How Does Section 8 Work?

When people today talk about “Section 8,” they usually refer to the Housing Choice Voucher Program, funded by the U.S. Department of Housing and Urban Development (HUD). This program does not provide public housing, but rather rent subsidies for low-income Americans. The benefits follow the tenant — the voucher holder — who can take their voucher and apply to any rental housing. Though funded by HUD, Section 8 is administered on the local level. Local public housing authorities (PHAs) review tenant applications for subsidized housing, choose recipients, screen landlord applications, inspect rental properties, and generally manage the rental assistance program. So participating landlords interact with their local housing authority. Once upon a time there was a second Section 8 program, the Project-Based Program. These benefits tied to the property owner, who partnered with the government to provide affordable housing for low-income families. However HUD stopped awarding new contracts for this program in the ‘80s, so only already-participating landlords can renew their contracts today.Tenant Eligibility & Income Limits

Designed to support low-income families and prevent homelessness, most Americans don’t qualify for Section 8. Generally speaking, only families earning less than 50% of the local median household income qualify. Renters earning more than 50% of the local median income level are on their own to find affordable rental housing. Local public housing agencies do take family size into account however when evaluating families’ annual income. Only United States citizens and specific legal immigrant statuses qualify for Section 8 supportive housing benefits.Do Landlords Have to Accept Section 8 Tenants?

In most areas, landlords have a choice to accept Section 8 vouchers or not. But not everywhere. Some states (such as Oregon) and cities (such as Seattle) impose laws that require landlords to accept Section 8 tenants. To deny Section 8 voucher holders constitutes discrimination in these jurisdictions, similar to Fair Housing Act violations. Granted, it’s largely a moot point in middle- and higher-income areas. But if you buy rental properties in low-income housing markets, your local laws may require you to accept Section 8 vouchers. As a final note, remember to always keep copies of all rental applications, tenant screening reports, and your own screening notes, even for prospective tenants you reject. If a declined applicant sues you for discrimination, you need to prove to a judge that you chose one tenant over another for a legitimate business reason. These include insufficient income, poor credit, eviction history, and bad landlord references, among others. Contrary to some internet myths, private landlords do not receive a tax credit for accepting Section 8 renters.How to Become a Section 8 Landlord

Tenants apply with the local housing office in order to get Section 8 approved vouchers. Those prospective Section 8 tenants usually sit on a waiting list to join the program. In some areas, it takes years for the local public housing agency to even review their application! Once approved, they submit rental applications to landlords like any other renter. They can use their vouchers for any type of housing units, from large multifamily complexes to detached single-family homes. Or rather, units owned by any private market landlord who accepts Section 8 vouchers (in areas where landlords have a choice). But wait one moment… does the government pay for all of the tenant’s rent? Usually not. Generally speaking, the tenant pays 30% of their household income toward the rent, and Section 8 picks up the balance above that. If you choose to rent to a Section 8 tenant, you collect a security deposit from them like any other renter. The same state and city laws regulating security deposits apply. But when you accept a tenant who has been accepted into the Section 8 housing assistance program, expect some red tape. Your property will undergo an inspection to determine if it meets Section 8’s “Housing Quality Standards.” Don’t be surprised if the inspector hands you an expensive list of repairs to meet their program requirements.Advantages of Section 8 for Landlords

So should I become a section 8 landlord? What are the advantages to signing a lease agreement with Section 8 tenants? Here are a few pros of accepting Section 8 tenants.1. On-Time Rent Payments

Well, for the government’s “housing assistance payment,” anyway. But don’t expect a guarantee that the tenants will pay their portion of the rent on time. Through good ol’ fashioned tenant screening, you can weed out unreliable renters with a poor credit history, showing a pattern of paying bills late (or not at all). It helps if you automate your rent collection to receive rent electronically, direct-deposited into your bank account. You can even buy a rent guarantee insurance policy for a few hundred dollars per year. Check out Steady or Rent Rescue to buy rent default insurance, that kicks in and pays you the rent if your tenants stop paying. Remember, Section 8 no longer pays all or even most of the rent for the tenant. The tenant typically pays 30% of their household income toward the rent themselves. Nor does Section 8 pay higher-than-market rents anymore, for the most part.2. High Allowable Rent Increases

Most cities allow landlords to raise the rent in the 5-8% range per annum. These are determined by the federal government’s findings of fair market rents; more on this below. But since the government pays much of their monthly rent, Section 8 tenants tend not to complain as much about rent hikes.3. Fill Vacancies Faster

