What has a greater impact on your wealth, your savings rate or the returns you earn on your investments?

A recent analysis by Pension Partners offers some decisive proof that savings rate trumps ROI, demonstrating that discipline matters more than clever investment choices.

That should come as a wake-up call for most Americans. Almost 70% of Americans have less than $1,000 in savings, and 35% of Americans have no savings whatsoever.

The average retirement savings among American workers? A paltry $5,000. There are car repairs that cost more than that.

As a nation, we need to save more of our incomes, and spend less on clothes, shoes, gadgets, cigarettes, booze, etc. A study by Deutsche Bank found that middle-income families spend half of their income on luxuries, and that even low-income families spend a whopping 40% on luxuries.

Here’s why we need to save more, if we ever want to retire.

What has a greater impact on your wealth, your savings rate or the returns you earn on your investments?

A recent analysis by Pension Partners offers some decisive proof that savings rate trumps ROI, demonstrating that discipline matters more than clever investment choices.

That should come as a wake-up call for most Americans. Almost 70% of Americans have less than $1,000 in savings, and 35% of Americans have no savings whatsoever.

The average retirement savings among American workers? A paltry $5,000. There are car repairs that cost more than that.

As a nation, we need to save more of our incomes, and spend less on clothes, shoes, gadgets, cigarettes, booze, etc. A study by Deutsche Bank found that middle-income families spend half of their income on luxuries, and that even low-income families spend a whopping 40% on luxuries.

Here’s why we need to save more, if we ever want to retire.

Savings Rate vs. ROI

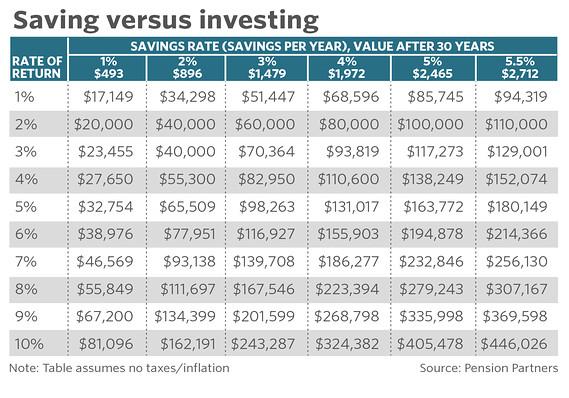

The Pension Partners study started with the median household income of $58,000. They then subtracted out 15% for income taxes (which is arguably low), leaving a total household budget of $49,300. Next, they built out a chart, showcasing what this family could expect to have earned over 30 years of saving and investing. At a savings rate of 1%, with an average return of 5%, the family would have accumulated $32,754.

By contrast, if they’d committed a savings rate of 5%, and only earned a lowly 1% average return, they’d accumulate nearly triple the money: $85,745.

How much you save makes a far greater impact on your end balance than your ROI.

Next, they built out a chart, showcasing what this family could expect to have earned over 30 years of saving and investing. At a savings rate of 1%, with an average return of 5%, the family would have accumulated $32,754.

By contrast, if they’d committed a savings rate of 5%, and only earned a lowly 1% average return, they’d accumulate nearly triple the money: $85,745.

How much you save makes a far greater impact on your end balance than your ROI.

Battling “Analysis Paralysis”

One of great silent killers of wealth is analysis paralysis. People don’t know how to invest their money, so they end up not investing at all. Even worse, that money usually doesn’t end up in savings, either. Most people just end up spending it instead, since they don’t know what to do with it otherwise. What this new study shows us is that low returns are not the risk – the risk is failing to save and invest in the first place. It’s better to save and invest money in even a low-return account like a money market account than it is to wait around for the perfect investment to come along. Your savings should be automatic. Each payday, a certain amount of your money should go straight to savings. How you invest that savings matters less. Invest it in low-cost index funds. Invest it in rental properties, to start earning passive income and working toward financial independence. But do the saving first, and then you can worry about maximizing your returns with clever investments.Free Mini-Course: Passive Income from Rentals

