow calculation to determine a property’s return on investment.

Here are the expenses to account for, whether you’re using a rental property calculator (psst: ours is free!) or manually calculating a rental property’s cash flow by hand.

Repairs, Maintenance, New Appliances & CapEx

Real estate is, well, real. It’s physical, and like everything physical, it falls apart if it’s not maintained properly.

Brand new homes need very little maintenance or repairs in their early years. Older homes need much more.

You’ll also incur costs every time you have a turnover, in the form of cleanout, new paint, perhaps new carpet, etc. What, you thought every tenant would leave the place in sparkling condition just like they found it? Think again.

Then there’s capital expenditures, or CapEx. CapEx is the long-term average of costs associated with big-ticket repairs: new roof, new furnace, new AC condenser, and so on. You can read more on how to calculate CapEx here.

Let’s say our friend Heidi is considering a duplex. Each unit rents for $800/month (or $1,600/month gross revenue, for the mathematically challenged). After running some numbers, Heidi determines that repairs and CapEx will cost her about 5%. She estimates another 8% for maintenance and replacing appliances periodically. That means:

- Repairs & CapEx: $80/month

- Maintenance & Appliances: $128/month

But she has a long way to go from there.

Vacancies

Rental properties don’t have perfect, 100% occupancy rates. After a renter moves out, typically it takes some time to repaint, replace the carpet, clean the unit, advertise it for rent, show it to prospective renters, sign a new lease agreement, etc.

That’s time you’re not earning rental income, and you need to account for it when you calculate rental property cash flow.

In blazing hot markets, turnovers may take place as quickly as a day or two. In slower markets, rental properties can sit vacant for six, nine, even twelve months at a time. (I’ve had properties sit vacant a year. Seriously. It’s like a slow-motion root canal for your wallet.)

Common baseline vacancy rates range from 4-8%, which is one month vacant every one to two years. But for slower markets, ratchet that up. Talk to other local landlords, property managers and real estate agents to get a good sense of the vacancy rate for the neighborhood in question.

After asking around, Heidi feels comfortable with an 4% vacancy rate, as turnover rates are relatively low and demand strong in this neighborhood. Her expense numbers now read:

- Repairs & CapEx: $80/month

- Maintenance & Appliances: $128/month

- Vacancy Rate: $64/month

Property Management Fees

Another common line from newbie real estate investors: “I don’t need to include property management fees, I’ll be managing it myself!”

Property management is a labor expense. Whether you’re doing the labor or someone else is, it’s still an expense.

You could take your money and go buy stocks or bonds, and have no labor. No weekends spent hassling with rental properties. No 3 AM phone calls from tenants whining that they need a light bulb changed. And for that matter, no trying to figure out how to calculate real estate ROI, either.

The point is, you need to account for this labor expense. And besides, the time will likely come when you have no interest in managing these properties yourself anymore.

Include property management expenses in your real estate ROI calculation.

Typical rates in the industry fall in the 8-10% range, although it can be as low as 7%, or as high as 15%. Property managers often charge a fee to place a new renter as well, ranging between half and a full month’s rent. Set aside at least 10% for the property management fee, and perhaps as much as 18%, to account for both ongoing rental management and new tenant placement fees.

Heidi decides to set aside 12% for property management fees as she calculates her rental property ROI and cash flow:

- Repairs & CapEx: $80/month (5%)

- Maintenance & Appliances: $128/month (8%)

- Vacancy Rate: $64/month (4%)

- Property Management: $192/month (12%)

Utilities

Are you paying the utilities, or are the renters?

Even if the renters are paying utilities, expect to get stuck with utility bills occasionally. Your tenants might move out and leave a hefty bill, and of course you’ll have to pay for utilities during vacancies.

Heidi’s renters will be paying for their own utilities, but she knows she’ll occasionally have to pay utility bills herself. She sets aside $10/month per unit.

- Repairs & CapEx: $80/month (5%)

- Maintenance & Appliances: $128/month (8%)

- Vacancy Rate: $64/month (4%)

- Property Management: $192/month (12%)

- Utilities: $20

Accounting, Bookkeeping, Administrative

Accounting, Bookkeeping, Administrative

For a single rental property, your auxiliary expenses may be negligible. Something you can round away.

But what if you own five rental properties? Ten? Twenty?

