Fueled by low inventory, especially among starter homes, the last five years have seen home values skyrocket. Look no further than Zillow’s Home Value Index, which leapt from $163,000 in December 2013 to $281,370 in May 2021.

That’s a shockingly fast rise of 72.6% over just seven and a half years, or an average increase of 9.7% a year.

Rents have risen, too, though not as fast. In fact, rents rose at less than half the speed of home values: Zillow’s Rent Index for 1-bedroom apartments rose from $1,353 to $1,742 – around 28.8% – over the same time period. That comes out to an average of 3.8% a year.

Despite tenant activists squawking about rents rising faster than incomes, both have grown at almost exactly the same pace. Median income in the five-year period from 2014-2019 (the latest available from the Census Bureau) rose by 18.5%, or 3.7% a year on average.

With home prices significantly outpacing rents and incomes, what’s a real estate investor to do, to find good deals on cashflowing rental properties?

Here’s what. Try these ten ideas on for size, to keep your competitive edge in an increasingly difficult real estate market for investors.

1. Look Further Afield

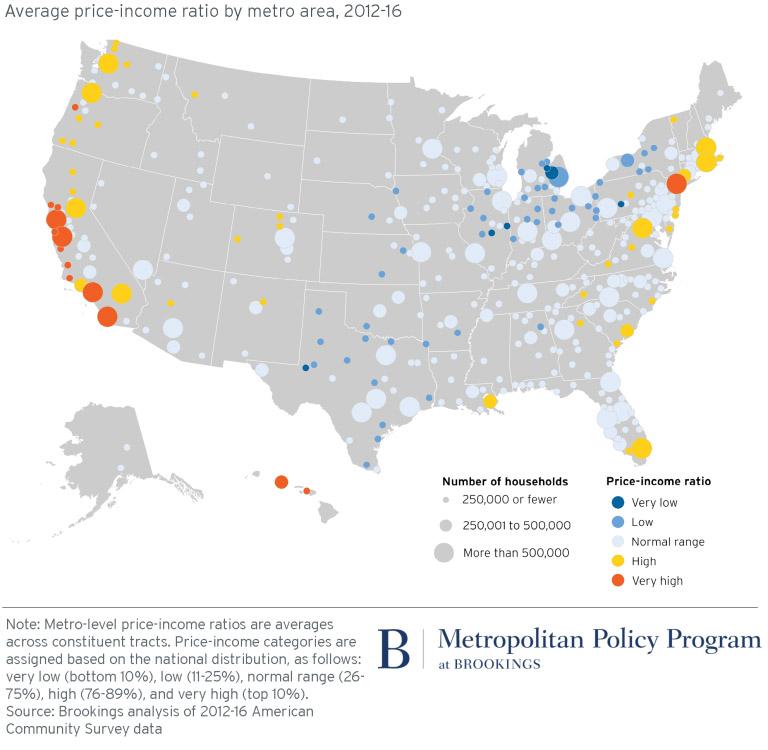

Some real estate markets are more skewed than others.

Surprising no one, overpriced coastal metropolises tend to have the greatest skews between home prices and incomes. Take a look for yourself:

So? Don’t invest in real estate there.

It’s easier than ever to invest in turnkey rental properties long-distance. With virtual reality tours, instant video sharing and broadcasting, and some good ol’ fashioned trust, you can invest with a partner or Realtor as your local eyes and boots on the ground, even from thousands of miles away.

In fact, entire platforms have risen over the last few years to help turnkey real estate investors buy long-distance. Check out Roofstock as the prime example:

You can also work directly with off-market turnkey sellers in any market.

Just make sure you have some automated property management software ready to go! (Cough cough.)

2. Use Technology to Find Distressed Sellers

Finding distressed sellers is a real estate investor’s bread and butter. And if you’re not up to speed on the latest real estate investing tools, you’ll find yourself woefully outmatched. Your competition sure isn’t sleeping on the job; you better believe they’re using the best real estate investing tools available.

One that we like is Propstream, which Deni reviewed in depth a few months back. It’s not free, but it offers some great tools, such as displaying local pre-foreclosures, vacant properties, lien balances, and even divorces.