Leading the Charge on Rebounding Savings Rates

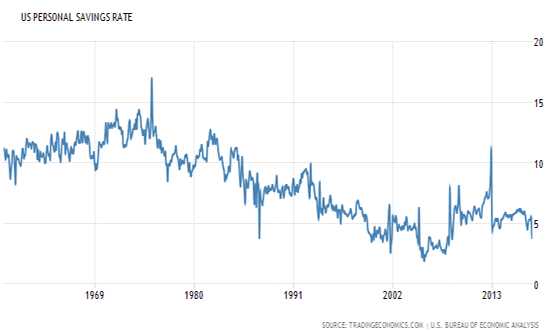

Average U.S. savings rates hit their peak in the 1970s, reaching an all-time high of around 17%. They then plummeted for decades, reaching an all-time low in 2005 of 1.9%. Since the Great Recession they’ve inched upward again, and have been hovering in the 5-5.5% range for the last few years.

That’s not high enough. Not by a long shot.

What would it take for you to live on half your income and invest the rest? It might sound impossible, but it’s not. The Thompsons lived on a tiny fraction of their income, and they were partially-employed teachers. It took them only six years to become financially independent, and they were traveling the world in the bargain!

While it’s not impossible, it does take discipline. The average household spends 70% of their income on just three things: housing, transportation, and food. How can you slim down your spending on those three categories?

One idea is to live for free through house hacking. You don’t even have to house hack a multi-unit property; you can use an income suite to house hack a single-family home!

Or you could just downsize or move to a less fancy home, although that’s less fun than house hacking, and still costs money.

Does everyone in your family need a car? Could you move within walking distance of work, groceries, etc.? Or get a bike? Or use Uber or ZipCar when you need wheels?

And we all know how going out to eat ruins budgets. Start polishing your culinary skills and try a new recipe at home tonight instead!

Working Smarter, Working Harder

At first glance, this study seems to refute the notion of working smarter, not harder. Saving money is hard work, with all that stuffy discipline and sacrifice.

Success never happens overnight. It takes both hard work and smart choices. If you want to reach financial independence any time soon, you’ll need to save more money, but also to invest it wisely.

One of the great things about rental properties is that their returns are so predictable. Sure, on a month by month basis, they fluctuate wildly as your renters move out, or as a repair bill comes due. But over time, it’s easy to calculate a rental property’s cash flow, based on long-term averages.

This means you can set a minimum return, and only buy properties that return more 8%, 10%, even 15% if you like.

And if you’re looking to replace your active income with passive income, to retire young, rental properties can work magic. As income-oriented investments, rental properties do wonders for your retirement planning.

Just start saving money. Make your savings the first “bill” paid, to keep it your highest priority. Once it’s saved, you can invest it in whatever you like, but just starting is the most important step!

What’s your target savings rate? Are you achieving it? Have any tips or tricks to saving money? We’re all friends here!

Interesting article. I wonder whether these numbers would look different compounded over a 40 year time horizon? Not that you want to wait 40 years to see results…

I suspect ROI would come out ahead at the higher return levels, if they were given 40 years to compound. But like you said, who wants to wait 40 years? I might be dead by then!

Why did they stop at a savings rate of 5.5% I’m curious what the numbers look like at a savings rate of 10%. Thought-provoking article though, thanks for sharing.

Great question Hank. I believe they stopped at 5.5% because average household savings rates have hovered around there for the last few years, and because it was enough to prove their point. But I agree, I’d like to see more aggressive saving numbers!

This just goes to show that you can’t count on cleverness and high returns. Some of it comes down to good ol’ fashioned discipline! Thanks for the reminder to hang tough with the savings.

Keep on hangin’ tough C. 🙂

I set up an automatic money transfer from my business account to my saving account in a monthly basis so that I would not miss putting money on my savings. Does anybody do the same? I’m wondering if there are other strategies they do for their savings.

Absolutely Jessica! I have several automated transfers and investments set up each month.

The best way to save money is to keep passive income growing. The greater the passive income, the greater the saving rate will be.

Amen Joshua!