If you’ve never heard the term “real estate syndication,” you’re not alone. Most people haven’t, and even fewer know what a real estate syndication is or how they work.

Historically, only the wealthy could access private equity investments like these. That has changed in recent years, and increasingly the middle classes can access real estate syndications.

But what is a real estate syndication? How are real estate syndications structured? How well do they pay, and what are the risks? And do you really need at least $50,000 to invest in them?

Strap in, because real estate syndications have changed the way I think about real estate investing, supercharging my returns while minimizing my labor.

Key Takeaways:

-

- Real estate syndications are passive investments, where you buy fractional ownership in an apartment complex or other large property (or properties in a fund).

- As a financial investor, you don’t have to do any labor, and don’t make management decisions.

- Most real estate syndications aim for high returns (15-30%+) and come with full real estate tax benefits.

- The risk of these investments isn’t necessarily high, but they do come with inconveniences including lack of liquidity, medium- or long-term commitment, and a high minimum investment.

The Quick Answer in <2 Minutes:

What Is a Real Estate Syndication?

A real estate syndication is a private equity real estate investment where the lead investor raises money from private investors to help fund buying a large commercial property. Types of properties could include multifamily apartment complexes, self-storage facilities, mobile home parks, retail properties, office buildings, agricultural land, even industrial parks or oil and gas fields. Imagine you find an apartment building for sale at a deep discount, and you want to buy it. But even with an investment property loan covering 70% of the purchase price, you still can’t afford the 30% down payment. So, you raise some of the remaining money from friends, family members, neighbors, and your aunt’s second cousin once removed. In exchange for a portion of the ownership, of course. Granted, most people don’t have enough rich family members to cover huge commercial real estate deals. So as they scale, they start raising money from people they don’t know. People like you and me.Who’s Involved In Real Estate Syndications?

There are a few key players in real estate syndications that you need to know. First, the lead investor on a real estate syndication deal is known as the sponsor, or alternatively the general partner (GP), operator, or syndicator. While lawyers quibble that there are technical differences between those labels, for our purposes we’ll use them interchangeably. Sponsors are professional real estate investors, hopefully with a long track record of success. Their duties include finding the deal, raising all the money needed to close it, overseeing all renovations and repairs, overseeing the property management, distributing cash flow, and eventually selling the property. If you see the term co-sponsor, it refers to someone who is helping to raise money or support the deal in another way, but who isn’t the lead sponsor on the deal. You might alternately see them referred to as co-GPs. General partners raise some of the capital for buying the property from financial investors — us. We invest our cash in the deal as “limited partners” or LPs, becoming fractional owners in the property. If you invest in a fund with multiple properties, the lead sponsor might instead refer to themselves as the fund manager. You know the other players involved: lenders, property managers, and contractors. But if you have any other questions about terminology, check out our glossary of terms in real estate investing.Real Estate Syndication Structure

In a real estate syndication, the sponsor/general partner finds the deal and oversees the purchase, repairs, management, and eventually the refinancing or sale of the property. They take out an investment property loan to cover some of it, put some of their own cash in the deal, and raise the rest from limited partners. The GP usually builds in some extra fees and returns for themselves to compensate them for their trouble. For example, they might collect an acquisition fee of 1-3% of the purchase price or a disposition fee when they sell the property. They also get a prespecified portion of the profits upon sale, known as the promote. Again, this serves as their reward for doing all the labor to oversee the deal. Some sponsors structure the returns so that the more the property earns, the greater their cut. For example, the limited partners (the passive investors like you and me) might get an 8% “preferred return” on all revenue. That means that we get paid the first 8% in returns, before the GP gets a dime. Above that 8% threshold, there could be a 70/30 split on returns up to 20%, with 70% of returns coming to LPs and 30% going to the GP. Over 20% annual returns, the split might drop to 50/50. In this example, imagine the property earns a total annualized return of 25%. The sponsor would earn a greater share of that than the limited partners, to compensate them for their work. Limited partners would earn an annualized return of 18.9%: the 8% preferred return plus 70% of the next 12% plus 50% of the next 5%. This kind of arrangement is called a waterfall, as the profit share changes once the returns hit certain thresholds. As for the legal structure, the sponsor creates a legal entity such as an LLC and all partners get listed as partial owners.Eligibility Criteria for Investing In Real Estate Syndications