Another great real estate investing tool is DealMachine. It’s pretty cool technology: with your phone, you snap a photo of a property, and the app immediately supplies the owner’s name, mailing address, mortgage balance, and other contact information.

Even better, with one click you can have DealMachine send a postcard to the owner, with your contact information and template letter.

A third tool to analyze properties and rental markets is Mashvisor (use that link for a 25% off coupon). Mashvisor displays both long-term market rents and Airbnb revenue for a potential neighborhood or property, along with other data to help you find the perfect neighborhood and property whether you’re looking for a long-term or short-term rental property.

You can also find foreclosures, tax sales, and other distressed sellers on Foreclosure.com. They offer a seven-day free trial period to give it a test drive before buying.

Again, if you’re not using the latest real estate investing tools, watch out, because your competition is.

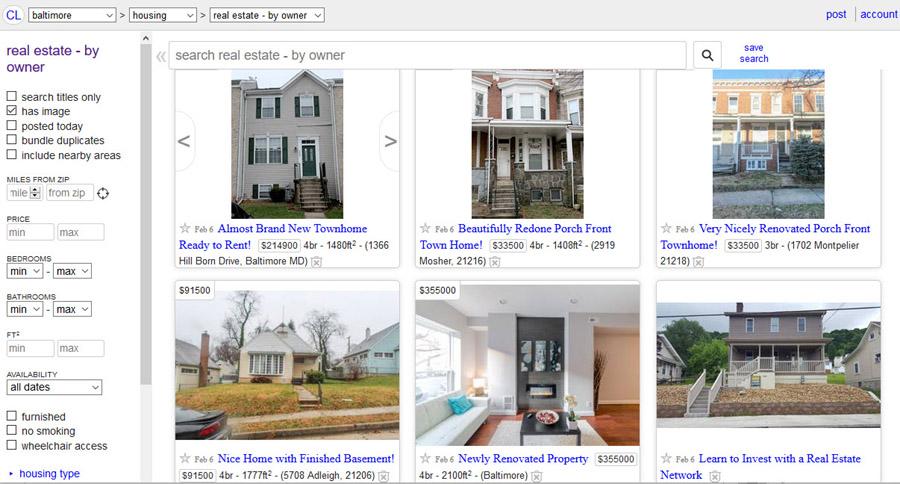

3. Check Craigslist FSBO Daily

Going from super high-tech to old-school, Craigslist remains an oldie-but-goodie, and an underused resource in many markets.

You can find hidden gems on Craigslist – properties that aren’t listed on the MLS, and that most investors aren’t seeing. But be prepared to do this manually, since Craigslist remains adamant about staying low-tech and un-automated.

Listings include both properties that need renovations and turnkey rental properties ready to rent. Owners, wholesalers, investors, turnkey sellers; you’ll find the lot of them listing on Craigslist.

And scammers and spammers, of course. Be very careful whenever working with a relatively anonymous online platform like Craigslist!

4. Move Lightning Fast on Deals

Good deals come along all the time, in every market. But they don’t last longer than 24 hours in most cases.

Whether you’re hunting for properties on-market through the MLS and a Realtor or off-market through wholesalers, turnkey sellers, or your own initiative, you need to be ready to visit properties immediately when you see a promising deal. And if it still looks like a winner after seeing it, be ready to put a contract on it instantly.

Set up email alerts on websites like Zillow and Trulia, and through your Realtor. Sign up for wholesalers’ and turnkey sellers’ mailing lists. Scout local Facebook groups.

As Deni and I are fond of saying to our FIRE from Real Estate course students, if you don’t want to be the highest offer, and you can’t make a cash offer, then you need to be the first offer.

5. Network Like Your Earnings Depend on It

You know the old adage: It’s not what you know, it’s who you know. There’s plenty of truth there, in the real estate investing industry.

