No matter how much you earn, you won’t build wealth if you spend every penny you bring in.

A person who earns $75,000 and saves $25,000 per year will create wealth faster than someone who earns $1,000,000 and spends $995,000 of it. Flashy cars and imposing homes may show off the illusion of wealth, but they actually slow your accumulation of wealth and passive income.

What really matters is your investable net worth, which exists on paper, not in status symbols or conspicuous consumption.

You build wealth based on the gap between what you spend and what you earn. In other words, based on your savings rate.

What Is Savings Rate?

Your savings rate is the percentage of your monthly income that you, well, save. Not exactly “rocket surgery,” eh?

People love to quibble over whether your savings rate should be based on your gross income or your net (after-tax) income. I personally urge you to base your savings rate on your net income, because the money you owe in income taxes isn’t actually yours; Uncle Sam is pretty clear on that point.

While that means that tactics to reduce your income taxes, such as IRA contributions or boosting your rental property tax deductions, will also impact your savings rate, using your after-tax income as the foundation to calculate savings rate still paints a clearer picture of your savings performance.

It’s also worth noting that “savings” doesn’t necessarily mean “putting cash in a savings account.” Any money you put toward investments (whether real estate or stocks or something else entirely), toward your emergency fund, toward paying off mortgages early, or toward other debts all count toward your savings rate. Note the emphasis on paying off debts early — your regular monthly payments don’t count!

How to Calculate Savings Rate

As calculations go, this one doesn’t require a math degree.

To calculate your savings rate, simply calculate the percentage of your net (or gross, if you prefer) income that you put towards savings, investment accounts, or early debt payoff. Here’s the formula:

Savings Amount

__________________________

Income Amount

That’s it!

For example, if you earn $5,000 per month in net (after-tax) income, and save $1,000 of it, you have a savings rate of 20% ($1,000/$5,000 = 20%).

The greater the savings rate, the faster you can reach financial independence and optionally retire early (FIRE). To play around with your own numbers, see our financial independence calculator.

But retiring isn’t your only financial goal. Other savings goals often include buying a home or your first rental property, helping your kids with college tuition, or taking time off of your career to raise kids.

Calculator: Savings Rate

If putzing around with Excel sheets isn’t your bag, don’t sweat it. We put together a simple savings percentage calculator to help you run your own numbers and calculate your savings rate.

Keep in mind that every dollar you put toward savings, investments, or paying down your mortgages faster results in compounded results over time. Money you put toward buying rental properties starts generating more income for you, which you can in turn put toward buying more rental properties or other sources of passive income, in a snowball effect of building ever more income.

Bear in mind you can compound your growth over time by investing in tax-sheltered accounts. These include retirement accounts such as 401(k)s, IRAs including self-directed IRAs, 529 plans, ESAs, and HSAs. The tax benefits provide extra money you can reinvest to keep snowballing your passive income.

Get creative to find ways to save more of your annual income, and keep playing with the savings percentage calculator above and the FIRE calculator to see how quickly you can quit your job.

The Average Savings Rate in the US

What’s “normal”? What’s the average savings rate in the US, to help you gauge your success?

It turns out there’s a precise answer to that question — and it’s not very useful.

The average savings rate in the US hovered between 5-8% in the 2010s. Here’s a graph from the Federal Reserve showing the average personal savings rate in the US over the last 65 years:

Note that sudden spike up to 32.2% during the coronavirus pandemic. That’s what fancy statisticians call an “anomaly,” and it already passed in the wake of high post-pandemic inflation. While a mildly interesting outlier, it doesn’t reflect the norm.

But here’s the thing about “the norm”: the Fed is calculating the average personal savings rate as a mean, not a median. That means the wealthy, and the FIRE walkers like you and me, heavily skew that number with our outrageously high savings rates.