When you accept Section 8 tenants, you can fill your vacancies faster. To begin with, many landlords don’t accept Section 8 vouchers, which leaves these tenants with fewer options. But there are also extra websites and newsletters specifically for Section 8 rental listings. Check out GoSection8 and WeTakeSection8 as two examples where Section 8 landlords can market their vacant rentals.4. Lower Vacancy & Turnover Rates

Because tenants with financial assistance often have a harder time finding landlords who accept vouchers, they tend to stay longer-term. That in turn means lower turnover rates and vacancy rates. Both of which mean higher profits and better real estate cash flow.5. Potential for Higher Rents

While it was more common in decades past, sometimes Section 8 tenants do pay higher rents than the housing market average. To research Section 8’s “fair market rates” (FMR) for your market, go to HUDuser.gov, select your state and then your county. There you will find a chart providing the FMR for efficiencies up through 4-bedroom rentals.Disadvantages to Renting to Section 8

Section 8 tenants can come with plenty of their own risks and drawbacks. Before you take the plunge and invest time and money to rent to Section 8 tenants, consider some of these disadvantages.

1. Red Tape

The bureaucracy can cost time and money, and delay new Section 8 tenants moving in. Worse yet, local housing departments often require extra steps in the eviction process, delaying eviction of non-paying Section 8 tenants.

Which, in turn, means months of unpaid rent.

2. Delayed Initial Payments

Sometimes your first rent check can take up to two months. Oh, you will get it eventually, but count on covering your expenses out-of-pocket for the first few months.

Just imagine telling your mortgage company “I’ll get it to you eventually!”

3. Inspections, Inspections & More Inspections

Did I say inspections? We are talking about a white-gloved, look-everywhere inspection.

This is the top reason many landlords do not accept Section 8 vouchers. It’s also why Brian stopped accepting Section 8 tenants — every year, his entire cash flow for the year would be wiped out by repairs ordered on a whim by local inspectors trying to prove they visited each home on their schedule.

4. Tenant Quality

Sure, the government portion will come in every month, but what about the tenant’s portion?

The simple fact is that lower-income tenants sometimes mean lower credit, lower reliability, and less stable income. Look out as well for “professional tenants” who know the system better than any landlord accepting Section 8 rent vouchers.

5. Property Damage

Higher-risk tenants aren’t just a risk for rent defaults. They also pose a higher risk to your property itself.

Tenants can put the proverbial beatdown on your rental unit leaving you, the homeowner, with the bill. What, you thought the government will accept liability for the Section 8 tenants’ actions? That you’d be reimbursed for any damage caused?

Think again.

Sure, you can take that low-income individual to small claims court and sue for the damages, but don’t count on getting that moolah, even if you win a judgment.

Brian shared some of his horror stories with me, and pointed out that the less financially invested people are in, well, anything, the less attention they pay. His Section 8 tenants often treated his properties badly, because they had little or no financial investment in it.

(article continues below)