Some real estate syndications only allow wealthy accredited investors to participate in them. To qualify as an accredited investor, you must have a net worth over $1 million (not including equity in your primary residence), or have earned at least $200,000 for each of the last two years ($300,000 for married couples). Why? Why exclude everyday investors? Because the government says so. The Securities and Exchange Commission (SEC) regulates these investments in a way that makes it harder for syndicators to accept middle-class investors. But they do leave the door open. Sponsors can raise money from up to 35 non-accredited investors for a syndication deal if they classify it as a 506(b) investment. It requires them to meet certain conditions and put up with some restrictions, however. First, these investors must have some knowledge about this field, and must count as “sophisticated investors.” Second, these investors must have a pre-existing relationship with the sponsor. The idea is to allow friends and family of the sponsor to invest with them, but not the general public. In fact, sponsors can’t advertise 506(b) investments to the public at all. If a sponsor wants to advertise to the public, they must file the investment as a 506(c) security. That restricts them to only accepting money from accredited investors, but it frees them from the restrictions on 506(b) investments.How to Invest In Real Estate Syndication Deals

The mechanics of investing in a syndication are simple: you wire the money and sign a legal agreement. This document, called a private placement memorandum or PPM, outlines the terms of the investment. Once you’ve invested your money, you sit back, relax, and let the passive income from distributions and profits roll into your bank account. But slow down a second here. How do you find reputable sponsors? How do you vet real estate syndication deals? The easy answer is that you join a real estate investment club like ours. We do the networking with sponsors for you, and we then in front of the club to explain their latest deals. Then our Co-Investing Club discusses and vets the deal together, and decides whether to proceed. If you want to invest on your own, then it’s up to you to network with sponsors, demand to see their track record, and evaluate their business model. It falls to you to vet each deal before investing in it.Pros and Cons of Investing in Syndicated Real Estate Investments

Should you invest in real estate syndications? It depends on how you feel about the following pros and cons.Pros of Real Estate Syndications

Investors like real estate syndications for the following reasons:-

- High potential returns: Real estate syndications aim for high returns, typically 15-30% annualized returns.

- Passive income: Part of those returns comes in the form of cash flow. While not syndications pay distributions, most do, commonly in the range of 4-8% per year.

- Appreciation & profits upon sale: The other part of the returns comes from profits when the property sells. In fact, the bulk of the targeted 15-30% annualized returns comes at the very end from these profits.

- Potential for infinite returns: If the sponsor refinances the property rather than selling, they can return your initial investment back to you — even as you keep your ownership interest in the property. You keep earning distributions and appreciation, even though you got your money back and can reinvest it in another asset.

- Tax advantages: Passive investors in real estate syndications get all the same tax benefits as landlords and active investors. All the same real estate tax deductions apply, plus you get accelerated depreciation. The upside: you often show a loss on your tax return, even though you collected distributions. (More on tax benefits below.)

- Simplified accounting: Rental properties come with accounting and bookkeeping headaches. You have to track all income and expenses, all properly labeled, and file a Schedule E tax statement for all your properties. Get it wrong, and the IRS comes knocking. With real estate syndications, the sponsor just sends you a K1 with a bottom line number for you to enter on your tax return.

- Diversification/low correlation to stocks: Real estate syndications share almost no correlation with the stock market. That means they provide true diversification from your stock investments.

- Passive investment: You don’t have to become a landlord, don’t have to line up financing or find deals, don’t have to hassle with contractors or tenants or property managers. Syndications are a purely passive investment in real estate.

Downsides of Real Estate Syndications

People often balk when I tell them the returns paid by real estate syndications. They either don’t believe it, or they assume the risk is high. But the fact is that syndications have to pay high returns, if they want to attract private investors despite the inconveniences of investing in syndications.-

- No liquidity: Once you invest money in a real estate syndication, it stays locked up until the sponsor refinances or sells the property. You can’t sell or withdraw funds early.

- Medium/long-term investment: Most real estate syndications last 2-7 years. That’s not a trivial amount of time to tie up your money with no access to it.

- High minimum investment: If you invest by yourself, rather than as a member of an investment club like ours, you have to invest the full minimum. Typical minimum investments range from $50,000 – $100,000.

- Potentially high investment in a single asset: Solo investors not investing through a club end up committing huge amounts of money to a single asset. That makes it hard to diversify within your real estate portfolio, hard to spread money among many investments.

- Some syndications only allow accredited investors: As outlined above, some real estate syndications only permit wealthy accredited investors to participate.

- Delay before distributions start: Some syndications don’t start paying passive income distributions for a year or two. It often depends on the amount of “value add” required by the property — the more renovations or updates required, the longer before the property starts cash flowing well.