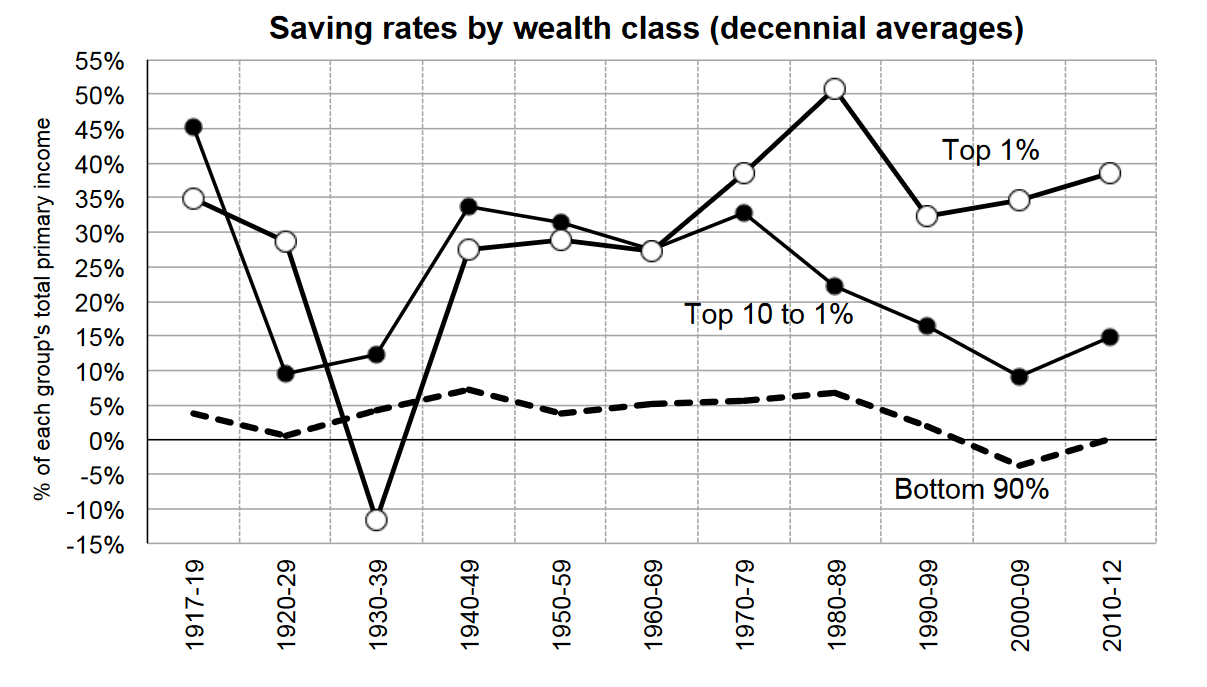

Does anyone provide more accurate savings percentage data? Not really, but economists Emmanuel Saez and Gabriel Zucman calculated the average savings rates for the top 1%, the 90-99th percentiles, and the bottom 90% of Americans a decade or so back, and the numbers are telling:

While these numbers don’t include the last few years, the pattern of the preceding century reveals more than enough. The bottom 90% of Americans save almost nothing, ranging between -5% and 5% depending on the strength of the economy.

Note that a negative savings rate means spending more than you earn, which typically takes the form of credit card- and other unsecured personal debts.

If you want to work and scrape for 40-50 years in order to afford a very modest retirement, follow the average American’s savings rate hovering around 0%. If you want to build wealth fast and reach financial independence within the next five-to-ten years, aim for an unreasonably high savings rate, such as living on half your income.

How Much of Your Paycheck Should You Save?

I see some variation of it asked on social media all the time:

“How much of your paycheck should u save?”

Your savings rate determines how quickly you can retire or reach other financial goals. Regardless of your age, working becomes optional once you reach financial freedom and can cover your living expenses with passive income.

Toward that end, here are a few mindset shifts to help you approach your nest egg with more savvy:

- Stop thinking in terms of “retirement” and start thinking in terms of financial independence (FI): the ability to cover your living expenses with passive income from investments.

- Ignore age, and instead plan based on your FI horizon (AKA retirement horizon): the number of years you plan to take to reach financial independence. If you’re 40 and want to reach FI by 50, your FI horizon is 10 years.

