In decades past, when investors wanted to add real estate to their portfolios, they’d buy shares in public real estate investment trusts (REITs).

But do publicly-traded REITs actually offer any diversification benefit? How correlated are their returns to stocks?

Strap in as we break down REITs versus other real estate investments, and how REITs have performed compared to stocks.

REITs vs. Stocks Returns

Real estate REIT stocks offer access to the real estate market without direct ownership responsibilities. They serve as passive investment vehicles for income-generating real estate assets.

Some investors think of REITs as “safer” investments than stocks because they pay high dividend yields and can be less volatile than the stock market. But they can fall just as fast as stocks, buyer beware.

There are two main types of real estate investment trusts: equity REITs and mortgage REITs. Equity REITs invest in income-producing real estate and earn income through rents. Mortgage REITs lend money directly to real estate owners and operators or indirectly through the purchase of mortgages or mortgage-backed securities, earning interest on them.

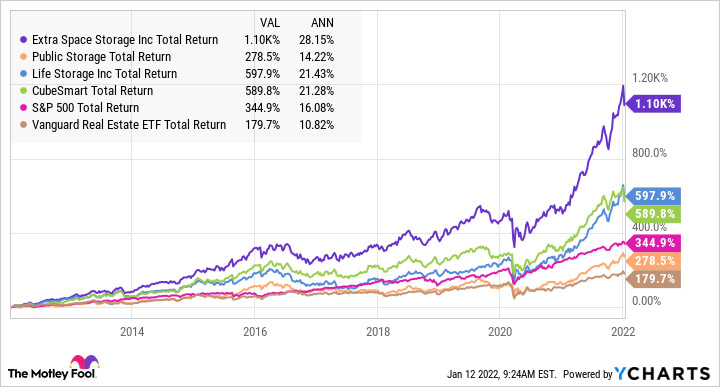

The following chart from The Motley Fool shows the performance of some of the most common REITs compared to the S&P 500 from 1994 to 2021:

| REIT SUBGROUP | AVERAGE ANNUAL TOTAL RETURN (1994 TO 2021) |

|---|---|

| Self-Storage | 18.8% |

| Industrial | 15.8% |

| Residential | 14.4% |

| Health Care | 12.7% |

| Office | 12.1% |

| Retail | 12.1% |

| Diversified | 9.3% |

| Lodging/Resorts | 9.3% |

| S&P 500 | 10.8% |

Stocks, on the other hand, are direct investments in companies that own and manage real assets. Investors who buy stocks buy a piece of the company and therefore a share of the company’s profits. When these companies grow their revenue, investors see their stocks rise.

