Just 39% of Americans could cover an emergency expense costing $1,000, per a 2021 study by Bankrate. The other 60% would be up the creek without a paddle.

Because emergencies do happen, and not just to other people, either. Three out of ten Americans say they or an immediate family member faced an urgent and unexpected bill last year, such as an emergency medical expense, home repair, or car repair.

Nor are they cheap: of those unexpected bills, over a third (36%) cost more than $5,000. Another 41% cost between $1,000-$5,000, and only 18% of these unexpected bills fell under $1,000. (For the math jocks out there who point out that those numbers don’t add up to 100%, a small percentage of respondents either didn’t know or didn’t answer the question. Don’t be a smarta$$.)

All of which raises some serious questions about how much of an emergency fund you should have. Here’s what you need to know about emergency fund amounts, how to save for an emergency fund, where to hold it, and why you especially need an emergency fund as a real estate investor or property owner.

Emergency Fund Definition

I hate to break it to you, but your stocks are not an emergency fund. Or at least they shouldn’t be.

An emergency fund is a source of stable, liquid assets that you can immediately draw on in a (you guessed it) emergency. If you can’t get to it quickly, painlessly, and risk-free, it’s not an emergency fund; it’s an investment.

Emergency funds must be easily accessible, with no risk of major losses by tapping into it. Long-term investments, such as stocks and real estate, are either too volatile (in the case of stocks) or not liquid enough (real estate) to serve as an emergency fund.

Your retirement account is not an emergency fund either — beyond the volatility of the investments in it, you’ll incur tax penalties if you withdraw money early.

How Much Emergency Fund Should I Have?

Like most questions worth asking, the answer is “It depends.” The more variable your income and/or expenses, the greater your emergency fund should be.

In the personal finance world, advisors typically measure emergency funds by the number of months of living expenses you can cover with it, rather than total dollar amount, once you surpass a minimum threshold like $1,000.

For example, if your monthly expenses total $4,000 a month, and you have $6,000 in your emergency fund, then you have 1.5 months’ expenses.

Is that enough? Too much? A person with neat, tidy, regular income and expenses doesn’t need as deep of an emergency fund amount as their less-predictable neighbor. With a biweekly paycheck and stable expenses, a cash emergency fund of 1-3 months’ expenses is usually sufficient.

For someone with highly irregular income, such as a full-time real estate investor, that’s not enough. They may go five months with no paycheck, followed by a $50,000 payday after flipping a house. People in this position should keep 3-6 months’ expenses in an emergency fund, maybe more, because they can’t count on a regular W2 paycheck.

Likewise, someone with irregular expenses (like landlords!) need a larger emergency fund. Even if you have a regular income, you need a larger emergency fund if your expenses vary month-to-month.

Property Owners Need Emergency Funds for Each Property

Remember how real estate cash flow works?

You have to calculate the long-term average of large-but-irregular expenses. That distinction between your “typical” expenses and your “average” expenses is lost on many new landlords, and they lose money accordingly.

In a typical month, your only expense is the mortgage payment and maybe property management fees. But that doesn’t mean you can ignore irregular expenses like vacancy rate, repairs, maintenance, accounting costs, property taxes, insurance (including rent default insurance), and so on.

You may get hit with a $3,000 HVAC repair this month, followed immediately by a $10,000 roof replacement bill the next month. Another property may suffer a vacancy, or worse, require that you start the eviction process, with no income for months while you make repairs, repaint, collect rental applications, run tenant screening reports, etc.

Every single property needs its own private emergency fund, where you set aside a percentage of each month’s rent payment. Forecast your average costs for these expenses (you can use our free rental cash flow calculator) – and then be disciplined about setting aside the money each month.

The same goes for homeowners. While you may not need to set aside money for vacancy rate or bookkeeping costs, you can still expect irregular repair bills that renters don’t face. You need a heftier emergency fund to compensate for that irregularity in your expenses.

Where to Keep an Emergency Fund

If you shouldn’t park money for an emergency in your retirement accounts, stocks, or illiquid real estate investments, where should you park it?

