At the risk of stating the obvious, real estate costs a lot.

That makes it expensive to invest in, and difficult to diversify among real estate investments. The median home price in the US is around $350,000, so an investor who buys a median property with a 20% down payment would need to come up with $70,000. And that doesn’t even include closing costs or property updating costs!

So what’s an investor to do if they want to add real estate investments to their portfolio, but only have $1,000 to invest?

Here’s how to invest $1,000 in real estate, whether you’re just getting started or simply want to diversify your existing investments.

How to Invest $1,000 in Real Estate

Yes, real estate is expensive. But in today’s world, you have plenty of options to invest $1,000 in real estate without hassling with 20% down payments.

The following types of real estate investments don’t require much cash, allowing you to get started with just $1,000 to invest.

1. Fractional Ownership in Properties

Several platforms let you buy fractional shares of individual properties.

The best known of these is Arrived Homes. They buy single-family rental properties in suburban neighborhoods across the United States, and you can buy shares in those properties at $10 increments. The minimum initial investment: just $100 per property.

Each quarter, Arrived Homes pays out dividends to you based on the net rental income collected for the property. After five to seven years, they sell the property, and you collect your share of the profits.

Accredited investors can also buy fractional ownership in rental properties through Roofstock One.

If you prefer commercial or mixed-use properties, accredited investors have a few options to choose from. Reputable crowdfunding platforms include EquityMultiple, RealtyMogul, and CrowdStreet. All let you buy fractional shares in apartment buildings, parking garages, mixed-use buildings, and other alternative investment properties that you wouldn’t be able to afford on your own. Like Arrived Homes, you typically collect dividends on the cash flow generated from each investment property.

Non-accredited investors can expect a harder time buying fractional ownership in individual properties however. If you’re not an accredited investor and you want to buy partial ownership in commercial properties, try public or private REITs.

2. Publicly-Traded REITs

The most traditional option on this list, anyone can buy shares of real estate investment trusts (REITs) through their regular brokerage account.

These companies trade on public stock exchanges, which makes them extremely liquid. You can buy and sell instantly, unlike brick-and-mortar real estate that takes months to buy or sell.

And you can buy with an extra $100 sitting in your bank account collecting dust, so there’s no financial barrier to entry.

A combined strength and weakness of publicly-traded REITs is their dividend yield. The Securities and Exchange Commission (SEC) requires all publicly-traded REITs to pay out at least 90% of their profits each year to shareholders, in the form of dividends. That keeps their dividends high, but it also makes it hard for REITs to reinvest their profits and build their portfolios. In turn, that limits their growth potential.

Their liquidity also cuts both ways. Because they trade on public stock exchanges, they tend to move in disturbing correlation with stock indexes. That largely defeats the purpose of diversifying into another asset class.

Consider VNQ, the Vanguard Real Estate Index Fund ETF Shares, with broad exposure to US REITs. In the pandemic-induced stock market crash of 2020, shares fell 44%. But US real estate values didn’t fall at all — quite the opposite. From March 2020 to March 2021, US home values actually rose 13.3% per the S&P CoreLogic Case-Shiller 20-city home price index. By late May 2021, share prices in VNQ hadn’t even fully recovered their 2020 peak, despite such strength in US housing markets.

In short, publicly-traded REITs make for easy, liquid real estate investments that you can buy with $1,000 dollars or $10. As a starting point for investing in real estate, consider these top REITs for beginners.

Just understand that publicly-traded REITs don’t provide much in the way of diversification.

3. Real Estate Crowdfunding: Private REITs

The most common type of real estate crowdfunding investments work similarly to REITs: pooled funds that own real estate directly or lend money secured against real properties.

However, they come with two distinct differences. First, they don’t trade on public stock exchanges — you buy shares directly from the crowdfunding platform. That makes them far less liquid, and also far less volatile. They don’t move in sync with stock indexes, so they provide real diversification.

In fact, most real estate crowdfunding platforms require you to hold shares for at least five years. You can usually sell shares back to them before then, but at a discounted price.

