Real estate investments can offer some huge tax breaks — if used wisely. In fact, some investors opt for real estate specifically for the tax breaks!

But how is rental income taxed? What other taxes do landlords and real estate investors pay? How can you avoid the worst of these taxes?

Leave your watch calculator at the door, and we’ll break down rental property taxes in layman’s terms.

How Rental Income Is Taxed

As a general rule, the IRS classifies rental income as passive income and taxes it accordingly. That means you pay taxes on it at your regular income tax rate, between 10-37% of your income. Womp womp.

But there are plenty of other rules, exceptions, caveats, deductions, and loopholes that affect rental property taxes beyond how passive income is taxed.

Strap in.

Passive Activity Losses

Broadly speaking, you can’t offset active income (like your W2 salary) with passive losses (like losses on stock investments).

But there are special rules for how rental income is taxed. If you “actively participate” in overseeing rental activities, you can offset your active income with up to $25,000 in passive losses each year.

For example, say you have a modified Adjusted Gross Income (MAGI) of $80,000, and you lost $24,000 on paper on your rental properties. You can deduct that $24,000 to reach a taxable income of $56,000.

To count as an active participant, you don’t have to field 3AM phone calls or unclog toilets. You do need to own at least 10% of the property and be involved in major management decisions such as approving and screening tenants, approving repairs, or raising rents. That means you can still hire a property manager and deduct passive rental losses.

That’s the good news. The bad news is that the ability to offset active income with rental losses starts phasing out at a MAGI of $100,000, and disappears entirely above $150,000.

Do Landlords Pay Self-Employment Taxes?

Most landlords don’t have to pay self-employment taxes (FICA taxes of 15.3%). That’s because of how rental income is taxed: as passive income on an investment, rather than an active business.

The tax code does make a few exceptions however. If they classify you as a “real estate dealer,” they make you pay self-employment tax on rental income. Real estate dealers are those considered to be in the business of buying and selling real estate, such as full-time house flippers.

You must also pay self-employment taxes on rental income if you provide additional paid services to your tenants. For instance, if you own an apartment complex and provide add-on services like dog walking, laundry, dry cleaning, and maid services, you likely have to pay self-employment taxes not just on that income but also your rental income. You go from collecting passive income streams to becoming a real estate professional with active business activities.

When in doubt, talk to a CPA about how you can avoid paying self-employment taxes on rental income.

The 14-Day or 10% Rule

Which properties count as second homes and which count as rental properties?

If you rent out a property for 14 days or fewer in a given year, it counts as a personal residence or vacation home. You don’t have to declare the rental income — but you also can’t deduct rental expenses. You can deduct mortgage interest and property taxes, just like on your primary residence, but it requires that you itemize your personal deductions rather than taking the standard deduction.

The property also counts as a second residence if you used it more than 14 days or 10% of the total days that it was rented. So if you rent it out for 90 days and use the property personally for 10 days, you can’t classify it as a rental property and deduct rental property expenses on your Schedule E.

Oh, and it must be rented out at fair market rent. Charging your brother a monthly rent of $50 doesn’t count, for a vacation property with a purchase price of $500,000.

If you lease out the property for more than 14 days and personally use it less than 10% of the days it’s rented, it counts as a rental property. That means you can take rental property deductions (more on these shortly).