- Set a target for monthly passive income to cover your living expenses. The lower your living expenses, the less money (and time!) it will take to reach financial independence!

With me so far? Great, let’s dive a little deeper into how savings rate impacts your retirement/financial independence planning.

Passive Income to Cover Your Living Expenses

Passive Income to Cover Your Living Expenses

Once you have a target for how much income it will take to cover your living expenses, you can start figuring out how to make it happen. Say you want $4,000 per month, or $48,000 per year. You could achieve that with:

-

- $2,000/month in net rental income

- $1,000/month in stock dividends and withdrawals

- $500/month in private REIT dividends (e.g. Fundrise and Streitwise, which pay 4-10% annually in dividends)

- $500/month in private notes (loans to other real estate investors)

For your stocks, imagine you’re following the 4% Rule, and planning to withdraw 4% per year from your stock portfolio to produce that $1,000/month in income. Start by multiplying that $1,000/month by 12 to reach the yearly amount ($12,000), then multiply that $12,000 by 25 to reach a target of $300,000 (4% x 25 = 100%). So you’d need $300,000 in stocks to produce $12,000 per year.

The good news is that you can bend the 4% Rule with rental properties. With a handful of rental properties, you can generate $2,000 per month in rental cash flow. You can even use tricks like the BRRRR strategy to keep recycling the same down payment over and over to build your rental property portfolio.

All in all, let’s say you want a nest egg of a million dollars. How long will it take you to save that up?

It depends on your savings rate, and the rate of return you can expect with your investments.

Savings Needed to Reach $1 Million

Over the last century or so, the S&P 500 has returned an average of around 10% per year, including dividends. Real estate investors can also expect to earn similar returns, albeit more predictably if they know how to use a rental cash flow calculator before buying.

I ran the numbers on how much monthly savings it takes to reach $1 million if you earn a 10% average return. Here’s what you’re looking at saving in order to reach financial independence over the following time horizons:

5 Years: $13,650/month

10 Years: $5,229/month

15 Years: $2,623/month

20 Years: $1,455/month

30 Years: $507/month

40 Years: $188/month

You can see why “Joe Six-Pack” doesn’t need a huge savings rate for retirement. He can live paycheck-to-paycheck because he plans to work a 40-50 year career. If you want to reach FI in just a few years, however, it takes a much higher savings rate.

To run the numbers for yourself, mess around with our free FIRE calculator!

(article continues below)

Tips to Boost Your Savings Rate

Like the idea of reaching financial independence in the next five or ten years, but not sure how you could possibly save all that money to do it?

Start with the Big 3 household expenses: housing, transportation, and food. According to the BLS, they make up nearly two-thirds of the average American household’s spending:

Would your readers appreciate this interactive spending chart? Click here for the embed code!

Share this Chart On Your Site

So yes, while cutting out the $5 latte helps, the greatest savings opportunities lie in a larger lifestyle overhaul that involves slashing your housing payment, transportation costs, and food costs. For gits and shiggles re-run the numbers in the savings percentage calculator above, cutting out your monthly housing payment. Quite the leap, eh?

Live for Free by House Hacking

I don’t pay for housing. Neither does our other founder Deni. How? By finding ways to make someone else pay for it.

The classic multifamily house hacking model involves buying a 2-4 unit property, moving into one unit, and renting out the other(s). But not everyone wants to live in a multifamily, and they’re hard to find in some areas.

Fortunately, there are plenty of other ways to house hack. I’ve used housemates before, and currently house hack through my wife Katie’s employer (which was not an accident: we designed our lives to make that happen). Deni has rented out storage space in her garage, moved into mixed-use properties, and even brought in international exchange students whose stipend covered her housing costs.

You can even house hack through your grown children with a kiddie condo loan.

Get creative with it, and find a way to make someone else pay for your housing!

Ditch at Least One Car

Americans don’t realize just how expensive cars are, when you add up all the costs.

According to AAA, the average cost to own a car for a year is $10,728, which includes maintenance, gas, parking, insurance, and, of course, the car itself. Think about how much faster you could build wealth and reach financial independence if you put that money toward your investments!