Your emergency fund should sit in easily-accessed savings accounts, money market accounts, or short-term investment accounts you can tap instantly. It should also be FDIC-insured, unlike your investments.

Look for the highest-return account that you can find, with no early withdrawal penalties if the worst happens tomorrow. Some online savings accounts and money market accounts offer interest up to 2% or even 2.5%, but be sure to read the fine print. They often include minimum balance requirements, and may charge a penalty if you pull money out within the first six months or year.

Ideally, you want to keep your emergency fund in a separate institution from your checking account. Out of sight, out of mind, so you aren’t tempted to tap into it to buy that new jacket you’ve been eyeing.

Layering Your Emergency Fund

If you spend $5,000 every month and want to keep six months’ expenses in an emergency fund, that’s $30,000 — an awfully high amount to keep in cash. The opportunity cost of letting that much cash collect dust is more than some investors can stomach.

The answer? Layer your emergency fund.

Start with a certain amount in cash, in a high-interest savings account. In this example, we’ll say that you keep one month’s expenses ($5,000) here, accessible at a moment’s notice.

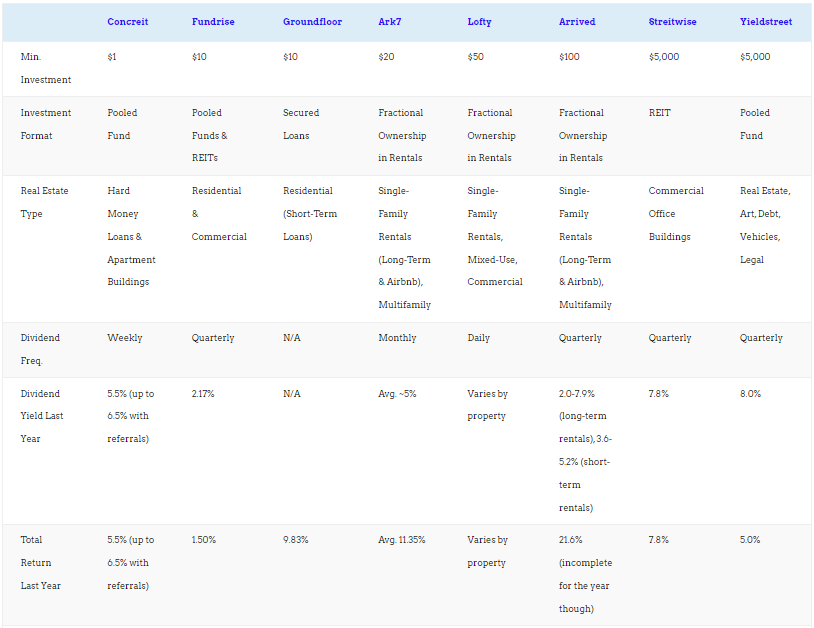

Then, let’s say you put another two- or three months’ expenses in a stable short-term investment. That could include a government bond fund or a liquid real estate crowdfunding investment such as Concreit or Stairs by Groundfloor. You can earn more than in your high-interest savings account, with stability and liquidity.

For the remaining amount, consider a credit line that you can tap into in a truly dire emergency. It could be an unused credit card that you set aside for emergencies, or a HELOC, or some other rotating line of credit. (Word to the wise: you can borrow HELOCs against rental properties, not just your home.)

The important thing is that you never use it, leaving it for emergencies only.

That way you don’t leave your entire emergency fund languishing in a savings account, not working for you, but you still have plenty of options to draw money in an emergency.

My Emergency Fund

I keep around two months’ expenses in a savings account. But as an entrepreneur with irregular income, I don’t stop there.

I keep another four months’ expenses in Concreit, that earns me 5.5% interest. I can liquidate it at any time to take advantage of a real estate opportunity, and as a hedge in case the stock market crashes. In which case I’d buy some stocks at a steep discount!

And, of course, it serves as a deeper reserve in case I face a truly massive repair bill on a rental property. But I budget separately for that — from every rent check that comes in, I set aside money for expenses like vacancy rate, repairs, and maintenance, based on my rental property cash flow forecasts and long-term averages.