Other Types of Taxes Landlords Pay

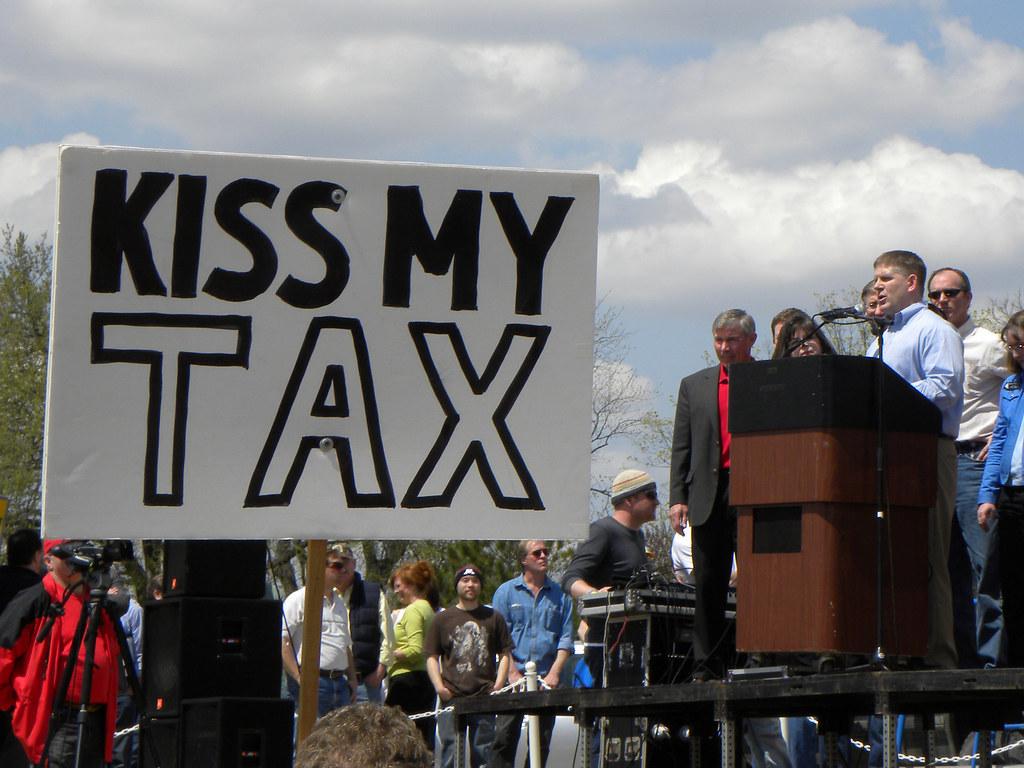

Before all the tax crusaders get too frothy about how landlords should pay even more in taxes than they already do — and rental income is taxed at the ordinary income tax rate — bear in mind that they do pay even more taxes.

Real estate investors pay property taxes, to begin with. Like landlord insurance, vacancy rate, property management fees, and repairs, property taxes are an expense that landlords should include in their expense figures when calculating rental cash flow.

When landlords sell a property, they pay capital gains taxes on it. If they own the property for under a year, they pay short-term capital gains, taxed at their regular income tax rate. Properties owned for more than a year qualify for the lower long-term capital gains tax rate. Fortunately, you do have some options to reduce or avoid capital gains taxes on real estate investments, such as 1031 exchanges).

Landlords also have to pay depreciation recapture tax when they sell a property — even if they never took depreciation on it. More on depreciation shortly.

In most states, landlords must also pay state income taxes, and sometimes local income taxes too. Which says nothing of local fees charged to landlords, such as rental property registration fees.

Finally, landlords pay sales tax on all materials they buy for repairs and capital improvements. At least in states that charge sales tax, which is most of them.

How to Reduce Taxes on Rental Income

Despite the high tax rate on rental income, landlords do have a few options in their toolkit for reducing taxes.

Rental Property Deductions

First and foremost, rental investors can and should take advantage of every landlord deduction they possibly can.

Remember, landlords take their rental property deductions on the Schedule E form of their tax return. That means that all expenses count as above the line deductions, and you can take them while also taking the standard deduction for yourself personally.

Here are a few common operating expenses you can take as rental property deductions:

-

- Mortgage interest

- Repairs and maintenance

- Property management fees

- Property taxes

- Rental property insurance

- Rent default insurance

- Homeowners association or condo association fees

- Marketing fees (such as listing your property for rent)

- Tenant screening fees

- Legal fees (such as buying a state-specific lease agreement)

- Accounting and bookkeeping costs

- Travel expenses

Don’t pay taxes on income you didn’t actually earn!

As a final note, security deposits do not count as investment property income. The exception: if you deduct part or all of the tenant’s deposit to cover damage. In that case, it counts as a type of income, but that’s offset by the costs you incurred to repair the damage.

