Rental properties offer better protection against recessions than most investments. But that doesn’t make them completely recession-proof.

As you look for ways to protect your portfolio from future recessions, here’s how rental properties have stacked up in past recessions.

Rents During Recessions

The good news for real estate investors is that rents don’t actually drop during recessions. People still need to live somewhere, regardless of how gross domestic product changes.

In fact, recessions can even drive up demand for rental properties. Fewer people can afford to buy homes and become homeowners, after all.

Take a look at the Federal Reserve’s consumer price index for rents over the last 75 years:

In some cases, rents level off during recessions. Landlords have less pricing power to raise rents.

But in other recessions, rents keep chugging upward undaunted.

Regardless, rents don’t fall during recessions, removing the risk of collapsing rental cash flow.

Property Values During Recessions

Home values, on the other hand, do sometimes dip when the economy falters.

Here’s how median home values have fared since the early 1960s:

Even so, they only fell significantly once in the last 60 years: during the Great Recession. Which makes sense, given that it was largely caused by a housing bubble in the first place.

Other recessions saw property prices decrease by around 5%. And in some recessions, home values didn’t drop at all.

While real estate investors certainly can’t count on property values always going up, they’re far more stable than stocks, and rarely drop by more than 5%.

And if you really want a recession-proof real estate investment, try self-storage facilities. During recessions, people tend to downsize, and many choose to rent a storage facility rather than get rid of their belongings that don’t fit in their new smaller home. You don’t have to buy an entire self-storage property by yourself either — buy fractional ownership in a property by investing in a real estate syndication. In fact, we invest in these sorts of group real estate investments every month in our investment club.

Evictions & Vacancy Rates in Recessions

Where landlords get in trouble during recessions is with rent defaults, turnovers, evictions, and vacancies.

A shrinking economy means fewer jobs, which in turn means more renters without work. If tenants lose their jobs, they often stop paying the rent, and landlords have to start the lengthy and expensive eviction process.

You can see this play out in rental vacancy rates jumping in recessions:

Case Study: Rentals in the Great Recession

The Great Recession ranks among the worst in America’s history, second only to the Great Depression. And given that it largely centered around overpriced real estate, it makes a great case study for a “worst-case scenario” for real estate investors. Median home prices fell from a peak of $257,400 in the first quarter of 2007 to a trough of $208,400 in the first quarter of 2009. That represents a 19% drop in value, and in many cities, home prices fell by 30, 40, or even 50% or more. Keep in mind those are quarterly numbers, which round out the extremes.Meanwhile, median US rents didn’t dip at all. They did flatten, however, in the aftermath and recovery from the Great Recession.

Rental vacancy rates did jump from 9.6% in the fourth quarter of 2007 to 11.1% in the third quarter of 2009. But that still only represents a bump of 1.5 percentage points — hardly a cause for panic.

(article continues below)

Dangerous Precedent of Eviction Moratoriums

The coronavirus pandemic created a dangerous precedent in the form of eviction moratoriums. Tenant activists got a taste for making lease agreements only one-way enforceable, leaving tenants able to enforce their side but landlords unable to enforce theirs.

When the next recession comes, it may prove “politically expedient” to pull the same stunt again. Landlords would again get strapped with non-paying tenants, forced to pay for someone else to live for free.

It could happen on a nationwide level or it could happen at the state and local levels. While you can’t protect against a federal eviction moratorium, you can avoid investing in tenant-friendly states with anti-landlord laws.

I certainly do — it’s one way I reduce risk in my real estate investments.

Stocks During Recessions

Stocks don’t fare so well during recessions.

Take a look at the jagged slopes of the S&P 500 in each recession for the last 90 years:

Chart courtesy of Macrotrends.net

In the year leading up to a recession, the S&P 500 dropped an average of 3%. During recessions, it dropped another 1% on average. In the Great Recession, the S&P 500 dropped a dizzying 57% from peak to trough, of which 37% happened during the technical recession.