The second difference is that crowdfunding platforms don’t have to classify their investments as REITs. That means crowdfunding platforms don’t inherently need to distribute 90%+ of their profits back to investors each year, and have more flexibility to reinvest them to keep growing their portfolios.

That can mean lower dividend yields, but it also means far greater potential for share price appreciation.

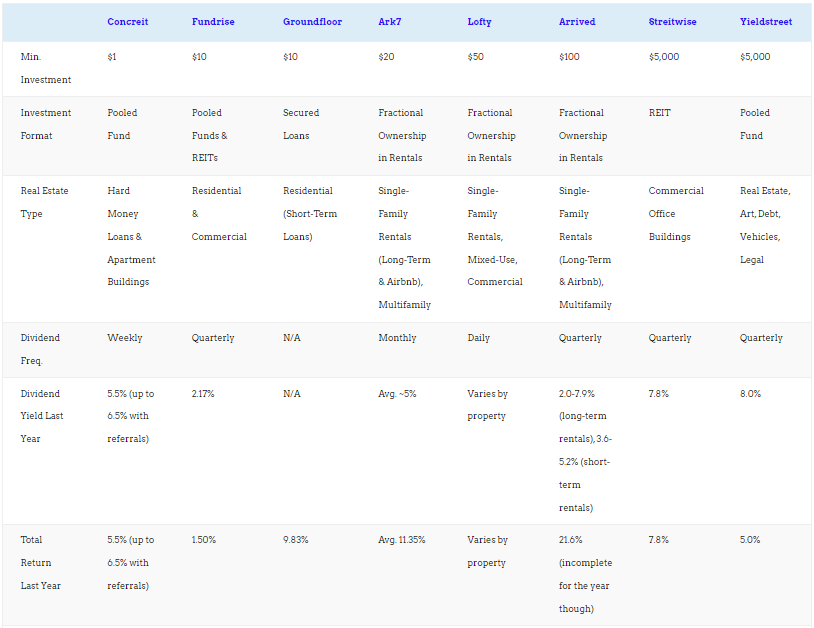

My two favorite crowdfunded REITs are Streitwise and Fundrise. Both allow non-accredited investors to invest, unlike many real estate crowdfunding companies. Streitwise specializes in commercial real estate, specifically office buildings and mixed-use properties in “non-gateway markets” (read: second-tier cities like Indianapolis and St. Louis, rather than the New Yorks and San Franciscos of the country). They’ve paid out 7-10% dividend yields every year since inception.

Fundrise specializes in residential apartment buildings, although they also own some commercial properties and single-family rental properties. You can choose between several REITs, some more dividend-oriented and others more growth-oriented. In addition to owning properties directly, they also lend money against real estate for even more diversification.

For full disclosure, I own shares in both, and have been largely happy with them. Fundrise lets you invest with just $10, although Streitwise recently raised their minimum investment to $5,000. On the plus side, Streitwise maintained their 8%+ dividends throughout the coronavirus pandemic — a time when most commercial real estate struggled. They also now allow you to invest via cryptocurrencies in addition to cash transfers.

4. Real Estate Crowdfunding: Loans

Some crowdfunding companies offer a different model, investing in real estate-secured debt rather than property ownership.

Consider Concreit. They operate a pooled fund with over 150 real estate loans, all short-term. Unlike every other real estate crowdfunding platform, they let you pull out your money at any time, with no loss of principal. That kind of liquidity is unheard of in real estate investing, outside of public REITs. Concreit pays an annual dividend yield of 5.5%, with payments every single week.

Other crowdfunding platforms let you put money toward individual mortgage loans secured by real property. My favorite of these is Groundfloor. It allows non-accredited investors, so you don’t need to be wealthy to invest. In fact, their minimum investment is only $10. Who doesn’t have an extra $10 lying around? Skip a couple of lattes this week and test out a new real estate investment.

They operate as a hard money lender, issuing purchase-rehab loans to flippers. Flippers borrow short-term loans from them to buy and renovate properties, then pay it back when they sell the property 6-12 months later. Or refinance with a long-term rental property loan, if they follow the BRRRR strategy.