So, when I needed to replace the windows at my property on Dean St., I didn’t have to drain my personal emergency fund. I had money in that property’s separate bank account set aside for it.

Lastly, I keep several unused credit cards, totally around one year’s living expenses. In a pinch, I could lean on them.

How to Start Saving an Emergency Fund

When you live month-to-month and spend nearly everything you earn, it’s hard to break that hand-to-mouth mindset. You think cyclically: when does my next paycheck arrive, so I can buy that new jacket?

You’ll never build wealth with that mindset.

Wealth comes from the gap between what you spend and what you earn. It’s called savings rate: the percentage of your income that you save and invest rather than spend.

“But Brian I have bills! I’m struggling to get by here!”

You and everyone else. And it’s the people who can find a way to slash their spending and invest their savings who build wealth. For a few ideas to get you started, start by looking at house hacking and these other tips to live on half your income. Better yet, take our masterclass on how the Hoeflers reached financial independence in five years.

Here are some more ways you can start setting aside more money, regardless of your current emergency fund amount.

1. Acorns App

I love automation. Especially when it comes to the things you really should be doing but just… don’t.

The Acorns app rounds up the purchases on your debit card, and sets aside the “spare change” in a separate savings account. For example, if you buy a sandwich for $6.50, it debits $7.00 from your checking account, and sets aside the remaining $0.50 in your savings account.

They even offer an automated investment option, through their robo-advisor brokerage service. It’s cheap too, costing between $1-3 each month.

Highly recommended for pain-free automated saving and optional investing.

2. Switch to a 4-Week Budget

There’s a disconnect between most people’s expenses and their income.

Most people get paid every two weeks but get billed for expenses monthly. The trick is to align your income and expenses.

Start by basing your budget on four weeks’ income, not your annual income divided by 12, which gives you an awkward and impractical fraction. In any given month, all you can count on is four weeks’ income!

Most months, you’ll only get those four weeks’ pay. But occasionally, you’ll receive a third biweekly paycheck, or a fifth weekly paycheck if you’re paid weekly. In those months, set aside those occasional “bonus” paychecks entirely towards savings and investing.

3. Transfer Savings Every Payday

Alternatively, you can set up automated recurring transfers to your emergency fund. Transfers that go out every single time you get paid.

The trouble is most people “pay themselves” last, setting aside savings based on whatever they didn’t spend at the end of the month. Financially savvy people pay themselves first, making their savings the first “expense” to come out of every single paycheck.

Most employers allow you to split your direct deposit into two accounts, which lets you shunt money directly into your savings account. But if your employer can’t do this, just set up an automated recurring transfer through your bank, to take place the same day you get paid.

(article continues below)

4. Rental Income!

Want to bring in more money?

Invest in income-producing properties!

The more passive income you earn, the more money you can funnel right back into savings and other investments. It’s how compounding works: when you reinvest your returns, it snowballs into greater and greater investments, which in turn produce greater returns, ad infinitum.

5. Other Side Gigs

If you truly can’t stomach the idea of spending less money, you can always just earn more money.

That could mean getting a raise of course (and avoiding lifestyle inflation!), but it could also mean starting a side gig. After all, the more you earn, the more you can save and boost your emergency fund size.

6. Save Your Tax Refund

An oldie but goodie, you can always funnel your tax refund right into your emergency fund.

Most people treat it as an excuse to splurge. But savvier investors treat “found money” differently – they put it toward their long-term financial goals, such as saving an emergency fund, saving for a down payment, or investing for financial independence and retiring early (FIRE).

Every day you make these choices, on a smaller scale:

“Am I willing to sacrifice now, in order to reach my larger goals? Or will I indulge in an immediate pleasure?”

That could mean spending money on dinners out or new clothes or gadgets, rather than investing the money. Or it could mean eating the burger and fries for lunch, rather than the healthy option.

The trick is to build habits and automate the behavior that helps you reach your long-term goals, rather than relying on discipline for every single decision.

Build an Emergency Fund or Pay Off Debt?

We recently explored a variation of this question, in Should I Pay Off Debt Or Invest? Ultimately, it depends on how expensive the debt is.

