You have $15,000 set aside, and you have a few rental properties. Should you aim to pay off a mortgage or invest in a new rental property?

The answer, of course, is it depends. But it’s an easier question to answer than you think.

Here’s what you need to know to decide whether to pay off debt or invest as you start building more passive income and wealth.

Long-Term Perspective: Changing Goals Over Your Life

The conventional wisdom is simple: invest when you’re young, pay off debts as you near retirement.

There’s more to the question than this, as we’ll get into in more detail later. Still, this general pattern serves as a baseline for the rest of the discussion.

When you’re young, your mission is to build wealth by accumulating assets. And not just any assets, but assets that both generate ongoing income and appreciate over time, such as stocks and real estate.

In the case of rental properties, you can leverage other people’s money to build your portfolio of assets. You have plenty of options at your disposal for rental property loans, from conventional mortgages to portfolio loans and beyond.

As you approach retirement, your goals and priorities shift. Instead of accumulating wealth and assets at the fastest pace possible, you start worrying about things like sequence risk, debt risk, asset management labor, and safe withdrawal rates.

The older you get, the less risk you can tolerate. And debt represents risk in several forms. But when you’re young and your income primarily comes from your job, you can handle far more investment risk.

With me so far? Great, because we’re going to get more nuanced from here.

Interest Rate vs. Expected ROI

One of the core questions when deciding whether to pay off a mortgage or invest your money is which one offers the better return on investment.

Say you have a rental property mortgage at 6% interest. You can effectively earn a 6% return by paying that mortgage off early.

Or you can invest the money instead. Depending on how far back you want to go and which stock index you look at, historically you can expect an average return in the 7-10% range from stocks. With a healthy dose of volatility and risk, of course.

For less volatility and risk, but more labor and knowledge required on your part, you can invest in rental properties. The returns on rentals are far more predictable – you can forecast your exact cash-on-cash ROI and monthly cash flow using a rental property ROI calculator. (For a more detailed comparison, read up on real estate vs. stocks for financial independence and retiring early.)

Let’s say you can earn a 9% cash-on-cash return from a new rental property. Mathematically, you can earn a higher return on your cash by investing in the new property rather than paying off your mortgage early.

But even rental properties come with risk, which is what that math ignores. You can earn a guaranteed 6% return by paying off the mortgage early; the 9% return on the new property is only a potential return.

It’s that element of uncertainty, of risk, that shifts in importance over time. While 25-year-olds can take that risk all day long without thinking twice about it, 70-year-olds dependent on their investment income have a different perspective on risk.

The narrower the gap between the interest rate on your mortgage and your expected cash-on-cash return, the more difficult the decision becomes, and the more you should consider other factors in your decision. Here are some of those other factors to consider, when deciding whether to pay off a mortgage or invest in a rental property.

Why Not Pay Off Mortgage Debt – Reasons to Keep Investing

As outlined above, one reason not to pay off your mortgages is to free up cash for other investments. Investments that may pay you more than your mortgage is costing you.

But that’s not the only reason. Here are a few more reasons why investing in more rental properties, or in stocks or other investments, often makes more sense than paying off your mortgage.

Tax Benefits of Mortgages

I’m the first to argue against buying rental properties with negative cash flow solely for the tax benefits. I believe rental properties should always be cashflow-positive, and that you can’t count on appreciation (even though you’ll probably get it).

That said, rental properties come with a host of tax advantages that investors can take advantage of. One of those rental property tax deductions is, of course, mortgage interest.

Which is not in itself a reason to carry a mortgage. It’s a real expense, not a paper expense. But it can tweak your tax numbers in a couple ways.

First, when you can deduct an expense, it means you effectively get a discount on that expense. If you’re in the 25% tax bracket, then for your deductible expenses you basically get 25% of your money back in the form of taxes you don’t need to pay.

In that case, your 6% interest mortgage is effectively only costing you 4.5%, because you can deduct it from your taxes and avoid 25% income taxes on that money. Suddenly that mortgage interest doesn’t look quite so bad.