Understanding Returns on Real Estate Syndications

Understanding Returns on Real Estate Syndications

I’ve seen real estate syndications pay annual returns over 100%.

Of course, that’s not typical. More often you’re looking at 15-30% annual returns, including both cash-on-cash returns (yield) and capital gains when the property sells.

Which raises another point: sponsors use several measurements for returns on real estate syndications.

The simplest is equity multiple: what the property sells for, as a multiple for what they bought it for. For example, if you invest in a syndication that buys a property for $1 million, and you sell it five years later for $2 million, that’s an equity multiple of 2.0. If it sold for 80% higher than what you bought it for — $1.8 million — that would be an equity multiple of 1.8.

Another simple way to measure real estate syndication returns is the average annual return. It’s literally just the total return on the project after it sells divided by the number of years you owned the property. In the example above, if you sold the property for $2 million after five years, that would mean a 20% average annual return: a 100% return on the initial investment, divided by five years of holding it.

The reality looks a little more complicated, as most syndications pay cash flow distributions along the way. For example, say that same project paid out 7% per year in distributions while you owned it, before selling for twice the initial investment five years later. In that case, the average annual return would be 27%.

The most complicated — and most accurate — measure of real estate syndication returns is internal rate of return (IRR). It sounds complicated, and the calculation is complicated, but the concept is simple enough. It calculates the annualized return you earned, taking compound interest into account. Because investments compound over time, but most real estate syndications pay out most of their returns at the very end, you don’t get to reinvest most of those returns along the way. The IRR metric calculates what your annual return would be if you had received the return each year and reinvested it at the same rate.

If you like the idea of 15-30% returns on passive real estate investments, but want to invest with $5,000 instead of $50,000, check out our Co-Investing Club. Our “tribe” proposes a real estate syndication deal every month, and we all combine funds together so we can each invest with less.

Read more about ROI on real estate for a deeper breakdown of returns on syndications.

Real Estate Syndication Risks

When people first learn about real estate syndications, their eyes often see dollar signs at the enormous returns most syndication projects generate. But high returns never come without risk. Large commercial real estate deals can and do go wrong, leaving investors with low returns or even losses. The renovations could cost double the estimated amount, or take twice as long. Occupancy rates could come in lower than expected. The local housing inspectors could refuse to issue permits until getting paid hefty bribes (you laugh, but I’ve seen that happen). For that matter, the sponsor could take your money and run off to Guatemala. More mundanely, the local market could just see a housing market correction or a recession could strike. While rental properties are more recession-proof than most investments, they aren’t immune to economic downturns. Rents don’t typically drop, but vacancy rates and eviction filings do rise in recessions. So how do you mitigate these risks as you evaluate investment opportunities? First, vet the sponsor carefully. How long have they been investing in this real estate niche? How many real estate property deals have they done in the past? What’s their track record and past returns on those real estate projects? Have they ever lost investors’ money? Next, do your due diligence on the real estate deal itself. Is the local real estate market seeing population growth? Economic and job market growth? What’s the local unemployment rate? What class of property is it (A, B, C, etc.)? How conservative is the underwriting of the deal? At what occupancy rate would the deal break even? How much property leverage is the sponsor borrowing? Keep asking questions until you either have a hard yes or a hard no on the deal. If you’re still on the fence after asking all your questions, opt out of the deal.Real Estate Syndication vs. REITs

What’s the difference between a real estate syndication and a REIT (real estate investment trust)?

Real estate syndications are private equity investments, not traded on public stock exchanges and not necessarily available to the general public. Many are only open to accredited investors, with a net worth over $1 million or high incomes.

There’s no secondary market for selling your shares in real estate syndications. That means no liquidity: once you buy in, your money remains locked in the deal until the GP either sells the property or refinances it to return capital to you and the other investors.

In other words, approach real estate syndications as long-term investments. Once on the ride, you stay on until it comes to a full stop.