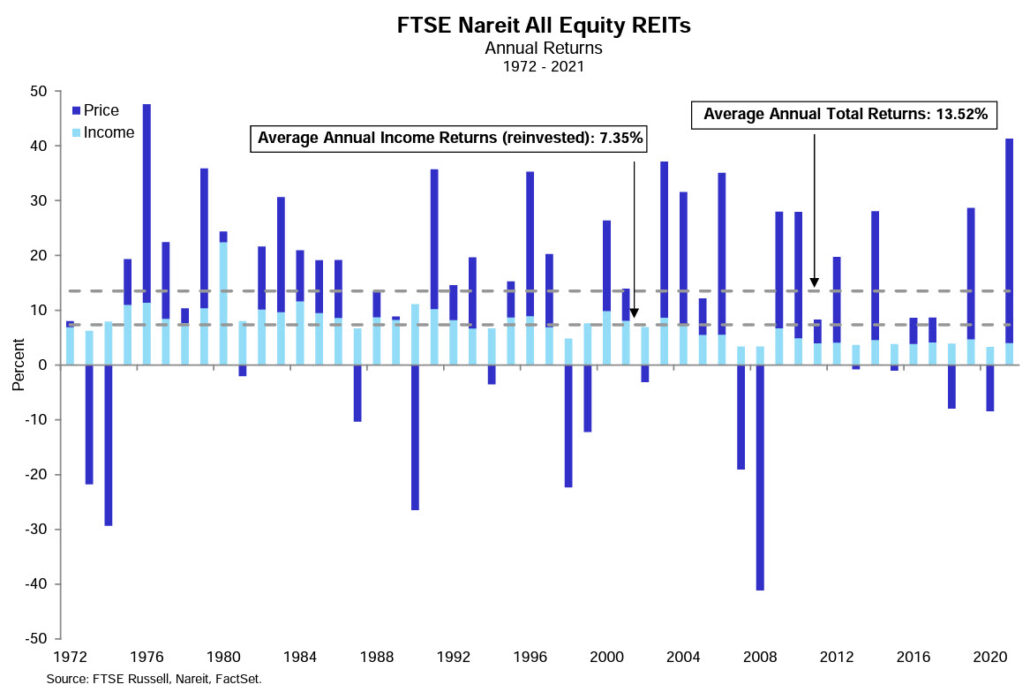

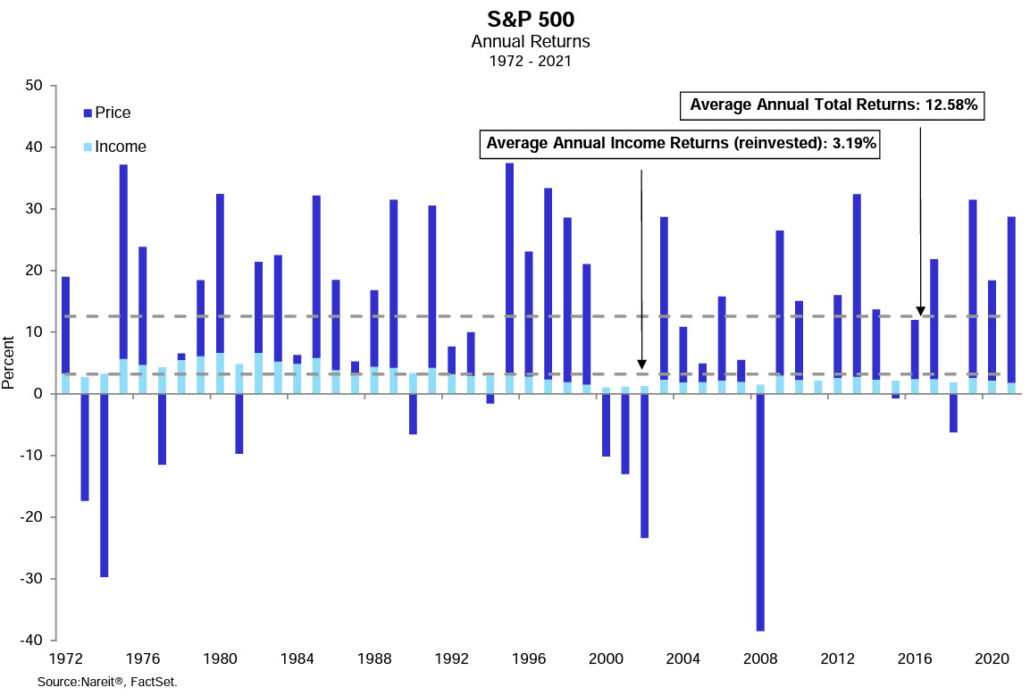

The chart below from Nareit shows that the long-term annual average return of the stock market has been 10%, but year-to-year returns can vary significantly.

Historical Performance of REITs

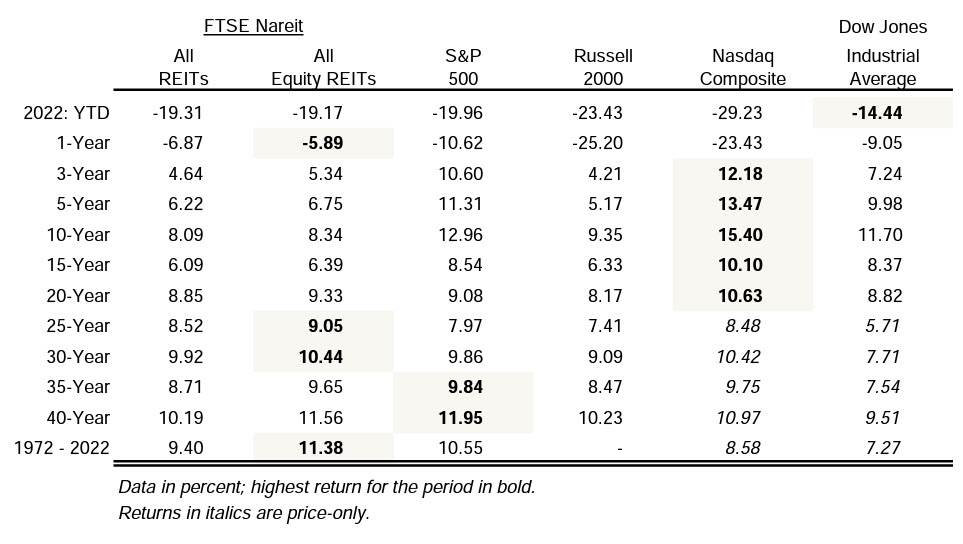

REITs have historically performed better than many asset classes. Over a 25-year period, the FTSE NAREIT All Equity REITs Index has returned 9.05%, and over a 30-year period, it has returned 10.44%.