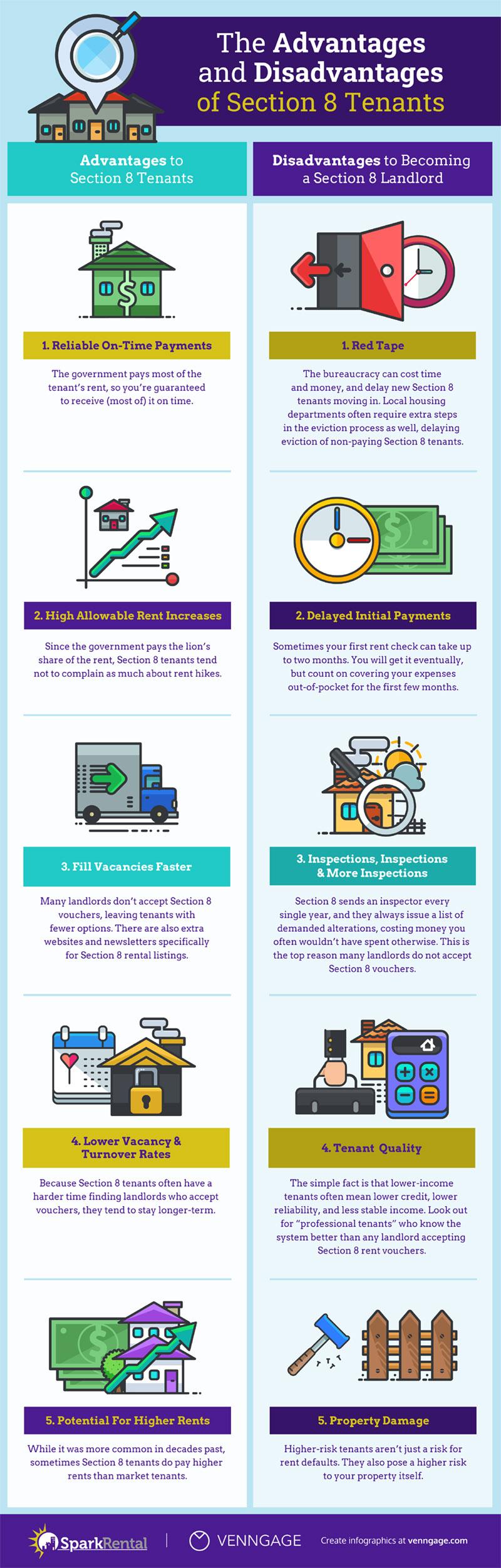

Infographic: Should I Become a Section 8 Landlord?

As a quick-reference summary of the pros and cons of becoming a Section 8 housing landlord, here’s a simple infographic outlining each. Keep in mind that Section 8 tenants vary widely in quality by geography as well; I know a landlord in rural Alabama who swears by them, while Brian has nothing but horror stories about the Section 8 renters he had in Baltimore City.

Without further ado, here are the most common Section 8 housing landlord problems and upsides!

Infographic courtesy of Venngage Infographic Maker

Would your readers appreciate this Section 8 landlord infographic? Click here for the embed code.

Share this Image On Your Site

Tips for Working with Section 8 Tenants

Still want to become a Section 8 landlord?

We’ve got you covered. Here are some tips for success, when starting out with Section 8 vouchers!

Screen Tenants Like $150,000 Depends on It

Or however much your property is worth. Because you are handing complete control and possession of your asset worth hundreds of thousands of dollars to these people.

Think of tenant screening as a mechanical process — remove any attachment and emotion from the equation. You need a written policy on your tenant screening criteria, that you follow like clockwork every time you collect rental applications.

List out all your tenant screening criteria such as monthly income, criminal background check, employment, credit score and credit history requirements, eviction history, landlord referrals, and condition of their current home. Feel free to start with a free tenant background check (hint hint!).

Following a set procedure also keeps you in compliance with landlord Fair Housing laws. Assuming, of course, that your policy adheres to FHA regulations.

Tenant-Proof Your Rental Property

Make your rental “strong like bull”! Start tenant-proofing your property by painting the walls with glossy, neutral-colored, inexpensive paint. It’s easier to rub scuffs away on glossier finishes rather than flat paint.

I personally steer clear of both carpets and real hardwood floors in rentals. However, sturdy lookalikes are perfect, from waterproof luxury vinyl tile (LVT) to faux wood to bamboo.

If you insist on installing carpets, use a thick, higher-grade padding, and lower-grade carpets with darker colors. You’ll have to replace the carpets often, but not the padding.

Use tamper-proof smoke and carbon monoxide testers. If you provide appliances, install second-hand ones with few bells and whistles. The more complex an appliance is, the more likely the tenant is to misuse and break it.

Likewise, remove other unnecessary features. No reason to include garbage disposals (they break easily), ceiling fans, window air conditioning units, or anything that is not a required addition. Bare minimum equals less inspection, less maintenance, and less damage to worry about.

Don’t provide screen doors. Tenants – particularly Section 8 tenants – end up breaking them, and if you include them when tenants move in, they’ll expect you to repair or replace them when they break them.

Many of the common repairs can even be done cheaply and by you, thus saving money but still maintaining the property in a good strong condition.

Inspect the Property Every 6 Months

Your goal is not to harass, but to look for needed repairs and ensure the tenant is complying with all lease agreement rules.

Schedule inspections and throw in a “I am doing a smoke detector check” surprise. Check for running toilets, leaking faucets and anything else that may be literally or figuratively flushing money down the drain. (Did you know that one toilet with a slow constant run costs about $75 per month?)

You will also be able to be sure that the tenant is complying with your lease agreement terms. Are there any unauthorized occupants? Dogs? Alligators in the bathtub?