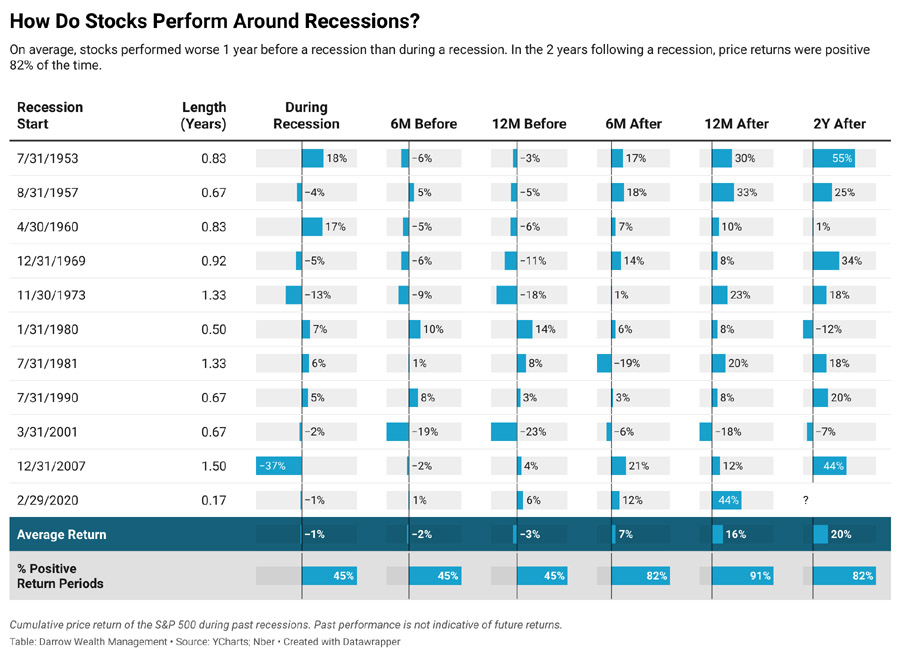

Here’s how the S&P 500 has performed before, during, and after each recession since the 1950s:

Chart courtesy of Darrow Wealth Management

The good news? Stocks nearly always boom in the aftermath of recessions, jumping an average of 16% in the year after recessions end.

I don’t avoid stocks before, during, or after recessions. Quite the contrary: US stocks earn an average historical return of around 10.5%, and they make up a large portion of my portfolio. Don’t think in terms of whether to invest in real estate versus stocks, but rather how much of each you want in your investment portfolio.

Still, stocks are about as far from recession-proof as you can get.

Are Rental Properties Recession-Proof?

No investment is 100% recession-proof. But rental properties perform better than most when the economy takes a nosedive.

Rents don’t fall at all. Home prices do sometimes correct downward, and rental vacancy rates can tick upward. If property values dip, that can remove one of your exit strategies if it puts you upside-down on your rental property mortgage.

When recessions hit, watch out for higher tenant turnover rates, rent default rates, and evictions. Buy rent default insurance to protect yourself against the risk of tenants not paying their rents.

Rental property owners remain mostly unscathed during recessions. But stay vigilant about rent defaults, avoid turnovers if possible, and consider rent freezes or other incentives to keep good tenants in place while the economy finds its footing.♦

What have your experiences been with rental properties during recessions?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-50% on $5K in Real Estate Syndications.

Sadly, my good tenant wants to move in to somewhere cheaper. So I gave her a freeze rent for 3 months for her good payment history for 5 years. That’s enough time to make her financially stable again.

Maybe. Or maybe she’s taking you for a ride.

You have a point. However, I already gave her the love letter in advance but that’s for recruiting many good tenants and in case she decided to go. I think it’s a good way of incentive since I never post ads.

I started my real estate career 5 years ago and I don’t foresee problems during recessions. I am also a graphic animator by the way, which adds some stability to my income.

Glad to hear it Allan!

I agree. Eviction is a very challenging during recession but I also take it as a great opportunity for good tenants to move in!

True Venus!

Rentals are not always butterflies and rainbows but it’s an amazing source of passive income.

Agreed Ann Marie!

Rentals offer an incredible opportunity for generating passive income during recession.

Real estate may be recession-resistant, but don’t let that lull you into a false sense of security. It’s like wearing a seat belt – you hope you’ll never need it, but you should still buckle up just in case. So take steps to mitigate risk and prepare for unexpected events in your real estate investments.

Very true Marc!