You get to pick and choose which Groundfloor loans you want to put money toward, in increments as low as $10. They grade the loans based on risk, from A-F, with higher risk loans paying out higher interest rates. Annual returns range from 7-15%, depending on the risk level. You can spread your money around to as many loans as you like, to diversify and spread both your risk and returns.

Alternatively, Groundfloor now offers a similar pooled fund model as Concreit. It pays 4-6% interest, and offers even better liquidity than Concreit, letting you pull out your money at any time with no penalty.

Time for the same disclosure: I myself invest my own money in Concreit and Groundfloor loans. And again, my experiences have been positive.

5. Private Notes

Know some successful real estate investors personally?

You don’t have to go through a crowdfunding company to lend money to other real estate investors. You can lend it to them directly, in the form of a private note.

A “note” is the legal document that a lender and borrower sign, as a promise to repay the loan according to specific terms.

I have some money lent out to a successful real estate investing couple that I know. Every quarter, they send me interest on our 10% note.

Whether you secure your note against a property as collateral is up to you. It does involve recording a deed of trust in the county records office, and if your borrower defaults, you have to go through the long, expensive foreclosure process to try and recover your money by forcing the sale of the property.

Either way, only lend money to investors you know and trust, who have a solid track record of success.

6. Real Estate Wholesaling

Wholesalers put properties under contract, but they don’t actually buy them. Instead, they flip the contract to other investors — for a margin.

For example, imagine you find a property worth $140,000, and you get it under contract for $100,000. You then turn around and sell the contract to another investor for $115,000. They buy the property at a discount, and you get a $15,000 paycheck. All without ever owning any real estate yourself.

You don’t have to come up with a down payment or get a rental property loan. You don’t have to negotiate with contractors or oversee renovations, or hassle with screening tenants or signing lease agreements.

All you have to come up with is the earnest money deposit, which could be as little as $500. And you get it back as soon as you find a buyer for the contract.

If you’re interested, read more about wholesaling real estate here.

7. Invest in Land

Want to hear a dirty little secret?

Deni and I are mostly investing in land these days, rather than residential rental properties.

It doesn’t fall apart or need renovation. Bad tenants can’t damage it. You don’t need to worry about screening tenants, rent defaults, or going through the eviction process. Or, for that matter, eviction moratoriums allowing tenants to live for free in your property.

My exit strategy involves flipping the parcels and offering optional owner financing. If the buyer-borrower defaults, I don’t have to go through the traditional foreclosure process. I just reclaim possession and sell it to someone else. Flipping keeps the investment time horizon short, so I don’t have to lock up my cash for a long period of time.

Best of all, you can buy parcels of land for as little as $100.

Check out how Scott Todd replaced his day job salary in 18 months with land investments, and learn how to invest in land with either the REtipster land investing course (which is excellent) or the Land Geek course. I’ve taken both, and they teach you how to invest with low risk and high returns.

8. House Hack

There are many ways to house hack, but the core concept involves using your home to generate revenue, which then offsets your housing costs, allowing you to “live for free.”

The classic multifamily house hacking model is buying a 2-4 unit property, moving into one unit, and renting out the other(s). You can use a standard owner-occupied mortgage loan, such as a Fannie Mae or Freddie Mac loan with a 3% down payment, or an FHA loan with a 3.5% down payment.

Which, granted, will still set you back more than $1,000. But it’s a lot closer than a full 20-25% down payment on a rental property loan. Note that your friends or family members can help you out with your down payment, but it must be a gift, not a loan.

Alternative house hacking options include renting out rooms to housemates or on Airbnb, setting up an income suite, renting out storage space or parking, or even bringing on a foreign exchange student. Deni did the latter, through a company called the Cambridge Network, and the stipend covers nearly her whole mortgage payment.

You get to live for free, and whenever you feel like moving out, you can keep it as a buy-and-hold rental.

(article continues below)

9. Rental Arbitrage

What if you could build an Airbnb empire without actually buying a bunch of properties?

That’s exactly what Al Williamson teaches you how to do in the joint webinar we held with him a few months ago. It’s called rental arbitrage, and involves signing a long-term lease with a landlord, then renting out the property as a short-term rental on Airbnb. Or better yet, renting it as a corporate rental for a few months at a time.