File for Eviction Immediately if Tenants Break the Lease Agreement

If the tenant, the tenant’s visitors, or their kids are breaking rules, get right on top of it. Start the eviction process as soon as possible; it takes several months (or longer, for Section 8 tenants) from the initial eviction notice until the eventual lockout. So the tenants will have plenty of time to correct the violation and avoid the eviction.

Often tenants who break their lease agreements will be bounced from the Section 8 program; they have much to lose by not following the rules.

Landlord Note: As of early 2022, the federal coronavirus eviction moratorium has expired, but state- or local COVID-19 eviction moratoriums remain in some jurisdictions. Note that you may not be able to evict non-paying tenants.

So… Should I Rent to Section 8 Housing?

Above all, know your neighborhood. If you have a great rental in a desirable neighborhood, you may want to rethink becoming a Section 8 landlord. Chances are that the FMR will be lower than what you can fetch on your own.

Now that you are armed with the info, the good, the bad and the truth, go forth and choose well! The Section 8 Housing Voucher program has its place and can be a viable option for many landlords. But before jumping in, make sure you know exactly what it is you’re getting into.

What to Do Now:

1. Comment below: Have you ever worked with Section 8 renters? How did it go? Would you rent to Section 8 housing in the future?

2. If you’re new to the rental investing game, take our free video course Ditch Your Day Job with Rentals.

3. Enjoy this article? Did it raise some questions and ideas that got you thinking? If so, your friends, colleagues, and family members will probably also get something out of it. Share it with them on Facebook or Twitter. You can also follow us on Facebook and or Twitter for awesome daily doses of, well, real estate awesomeness ?

Photo courtesy of Career Employer.

I’ve thought about Section 8. I might try it for my next property, see how it goes!

Keep us posted on how it goes Allison!

No! Don’t do it unless your property is in a bad area and it’s your most reliable option!

My opinion but I manage a lot of section 8 and non section 8 units and I’d never personally do section 8.

The tenants can run to mommy and daddy (I mean section 8) and complaint about anything and guess what, you get yourself a “special inspection” and have to make even more repairs, 90% of section 8 tenants are terrible, like throw garabage out the window and complain about the trash, keep dogs in the basement who poop all over (I’ve never seen a non section 8 tenant do this but somehow section 8 tenants love having dog poop in the basement).

Besides having to do the annual inspections that are stricter than the city inspections (just had section 8 make us replace a whole driveway (10k to the owner).

I’m so sorry you’ve had those experiences with Section 8 tenants Shannon! You’re certainly not alone, sadly.

Brian, I am a new Section 8 landlord 4 years to one tenant.

Does Chicago housing authority section 8 program allow you to rent to a Sister in law? Their guidelines named all the family members except me. So I moved forward with allowing her to live in my unit. Her brother my husband is not on title or deed of my home.

I have found myself in this mess right when she has said that she wanted to move out summer 2022.

Now they terminated her voucher, and I am afraid that I mis Interpreted their definition of family according to their family obligations. She is apparently scheduling an informal hearing.

I did no favors to her, I rented to her as I would anyone else and to be honest we have never really seen eye to eye but because she was seeking a place I had a unit available and offered it up to her. She then said she had section 8, and I told her I would look into it. Fast forward she was approved and moved into my unit. Their definition on the contract with section 8 says that family was:

“Receive Housing Choice Voucher Program housing assistance while residing in a unit owned by a spouse, domestic partner, parent, child, grandparent, grandchild, sister or brother of any member of the family, unless the CHA has determined (and has notified the owner and the family of such determination) that approving rental of the unit, notwithstanding such relationship, would provide reasonable accommodation for a family member who is a person with disabilities.”

I understood that family was the family receiving the voucher and I couldn’t be any of those things to that family.

I’ve consulted lawyers and they all say that according to this I am not family.

Any insight I would appreciate thank you.

Hi Sandra, if your attorneys tell you you’re in the clear, they would know better than I would. But I think Section 8 might disagree that you don’t count as family. Best of luck at the hearing, and I hope you can get a new paying renter in the unit quickly!

I am petrified that they would make me pay back everything they have paid for her rent.

I hope at the end of the day they either make it clear whom is related according to their rules. It’s misleading. Anyone can misconstrue this.

