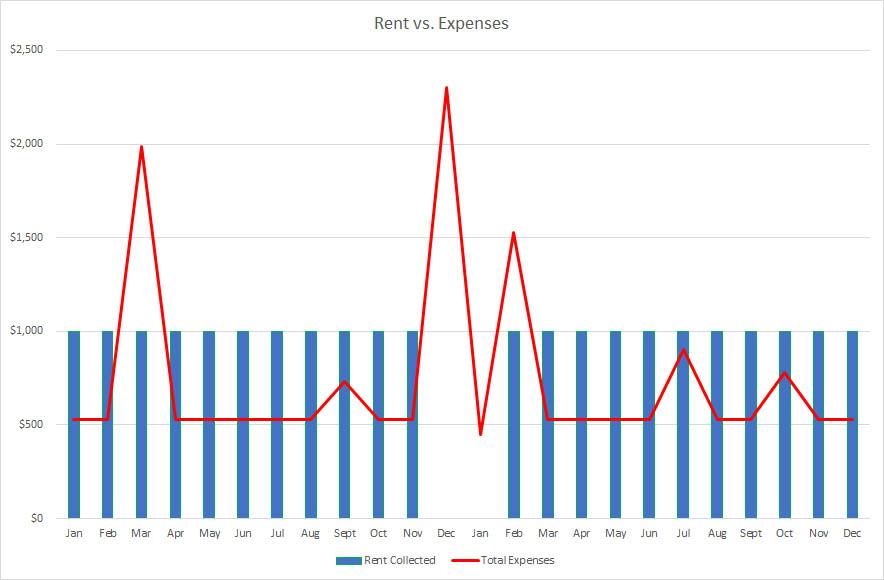

In a “normal” month, your expenses will probably be minimal. And then a not-so-normal month hits, and you get slapped with a $2,500 expense.

So when rental investors forecast real estate cash flow, they need to level out the peaks and valleys, to calculate the long-term average cash flow. To illustrate that point, we’re going to, well, literally illustrate it!

Real Estate Cash Flow Expenses

Net operating income includes expenses, not just revenue. Mess up calculating your real estate investment cash flow, and you may well end up with negative cash flow instead of a profit.

We did a deep dive into many of these operating expenses when we talked about calculating cash flow, but as a landlord you need to remember these in addition to the monthly mortgage payment, property taxes, and rental property insurance.

Repairs & CapEx

Your property will need repairs periodically, and some of them will be major. After all, every single piece of your property will need to be replaced sooner or later!

Consider setting aside around 8% of the rent for repairs and CapEx (capital expenditures, or large property replacements & repairs that are uncommon but recurring). They don’t hit you as regular monthly expenses, but that doesn’t make them any less real.

Maintenance

Unlike repairs and CapEx, maintenance isn’t about occasionally fixing something that breaks. Instead, it’s about keeping the property humming along, able to be rented for top dollar.

It can include painting the property or replacing carpets in between tenants, for example. Don’t count on being able to deduct these from the security deposit — often this simply comes down to normal wear and tear.

Or it could mean preventative maintenance such as sending an HVAC technician to service the furnace or air conditioning condenser before peak usage. Or groundskeeping for apartment buildings, or maintaining other public areas, or any number of other basic upkeep.

I budget around 5% of the rent for maintenance costs. You budget as you see fit, but remember that property owners face more maintenance expenses than just repair costs when things break.

Vacancy Rate

Landlords forget this one all the time. This varies widely by market – hot markets might have vacancy rates in the 2-4% range.

But ice-cold, low-demand markets could have vacancy rates as high as 20-30%!

A good baseline is 8% of the rent (roughly one month/year), but make sure you know this figure for your specific real estate market.

Property Management

Whether you hire a property manager or you manage the property yourself, property management is a labor expense. If you manage your property but don’t deduct expenses for your labor, then you won’t have a clear idea of your real property ownership costs.

Because you could have put your money in an index fund, with no labor at all. Real estate investing comes with more labor and headaches than stocks, and landlords need to remember that when they calculate the rate of return on a rental property investment.

