If you ever hope to reach financial independence and early retirement, you need more than just a high savings rate. You need investments that do the heavy lifting for you.

Enter compound interest, A.K.A. compounding returns. But what is compounding? What’s the formula to calculate compound interest? And most importantly, what are the best investments for compound interest?

The underlying math might be complex, but fortunately, all you have to know how to do is use a compound interest calculator.

What Is Compounding?

Quite simply, compound interest occurs when you reinvest your returns, which in turn start earning returns on themselves.

To use an oversimplified example, imagine you put $20,000 down on a rental property. You set aside the monthly cash flow, and within two years, you have another $20,000 that you then put down on a second rental property. Now you have two rental properties, both generating cash flow for you — but you bought the second one entirely with the returns from the first. By doubling your cash flow, now it only takes you one year to save up enough to buy a third property, which further adds to your cash flow. With each investment, you earn more money, enabling you to exponentially increase your assets and passive income.

“When most people think about getting rich, they envision making a large sum of money through a single transaction, such as winning the lottery or inheritance,” explains Max Benz, founder of BankingGeek.com. “However, the truth is that building wealth is more often a slow and steady process. As your investment portfolio grows, the interest you earn each year snowballs, leading to exponential growth.

“The key to successful investing is to start early and let compound returns work their magic over time. With patience and a disciplined approach, compound returns can help you build a fortune over time.”

Compound Interest Calculator

You can find the formula to calculate compound interest below, but let’s be honest: most of us just want to plug numbers into a calculator.

So, we obliged you by creating a free compound interest calculator:

As you can see by playing around with the numbers, higher rates of return make for drastic differences in your future riches. And the longer the money stays invested, the more dramatic the differences.

But most of us don’t just invest a lump sum of money once and then never invest again. Rather, we invest money toward our retirement plans and other savings goals every single month.

So how do you take monthly contributions into account when calculating compound interest?

Compound Interest Calculator with Monthly Contributions

Because I’m a big nerd, I also created a compound interest calculator that takes monthly investments into account. It was a lot more work than the first, I can assure you.

But it’s also a lot more useful.

Play around with the compound interest calculator below, with different monthly amounts and returns.

Let’s run through a realistic example, shall we?

Imagine you invest $5,000 up front with Streitwise, plus another $500 per month for the next ten years. Streitwise pays an 8.4% dividend yield like clockwork, distributed quarterly. You set up automated recurring investments of $500/month, and select to automatically reinvest dividends.

After ten years you’d have a future balance of $104,075. Keep going for 20 years and you’d have $331,581. Invest the same way for 30 years and you’d have $854,004. After 40 years you’d have $2,053,647.

That’s the power of compound interest.

Formula to Calculate Compound Interest

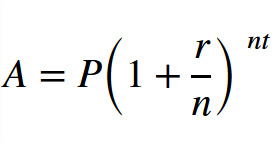

The mathematical formula for compound interest reads as follows:

As text, it reads like this:

A = P(1 + r/n)(nt)

Where:

- A or FV = Amount or Future Value: The future amount you’ll end up with, including interest

- P = Principal: Your initial investment amount

- r = Rate of Return: The annual rate of return (or interest), as a decimal

- n = Compounding Frequency: The number of times that returns are compounded per year (e.g. 12 times per year means compounded monthly)

- t = Time Period: The number of years you leave the money invested

Calculate Compound Interest Example

Got all that? I know, my high school math is rusty too. All right, let’s run an example.