What an inconsiderate jerk with a stick up his butt. I get the need to be wary or careful with low income families…but completely demonizing them and speaking such ignorant claims like- sec. 8 tend to break rules and tear holes in walls blah blah. Don’t be a lazy ass and just run the reports and screen them. And you shouldn’t have to worry about inspections if you’re actually a good landlord and give a crap about your investments and the safety of your tenants. What a moron.

No way! I deal with enough legal hassles regulating this and that with regards to landlord/tenant laws favoring the tenant. I am not piling another on.

I hear you Ed! Section 8 definitely adds another wrinkle. I no longer accept Section 8 renters either, although in my case it had more to do with the local Section 8 office.

Bad people ruin it for the good people.

Wow….way to go grouping all section 8 renters into lovers who don’t give a crap about the property they are renting!

I’m a retired/disabled 58 yr old nurse who had to use section 8 so I didn’t become homeless. It was very embarrassing and degrading. My landlord was a Godsend and gave me a chance. My apartment is spotless, cared for and well maintained. I am the best renter he has ever had according to him. Many of us are grateful & thankful for the section 8 program and landlords that participate. Do your screening, look at the prospective renters, look at the cleanliness of there vehicle and use your best judgment! Of course there are bad apples but don’t let that discourage you from helping!

Can I enter without permission

Hi Isabel, normally landlords have to give 24-48 hours’ written notice before entering rental units, unless given specific permission by the tenants. Check your state’s landlord-tenant laws (we have summaries of all 50 states’ laws) to see exactly how long the notice period is in your state.

Are landlords responsible to cut lawn and remove snow for section 8 properties ?

Hi Venkata, not necessarily. It depends on the terms of your lease agreement.

If a section 8 home fails inspection due to landlord responsible issues/repairs, is the tenant responsible to pay for the “section 8 unpaid days” ? I have a situation where Section 8 paid prorated days of the month up until the unit failed. The repairs were made then the re-inspection took place 3 weeks later (delayed due to the sect 8 office was closed for 1 week on vacation then they had scheduled the wrong day). My owner is out almost the full month of rent due to non-compliance issues (4 items the tenant never requested through a work order for repair) and I have been told by other sources (owners/Brokers) that the tenant doesn’t have to pay for those days because the “fails were on the owner side”… I can’t find any information supporting this & no one at the Sect 8 office can answer this question for me… I’m in Louisiana. Thank you, SB

I keep reading that it may take up to 2 months for the landlord to get that first rent check. Does this first rent check cover back rent or do you really lose 2 months worth of rental income?

Hi Jaymes, you get the rent money for the time the tenant occupies the property. But keep vacancy rate in mind as an expense as you forecast cash flow, and feel free to use our rental income calculator to run the numbers.

People are people. Judge each on their merit, not on stereotypes. You may miss out on the perfect renter. Not all Sec. 8 people are awful because they get help from the government.

I’ve has renters who actually repaired items with my approval and installed ceiling fans again w my ok. They even paid for the fans and repairs. Because they too wanted to live in a place they could call home.

I also heard that in some states it is illegal to discriminate against those with Serc. 8 Vouchers.

I hope others find the joy in knowing you are helping others and having payments paid on time with non-destructive renters.

Always, no matter what you think you can tell about a person run a background check.

Ask for extra references.

Make good decisions based on the facts you find for each applicant, Don’t stonewall because of ignorance.

Thank you Sarah for your comment. I work with young mothers living in Illinois and they receive their section 8 vouchers, these are potentially great tenants, because they are ending their current leases. Unfortunately, i n Illinois landlords are not required to rent to section 8 voucher holders, and landlords that do accept the vouchers, may have properties in great neighborhoods but will only rent to section 8 voucher holders in less desirable properties. There should be something to stop this discriminatory practice. Section 8 is simply another form of payment, not a deciding factor. I have worked previously in at a rental company and have seen how people without Section 8 vouchers leave apartments and learned that bad tenants come in all forms.

Then take some risk off the landlords and incentivize them:

On average section 8 tenants do cause more damage.

There’s more paperwork and more admin burden for section 8 landlords/ property management.

There’s no good appeal process for managers to take up issues with their local PHA, literally it just takes one bad worker or inspector and your screwed and it’s like calling the IRS to try to get any answers.

If a unit or house is city rental certified, it shouldn’t need an additional section 8 inspection..period, if it passes city building code it’s good enough for everyone else why does section 8 have extra rules? This is one of the biggest pet peeves, inspections stricter than city code every single year plus special inspections any time a tenant wants to complain (even without them putting work orders in first)

– I literally just saw a section 8 repair list with an item to wire her ring doorbell because she doesn’t want to keep charging her batteries!