If you have credit card debt costing you 24% APR, you should pay that off pronto. It’s extremely expensive debt, and it drains your resources each month.

On the opposite end of the spectrum, if you have a mortgage costing you 3.5% interest, you should leave it in place and save for an emergency fund.

Why? Isn’t that 3.5% interest higher than you can expect to earn on your emergency fund?

Yes, it is. But the point of your emergency fund isn’t to earn a return – that’s what your investments are for. Your emergency fund is there to protect you, a buffer against the inevitable crises that occasionally rear an ugly head.

As for mid-range debt, such as student loans, in general you should prioritize them, even as you gradually build an emergency fund at the same time. For example, if I had $30,000 in student loans and I set aside $1,000/month toward savings and debts, I’d put something like $900 toward the student loans and $100 toward my emergency fund until I reached a minimal “sleep at night” balance of $1,000 or so in my emergency fund. Then I’d funnel everything into the debt, or perhaps put that extra $100 toward my retirement account or my next rental property.

It just depends on how expensive the debt is, and your risk tolerance. But as a general rule, the higher the interest rate on the debt, the more urgent it is to pay off immediately.

Final Thoughts

Everyone needs an emergency fund, regardless of the size.

Steady Eddie who earns and spends the same amount every month doesn’t need a very high emergency fund amount. With a stable job and finances, he faces less risk than someone with variable income or expenses.

Landlord Lucy, on the other hand, needs to set aside money for every single property she owns. She knows that sooner or later she’ll incur hefty expenses for every single property, and she budgets for them every month.

How much emergency fund should you have? Aim for at least a month’s expenses if you have extremely stable income and expenses, and significantly more if your job, income, or expenses are not as steady.

What do you keep as your emergency fund? What’s your goal, and how did you set it?

More Unconventional Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Great information! I’m working towards building my emergency fund now.

Thanks Arlene, glad to hear it was useful for you!

Excellent advise.I have followed many of those principals. Start saving early and consistently and build up an emergency fund.

Thanks for the comment Henry! Consistency is absolutely, 100% key to both building an emergency fund and reaching financial independence and retiring.

Of course when you get your emergency fund where you want it, that’s when an emergency happens and you have to start all over again. However, I am glad that I have always had the funds, to back up any surprise costs.

Haha, I hear you Eric! That’s life for you. But that’s what the emergency fund is there for, right?

How much would be a good amount to set aside for each property? I was thinking about 6 months worth of payments for each? Is there a better metric?

Thanks, this article comes at a good time for me.

Glad to hear it was useful for you David! Personally, for my rental properties I don’t budget by aiming for a target amount, but just by setting aside the percentage estimated for vacancy rate, repairs, maintenance, and other non-mortgage expenses each month. Eventually those expenses will hit you, and when they do you’ll need the money.

If the account reaches an extremely high amount, you can always transfer some money to another investment. And, of course, you can always adjust your estimated expense percentages as time goes by.

For further reading, check out https://sparkrental.com/calculating-cash-flow-investing-rental-property/.

Keep us posted on how we can help!

Great advice. – especially for rental properties.

It’s easy to get lulled into a false sense of security when you have one or two months of expenses covered. I aim to keep 6 month of operating expenses per property.

Maybe it’s extreme, but I know I’m covered in case of multiple emergencies (vacancy plus major repair for example).

Thanks AR! Yeah property owners definitely need to budget for deep cash reserves. And to your point, often it’s during vacancies and turnovers when you end up having to shell out for repairs and maintenance, getting hit all at once with costs.

That’s also my question, how did you get emergency funds? 😅 I have massive loans and I want to build up my passive income to start saving.

I recommend putting most of your saved money toward paying down high-interest loans each month, but putting some money toward your emergency fund as well. Both are important!

Cash reserves have been on my mind recently, as I’ve added a couple properties to my portfolio. Thanks for the clear thoughts.

Should any of my emergency fund be in stocks?

Hi AJ, no, stocks are too volatile. But you could keep some of your emergency fund in Concreit or Stairs by Groundfloor, those are liquid and stable.

Start building emergency fund no matter how small it is. Build a good investing habit is the most difficult part!

Absolutely Nick!