Real estate investors often assume that real estate returns beat stock returns. And it’s often true — check out this study on returns over 145 years in 16 developed countries.

But to compare real estate versus stocks, it helps to know the average historical stock market return.

Here’s how US stocks have performed for the last century, along with some fun charts, graphs, and downloadable data.

Historical Stock Market Return in US

In 1926, Standard & Poor’s launched the S&P index, tracking 90 large-cap US stocks. They expanded the index to include 500 of the largest US companies in 1957, and the index became known as the S&P 500.

From 1926 through the end of 2021, the S&P delivered an average stock market return rate of 10.49%. That average annual return includes dividends, but not inflation. More on inflation-adjusted stock returns shortly.

For gits and shiggles, here’s an interactive graph of the S&P 500's price over the last ten years as well:

You can also download a table of the S&P 500’s returns for each year since its inception here.

Stock Market Returns Adjusted for Inflation

If you adjust for inflation, the average stock market return drops to 7.37%. Which is still not too shabby.

Stocks offer some protection against inflation, as companies can typically raise their prices to compensate for a weakening dollar. But nothing beats real estate as a hedge against inflation.

In contrast, bonds offer no protection against inflation at all. If a bond pays 3%, and inflation rages at 8%, you effectively lose 5% on your investment.

It’s one of the many reasons why I invest in real estate as an alternative to bonds in my portfolio.

Compound Annual Growth Rate

Coming up with an average stock market return is surprisingly complex, as you can’t just calculate the mean of each year’s returns.

Consider this quick example of why not. Imagine you invest $100, and in the first year, it grew 100%, doubling your money to $200. In the second year, it fell by 50%, dropping your balance back to $100.

If you take the average of 100% and -50%, you get an arithmetic average (mean) return of 25%. But this example illustrates that after two years, your real return is 0%.

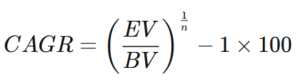

When you’re calculating financial returns over time, you need to use a more complex formula called compound annual growth rate (CAGR). The formula looks like this:

Where:

EV = Ending value

BV = Beginning value

n = Number of years

You might need a cocktail or two before attempting that on a cocktail napkin.

Regarding the average S&P 500 return over time, the arithmetic mean of each year’s return since 1926 is 12.39%, but the true return calculated by the CAGR is roughly two percentage points lower at 10.49%.

Average Stock Market Return Rate in Other Countries

Stock market historical returns in other countries vary widely.

Germany’s Dax index, for example, has returned around 8.6% per year on average since its inception in 1988.

Japan’s Nikkei index remains below its 1988 levels in Spring 2022. In fact, it sits around 27.4% lower than its 1989 peak:

The London FTSE has delivered around a 5.5% historical stock market return since 1984.

Meanwhile, emerging markets’ stock returns have underperformed the S&P 500 in the decade from 2010-2019 (3.68% vs. the S&P’s 13.56%), but trounced US stock markets from 2000-2009 (9.78% vs. -0.95%). Over the last 30 years, emerging markets have roughly equaled US stock market returns on average.

Price Growth & Dividends

Stocks, like real estate, earn returns in two ways: price growth and income yield. To understand the total return on a stock or index fund, you need to include both.

Stock price growth is easy enough to understand. If a stock rises in price from $10 to $11 over a year, it returned 10% on price growth alone.

Dividends aren’t “rocket surgery” either, as my ex-girlfriend used to say. If a stock pays a 2% dividend yield, you earn $0.20 over that year, in addition to the $1 rise in price. Of course, in the real world, the price and dividends are constantly changing, but you can look at how the stock has paid dividends compared to its current price.

The total stock market return of 10.49% for the S&P 500 assumes that you reinvested dividends. But you can, of course, live on dividend income as well, to help you reach financial independence and early retirement.

Nor are stocks the only investment that pay dividends. Most real estate crowdfunding investments also pay dividends, often at high yields. For example, the Income portfolio at Fundrise paid a nearly 5% dividend yield in 2021, and Streitwise paid an 8.4% dividend yield. Both enjoy a place in my personal nest egg.

Volatility: “Average” vs. “Normal”

From 1926, the S&P 500 only delivered returns in the “average” range of 8-12% seven times.

Seven times, out of nearly 100 years.

Instead, you see soaring returns like 2021’s 26.89%, or flops like 2018’s -6.24%. Or utter crashes like 2008’s -38.49%.

Word to the wise: automate your stock investments with a robo-advisor. Set it and forget it. Do not, under any circumstances, panic sell when the bottom drops out of the market. I personally use Charles Schwab’s free robo-advisor service, but SoFi Invest and Ally Invest offer two other free alternatives.

(article continues below)

The Average Investor Underperforms the S&P

With the rise of index fund ETFs and mutual funds, you’d think that every investor should earn at least average stock market returns. But you’d be wrong.

The average investor earns several percentage points less than the S&P 500 returns, over time.

Why? For several reasons, but largely because they get jittery. Individual investors plow money into the stock market when it does well (buying high) and panic sell when the market crashes (selling low).

Retail investors also try to time the market — a losing strategy in stocks, just like it is in real estate. Sometimes, they also try to prove how smart they are by picking single stocks.

Stop trying to get fancy and just automate your stock investments with a robo-advisor. Not only will you earn a higher rate of return, but you'll also reduce your risk. How many other strategies let you lower your risk tolerance by raising your investment returns?

Final Thoughts

Some real estate investors plow all their money into properties and ignore stocks entirely.

They’re doing it wrong.

Stocks and real estate serve different purposes in your portfolio. Stocks offer instant liquidity, strong price gains, and 100% passive investing. They also make it easy to invest through tax-sheltered accounts like IRAs, 401(k)s, 529 plans, and HSAs.

Real estate offers strong passive income, stability, and tax advantages such as rental property deductions and ways to defer or avoid capital gains taxes. Plus, leverage in real estate can help you earn high cash-on-cash returns, and bend the 4% Rule in retirement.

Invest in both for diversification and to serve these different purposes. I personally aim for around 60% of my assets in stocks and around 40% in real estate. That includes stocks from all of the world, and my real estate portfolio includes not just rental properties, but also real estate crowdfunding investments, private notes, public REITs, and more.

Settle on your own ideal asset allocation, and whatever you do, don’t try to time the market or let emotions drive your investments.♦

How do you currently invest in stocks versus real estate? Are you earning the historical stock market return, or do you see lower returns from trying to beat the market?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

I haven’t started investing in stocks yet. I’m aiming for 80% real estate and 20% stocks at first, then probably make it 50/50 in the future. Do you have any tips on how I can start investing in stocks?

Hi Martin, yes I recommend setting up an account with a robo-advisor to manage your stock investments. Aim for the most aggressive settings so they don’t include a bunch of bonds, unless you’re close to retirement.

Super clear answer to this question, thanks!

Glad it was helpful Martin!

I invest in cryptocurrency instead of stocks and it’s unbelievable! I think that’s a better alternative. Thoughts?

The problem is that cryptocurrencies don’t have an inherent underlying value, the way stocks and real estate do. That makes cryptocurrencies speculative, rather than an investment based on measurable traits like revenue.

You’re right. The risk is crazy high in crypto even with automation. It made me realize that I should have put more faith in stocks rather than gambling in crypto.

My partner was pumped when I told him about this! Thanks for sharing.

Glad it was helpful Angelo!

Robo-advisor is indeed helpful! Thanks for the tips.

Absolutely Jastin!