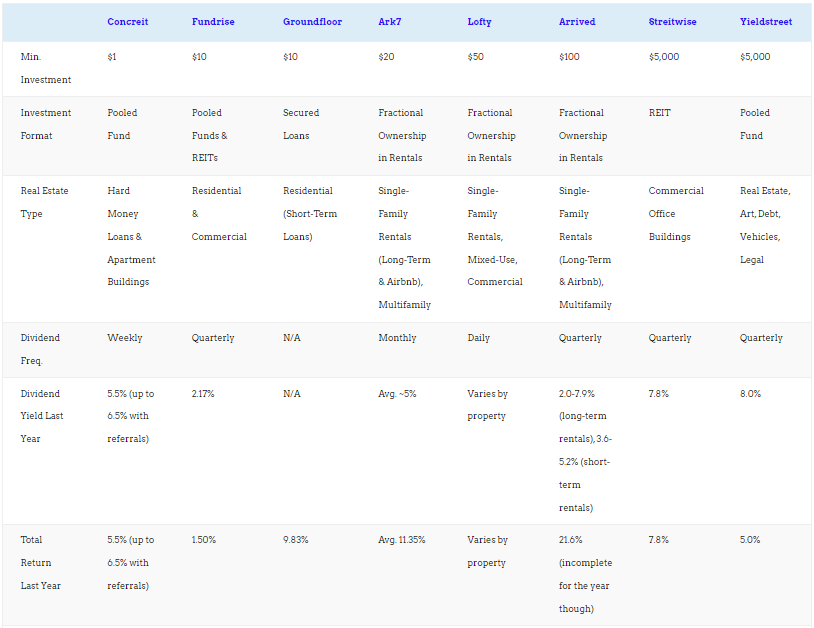

Real estate syndications also come with much higher minimum investments than public REITs. Most syndications require a minimum investment between $25,000 and $100,000 — hardly chump change. In contrast, you can buy shares in publicly-traded REITs for the price of a single share, often $10–$100.

If those all sound like downsides (and they are), real estate syndications come with several huge upsides. To begin with, REITs share too much correlation with the broader stock market. When the stock market falls, so do REITs in most cases, even if real estate markets remain strong.

Real estate syndications often pay dramatically higher returns. Public REITs, being available to the public, earn returns based on whatever Joe Six Pack is willing to accept. If you’re only willing to invest at a yield of 10%, but he’s willing to invest for a 7% yield, he’ll outbid you on the stock.

But real estate syndications are private investments, not easily accessible to every Jimmy and Joe. That exclusivity is precisely what drives up the returns.

See the other pros of real estate syndications outlined above. Personally, I avoid REITs and invest my own money in real estate syndications.

Real Estate Syndications vs. Crowdfunding

Real Estate Syndications vs. Crowdfunding

While real estate crowdfunding investments have more in common with real estate syndications than public REITs, they’re still available to the public. Some only allow accredited investors to participate, others allow anyone to invest, but they’re all publicly advertised.

Most real estate crowdfunding platforms allow investors to sell early, even if they charge a penalty for it. You have the option to pull your money out early, if you’re willing to take a hit. That option doesn’t exist at all for most real estate syndications.

Like real estate crowdfunding investments, some syndications allow equity investments, others offer debt investments. Some offer both. Debt investments pay more consistent and high cash flow, while equity investments offer more upside potential when the property sells.

If you’re new to passive real estate investing, start with real estate crowdfunding. You can more easily find public reviews of crowdfunding platforms than private real estate syndicators, making them easier to vet. Plus, you can usually invest at any time, rather than waiting for individual property deals to come along.

Tax Benefits of Real Estate Syndications

Syndications come with significant tax advantages, even for passive investors.

The syndication legal entity doesn’t pay any taxes itself — all profits and losses pass through to individual investors. That prevents double taxation.

It also means that all investors, including limited partners, get to take advantage of all property tax deductions. From loan interest to closing costs, repairs to property management fees and beyond, these deductions reduce the taxable income from syndications.

Most notably of all, those deductions include paper losses from depreciation. Even as investors collect distributions and cash flow, they typically show paper losses on their tax returns in the first few years due to accelerated depreciation. You can use those paper losses to offset passive income from other sources, but unlike how rental income is taxed, you can’t use losses from syndications to offset up to $25,000 in active income.

If you don’t have other streams of passive income to offset this year, you can carry the paper losses forward. They’ll come in handy when the property sells, and you get a fat paycheck (and tax bill).

You can also use 1031 exchanges with real estate syndications, but it’s tricky. If you want to 1031 exchange funds from another real estate sale into a syndication, you have to convince the sponsor to structure your investment as “Tenants in Common” rather than a typical LP investment. Most sponsors are only willing to do that for high rollers investing $500,000 or $1 million in their deal.

Alternatively, entire real estate syndications can 1031 exchange when they sell a property. But it requires all (or at least most) LPs to be on board, so it’s usually designed this way from the start.