Will you still do your own taxes? Maybe, if you use landlord software like ours that automatically generates Schedule E returns for you. Or maybe not, depending on how complicated the rest of your return is.

What about bookkeeping and administrative help? Will you keep proper books with rent ledgers, expenses, depreciation, and so on?

Our landlord software keeps your books for you as well, but you may decide you still want a virtual assistant or bookkeeper to help out, in addition to your accountant.

These costs can vary, but count on at least 2-3% for them.

Heidi’s costs:

- Repairs & CapEx: $80/month (5%)

- Maintenance & Appliances: $128/month (8%)

- Vacancy Rate: $64/month (4%)

- Property Management: $192/month (12%)

- Utilities: $20

- Accounting, Bookkeeping, Administrative: $32 (2%)

Software, Office Supplies, Gas & Mileage, and All the Rest

Do you use online landlord software such as ours to help you manage your rentals? While we have a free account option, there are also premium options, which you would need to budget for if you use a paid account.

What about physical trips to the property? Semi-annual inspections (which you’re doing… right?) take time, gas, and mileage on your car. When a property is vacant and you have to turn it over, expect many trips to and from the vacant unit.

How often do you have to print and mail physical tenant notices? Again, these are expenses you only incur because you’re investing in real estate rather than stocks or bonds or private notes. They may be small, but you still need to include them when you calculate real estate ROI.

It all adds up. Consider a “miscellaneous” category for these types of expenses, at around 2%.

Heidi’s new expense list:

- Repairs & CapEx: $80/month (5%)

- Maintenance & Appliances: $128/month (8%)

- Vacancy Rate: $64/month (4%)

- Property Management: $192/month (12%)

- Utilities: $20

- Accounting, Bookkeeping, Administrative: $32 (2%)

- Miscellaneous: $32 (2%)

(article continues below)

Real Estate Investing Tools to Help with Calculating Cash Flow

If you have a deal in mind, you can always run the numbers for free using our rental income calculator. It includes cash-on-cash returns, monthly cash flow, cap rates, and also has a built-in mortgage calculator.

Beyond calculators, some real estate investing tools help you find good deals on investment properties. In some cases, they include the exact returns and multi-year forecasts for you!

One such tool is Roofstock, a platform to help investors buy turnkey rental properties long-distance. They have excellent financial data, analytics, and forecasts. Here’s a super quick overview of how their platform works:

Another real estate investing tool to check out is Propstream. Where Propstream excels is helping investors find motivated sellers with high equity. Propstream lets you zoom into a neighborhood and find pre-foreclosures, post-foreclosures, properties with tax liens, divorcing owners, and properties that are or appear vacant.

They also break down the equity in these properties, displaying mortgages and other liens. But most relevantly here, Propstream displays estimated returns on potential properties.

If you’re interested in learning more, check out our full, unbiased Propstream review here.

If you haven’t checked out Rentometer, this is an easy way to compare your rent with other local properties. Rentometer provides a detailed analysis by address, neighborhood, zipcode or city.

You can access key rent metrics including average rent, median rent, and percentile. To get a sense for how rents shift by neigborhood or even by block, check out the map view feature.