Property managers typically charge 7-10% of the rent collected, and a fee to place new renters in vacant units. This can range from half to a full month’s rent. (And shady ones often charge other hidden fees — landlord beware!)

Administrative & Miscellaneous

You’ll have higher accounting costs, bookkeeping costs, mileage costs, occasional utility costs, and so forth. Budget 5-7% for these.

Pro Tip: Use our free rental income calculator to forecast a rental property’s cashflow!

Two Years of Rental Property Cash Flow

Imagine a property that rents for $1,000/month. The mortgage (which includes property taxes and insurance), is $450. Property management costs 8% of the rent collected ($80), plus a one-month’s rent fee for filling vacancies.

In a “normal” month, cash flow is $470. Which drops sometimes though, as other expenses rear their ugly head.

Here’s how the actual monthly cash flow might look over the course of two years:

In this example, the average monthly cash flow is $179.46.

Here’s another way of looking at it, with the blue bars being total rental income, and the red line being expenses:

Real Estate Cash Flow Analysis

In March of Year 1, the roof needs repair work, to the tune of $1,458.

Six months later, in September, you have to service the furnace for $200.

Then the tenants move out at the end of November. You send in a crew to paint the inside of the unit, costing $1,850.

You receive $0 in rent for December and January, while you advertise the property for rent, show it to prospective renters, run tenant screening reports on applicants, negotiate and sign a new lease agreement, etc.

Placing the new renters costs you one month’s rent, plus the normal 8%, so for February’s rent you chalk off $1,080 for property management expenses.

Your property hums along for a while, then in July another $375 repair comes along.

In October, you send a maintenance worker out to check on some additional furnace issues. Another $250 disappears.

It’s worth noting that repairs are not the landlord’s worst enemy here. Sure this is a made-up example, but this is a typical two-year snapshot of an investment property. You may have noticed that it was actually the turnover that cost the landlord the most: $2,000 in lost monthly rents, $1,000 in extra property management fees, and $1,850 in painting expenses.

Here’s a breakdown in chart format:

| Month | Rent Collected | Mortgage | Repairs & CapEx | Maintenance | Management Costs | Total Expenses | Cash Flow |

| Jan | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Feb | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Mar | $1,000 | $450 | $1,458 | $0 | $80 | $1,988 | ($988) |

| Apr | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| May | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Jun | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Jul | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Aug | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Sept | $1,000 | $450 | $0 | $200 | $80 | $730 | $270 |

| Oct | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Nov | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Dec | $0 | $450 | $0 | $1,850 | $0 | $2,300 | ($2,300) |

| Jan | $0 | $450 | $0 | $0 | $0 | $450 | ($450) |

| Feb | $1,000 | $450 | $0 | $0 | $1,080 | $1,530 | ($530) |

| Mar | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Apr | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| May | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Jun | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Jul | $1,000 | $450 | $375 | $0 | $80 | $905 | $95 |

| Aug | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Sept | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Oct | $1,000 | $450 | $0 | $250 | $80 | $780 | $220 |

| Nov | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

| Dec | $1,000 | $450 | $0 | $0 | $80 | $530 | $470 |

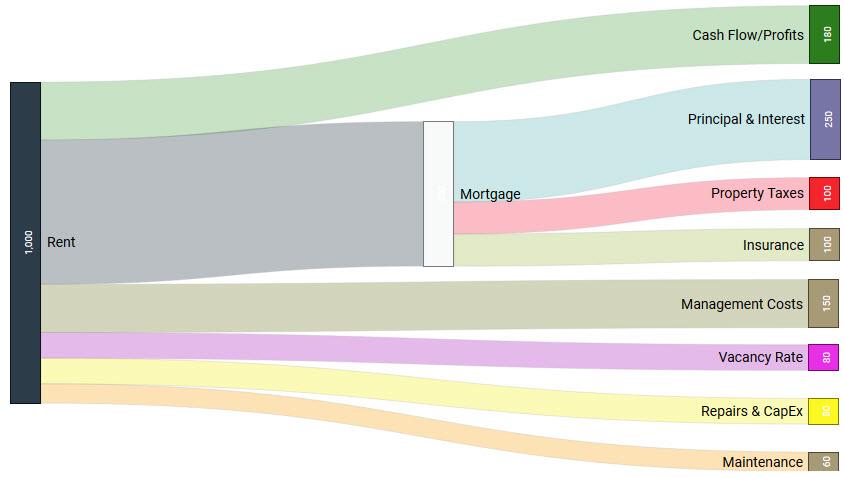

Averaging Monthly Real Estate Cash Flow

Yes, for most months in the example above, the landlord pocketed the full rent minus the mortgage.