Rental Property Depreciation

Landlords can deduct the cost of the building itself, certain closing costs, and any capital expenditures that improve it or extend its life. You just can’t take the deduction all at once.

Instead, you have to spread it over 27.5 years. It’s called depreciation, and it’s not as complicated as it sounds. Use our rental property depreciation calculator to see how much you can deduct as an annual depreciation expense.

Bear in mind that you’ll owe depreciation recapture when you sell the property, even if you don’t take depreciation now. That means you’ll pay taxes twice if you don’t take depreciation each year that you own your property.

Qualified Business Deduction

Some business owners can take an extra 20% deduction on qualified pass-through business income. Known as the qualified business income (QBI) deduction, pass-through deduction, or Section 199A deduction, it gets complicated fast.

Talk to your tax professional about whether you qualify to take it; in the meantime, here’s some titillating reading from the IRS about it.

(article continues below)

Rental Income Tax Calculation Example

So, how does this actually look in real life?

Say you own a rental property that generates $24,000 in gross rental income (you collect $2,000 per month). You deduct the following expenses for it:

-

- Mortgage interest: $10,000

- Property taxes: $4,000

- Landlord insurance: $1,000

- Repairs and maintenance: $2,600

- Property management fees: $2,400

- Legal fees: $30

- Accounting and bookkeeping costs: $170

- Travel costs: $100

You calculate depreciation as follows: You bought the property $250,000, and $200,000 of that was the value of the building rather than the land. That means you can deduct $7,272.73 for depreciation (1/27.5th of $200,000).

That comes to a total of $27,572.73 in deductible expenses. Thus, on paper, you took a loss of $3,572.73, which you can (probably) use to offset your other taxable income.

How to Report Rental Income on Your Tax Return

You enter both your gross rental income and all rental property expenses (including depreciation) on Schedule E of Form 1040.

As noted above, that means you can take rental property tax deductions and also take the standard deduction personally. You don’t need to itemize your personal deductions.

Online tax preparation software will guide you through it, as will an accountant. You can also do it easily enough on your own, but your time is valuable and you’d probably rather spend your Saturdays with your family or friends than hunched over a pile of tax return documents.

Why Do I Have to Pay Tax on Rental Income?

Because the IRS hates you and wants to punish you. The end.

Well, not entirely. Every American has to file a tax return and pay federal income taxes. We can disapprove of how the government manages our money, but the simple fact is that we still need a government, and it costs money to run. So it taxes us on every dollar we earn — not just our salary or self-employed income, but also our investment income.

You can use deductions and depreciation to reduce your tax liability on rental income. You may even create paper losses while collecting strong rental income in the real world. But eventually you’ll have to pay the piper when you sell, reimbursing Uncle Sam for depreciation recapture.

I deeply disapprove of our government’s fiscal policies, so I spend most of my year living overseas and take advantage of the foreign earned income exclusion. That also helps me avoid paying state and local taxes on rental income. If that sounds appealing to you, check out this couple’s story of moving to Europe and living on a houseboat as fun and cheap alternative housing.♦

How do you lower your effective tax rate come tax season? Share your tips on reducing real estate taxes below!

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

I have to admit; I always want to get away with avoiding taxes but always end paying them anyway.

Haha, I hear you George!

Informative content.

Thanks Ceaser!

These are great info for paying taxes! Thanks for the share!

Thanks Carla!

Living overseas to gain advantage is pretty interesting to me… I’ll think about it.

I’ve enjoyed it!

I need to practice this. Thanks for sharing!

Glad you found it helpful Junior!

Any 401 Ks, Ira, accounts ?? for Landlords with 100 % passive income ? Thanks Mike

You can invest in rental properties through self-directed IRAs, but it comes with some administrative costs, limitations, and accounting headaches. Honestly I don’t really recommend it. Everyone should have some stocks in their portfolio for diversification, so you might as well own those stocks in your regular IRA or 401(k). Real estate comes with some good tax advantages as is.

Aside from my X-es, tax is the next thing I want to avoid but I have to deal with it every time it slams in front of my face!

Haha, I hear you Jessica!

need to know more about HUD rental

Hi Peter, what do you mean?