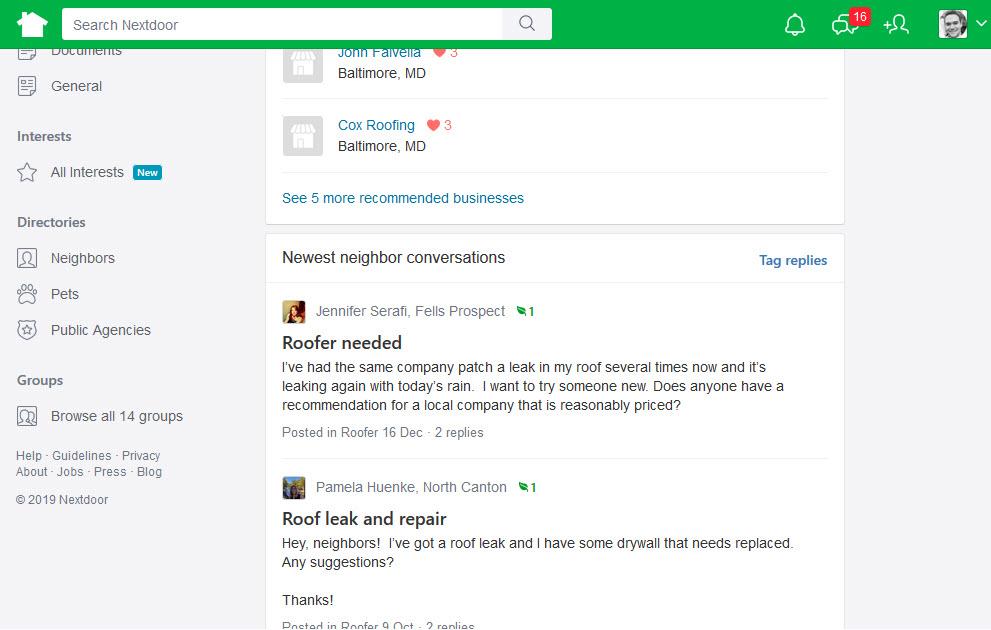

In your market, you should get to know every serious investor. Go to real estate investing club groups to meet people in person. Network with investors online through NextDoor, BiggerPockets, Facebook groups for real estate investors.

Don’t stop at investors, either. Collect contractors, lenders, insurance providers, Realtors, home inspectors, appraisers.

The more people you know, the more opportunities and deals will come your way. It’s a fact of life no less reliable than the sun rising in the east.

As you connect with these other people in the industry, share with them exactly the kind of real estate deals you’re looking for. The more precise you are, the more likely they are to remember you when they come across one of those deals, and to pick up the phone to call you.

After all, not every investor is looking for same kind of real estate deal. You may be looking for turnkey duplexes, while another investor likes flipping single-family homes in dire need of renovation. Finding these complementary investors will help you share deals and help one another out, as you build a reputation for honesty and fair play in your market.

6. Connect with Local Wholesalers, Turnkey Sellers, and REO Managers

Off-market sellers, by definition, don’t list their properties for sale on the MLS. Which means you need to find them, because they sure aren’t going to find you.

Wholesalers, turnkey sellers, and some REO managers (typically those of local hard money lenders and local banks) maintain buyer lists. When they have a deal to sell, they send an email to their list, and it’s first-come first-served.

But if you build a relationship with them, and again, express exactly what kind of deals you’re looking for, sometimes these off-market sellers will call you first.

They won’t do that for someone they met one time, 18 months ago at a real estate investing club meeting. They’ll do it for someone they occasionally have happy hour with, or whose children play with their children. In other words, people they have a true relationship with.

To cite another old saying that borders on the cliché, but remains no less true for it: your net worth is determined by your network.

7. Ask What’s Working in Other Markets

If you’re investing in duplexes in Baltimore, and ask another Baltimore real estate investor who loves duplexes exactly how they’re finding their deals, don’t expect them to share their secrets and draw you a detailed investing plan.

But if you ask a duplex investor in Buffalo? You’re not their competition, not a threat to their business, so they’re far more likely to open up.

As you network with other investors, particularly out-of-state investors, ask them exactly how they’re finding good deals on investment properties. Not everyone will bare their business plan to you, but some will, and you’ll gain valuable insights, ideas, and tactical advice.