But that hardly tells the whole picture, does it?

When you take the long-term averages of these costs, monthly real estate cash flow looks more like this:

(Who doesn’t love a good Sankey diagram?)

If you want to succeed as a rental property owner, learn to forecast these long-term average costs accurately! That’s how you can forecast your monthly profits and true positive cash flow.

(article continues below)

Real Estate Cash Flow Calculator

Sometimes you just want a calculator to do the thinking for you. No judgment here.

Try this real estate cash flow calculator to forecast the return on investment on any rental property:

As you run the annual cash flow numbers through a rental property calculator, make sure you understand the difference between capitalization rates (cap rates), cash-on-cash return, and of course cash flow. For that matter, multifamily property investors should also understand internal rate of return (IRR) and how it differs from other potential returns.

All measure returns and passive income potential, but serve different purposes for real estate investors. If you invest in real estate syndications, you need to understand IRR. If you only invest in single-family rentals, you probably don’t. Make sure you understand which types of returns you need to know for your real estate portfolio.

Stay Liquid, My Friends

Everyone should have an emergency fund or cash reserve. After all, you never know when an unexpected medical bill will come along. Or your car will need an expensive repair. Or your spouse will run off with an alligator wrestler from the circus and leave you with nothing but bills.

But for landlords, this goes doubly.

Get it? Stay liquid? Oh man, tough crowd

Look at the example above. Out of the clear blue sky, the occasional lightning bolt of expenses came crashing down on our imaginary landlord friend.

That’s how it is, owning rental properties. To prepare for these expenses, landlords need to stay liquid with an expense fund, which they fill up to a certain cash cushion before touching any of their profits.

A good rule of thumb for a cash cushion is the greater of either $2,500 or three months’ rent. Landlords need to be prepared for turnovers, for repairs, for whatever comes down the pike at them.

And yes, even if you have a $2,500 cash cushion, you could still be hit with a $3,500 roof repair bill. But it’s a lot easier to come up with an extra $1,000 than it is to come up with an extra $3,500, right?

Leave yourself options to draw on in emergencies, such as unused credit cards, HELOCs, equities, etc. When a repair or turnover rears up at you, you’ll be ready for it, which is the difference between “Well, that’s annoying,” and “Oh @$%&, how the @#*% am I going to feed my family this month?!”

Cash cushion = important.

Have any tips for calculating rental property cash flow? How do you decide what makes a worthwhile investment?

Great way to simplify the abstract with concrete visuals Brian! Love this blog, you guys are always doing something a little different

Thanks Sally! We try 😉

I totally agree. Incredibly important that we all save an emergency fund so that we aren’t ruined by emergencies or unexpected events. Thanks for sharing!

So true Steve!

Far too many new landlords mess this up. Thanks for shedding some light on this, definitely something new investors need to learn.

I know I messed this up badly when I first started investing in real estate. Thanks for reading, and the comment Mike!

Thanks for giving an idea what are the expenses for rental business. This is very helpful for me since I am very interested to start my own rental business. This is a very useful post. I’ll definitely return to this site.

Thanks James, much appreciated!

It is always good to have a visual presentation of expense vs income cash flow. I use spreadsheet a lotttt… This definitely helps on forecasting! Thanks a bunch. newbie here.

Visuals definitely help Jonathan! And I’m a secret spreadsheet nerd myself 😉

I learned something new today. Thanks for the share!

Glad it was helpful Patrick!

I’m not good at forecasting but I understand how important it is and thanks for the cash flow calculator. That helps a ton!

Glad to hear it Chickie!