Crunching numbers from Nareit, the total average annualized from U.S. REITs between 1972-2023 came out to 10.28%. Bear in mind that the bulk of the returns from REITs has historically come from dividends. Of that 10.28% average return, 7.33% came from dividends, with the other 2.95% coming from share price growth.

It makes sense, if you think about it. The SEC requires REITs to pay 90% of their annual profits back out to shareholders in the form of dividends. That leaves little left over to reinvest in growing the business.

Historical Performance of Stocks

In the last 3 decades, stocks have performed slightly lower than REITs. Nevertheless, stocks remain a sound investment historically. Over a 25-year period, the S&P 500 returned 7.97% and 9.86% over a 30-year period.

Because you can invest in cheap, passive index funds, it’s extremely easy to diversify your stock holdings. A single ETF mirroring the S&P 500 gives you instant ownership of 500 companies. And you can similarly invest in U.S. small cap indexes like the Russell 2000, or international indexes for broad exposure to overseas companies.

Stocks vs. REITs: Differences

REITs offer investors a way to invest in real estate without purchasing, managing, or financing income-producing properties directly.

Stocks, on the other hand, are shares of ownership in a publicly traded company. They both differ in volatility, structure, dividends, and tax status.

Volatility

REIT stocks are typically volatile due to market risk, because they trade on major stock exchanges and are subject to price movements on financial markets. There are many causes of market risk, including recessions, changes in interest rates, natural disasters and political events. When any of these events occur the financial markets tend to react with mass selloffs or price run-ups, and REITs are no exception.

Some markets have more volatility than others, meaning they swing widely in either direction over time. The potential for large swings in the market due to any of these factors can make stock investments risky, but also potentially very profitable in the long run.

The volatility of most real estate REIT stocks is lower than the volatility of stocks on the S&P 500, with some only half as volatile as the market at large. This is because REITs tend to focus on income-producing properties such as office buildings, apartments, and shopping malls, which are less sensitive to market fluctuations than stocks. Additionally, REIT companies tend to have a naturally diversified portfolio, which helps to reduce volatility.

Structure

REITs are structured like mutual funds, pooling private investor capital into one fund to be invested as a whole. REITs then buy, lease and sell real estate or property-secured debts. Income from these investments is distributed as dividends to shareholders and private investors. Dividend payments provide investors with steady income and potential capital gains.

In the case of stocks, the value of a single share (its price) does not matter as much as the ownership it represents. Companies can issue different types, series, and classes of shares. Every company has at least one share class. A class of shares may have one or more series within it if the restrictions and special rights connected to that class permit this inclusion.

Each of these structures have their own unique advantages. While the best REIT dividend stocks focus on diversification, the best stocks are more flexible and can be easily tailored to investor goals.

Dividends

Stock dividends are usually paid quarterly, either in cash or additional stock. Shareholders of dividend-paying companies are entitled to receive dividends as long as their shares are owned before the ex-dividend date. Dividend yield is the annual dividend per share and is expressed as a percentage of a company’s share price.

REITS must distribute at least 90 percent of their taxable income as dividends. These payouts can be made in cash or a combination of cash and stock, but shareholders must choose how they receive dividend distributions. Some REITs pay dividends monthly, others quarterly or annually.

Given that 90% payout requirement, REITs typically pay higher dividend yields than stocks. This means investors can expect regular dividend payouts, regardless of market conditions. Stocks do not necessarily have to pay dividends. This means that companies may cut dividend payouts under certain circumstances such as weakened earnings or insufficient profits.

Tax Status

REIT dividends are taxable at different rates depending on whether they are allocated to ordinary income, capital gains or return on capital. The 2017 Tax Cuts and Jobs Act allows individual REIT shareholders to deduct 20% of their Qualified Business Income. This includes all Qualified REIT dividends but excludes capital gains distributions. There is no limit on the deduction and it is not based on wage restrictions. Investors do not need to itemize deductions to receive this benefit. The highest effective tax rate on Qualified REIT dividends is 29.6%.

Beware that dividends are taxed as ordinary income. However, 20% of REIT dividends can be deducted as QBI deduction while stock dividends do not qualify for this deduction.

When you sell either REIT or stock shares, you pay capital gains tax on it. If you held the shares for under a year you pay your regular income tax rate, but if you held them for over a year you pay the lower long-term capital gains tax rate (0% or 15% for most Americans). Read up on the tax implications of selling commercial real estate, and ways to defer or avoid capital gains tax on real estate.

Do REITs Correlate With the Stock Market?