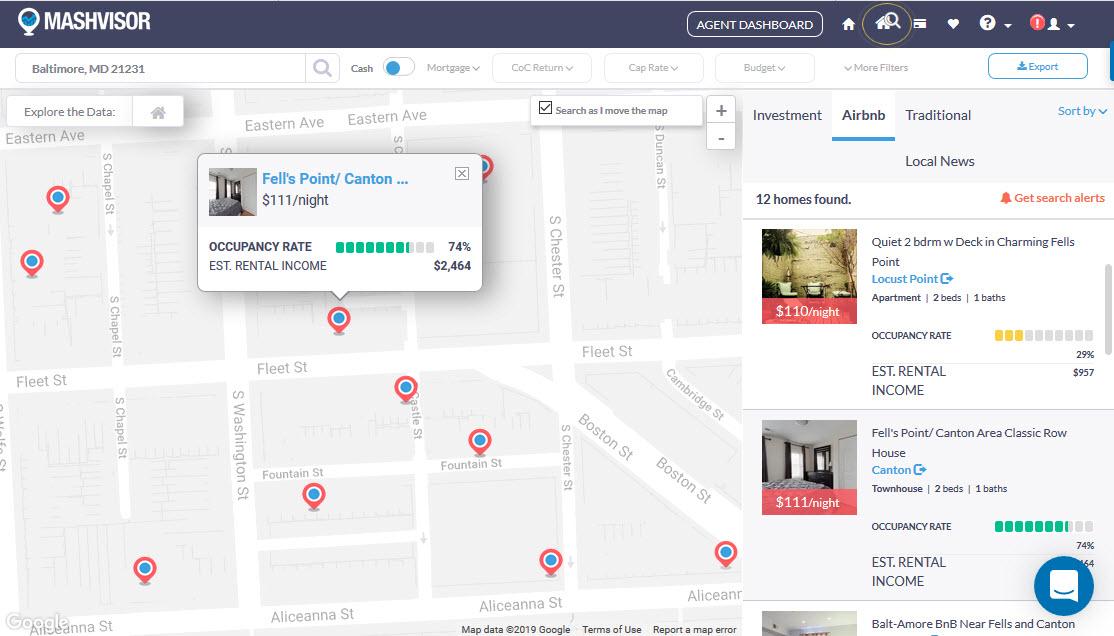

One last tool to consider is Mashvisor. Working at both the neighborhood and the property level, Mashvisor provides estimated returns, both for long-term rentals and Airbnb or short-term rentals. In fact, they even you analyze which rental strategy would net the most profits for any given property. (Use the link above for a 25% discount on Mashvisor’s services.)

Example: Heidi’s Numbers

Heidi is looking at paying $125,000 for the duplex. She’s putting 20% down ($25,000), and borrowing the remaining $100,000 as a rental property loan at 5% interest for 30 years, for a principal and payment of $536.82. (To compare rates on conventional mortgages, check out Credible.)

So Heidi avoids mortgage insurance, and her property is not in a flood plain. The property taxes are $1,500/year, and the insurance is $900/year. That comes to $2,400/year, or $200/month. So, Heidi’s PITI mortgage payment is around $737.

Here’s a final breakdown for calculating her rental property cash flow:

- Mortgage (PITI): $737

- Repairs & CapEx: $80/month (5%)

- Maintenance & Appliances: $128/month (8%)

- Vacancy Rate: $64/month (4%)

- Property Management: $192/month (12%)

- Utilities: $20

- Accounting, Bookkeeping, Administrative: $32 (2%)

- Miscellaneous: $32 (2%)

Total Expenses: $1,285

Her gross monthly rent is $1,600, so her net monthly cash flow is $315.

What about her cash-on-cash return on investment? Heidi put $20,000 down, plus we’ll say $5,000 in closing costs. We’ll assume the property needed $10,000 in repairs when she bought it.

So Heidi invested $35,000 in cash. Her annual net revenue is $3,780 ($315 x 12). That means she’s earning about a 10.8% cash-on-cash return on her investment: $3,780 / $35,000 = 10.8% ROI.

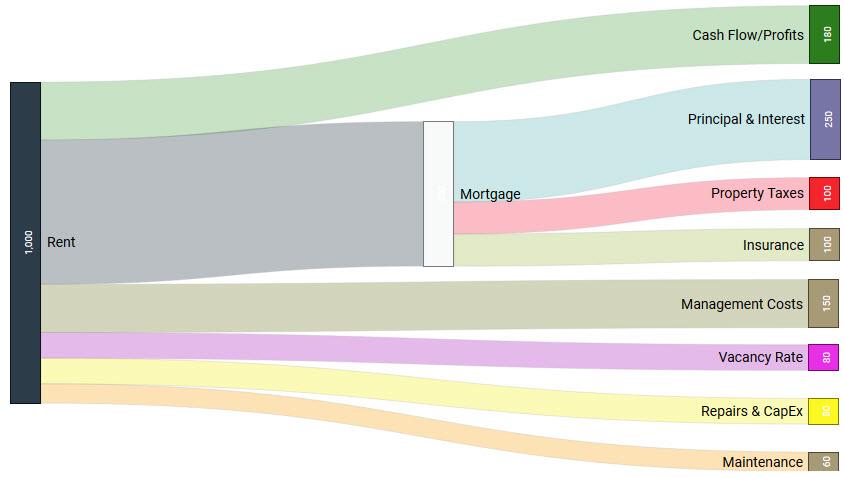

Here’s a quick visualization of how real estate cash flow typically looks (in a fun Sankey diagram):

Shorthand Calculation: The 50% Rule

“Hang on Brian, you promised a quick calculation that would take five seconds!”

