Thought 1: “I think I could retire on what I have invested right now! Woohoo!”

Which is quickly followed by Thought 2: “But what if the market crashes the day after I quit my job?”

My mother and step-father are in the midst of this conversation right now. That question turns out to be a serious one, not just the ravings of paranoia. Every financial advisor they’ve talked to has raised this issue.

It has a name, too: sequence risk, AKA sequence of return risk. And in today’s aging bull market, the risk of a crash is all too real!

Whether you’re 30 and hoping to retire young over the next five to ten years, or 65 and wondering if you can afford to quit your job, here’s the layman’s guide to sequence risk – and how rental properties can make all the difference in the world.

What Is Sequence Risk?

When most of us talk about stock market returns (or real estate returns, for that matter), we talk about long-term averages. The market shoots up 20% this year, drops 12% next year, then recovers by 18% the next year, and all of those peaks and valleys get averaged out, right? Over time, the stock market tends to rise by about 8% a year, so if we keep plugging away, we’ll see results, yes?

That’s a useful way of thinking about returns… if you’re continuing to pump money to your portfolio and you have the luxury of time to let it average itself out.

But the math changes when you stop investing more money into your portfolio. Once that happens, your retirement success isn’t just about the long-term average, but also the order in which your portfolio earns its returns.

Sequence of return risk is the risk that a crash will happen at the beginning of your retirement, rather than later down the road.

Two Quick Reasons Why Sequence of Returns Matters

When the stock market crashes, you lose money on what you already have invested, but the good news is that you’ll be able to buy new stocks at a discount. You can buy when stocks are cheap, and benefit from the recovery.

Unless you’re a retiree not earning any money, and can’t buy any “discounted” stocks. For you, it’s all downside – you lose money in the crash, but don’t benefit from the “fire sale” on low prices.

What’s worse, during the crash you’ll be burning through your stocks that much faster. If the market crashes 35%, and you depend on selling off stocks for your income, you’ll need to sell off 35% more stocks each month just to bring in the same cash.

And not just during the crash, either. Even during the recovery, stock prices will still be lower, until they (eventually) reach their pre-crash level. Which could take decades.

Want a mainstream example? Look no further than the Nasdaq Composite Index, which took 15 years to recover from the crash of the early 2000s.

Illustrating Sequence Risk

What’s that you say? You’re a visual learner?

Me too. Let’s get tangible here.

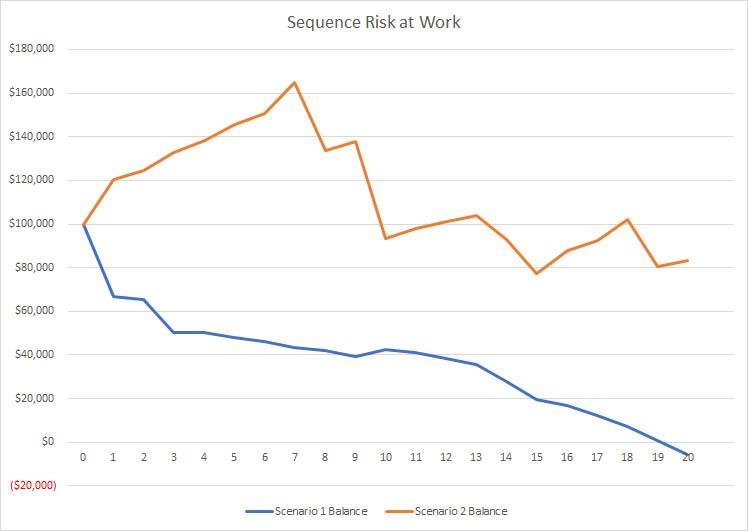

Joanna invests $100,000 in the stock market. In Scenario 1, the market then crashes in Year 1 of her retirement, by a devastating 29%. Then it bounces up and down over the next 20 years, as stocks do.

In Scenario 2, Joanna’s returns over the first ten years are reversed. That ugly 29% crash still hits Joanna, but not until Year 10 in her retirement.

Joanna withdraws $6,000/year in both cases. Her long-term average return remains a mediocre 5.3% in both as well – the only difference is the order in which she earns her returns.

Here’s how Joanna’s nest egg looks after 20 years, in each scenario:

Want to look at Joanna’s actual returns each year? Have at it:

| Year | Scenario 1 Return | Scenario 1 Balance | Scenario 2 Return | Scenario 2 Balance |