There is a correlation between the stock market and publicly traded REITs. Because REITs trade on public stock exchanges, they provide the same liquidity and ease of investing as stocks.

But the liquidity of trading on stocks exchanges creates some huge downsides for REITs. To begin with, they often move in tandem as investors get jittery or exuberant. This exposes REITs to not just the same volatility as stocks, but also an uncomfortably close correlation.

How close? One study over two decades found a correlation of 0.59 between REITs and the total U.S. stock market. If your middle-school math is rusty, a correlation of 0 means no connection at all, and a correlation of 1 equals lock-step movements.

A correlation of 0.59 puts REITs in the same ballpark correlation to the broader stock market as energy stocks, telecommunications stocks, and consumer staples. In fact, REITs correlate much more closely with the broader stock market than utility stocks do.

Take a look for yourself how correlated they were from 1972-2022:

That correlation means REITs don’t actually offer much diversification benefit. If you want to add real estate to your portfolio to diversify it, adding REITs won’t help you much, because a stock market crash is likely to tank your REIT stocks too.

Related Article Read: How to reduce capital tax gains on real estate?

Beyond REITs: True Real Estate Diversification

While REITs are cheap, liquid, and easy to invest in, the close correlation with stock markets makes them a poor way to diversify away from stocks. Fortunately, they’re far from your only option for real estate investing.

1. Direct Property Investing

You can always go out and become a landlord!

Buying rental properties offers benefits including tax advantages, ongoing passive income, long-term wealth creation, and capital appreciation. Additionally, direct property investors can benefit from increased control over their investments.

2. Real Estate Equity Crowdfunding

Real estate equity crowdfunding is a form of fundraising where investors buy a stake in a real estate project. This form of crowdfunding allows investors to invest in real estate projects without purchasing the entire property. The investors receive a fractional ownership in a property and share in the profits generated by the project.

Investors can purchase shares in a variety of real estate projects, including residential and commercial properties, construction projects, and land development. Check out Fundrise for a good example of diverse real estate funds, and Arrived or Ark7 as options for buying fractional ownership in a single rental property.

3. Real Estate Debt Crowdfunding

Real estate debt crowdfunding involves funding loans secured by real estate. Instead of owning a share in a property, you earn interest on a loan (or a pool of loans).

For example, check out Groundfloor as an option that lets you fund short-term purchase-rehab loans for $10 apiece, paying 8-14% interest on average. You get your interest when the loan repays, usually in 2-12 months.

Alternatively, you can invest in pooled funds that let you pull your money out at any time through Stairs by Groundfloor or Concreit. That liquidity comes at a cost however — they pay 4-6% interest.

4. Real Estate Syndications

Real estate syndications are a type of real estate investment that allows multiple investors to pool their money and resources together. This allows them to purchase, maintain, and sell a large property or a portfolio of properties. Syndications are structured as limited partnerships, and each investor is typically a limited partner in the syndication, receiving investment distributions.

The limited partnership is managed by one or more general partners who manage the property portfolio, distribute profits and communicate with investors using real estate syndication software platforms.

The general partner finds properties to purchase, manages them, and sells them. As a passive investor — called a limited partner — you just sit back and collect cash flow distributions.

Real estate syndications pay huge returns (typically 15-30%) and come with nearly all the same tax benefits as direct ownership. The main downside is that they require high minimum investments, usually $50,000 – $100,000. You can get around those by investing as part of a real estate investment club.

Which Types of Properties Have Historically Outperformed Stocks?

The following real estate asset classes have historically outperformed stocks.

Self-storage

The flexibility of self-storage facilities makes them incredibly resilient through all economic cycles. After all, in recessions many people downsize, leaving them without enough room in their new home for all their belongings.

Self-storage facilities have low overhead costs, making them an appealing asset class. The smaller and mid-size units do not need much hands-on management, and can get by with only part time managers.

Based on annual performance data since 2012, self storage REITs have outperformed all other REITs as well as the S&P 500 over the last decade.

Industrial

Industrial real estate is a hot property sector. It’s seen sustained demand from tenants since 2016, and that demand has led to record rental growth, significant increases in land value, and ultra-low vacancies.

Also, industrial real estate investment trusts have outperformed all other commercial real estate investment trusts by sector over the past five years. For example in 2021, the industrial sector earned an annual total return of 32.38%, according to The National Council of Real Estate Investment Fiduciaries’ (NCREIF) data; over double the next leading CRE sector.

And while warehouse space and logistics facilities are seeing high demand, there are new drivers that may support sustained demand for industrial properties in 2023 and beyond.

Residential

Single-family rentals have historically offered more attractive risk-adjusted returns than the S&P 500 and bonds.