No down payments. No roof replacements or repainting. Just passive income from someone else’s property.

10. Borrow the Down Payment with Credit Lines

Conventional mortgage lenders don’t typically let you borrow the down payment. But private rental property loans allow it.

Which means you can theoretically borrow a rental property loan from a portfolio lender, and then borrow the down payment from a credit line opened through credit concierge services like Fund&Grow.

Fund&Grow helps you open $50,000-$250,000 in unsecured business credit lines and credit cards. No collateral necessary, and real estate investors count as businesses. You can then tap into these credit lines and cards for down payments, for renovation costs, or even to finance properties entirely.

How to Invest $1,000 in Stocks

Interested in stocks as well as real estate?

Many novice investors feel intimidated by stocks. They’re far more conceptual than real estate, and feel less intuitive. But the fact is that stocks are actually easier to invest in than real estate, because you can use a robo-advisor to set your investments for you.

When you open an account with a robo-advisor, they ask you a series of questions to determine your goals, risk tolerance, and the best investing strategy for you personally. Based on your answers, they propose an asset allocation, and if you approve it, they then invest your money accordingly. They use low-cost, passive exchange-traded funds (ETFs) to give you broad exposure to the stock market rather than picking individual stocks. That keeps you diversified and manages your risk.

You can set up automated recurring transfers into your robo-advisor account for them to invest. As some investments inevitably outperform others, they rebalance your account for you to keep your asset allocation on target.

Mutual funds also allow for easy diversification with small amounts of money, if you prefer more human management of your investment funds.

It’s that simple. Your stock investments go on autopilot, all taking place in the background without you having to lift a finger.

For a free robo-advisor, check out SoFi Invest or Schwab Intelligent Portfolios. I use Charles Schwab myself, although beware that Schwab requires a $5,000 minimum investment. If you have less, start with SoFi Invest.

Final Thoughts

Rather than fretting about where to invest $1,000 dollars, just get started.

There’s no perfect investment. If you want a completely passive investment, try GroundFloor, Streitwise, or Fundrise. If you want to live for free, look into house hacking, but note that it will take more knowledge, work, and money on your part.

Or dig into land investing with the REtipster land investing course for high returns and low risk. But again, they require more knowledge and labor on your part.

Don’t freeze up with analysis paralysis. Pick one of the options above for how to invest $1,000 dollars, and you’ll quickly grow more comfortable with investing to build long-term wealth.

Because with enough passive income, you reach financial independence and working becomes optional.♦

What have your experiences been with the real estate investments outlined above? What are your tips and ideas for how to invest $1,000?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

I don’t have that much money in my pocket but this really gives an urge to invest in Real Estate. Maybe I should start it now! Thanks for this very encouraging article!

Glad it was helpful Heidi!

I think investing in real estate crowdfunding is a better option when you’re just investing with $1,000 dollars. Or you could become a real estate agent taking commission when you rent out a property for someone!

I hear you Theo! It’s definitely easier 🙂

Impressive! Really liked the article. Who could have thought a $1000 can be invested in real estate.

Thanks Mike, glad it was useful!

Investing in land is the best thing you could do. Land prices keep on rising.

Agreed Kian!

House Hack is the most accessible way to get started for us in the younger generations these days. I started using TruVest.io to compare investment strategies

I’m a huge fan of house hacking too Giannis!

Indeed, I fret on where to invest my $1,000 (or more) but my first choice would be Real Estate Crowdfunding: Loans. I’ll try GroundFloor and thanks for the recommendation.

Keep us posted about your experience investing with them!

It goes to show that real estate investing is a sustainable passive income for many many years. May we all be blessed with great fortune in the years to come!

Amen Maria!

Thank you for the very informative article. Now as a beginner, i can’t seem to decide which is better, the higher dividend of public REITs or the share price appreciation of the private REITs.

Many private REITs have a high dividend yield. Streitwise pays out 8.4%, for example.

Who else started as a wholesaler? It’s perfect for $1000 investment or less!

Absolutely Marie!