| 0 | $100,000 | $100,000 | ||

| 1 | -29% | $66,740 | 28% | $120,320 |

| 2 | 8% | $65,599 | 9% | $124,609 |

| 3 | -16% | $50,063 | 12% | $132,842 |

| 4 | 14% | $50,232 | 9% | $138,258 |

| 5 | 8% | $47,771 | 10% | $145,483 |

| 6 | 10% | $45,948 | 8% | $150,642 |

| 7 | 9% | $43,543 | 14% | $164,892 |

| 8 | 12% | $42,048 | -16% | $133,469 |

| 9 | 9% | $39,293 | 8% | $137,667 |

| 10 | 28% | $42,615 | -29% | $93,483 |

| 11 | 12% | $41,008 | 12% | $97,981 |

| 12 | 10% | $38,509 | 10% | $101,180 |

| 13 | 9% | $35,435 | 9% | $103,746 |

| 14 | -5% | $27,963 | -5% | $92,858 |

| 15 | -11% | $19,547 | -11% | $77,304 |

| 16 | 23% | $16,663 | 23% | $87,704 |

| 17 | 13% | $12,049 | 13% | $92,325 |

| 18 | 18% | $7,138 | 18% | $101,864 |

| 19 | -16% | $956 | -16% | $80,526 |

| 20 | 12% | -$5,649 | 12% | $83,469 |

| Avg. Return: | 5.30% | 5.30% |

“You know, 5.3% is on the low side for stock market returns. And maybe Joanna’s money would have lasted a little longer if she’d only withdrawn 4% a year, instead of 6%.”

Yes, Joanna should have followed the 4% Rule, rather than pulling out 6% each year. But she didn’t. And don’t give me that lip about the stock market returns being low, there have been stretches where they’ve averaged that over the last 100 years.

Any other obnoxious questions?

“How the heck does she live on $6,000/year?”

You’re missing the point! The point is that the order (or sequence) that you earn your returns matters!

Jeesh.

Related Article Read: Ways to find pre foreclosure homes.

Related Article Read: Guide to Driving For Dollars.

Free Mini-Course: Passive Income from Small Multifamily Properties

What Financial Advisors Say About Sequence Risk

The first (and often only) answer that financial advisors offer for sequence risk is bonds, bonds, and more bonds.

Cue the predictable, boring explanation from your garden-variety advisor: “Well, you should follow the Rule of 100: just subtract your age from 100, and that’s what percentage of your portfolio should be in stocks. The rest should be in bonds! It’s what we eggheads call ‘asset allocation.’ Now, just hand me your nest egg and I’ll take care of everything.”

But are bonds the perfect answer? Consider US Treasury bond returns so far this century:

“Well Brian, no one says I have to invest so conservatively. I could buy higher-risk, higher-return bonds, you know!”

Which defeats the entire point of avoiding risk by re-allocating your money to bonds.

Oh, and one other thing: bonds have an expiration date. They run out and stop paying you at a certain point. Dividends from stocks and rental income? They don’t expire.

I’m not saying you shouldn’t invest in bonds. It does make sense for part of your portfolio to be in rock-solid, safe US Treasury bonds. But it’s only one answer to sequence risk, and not the most interesting one at that.

3 Other (More Interesting) Ideas from Financial Advisors

First, consider the benefits of Roth IRAs.

The returns are, of course, tax-free (which is awesome in itself). And unlike regular IRAs, you aren’t required to start drawing them down when you reach 70 ½, which gives you more flexibility. For example, if the market crashes, you won’t be forced to sell during the crash.

My parents’ advisor gave them an interesting idea: pull out a reserve fund in cash, enough to cover several years’ expenses. If the stock market crashes, they won’t have to sell a single stock. If it doesn’t, their stocks keep growing and they’re still in good shape.

It’s not without its costs. They’ll lose money to inflation – a loss of around 2%/year. There’s also a hefty opportunity cost; think of all the money they could have earned in returns on that cash! But safety comes with a cost.

A third idea is to set trailing stop orders. If you’re not as much of a personal finance nerd as I am, the short explanation is that you set an automatic order to sell your stocks if they drop in price by more than X%. That percent follows the stocks upward though – if you set a trailing stop order of 5%, it will trigger if the stock drops by 5% of its most recent high, rather than 5% of its value when you placed the order.

(Note: Don’t go out and blindly set 5% trailing stop orders. Do your homework on them first!)

Just some ideas. But what about rental properties?

Get to the Rental Income Already!

As we alluded to earlier, rental income never expires like a bond. It doesn’t chip away by selling off your portfolio, like stocks.

It’s forever income, which is pretty awesome. And it rises alongside inflation, unlike stock or bond income!

Joanna decides she wants half her retirement income to come from rentals, and half from her stock portfolio. Suddenly, her exposure to stock market crashes has been cut in half! She’s selling off her stocks at half the pace, and is half as dependent on revenue from selling off her stocks.

But Joanna also has some control over how much she pulls from her rentals and from her stocks, in any given month. It doesn’t have to be 50/50.

For example, say the stock market crashes, and she doesn’t want to sell any stocks this month. Instead of putting as much money toward her property expense account as she normally would, Joanna takes more of it for her own personal expenses.

“That’s all well and good, but what happens when the roof sprouts a leak?”

In normal conditions, maybe she does the full roof repair or replacement. But during a stock crash, she may decide to do the $300 patch rather than the $5,000 roof replacement.

By doing so, she buys herself another year or two for her stock portfolio to recover.

Rental Portfolios as a Counterbalance to Stock Portfolios

This sort of gyration won’t change Joanna’s long-term average returns on her rentals, but the point is landlords have some control over the timing of their month-to-month expenses.

And it goes the other way, too. Say the stock market is doing just peachy, but Joanna has a turnover (and we know how expensive tenant turnovers are!). She has negative cash flow that month, from that rental property. (Learn how to perfectly predict real estate cash flow here.)