Two factors have driven momentum in the single-family rental market: jobs and interest rates.

And unlike bonds and stocks, real estate investing offers the opportunity to leverage a portion of the purchase price by taking out a mortgage.

Senior Living Centers

Given America’s aging population, continued healthcare problems and rising healthcare costs, many believe that the healthcare industry has a very bright future in the U.S.

And they’d be right: according to the Bureau of Labor Statistics (BLS), employment in healthcare occupations will grow 16 percent between 2020 and 2030, far outpacing the average for all occupations. This equates to roughly 2.6 million new healthcare jobs over this period.

And even if economic conditions sour, people will still need medical attention and care.

What Happens to REIT Stocks When Interest Rates Rise?

A rise in interest rates can lead to a decline in the price of REITs. While dividends may increase with interest rates, publicly-traded REITs may decline. This is because higher rates decrease the value of existing fixed-rate mortgages held by REITs. Higher rates also reduce the value of future cash flows from mortgage-backed securities. As a result, REITs may become less attractive investments for investors, leading to a decline in their prices.

So, are REITs and stocks correlated? While there is some variation in the degree of correlation, they’re more correlated than the underlying value of real estate assets would justify on its own. This has been attributed to the fact that public REITs are driven by the same macroeconomic forces that affect the stock market. These forces include interest rates and economic growth. Although public REITS provide solid returns over time, they are susceptible to market forces.

But REIT stocks are just one of many options for real estate investing. Direct property investing, real estate crowdfunding, and real estate syndications all present unique opportunities for investors to diversify their portfolios and generate returns. Investing directly in properties gives you less correlation (and therefore greater diversification).

Real estate investing is now easier than ever. Small-time investors can participate in large real estate property deals and developments through real estate syndications. In low inventory markets where finding the right deals for the right price might be hard, investors can pull resources together and co-invest in properties. Check out SparkRental’s real estate investing club where members can invest in vetted real estate deals for as little as $5,000 apiece.♦

Do you invest in REITs? How else do you invest in real estate to diversify your investment portfolio?

Too much correlation for my taste. I steer clear of public REITs.

I hear you Liam!

I invest in real estate and non-traditional investments which have had higher returns than traditional asset classes over the last few decades. Important not to just do what everyone else is doing.

Agreed MJ!

The article says a correlation of .59 between REITs and the stock market (I presume the S&P 500) is too high. What’s missing is the correlation between crowdfunded real estate investments and the stock market. I’m quite sure it’s less than .59, but we need a solid number to make a reasoned judgment.

As for the sickening volatility of REITs from year to year, it’s only fair to look at a reasonable holding period. If people can go in and out of crowdfunding investments in a year and do so, then REIT volatility is comparatively horrendous. If the holding period is 10 years, the REITs’ returns smooth out. Tax liability is an issue too in taxable accounts. As long as tax laws don’t change, tax effects in REITs are steady. My understanding is that taxes on real estate investments can be volatile.

Please ignore my reply above. It was supposed to be a comment about the article, not a reply to your post.

Everyone who started investing in the broad stock market after 1933 has done OK following the crowd if they stuck it out long enough. Even those who started in Sept. 1929 did OK if they lived long enough. But like you, I’m always loooking for an edge. I had one in time zone arbitrage but then the mutual funds took it away. What non=traditional investments are you investing in, and importantly in the context of this article, what is their risk profile?

Excellent financial data and analysis. Very insightful.

Thanks Neil!

This question never occurred to me to ask, about how correlated REITs and stocks are. But for diversification, it’s THE question. Good stuff guys, thanks.

Glad you got something out of it Anya!

Glad to see you guys diving into this question. For me as a real estate investor, diversification is a topic that not enough people talk about.

Thanks Alexandra, and I agree!

REIT stocks can be risky because their prices often change a lot due to market factors. It’s important to think about these things before making any decisions.

Very true Sevanna!

Ugh, my comment turned into a reply somehow. Trying again….

The article says a correlation of .59 between REITs and the stock market (I presume the S&P 500) is too high. What’s missing is the correlation between crowdfunded real estate investments and the stock market. I’m quite sure it’s less than .59, but we need a solid number to make a reasoned judgment.

As for the sickening volatility of REITs from year to year, it’s only fair to look at a reasonable holding period. If people can go in and out of crowdfunding investments in a year and do so, then REIT volatility is comparatively horrendous. If the holding period is 10 years, the REITs’ returns smooth out. Tax liability is an issue too in taxable accounts. As long as tax laws don’t change, tax effects in REITs are steady. My understanding is that taxes on real estate investments can be volatile.