You invest $1,000 of initial principal at 9% interest for two years, compounded monthly. The formula looks like this:

$1,196.41 = $1,000(1 + 0.09/12)(12×2)

If you left the money invested for a five year period of time instead, the formula would look like this:

$1,565.68 = $1,000(1 + 0.09/12)(12×5)

Or, if you earned a 15% return over five years, the formula to calculate compound interest looks like:

$2,107.18 = $1,000(1 + 0.15/12)(12×5)

Formula for Compound Interest in Excel

To run this formula in an Excel spreadsheet, it looks like this:

=P*(1+(r/n)^(n*t)

To use the latest example from above, with a 15% return compounded monthly for five years, the Excel formula would read like this:

=1000*(1+0.15/12)^(12*5)

That said, Excel actually has a built-in formula for calculating compound interest. It works like this:

=FV((r/n),(n*t),pmt,-PV)

Note that “pmt” refers to additional periodic payment withdrawals, which we’re ignoring for now. So, the Excel formula for the 15% interest investment over five years, compounded monthly, looks like this:

=FV((0.15/12),60,0,-1000)

Formula for Compound Interest with Monthly Contributions

Ready for the math to get more complicated?

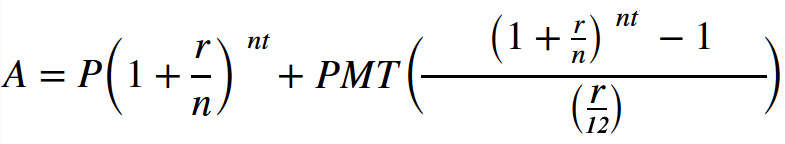

Here’s what the formula looks like to calculate compound interest with monthly investments:

In text, the compound interest formula looks like this:

A = P(1 + r/n)(nt) + PMT((1 + r/n)(nt))/(r/12)

You’d be shocked at how many websites get this formula for additional deposits wrong, by the way. But I digress.

Have fun plugging away at that compound interest formula. I don’t plan on ever using it again, after blowing hours building that dang online calculator.

Investments with Compound Interest

What investments generate compound returns?

Technically, any investment that generates income can create compound returns, if you reinvest the income back into more investments.

Still, some investments lend themselves better to compound interest than others. Here are a few of my favorite investments for compound interest.

Rental Properties

You knew this one would make an appearance.

If you reinvest your real estate cash flow into more real estate investments, you start earning returns on your returns. Look no further than the example above, where you put your rents aside and use them to buy more properties. With each property you buy, you earn more monthly cash flow, and can buy the next property even faster.

The trick, of course, is not to touch your profits, but to reinvest them.

For a clever way to invest with none of your own money tied up in each property, read up on the BRRRR method. In fact, rental properties help you bend the 4% Rule in retirement planning, with their ongoing passive income and your ability to invest with leverage.

House Flipping

Say you flip a house with $50,000 of your own money as a down payment and for closing costs. After renovating, you sell the property for a $50,000 profit.

You now have $100,000 in investment capital, so next time you flip a higher-end property with twice the profit potential. After completing the renovations, you sell the house for a $100,000 profit.

With $200,000 in investment capital, you buy two properties to flip next time around. And so it goes, as you exponentially grow your capital.

For a fun read, check out these ideas to flip a house with no money down.

Real Estate Crowdfunding Investments

You already saw the example above with Streitwise, which pays 8.4% annual dividends. If you reinvest those dividends every quarter, your initial investment compounds on itself.

But Streitwise is far from the only example of a good real estate crowdfunding investment for compound returns. Fundrise pays between 3-5% in dividends each year, on top of hefty appreciation. You can opt to reinvest those dividends automatically, just like Streitwise.

Another great investment for compound interest is Groundfloor. They issue short-term loans paying annual interest rates from 6-15%, which you can reinvest automatically once the borrower repays the loan in full.

YieldStreet paid an 8% dividend in 2021, which you can reinvest automatically. Concreit pays a more modest 5.5% dividend, but lets you withdraw your money at any time. RealtyMogul offers two different REITs, one with a 4.5% dividend and the other paying a 6% dividend. And so it goes.

Reinvest the dividends and reap the rewards of compounded returns.

(article continues below)

Dividend-Paying Stocks

The same logic applies to dividend-paying stocks too, of course.

Included in its average historical stock returns of around 10.5%, the S&P 500 has paid around 2-3% per year in dividends. Investors who reinvested dividends in index funds mirroring the S&P 500 have earned strong returns over the last hundred years.