The housing authorities need to be better staffed, have a clear standardized appeal process that is quick and efficient (I’m still waiting on one from Jan of this year), give landlords extra security or lease signing bonuses to accept the risks, pay a lease up admin fee for the extra paperwork, and stop with all the inspections that are incessant especially if the property passes city inspection.

I hear you Shannon!

I couldn’t agree with you more.

I am compelled to respond against all I have read about Section 8 renters.

I found myself needing Section 8 housing and I am the tenant that takes care of my surroundings as I once owned a $ 200,000 home. A bad break up of my marriage due to my having breast cancer, I gave my husband the house and its contents not thinking about my future and old age.

Please don’t think all Section 8 tenants are going to trash your property. You could be in my shoes and never expecting ir wanting to.

Thanks for sharing another perspective on Section 8 renters Vicki! And I’m so sorry to hear about your health, I hope you’re on the road to recovery.

“Not all Sec. 8 people are awful because they get help from the government”

First of all, they don’t get help from the ‘government’….they get help from the taxpayers that the government forces on the taxpayers.

Secondly, MOST people on taxpayers assistance ARE terrible, so your chances of getting good people are slim to none…….I’ll put it this way…..if you were skydiving and their were 4 parachutes available but 3 were bad and only one was good, but you didn’y know which one the good one was, would you still pick one and jump out of the plane, knowing that you only had a 1/4 chance of surviving?

I’ve known landlords who have had good experiences with Section 8 renters. But my personal experiences with Section 8 tenants has not been positive.

You know what’s really sad.. as I read these comments I am truly disappointed and disheartened to see so many people demonize people for having section 8. I found this article because my husband and I are very hard working middle class(my husband is a fedex worker and I’m an entrepreneur. We have been renting our two bed room apartment for 14 years in a very nice neighborhood without section 8. We have never missed rent or fell behind, we keep the place clean and we take care of anything or contact our landlord right away if there are any repairs needed. We since have had three children and have out grown our space. During the pandemic our financial situation changed and we a applied for help and recently received a section 8 voucher. Our children are in private school we desire to live in a neighborhood like where we are but just in a bigger place. I have never in my life seen such stereotypes around the people who hold the voucher. We have been turned down and completely avoided as if we were a plague. I’m in no way nieve to the fact that there are horrible renters out there (with and without section 8). However just because people have a voucher it doesn’t mean we don’t want to live in a nice area. I refuse to stay in some of these places that are being offered just because they accept a voucher. It’s really sad that you try to give your family a safe, clean place to live in a neighborhood that is conducive for them and you are literally discriminated against because you have help from the voucher program.

You are definitely the exception to the rule. I have experience with section 8 and there was nothing positive about it. It’s not that landowners are “discriminating”, it is the tenant and government’s earned reputation that has made section 8 undesirable.

If I have a HAP Contract with a housing authority , Do I have to comply with state and local laws on tenant rental?

Hi Robert, landlords must always comply with state and local landlord-tenant laws. There shouldn’t be anything in your HAP contract that violates those laws.

I “inherited” section 8 tenants after my father passed away. These tenants are taking advantage of him not being here. They constantly have illegal guests and are known drug sellers. I have brought this up with my local office but they prefer to cover their eyes. I have also spent $4000 on a lawyer that was useless

Tenants seem to have more rights than landlords

I’m so sorry to hear that Gail. Unfortunately most landlord-tenant laws are designed around protecting tenants, not landlords. It’s a reality of this business, and makes tenant screening and prevention all the more important!

I am a property owner in Colorado and the laws are unbelievably tilted toward protecting tenants versus property owners. It is ridiculously unfair.

Recently found you on FB Live, talking about section 8 so came to check this article out as well. It has been something I have been interested in. I really enjoy all of your content! Very informative. Keep up the great work!

Thanks Anthony! Very gratifying to hear the content’s been helpful for you!

Thanks for this Brian! A piece worth sharing!

Much appreciated Kevin, thanks for reading and the note!

I have someone interested in my condo and she has been approved for section 8. She is mentally disabled and will have an aide living with her. What kind of questions am I allowed to ask? I have not met the tenant, only spoken with her aide. What kind of questions can I ask regarding her condition/mental capacities?