So, because she has a bad month with her rental income, she pulls more money than she normally would from her stock portfolio.

“Okay, fine, but what if the stock market crashes and her rentals all become vacant at the same time?”

No one said rental properties are the answer to everything, dang it! All investments have risk.

Still, this risk is lower than you think. In the Great Recession, both home values and stocks lost 30-35% of their value (albeit at different times – stocks crash quickly, but housing crashes are much slower). But what happened to rents and rental demand?

They went up.

The Other Answer to Sequence Risk

No one says you have to stop work cold-turkey when you retire, you know.

The whole move-to-Florida-and-play-golf-all-day narrative? It’s a myth. Why not keep working, doing something you love?

It doesn’t have to be full-time. It doesn’t have to earn you massive income. Heck, it doesn’t have to be a job! Make a side hustle your only hustle. Tutor kids. Offer consulting services. Do freelance work.

But keeping your foot in the working world is a great way to keep some independence from relying solely on your stock portfolio or your rental properties for income. (And for that matter, to keep your mind and soul engaged with the world around you!)

Have a bad month with your rentals? Stock market tanked? Pick up a few more hours.

Semi-retirement is a great way to stay engaged, stay sharp, and stay funded.

And hey, it also helps you avoid taking Social Security too young, and settling for lower monthly benefits!

The Magic Word: Diversity

How do you mitigate sequence risk? You make yourself less dependent on stocks.

Don’t get me wrong, I love stocks. I invest in them now, and I’ll keep investing in them when the market crashes again (be that next week, next year, or next decade).

But it’s useful to start thinking of your nest egg in the plural, and putting all those eggs in different baskets.

Consider some of these strategies we’ve reviewed in this article:

- Bonds

- Cash cushion of a few years’ expenses

- Trailing stop orders to limit stock losses

- Rental properties

- Semi-retirement

They’re all about diversification, and minimizing the risk that an early stock crash will cripple your retirement funds.

You want to be around for decades to come, right? Here’s to making sure your nest egg doesn’t go belly up before you do!

Related Article Read: What Is the Due Diligence Period in Real Estate?

Related Article Read: How to transfer property from a person to an LLC.

Related Article Read: What You Need to Know About Condemned Houses in 2023?

What to Do Now:

- Comment below: when are you hoping to retire? Is rental income part of your plan? What can you do to get there faster?

- Take our free mini-course on building passive income from rentals.

- Enjoy this article? Did it raise some questions and ideas that got you thinking? If so, your friends, colleagues, and family members will probably also get something out of it. Share it with them on Facebook or Twitter. You can also follow us on Facebook and or Twitter for awesome daily doses of, well, real estate awesomeness

Thanks for breaking this down, seems like something most people in personal finance (and real estate investing for that matter don’t talk about. You guys always make complex investing info super digestible!

Thank YOU Allison! That’s our goal, and it’s extremely gratifying to hear when we reach it!

This has definitely not been front-of-mind for me. I had never even heard of sequence risk until a month or so ago, and didn’t understand it until reading this article.

Thanks for tackling an under-discussed subject!

Glad it was useful for you Mike! Hope retirement is sooner rather than later for you 😉

Well explained, Brian! I get into the sequence of risk conversation with a lot of people in the FIRE (Financial Independence/Retire Early) community. And it never seems to be as big of a concern for me because rental income is my driver. But I like the idea long-term of balancing the rental assets with stocks, bonds, side-hustle income, etc.

Patience, flexibility, and diversification are the solutions to a lot of investment problems.

So true Chad! Those are actually the solution to most investment problems.

And rental income makes a huge difference, as you mentioned. One of the extra perks of retiring young is you’re less vulnerable to sequence risk as well, since it’s easier for you re-enter the workforce if the need arose.

Given the situation nowadays, I’m thinking critically about what I have to do with our investments for the next few years. Good read.

Thanks Alex!

I’m hoping to retire in mid 40s and yes, I would definitely invest in real estate. I’d like to learn more so I’ll be reading your mini-courses on my free time. Thanks for the free content!

Glad you’re finding it helpful Nico!

Just another anecdotal data point from an average guy who drives a Chevy. After the GFC turned the 401k into a 201k I decided to split investable assets 50/50 between physical rental and market risk assets. It took 8 years from 2012 to 2020 to achieve the form of FI where rents and dividends eliminated dollar-cast-ravaging and SORR. Left the workforce in 4Q19 and have SWAN ever since knowing I don’t need to sell shares to cover expenses. Not a HNW individual or business owner.

That’s awesome JT, congratulations on reaching financial independence and retiring from your full-time job!

Interesting read. I’m 54 and a huge fan of real estate, having bought my first single family rental home in 2017 and my fourth last fall. They have been a true game changer, and I wish I’d done it 20 years ago. I also have ( had!! ) about 220k is 401k which these days looks more like 170. Am hoping if it really tanks, the rentals will be my saving grace. Am wondering if I could talk you into adding another breakdown of the 20 year sequence scenario using less extreme numbers ( like maybe 10% each way instead of the 29% figure?