FAQs About Real Estate Syndications

Still have questions about these group real estate investments? These answers might help.

What are the three phases of real estate syndication?

General partners for real estate syndications refer to three phases of a deal: the origination phase, the operation phase, and the liquidation phase. The origination phase involves finding a good deal, raising money to buy it, and closing on the property. As the name suggests, the operation phase involves managing the property, improving it, and raising revenues. And the liquidation phase involves selling the property for a profit.

How do real estate syndicates make money?

Real estate syndication deals make money by adding value to a property and raising the rents. Not only does that improve the cash flow while the sponsor owns the property, but it also increases the value of the property, as commercial real estate is priced based on net operating income and cap rates. By increasing rents and revenues, the sponsor adds value, adding profits upon sale.

What are different types of real estate syndications?

Real estate syndications fall into many buckets. To begin with, they could be a single property, a fixed portfolio of a few properties, or an open-ended fund that hasn’t yet bought all the properties. Syndications could include different types of commercial properties including multifamily apartment buildings, self-storage facilities, mobile home parks, retail or restaurant properties, industrial properties, office buildings, outdoor recreation such as campgrounds and RV parks, natural resources such as oil and gas, or agricultural properties such as farms or vineyards.

How do investors decide which real estate syndications to get involved in?

I mean… how do investors decide which stocks to buy? You invest based on your goals, risk tolerance, and investment hypothesis.

Look for deals in stable or growing markets, with investor-friendly local laws. Look for a fair profit split between the GP and LPs. Most of all, look for GPs with a strong and long track record of success.

I personally invest for diversification: I want to do deals in many cities and states, with different sponsors, and different property types. I don’t know what tomorrow will bring, but I know that with eggs in enough different baskets, the law of averages will help protect my returns.

How do you determine the potential returns of a syndication?

The sponsor provides you with projected returns, but it’s up to you to verify how realistic and conservative they are. Broadly speaking, returns come down to two main factors: how well the sponsor can raise revenues, and the exit cap rate.

Sponsors don’t have much control over the exit cap rate, so look for a “sensitivity analysis” showing how the deal would perform at different exit cap rates. The market might move, with buyers paying less for the same income levels.

Sponsors have more control over raising revenues. What’s their plan for improving the property to command higher rents? What’s their plan to improve property management and occupancy rates? Make sure you feel comfortable with their projections.

Final Thoughts

Real estate investors can make money in countless ways, from long-term rentals to short-term, flipping houses to wholesaling real estate, mobile home parks to self-storage to office buildings. And that says nothing of passive real estate investing options like REITs, private notes, and real estate crowdfunding.

But few real estate assets blend the high return on investment, positive cash flow, tax breaks, and hands-off nature of real estate syndication deals.

As you consider expanding your investment portfolio to include real estate syndications, keep your long-term investment goals and financial needs in mind. You may not get your money back for five years or longer — a deal breaker for many investors, regardless of the returns.♦

How do you see syndications fitting into your real estate portfolio? What questions do you have about them?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.

Real estate syndications are a great source of passive income. Invested in my first one last year, exceeded my expectations so far.

Glad to hear you’ve had positive experiences investing in real estate syndications Kevin!

I’m considering adding syndications in my portfolio but I need some guidance. Do you have any recommendations?

Hi Stephanie, we’re actually in the process of re-releasing our FIRE from Real Estate course, and one of the benefits we’ll be offering for our students is a list of vetted, reputable real estate syndication sponsors. We’ll even be coordinating joint venture investments in some, so our students can pool resources and invest with less capital.

Count me in! Please reach me through my email when it’s out.

The minimum investment between $25,000 and $100,000 in syndications gave me a second thought. I would rather go with crowdfunding.

I hear you Leonard! We’ll soon be letting our students invest with $5-10K, but that’s still a lot more than the $10 that some real estate crowdfunding companies allow.

$5-10K is still a little bit high but I can take that. A lot better than $50-100K.

Real estate syndications are a go-to for experienced investors. It’s almost like a trade secret in the industry.

Agreed Oscar!

I’ve been curious to real estate syndication for many months. The time has come for me to join the club!

Glad to hear it Aliza!

Love the idea of splitting the minimum investment with other investors. I’m big on diversification, so the less I can invest in each syndication deal, the more I can spread my money among many different deals, cities, etc.

I agree wholeheartedly Patrick!

Been something that I keep hearing about. Going to look into your investment club and see if it’s a good fit.

Keep us posted about your questions Jenn!