Second, deducting mortgage interest can combine with paper expenses like depreciation to show a paper loss for the property on your tax returns. In that case, your rental property can actually reduce your total tax bill by offsetting your other income.

Offsetting your other income is particularly useful for higher-income earners, and can make every real estate-related tax deduction all the more valuable.

Inflation Disproportionately Improves Your Leveraged Returns

When you take out a fixed-interest mortgage on a rental property, your mortgage payment (at least the principal and interest portion) stays the same every month for the life of your loan.

But your rents don’t stay the same. They keep rising alongside inflation, often faster than inflation.

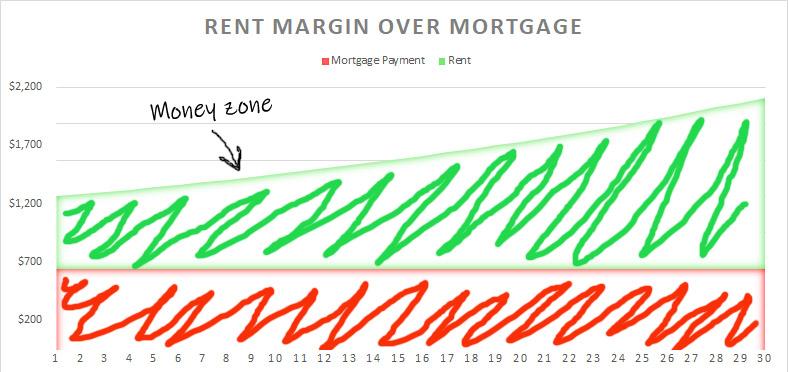

That has profound implications for your returns. Say your mortgage P&I is $500/month, and the initial rent when you buy the property is $1,000/month. We’ll assume your other expenses (vacancy rate, repairs, insurance, etc.) come to 40% of the rent, and that the rent goes up by 2% a year. Which is low, by the way; in recent years rents have risen between 3-5% each year nationwide.

In Year 1, you earn $100/month in profit. In Year 2, the rent rises by $20/month to $1,020. Of that extra $20/month, 40% of it includes variable expenses that rise too: $8 in additional expenses.

But your mortgage didn’t rise – it held steady at $500. So your monthly cash flow jumped from $100 to $112: a 12% increase in profit.

Think about that for a second. Even though the rent only rose by 2%, your profit rose by 12%, because your largest expense is fixed.

In Year 3, the rent rises by another 2% to $1,040 (rounded down). Another $20 increase in rent, of which 40% ($8) goes to variable expenses. But the other $12 goes right in your pocket as additional profit.

Now you’re earning $124/month in cash flow, instead of your original $100. And your mortgage is still only $500.

Over time, that gap spreads exponentially. Here’s how it looks in a not-so-fancy graph:

Your Tenants Can Pay Off Your Mortgage

Yes, you could earn higher cash flow every month from your property if you pay off your mortgage.

But as long as your property generates positive cash flow – which improves every year, as outlined above – it’s not actually costing you money in a tangible sense. It’s an opportunity cost: you could earn more money than you’re earning, but you’re not actually losing money.

You can strain and stretch yourself financially to pay off your mortgage early. Or you could just keep collecting the rent and earning an ever-growing cash flow margin until your tenants eventually pay off your mortgage for you.

It’s a simpler point than the two above. But it’s no less true for its simplicity.

Why Pay Off Your Mortgage Early Rather than Invest

As compelling as all those reasons are, they aren’t the full story. There does come a time to think about consolidating your investments and ditching debts.

Here are a few reasons to consider paying off debts rather than investing in new rental properties or stock funds.

Less Debt = Less Risk

I touched on this above, but it’s worth exploring further here.

When your margins are tighter, as happens when you carry large mortgages on rental properties, a major expense can eat up your entire cash flow for several years. For example, if your property only cash flows $100/month and you have a $5,000 repair, that repair represents over four years’ worth of profits. You’ll probably have to pay for that expense out of your own pocket, rather than with profits earned by your property.