Great question Rachel. I would treat her just like any other applicant, and screen her credit and eviction history, talk to her current and prior landlords about what she was like as a tenant, and visit her current home to see how she treats it.

You’re within your rights to turn her down for things like bad credit or bad rental history or bad treatment of her current/former homes. But you can’t screen her differently than you’d screen other applicants.

Hope that helps!

Rachel, get familiar with Discrimination laws please. Do not, and I repeat, do not ask any questions about her disability—that is a no no. If you refuse her as a tenant, it would be perceived as discrimination due to the information you sought from her. Do not go there. Brian is telling you to treat her as all others. It is so easy to discriminate and not realize it. Just use discernment.

A couple of pros and cons that you did not mention. A pro is that, if tenants do get evicted, they lose their Section 8 voucher. In my state, Erie County NY, there are about 5000 people on the waiting list. Most tenants who receive a voucher know how precious it is to have. They don’t want to do anything to lose it. You can ask that person if they have been approved for the rent amount of the apartment ahead of time. I also ask to speak to their coordinator as a potential reference.

One con is that if you find yourself needing to evict someone or decide to not renew their lease, you must notify the section 8 coordinator (Belmont, as it’s known to me) and they will cease paying any rent after your stated eviction or lease termination date. So if the tenant doesn’t vacate, you have no funds coming in at all. I find that section 8 coordinators, while they officially don’t get involved in disputes, I think can counsel their clients to be better tenants. They have helped me understand the laws as a new section 8 landlord (we inherited vouchered tenants) and answered any questions I had.

Great points Jenny, thanks for adding them!

Finally found the information I was looking for. I’m planning to rent my apartment as I’m moving to my mom’s house. I really wanted to know more about section 8 tenants. Glad that I found all the info here.

Can you sell a house to a private buyer that is currently being rented out to section 8 tenants so that they become his or her tenents? Can you do this for non section 8 rental properties with active leases on them?

Yes leases survive transfers in ownership. But in some states and municipalities, you have to give the tenants the right of first refusal, to buy the property themselves if they’re interested.

King Frey, I don’t know where you live but here in California, if your property is for sale while Section 8 tenants are renting, as soon as the property goes into Escrow, the day it goes into escrow, the tenants legally have 120 more days to remain in the property.. Therefore, the new buyer would naturally be informed. He/she may prefer to look for another property less unencumbered.

I am sad to hear the judgement placed on section 8 recipients. Still “clumping” together I see. Now I have been graciously given this gift of section 8 after a almost 15 year waiting list. I have never missed a payment I do work all the time around the house. As a resident or homeowner or renter that should just be common sense. I’m a great section 8 renter me and my child. Please stop the judgement -how about instead we mention the good ones, that are human just like the “land lords”. You want to see the change it starts with you!

For landlords:

It’s important to know that there is a 99% chance you will fail the initial inspection. If you decide to work with a section 8 administrator in Erie county they will tell you this directly. There are about four inspectors and an 8 year waitlist in Erie county. This works out to inspectors being responsible for 10-15 inspections a day. The initial rent payment delay will almost always be related to the failure of the initial inspection and the rescheduling of the follow up inspection. Before you decide to work with a section 8

Administrator go to any orientations they have for landlords and get all of the information you can. In Buffalo if you receive a voucher through Belmont you most likely have been waiting a decade for it and you will end up (most likely) with a tenant who will not jeopardize losing their voucher, as long as you can make it through the inspections and red tape.

Kelly, you are to be commended my dear. I have had Section 8 tenants since the 80’s. I agree with what you just said, Section 8 is a gift. My tenants waited for years, like you, to get their vouchers. After such a long wait, I told them and still tell them to cherish their Section 8 privilege. I told them and tell them that they should embrace it. A person with thinking ability—they get it—they cherish it. However, unfortunately, whether on Section 8 or non-Section 8, some do not have appreciation for what they have. Common sense is not as common as it use to be. But when you find a person like you, it’s a wonderful thing. Keep setting the right example. Also, my rentals are 4-bedrooms and what I have to look at for is tenants renting rooms out. Rents are steadily climbing and people look out for friends and relatives,. That being said, I’m resigning. Keep up the good work Kelly.

😊

considering buying a house for the soul purpose of renting it for more then mortgage. As a first time property investor, do you think this will be a good idea? btw… I live in Hawaii & cost of living is very high. Hoping this higher rent will help offset my expensive rent. Plus I’ll have a house at the end of the day. Do you have thoughts about this?