8. Drive for Dollars

Another oldie-but-goodie, there’s a reason why investors still drive for dollars.

If you’re not familiar with this little tidbit of real estate investor slang, it’s as simple as it sounds. You literally drive around your target market, looking for vacant or dilapidated homes that look ripe for a lowball offer.

In the days of yore, you’d have to jot down the addresses, then later look up the owners on public records. Then you’d send out a template letter to them by snail mail.

Nowadays you can skip all that, using a service like DealMachine. With a click of your phone’s camera, you can find everything you need to know about the owner, the property, and the equity in it. And then click one more button to have a letter automatically sent by mail.

Still, there’s nothing like a handwritten envelope to get more owners to actually open your letters. Keep that in mind before going buck wild on mail merge forms in Microsoft Word and Excel.

9. Attend Auctions

Unlike the latest trend or tactic, auctions are timeless.

There will always be auctions, because some sellers would rather have a firm sales date than a firm sales price. That means there will always be buyers finding good deals on real estate investment properties at auctions.

With that said, auctions are a numbers game. You might attend 50 auctions before you find a cool crowd that’s just not bidding much on a decent property deal.

Regular auction attendees tend to be a relatively small group in any given market. If you start attending them, you’ll find the same 10-15 faces showing up at every auction.

Which, once again, makes for good networking.

Become a regular. Flex your muscles by bidding, albeit conservatively for your first half-dozen auctions. Show that you’re serious, and you’ll be welcomed into this small cadre of investors. As you get to know these other investors better, you’ll develop an unspoken rhythm with them, where you can avoid all-out bidding wars and learn when to step aside for a fellow investor – and when to show you’re serious about a given property.

10. Explore Multifamily Rental Properties

When you look for deals on single-family homes, you compete with homebuyers. In other words, with “retail” buyers rather than “wholesale” buyers like yourself, looking for a profit margin.

And sure, there are the occasional house hackers looking to buy small multifamily properties and move in. But most demand for multifamily properties is among investors, who want to pay as little as possible to keep that profit margin intact.

The larger you go, the less demand there is. Most garden-variety real estate investors will be open to finding deals on duplexes. But there’s less demand for quadplexes, and even less competition for 10-unit apartment buildings, and less still for 100-unit apartment complexes.

If you want to find larger profit margins on income properties, look at larger properties. It’s easier to find good deals, and you don’t necessarily have to make an offer within six hours of the property being listed for sale, as with single-family rentals.

Final Word

Finding good deals on real estate takes patience, and it takes work. It’s not like investing in stocks, where you simply click a button to buy.

But it also means you can control your own returns. You can calculate a rental property’s cash flow before you buy, instantly, using a rental property calculator.

Which means never buying a bad deal, or a property that loses money.

Happy hunting my friends!

What strategies have you used to find good deals on real estate in the past? What about in today’s market?

I’ve had particular success using Propstream, personally. Been a help in finding motivated sellers.

Like you said, it’s been harder over the last few years!

Glad to hear it Maddie, and thanks for sharing your experience!

Awesome article as usual. I didn’t know there was a service like Dealmachine out there, going to download it and give it a whirl

Thanks C., and I’m glad we were able to introduce you to a new real estate investing tool!

These are great strategies. Thank you for the article.

Glad it was useful for you Charis!

These are some great ways to find good deals. Hats off!

Thanks Wayman!

I have tried these, and guess what, they work!

Glad to hear it Craig!

Wow. The crack about “tenant activists squawking” really sets the tone. Maybe let’s not be so dismissive and condescending about the people who make a lot of this investing possible…

Tenants are clients, and should be valued. I’m a tenant myself, in my primary residence. But activists push for anti-landlord laws, which repel mom-and-pop investors, leaving only corporate investors willing to navigate the complex regulation and red tape.

It seems tedious but patience is the key. Thanks for sharing!

Patience is absolutely the key to finding great deals on investment properties Allan!

Thank you for the tips! This helps a lot.

Glad to hear it Tatiana!

I’m familiar with some of these but not others. Going to try to expand my toolbox for finding deals.

Keep us posted on your progress Janna!