Alternatively, say you own that property free and clear and it cash flows $1,000/month. That massive $5,000 repair now only represents five months’ worth of profits; even if you have to come out of pocket for part of that bill, you know you’ll earn it back within a few months.

The same logic applies to vacancies. Say your tenant defaults on the rent and you have to go through the entire eviction process. After a grueling four months in and out of court, you finally get them out… only to discover they left major damage. It takes another two months for you to finish the repairs and get the property re-rented. For six months, you either had to carry a hefty mortgage payment… or you didn’t.

Of course, you could also just spend a few hundred dollars a year and insure against lost rents. If the tenant stops paying, the insurance kicks in and pay the rent until you sign a new lease agreement. But that’s another conversation entirely.

The bottom line is that debt creates risk, which is why conventional wisdom is to pay off as much debt as possible before retiring.

More Leveraged Properties = More Work

The more properties you own, the more work you have to do to manage those properties. And more leverage typically means owning more properties with thinner margins.

To illustrate with a simplified example, imagine you have $200,000 in cash. You want to invest that money in rental properties, and you have a choice: you can either buy one $200,000 rental in cash, or you can buy five rental properties with a 20% down payment ($40,000) on each.

For the sake of the example we’ll assume the cash flow is the same, at $1,400/month. So, you can either earn $1,400/month from managing one property, or earn $1,400/month from managing five properties.

Which takes more work on your part? Which complicates your tax returns and accounting more?

The five leveraged properties, of course.

In real life, the math usually works out differently, with leverage improving your cash-on-cash returns. But you get the point: more properties require more work on your part.

Let’s try one other example, tying it back to retirement. By the time you retire you own ten rental properties, that earn you $2,500/month. You’ve built up some equity in them and realize that you could sell five of them and pay off the mortgages on the remaining five properties. By doing so, you cut the property management work in half, but boost your monthly cash flow to $3,000.

Less work, less debt, less risk, fewer headaches, and more cash flow: a retiree’s dream.

Skip to the Head of the Interest

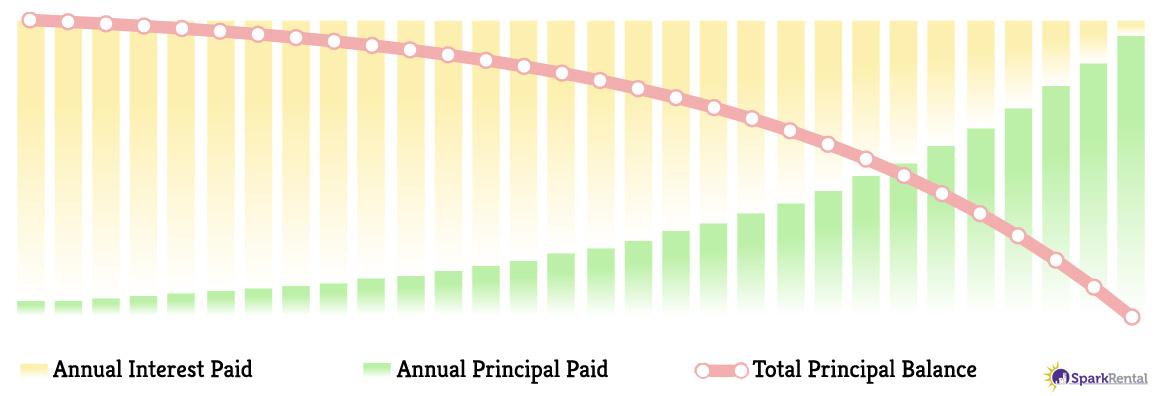

At the beginning of your mortgage, nearly all of your monthly payments go toward interest. It’s only toward the end of your loan term that the majority of your payments start going toward paying down your principal balance.

Here’s how a 30-year loan term looks visually:

You can see why banks are so eager to push refinancing on you, once you reach a certain point in your loan!