So I did, so I did.

Enter: The 50% Rule. Quite simply, you can estimate a property’s expenses at 50% of the rent, plus the P&I mortgage payment (just principal and interest – the property taxes and insurance are included in the 50% estimate).

So in Heidi’s case, 50% of the gross rents is $800, plus the P&I payment of $537, for a total monthly expense of $1,337. This method puts her monthly cash flow at $263.

It’s a rougher estimate, less accurate. In this example it was off by $52/month. Use the 50% Rule as a shorthand way to evaluate whether a deal is worth looking into further. If it looks like it could potentially work, you can invest more time to look at the property more closely, and use a proper rental income calculator. If the deal clearly doesn’t work, well, you only lost 30 seconds of your life!

Final Word

Is Heidi’s cash flow good? Bad? That’s your judgment call, not mine, but personally I would find that ROI acceptable.

Why? Because it’s predictable. Sure, the stock market may surge 15% this year… or it might drop 15%. I have no control over my stock investments. I don’t know what I’ll earn from them.

But Heidi knows how to calculate real estate ROI and rental cash flow. Perhaps best of all, these numbers don’t even include appreciation, or take into account the gradual decline in her mortgage’s principal balance. In 30 years she’ll own the property free and clear, and then she’ll really have strong cash flow!

If you don’t calculate cash flow properly, prepare for a miserable experience as a rental investor. Year after year of saying “Well, this year we had that $2,500 furnace problem and lost money, but next year will be different!” Except it won’t be. Next year it will be electrical wiring that needs replacing, and so forth.

When you calculate cash flow properly, you don’t have to wonder when your “luck” will turn around. Instead you say “Another year of passive income! Our expense budget easily covered the $2,500 furnace repair. I’m going to put my feet up and have another cup of tea.”

Get rental property cash flow projections right, and you’ll never buy a bad deal in your life.

Ever ran into trouble over cash flow calculations? What happened? What have you learned since? Don’t be shy, we’re in the Trust Tree here!

More Fundamentals of Rental Investing:

I want to know more about…

I’ve messed this up before big time. I didn’t include property management fees or vacancy rate, and it’s still costing me to this day. Overpaid and now I can’t unload it. Fricking awful

I’m so sorry to hear that David. No fun at all. But at least you know what to look out for next time!

I don’t know whether say “thank you” or scream and yell in rage. I just re-ran the numbers on a deal I was about to buy, and they no longer work. The good news is that I can get out of the deal.

But I guess it’s back to the drawing board, and I know it’s not going to be easy to find a deal that works using this more conservative cashflow formula. Better to buy no deal than a bad deal though, right?

Absolutely, 100% correct – it’s better to keep plugging away at finding a good deal until you find one, rather than settling for a mediocre (or bad) deal.

Sorry your deal didn’t work out, but you’re better off in the long run!

Well you explained it very well Brian so thanks. My question is about the cap rate…What is the easiest formula to calculate it? GREAT article!

Hi there, we have an article on that very topic: https://sparkrental.com/cap-rates-a-non-nerds-quick-guide-to-capitalization-rates/

Brian there is always the tax deductions/taxations that play in – without that you cannot calculate the accurate cashflow. Great article but needs the tax factored in.

Super important topic for landlords. Wish I’d understood rental cash flow properly before I started investing in real estate!

I dont quite understand how the $120k mortgage at 7% for 30 years comes to $399???

Hi Couryn, right you are! Not sure how that slipped in there. Numbers updated!

Ah – no problem! I just wanted to make sure I wasn’t losing my mind. Great article otherwise – cheers!

Nice Post! You have explained this post very well! Thanks for sharing

Amazing work!! Thanks

Thank you Victor!

I didn’t realize how easy it is to calculate rental property ROI. Thanks for sharing!

Glad to help IP!

For 3 years, I’ve been calculating my ROI incorrectly. 😂 That’s why I don’t let my wife see my numbers. LOL

Haha, maybe she could have helped!

I’m confused about your 50% rule. It looks to me like the math is off in your example.

$800 + $537 = 1337 Where does 1357 come from?

Thank you. I’m really trying to understand all of this.

Good catch Sandra! I had a typo in there. You’re right, it’s $1,337 in that example. Sorry for the confusion!

Good read for young investors and refresher course for seasoned investors

Thanks Zach!