For years, my wife and I each owned a car. Then we got rid of one, and shared a car for four years, which saved us a ton of money. A few years ago, we intentionally moved to home where we can bike or walk to nearly everything we need to — in the rare instances we need a car, we take an Uber or rent a car for a weekend getaway.

It’s one of the ways we’ve achieved a 60% savings rate.

Stop Eating Meals Prepared by Someone Else

People love to fool themselves by categorizing restaurant meals, delivery, take-out, and other meals they didn’t make themselves under the broad category of “food” and calling it a necessity.

Basic groceries are a necessity. Meals that you pay someone else to make are a luxury and an entertainment expense. Stop kidding yourself.

In your budget, separate groceries from meals you pay someone else to prepare for you. Those should fall under the category of entertainment.

Pack your lunch every day. Host pot luck dinners rather than meeting friends out at restaurants. Stop ordering delivery and learn how to cook.

By cutting out meals you pay someone else to prepare, the median American family would save around $3,500 per year. And depending on your habits, that number could be far higher.

Cut Your Cable & Other Subscriptions

The average cable bill costs over $100 per month. You can instead pay around $10 for an online streaming service like Netflix or Hulu.

It’s a no-brainer. Cut the cord.

Then look into every other subscription you pay for monthly. Music streaming services, monthly delivery services like wine-of-the-month clubs or beauty product boxes, unused gym memberships, and a dozen other subscriptions sap your wealth every single month.

Pick one or two that you actually use all the time and can’t live without. Ditch the rest.

Try a Savings Challenge

Money saving challenges tend to be short-term sprints rather than ongoing lifestyle changes. But that doesn’t mean they can’t impact your long-term finances.

Savings challenges often prove to you that you can live on less than you previously thought possible. Sometimes they give you ideas for costs to cut, that you never would have thought up otherwise.

Even a quick, brief sprint can help you save a tidy sum quickly, that you can put toward a down payment on a rental property or some other income-producing investment. Which in turn helps you save money faster in the future.

Final Thoughts

What is a savings rate? It’s what enables you to build wealth — or what keeps you broke.

Which raises the next question: How much of your paycheck should you save?

It depends on how quickly you want to build real wealth and reach financial freedom. Real wealth isn’t conspicuous. You can’t drive it or wear it or show it off to your friends. Real wealth exists in ones and zeroes, in your financial investments and real estate holdings.

It’s precisely why people serious about growing their net worth talk about “stealth wealth.” They live in humble homes, share a car with their spouse, wear affordable clothes. And they build wealth far faster than their flashy friends.

You will build wealth and reach financial independence based on the gap between what you earn and what you spend. Grow the gap, and watch your riches start to compound on themselves.

What’s your current calculator savings rate? How are you boosting your monthly deposits and saving for retirement faster?

Reach Financial Independence with Real Estate

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

If I say my life, my choice, I don’t need your advice then I am probably one of those losers who just don’t want to educate themselves on how important passive income is.

Building wealth and passive income, lifestyle design – these are all voluntary, all choices. Not everyone is interested. But for people who do want to design their perfect life, we’re excited that they’re taking that journey alongside us. My life got a LOT better when I started bringing more intentionality to it, writing out the exact life I wanted and mapping out how to make it a reality.

I actually added your blog to my favourites and will look forward for more updates. Great job, keep it up!

Thanks Omyaa, much appreciated!

Hi! Love the blog. Love the calculator. What is missing for me is savings percentage rates benchmarks by age. At 25, 15% is good, but what about 30 to 65 starting for each age? It would be a resource for late starters, and a real visual aid for the downfalls of starting later.

Thanks for the feedback Elsie! We actually have a chart for savings rate vs. years to retire, definitely check it out. Also, check out our FIRE calculator to run the numbers for yourself!

Nobody should underestimate the power of savings. We should learn from the ants.

Haha, true enough Walter!

As they say in business, that which gets measured gets done. Measure your savings rate every month if you want to build wealth.

Absolutely Floyd!