You can see why banks are so eager to push refinancing on you, once you reach a certain point in your loan!

But by paying extra toward your mortgage, you can skip those early years when most of your monthly payment goes toward interest. Even if you just pay extra for a few years then stop paying extra, you can see how much interest you can save by skipping the worst of the interest payments.

Creative Ways to Use Leverage – Then Pay Off the Debt

You’re not limited to binary, either/or choices of buying rental properties with a mortgage or not, paying off debt quickly or not.

Here are a few more options to get your metaphorical hamster wheel turning, and to take a more creative approach to real estate leverage.

Combining the BRRRR Method and Debt Snowball Method

If you’re not familiar with the BRRRR method of real estate investing, it’s a simple acronym for buy, renovate, rent, refinance, repeat.

Many investors love it because it lets them pull their original down payment back out when they refinance. The idea is that you create enough equity by renovating that you can borrow more money when you refinance – enough to get your initial cash investment back.

In other words, 100% real estate leverage.

Which can be dangerous, make no mistake. It’s easy to overleverage yourself and end up with too-thin cash flow margins, or even negative cash flow.

But if you do it right, you stack on more passive income with each property, without investing any net cash. And with ever-increasing cash flow, you can eventually pivot and start funneling all that passive income back into paying down debt.

Imagine you spend five years building your portfolio of income-producing rental properties. You reach ten doors, or 20, or 30, or whatever your magic number is. Then you decide you’d rather pay off the mortgages than invest in new properties.

So you spend the next five years funneling all your money into paying off the mortgages. With each mortgage that you pay off, your monthly cash flow leaps upward, snowballing and letting you pump even more money into paying off the next loan.

Which is exactly how the debt snowball method works. You pay off the smallest debt first, freeing up more money to put toward the next smallest debt, until you’re completely debt-free.

House Hacking for Cheap Mortgages

We’ve spent a lot of time writing, talking, and video-ing about house hacking. And while there are plenty of ways to house hack a single-family home, for this discussion I’m focusing on traditional house hacking where you buy a multifamily property – financed with a traditional owner-occupied mortgage – then rent out the other unit(s).

It’s exactly how the Hoefler twins reached financial independence in around five years. They house hacked multiple properties in a row, building their rental portfolio with low-interest, 3.5%-down-payment loans. We actually held a free masterclass with them breaking down how they did it; it’s worth watching!

With mortgages at 3-4.5% interest, there’s little incentive to pay off the mortgages early. It’s so much lower than your expected returns from other investments that it almost makes keeping the mortgages a no-brainer.

Rotating Credit Combined with Fast Payoff

Going a different direction entirely, you can borrow money at high interest rates for acquisition or renovation, then pay it down extremely fast.

For example, I once financed a property and its renovation cost entirely on credit cards. I then spent the next six months paying them off. As a real estate investor, you can open unsecured business credit cards and business lines of credit. Check out Fund & Grow as a business credit service that helps you open $150,000-250,000 in credit lines.

Alternatively, you could use a HELOC to buy and/or renovate a home, then pay it off quickly. Try Figure for a fast HELOC closing within five days.

And you don’t necessarily have to pay the debt off with cash. You could simply refinance the property with a long-term mortgage at a lower interest rate. With rents coming in and positive cash flow, it takes the urgency out of paying off the mortgage.

Painless Ways to Pay Down Mortgages Faster

Finally, paying off your mortgage early doesn’t have to just involve making enormous payments every month.

One pain-free trick is to switch to biweekly payments on your mortgage. You divide your monthly mortgage in half, and make that payment every two weeks. That comes to 26 half-month payments in a year, or 13 months’ worth of payments every year. You won’t even notice the difference, since you probably get paid biweekly anyway.

Another option is to aggressively pay down your mortgage until you can remove the PMI, if applicable. Once removed, your monthly payment lowers, boosting your cash flow. At that point, you can either stop paying down the mortgage faster, or you can keep making the original high mortgage payment to pay the loan off faster.