Which raises an important point: you don’t have to pick individual stocks paying high dividends. Stick with ETFs or mutual funds, which own many different stocks, for broad diversification.

Bonds

Investors don’t normally think of bonds in the context of compound interest.

To begin with, bonds just haven’t paid very well over the last several decades. Plus, most investors consider bonds more the realm of steady passive income for retirees than a way to invest for wealth.

But you could theoretically reinvest the bond interest you collect each month into more bonds.

Personally, I don’t bother with bonds, opting for real estate to serve the role of bonds in my portfolio. It pays higher annual returns while offering the same stability and diversification from the stock market.

How Compounding Frequency Impacts Returns

The more often an investment pays out and compounds, the greater the compounding effect. You effectively earn higher returns.

For example, Streitwise pays its 8.4% dividend quarterly. So, four times a year, it pays you a dividend based on your balance. If you reinvest dividends, that raises your balance four times each year, and each time, it takes into account that higher balance when paying out your next dividend.

If you earned an 8.4% annual interest rate on a $10,000 initial investment for ten years, here’s how your ending balance would differ based on the number of compounding periods each year:

| Compound Period | Value After 10 Years |

| Annually | $22,402.31 |

| Quarterly | $22,963.06 |

| Monthly | $23,095.98 |

| Daily | $23,161.43 |

What Is Compounding Annually?

Annual compounding involves setting the compound frequency to “1” in the formula.

The formula to calculate compound interest annually would therefore be:

FV = P(1 + r/1)(1 x t)

Since “1” divided or multiplied by itself doesn’t affect the formula, you could also write the annual compound interest formula more simply as:

FV = P(1 + r)t

Which would look like this for $1,000 investment at a 9% return over ten years:

$2,367.36 = $1,000(1 + 0.09/1)(1×10)

Compound Interest Daily Formula

On the opposite end of the spectrum, you have daily compounding, where the investment generates a return every single day. That return gets reinvested every day as well, constantly changing the balance, thereby increasing the return faster.

The compound interest daily formula looks like this:

FV = P(1 + r/365)(365 x t)

To use the same sample formula, but adjusted for daily compound interest, here’s a $1,000 investment at 9% interest compounded over ten years:

$2,459.33 = $1,000(1 + 0.09/365)(365×10)

Final Thoughts

Compound interest can work against you, rather than for you, if you fall behind on debts.

The easiest example is credit card balances. If you carry a balance from one month to the next, the card company charges you interest. If you fail to pay that, they charge you interest again — this time on top of both your original balance plus the interest you failed to pay originally. Plus a late fee for good measure.

Quickly, your balance spins out of control, as you keep paying interest on top of interest.

Don’t fall into that trap. Instead, invest your money for compounding returns. Don’t be afraid to use leverage: rental property loans can help you buy more properties faster, for example. That lets you keep reinvesting your cash flow into new properties, and building ever more cash flow.

But beware of any debt that makes you poorer, rather than richer. That basically includes any debt not associated with an investment property or a business.♦

What are your favorite investments for compound interest? What questions do you have about how to calculate compound interest?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Thanks for the tips. There really are lots of things to consider, but if you have them right you can FIRE. Financial Independence/Retire Early.

Absolutely – compounding is a key ingredient for retiring at any age!

This is inspiring! Now all i have to do is earn more to save more. The question is, how

to earn ten folds?

Haha, good question! By finding high-return investments and leaving your money parked there for as long as possible 😉

In reality, we stumble sometimes with our savings, but I am pretty sure that leverages and our due diligence will help us accomplish compound returns. Indeed, this is the secret formula to become rich!

You’ll have the occasional misstep financially, but just keep plowing as much money as you can into high-return investments and you can’t help but build wealth!

Thanks for sharing the calculator.

Glad you found it useful Will!

Rental is still the best investment for compounding interest! Just do your due diligence on screening tenants and it will be compounding like crazy! Currently, I have 3 properties.

I hear you John!

I think I love math now 😉

Right?

Done reading! Time to build equity and compound multiple investments.

Glad to hear it Jerry!