One other perk of making an initial push to lower your LTV (loan-to-value ratio) is that it helps you skip the highest-interest phase of your mortgage. In the beginning of your mortgage, nearly all of your monthly payment goes toward interest. As time goes by, more of your payment goes toward principal.

It’s called “simple interest amortization,” and it’s a misnomer. But the take-home message is: by making extra payments to pay off your mortgage early, you fast-forward your way along that interest-principal curve. More of your payments go toward principal, and faster.

Read up on some more strategies to pay down your mortgage faster here.

Final Thoughts

The decision to pay off your mortgage or invest in rental properties is more nuanced than it appears at first. But it’s not rocket science, and largely depends on your goals, age, and comfort with debt.

In your 20s, 30s, and 40s, I’d lean toward scaling your portfolio and investing in new properties. Your 50s enter a grayer area (no pun intended), and by your 60s and beyond the risks posed by debt increase.

But ultimately there’s no wrong answer, as long as your rental properties are generating positive cash flow each year. Before buying, make sure you understand how to calculate rental cash flow, so you don’t get caught flat-footed with negative cash flow.

Lastly, remember you don’t have to choose only between paying off debt or investing. It’s not black and white, either-or. You can always put your money into paying down your mortgage debts when you don’t see any promising properties on the market, and pick up new properties as you find them.

Either way, you’ll be richer for your efforts!

Would you rather pay off your mortgages or invest in new rental properties? Why? Share your thoughts below!

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-25% on Fractional Real Estate Investments.

I came across this article looking for some insight on whether or not I should work towards our next investment or just pay off the mortgage. This was very helpful.

Glad to hear it was useful for you Liam! Keep us posted on how we can help!

Great information Brian! My plan is, as you mentioned above, to invest right now while I’m young and then pay off debt as I get older and closer towards retirement.

Thanks Ron! Let us know how we can help!

For a real estate investor, would the sequence of risk decrease by paying off mortgages before retiring?

Hi Brandy, yes and no. Paying off your mortgage would reduce your mandatory monthly expenses, which would help you sell off less stock in the event of a stock market correction. That would leave your portfolio less depleted once the recovery comes around.

To reduce sequence risk, I’d also look at diversifying your income in early retirement. Obviously rental properties can help, but jobs and gigs help too.

It seems to be a good idea to buy more income properties rather than paying off mortgage early. But what’s your take on when someone has a negative cash flow on that rental property. If the rent collection is less than mortgage payment, should one go for paying off mortgage? What you suggest Brian?

I personally wouldn’t recommend holding onto any negative cashflowing properties, without some outrageously good reason. Landlords also incur far more costs than just the mortgage payment – non-mortgage expenses often come to around 50% of the rent. I’d get rid of any properties that cost you money rather than you earn you money each year.

I struggle with this: pay off mortgage on my primary house or invest in real estate. I already have a rental with no mortgage and now should I pay off primary house or invest? If I pay off my primary mortgage and ‘collect rent’ every month now ( instead of paying principal and interest), I am generating cash flow on my primary residence. So, saving 1700 per month gives me almost a guaranteed 7% return on my money that I used to pay off my mortgage early plus the interest over time. I would not be cash poor as I have a emergency fund, and collecting another $1400/month on the other rental. Plus I would be debt free. Am I missing something? Taking the 300k and investing it would come with more risk. Thoughts? Thank you

Hi Michael, it depends on your risk tolerance, and the interest rate you’re paying on your home mortgage. At this stage in my own life, if I can borrow money at 3-4% and invest it at 8-10%, I’ll do that all day long. But the closer you get to retirement, the lower your risk tolerance, and the more valuable a guaranteed return by eliminating debt becomes.

No right or wrong answer, it just comes down to your personal goals and needs.

It’s a bit complicated but I get the gist. I’m new to real estate investing and is about to inhert a property in a few months. I learn a lot from your blogs!

Glad to hear it Thomas!