Hi Mark, we obviously love real estate as an asset class and rentals as a source of semi-passive income, although we’re equally big on making sure new investors know what they’re getting into. One of the most common mistakes made by new rental investors is miscalculating rental cash flow, usually by underestimating expenses. It always makes me nervous when I hear new investors talk about “renting properties for more than the mortgage,” because the mortgage is only one of many expenses. Non-mortgage expenses typically account for 45-50% of the rent payment. See our rental cash flow calculator to run the numbers for yourself, and be VERY conservative with your estimates!

We need to remove a section 8 renter. My elderly mother owns the property and she now needs to live there with the sale of her own home. Is this easy to do ? All the paperwork was done through a non for profit agency and I can’t find a contract

Hi Pam, unfortunately you’ll have to wait until the CARES Act expires in late July to non-renew your Section 8 renter. See this piece on evictions during the COVID-19 pandemic for more info.

Best of luck!

If I decide to no longer be a Section 8 landlord after my Section 8 tenant moves out, can I rent to non Section 8 renters with ease? Are there any adverse effects from being a Section 8 landlord in the past?

Also, do I have an absolute final say in choosing my Section 8 tenant? Can the city or state forcibly assign a tenant to me against my objection?

Thanks!

Hi Will, yes you can rent to non-Section 8 tenants moving forward with no problems, assuming there’s plenty of demand in your area. You shouldn’t see any adverse effects from being an ex Section 8 landlord.

If you do opt to rent to Section 8 tenants, you do get to choose them just like any other renter. No one forces you to pick one. The only exception to that rule is that a few tenant-friendly cities and states have “first come first served” laws, where you have to rent to the first qualified renter that applies. But that doesn’t just apply to Section 8, it applies to all applicants.

We found that section 8 renters often come with an attitude of entitlement. As a landlord of a small property, the tenant and their family often saw us as a faceless entity and perhaps imagined that “their” was hoarded away into our stash of loot somewhere. They refused to understand that much of that money goes into insurance, Water, garbage, and improvements to the property.

I’ve had similar experiences with entitled Section 8 tenants Rosie. But not all of them bring that attitude of entitlement – the trick, for landlords renting to Section 8 tenants, is to separate out the ones with an adversarial, anti-landlord, entitled attitude from those who are genuinely grateful for the government assistance and the landlord for providing subsidized housing.

I want to buy property in another state so a family member could rent it out with section 8. Will it be an issue when it’s a investment property?

You should probably be all right Wendy, although the local Section 8 office may raise their eyebrows if they know you’re related.

My friend has section 8, unable to find a rental (live in Sacramento CA, rent is very high, and being that we are in a pandemic) and has been renting a room from me for about a year, while trying to find his own place. I own and reside in my house, can I become a section 8 landlord in order to rent my friend a room.

Hi Deanna, I don’t know that Section 8 will cover a room rental. He probably needs to find his own unit if he wants to use his Section 8 voucher.

Hi Mr. Davis,

This is the info I finally found under the Sacramento Housing Redevelopment Agency for “shared housing”. Any input would be appreciated.

The shared unit consists of both common space and separate

private space for each assisted family

• The entire unit must pass Housing Quality Standard Inspection,

not just the areas rented by the family

• An assisted family may share a unit with other persons assisted

under the HCV program or with other unassisted persons

• The owner of a shared housing unit may reside in the unit as

long as the owner is not related to the tenant

• The PHA will not approve shared housing for a tenant who is

related to the owner, even as a reasonable accommodation

• The payment standard and utility allowances are pro‐rated

I have heard that as of September 1st 2020 that all apartments will have to except vouchers, is this true?

Hi Elaine, not as a nationwide law. It’s possible your city or state has implemented a new rule on the local level however – you’ll have to ask around locally.

I have a portfolio (25 doors currently) of Section 8 rentals in the St. Louis, MO area. We have great tenants who pay on time (our tenants pay for all of their utilities and most pay at least a portion of the rent) and take good care of our properties. The key for us has been learning the Section 8 systems and creating processes, documents and checklists to excel in this niche.

There are a lot of “tips and tricks” to making it work well. I think it may be hard to do successfully if you’re only taking Section 8 here and there. We’ve gotten really good at it because it’s all we do.

Great point Jennifer! There are a lot of niche skills involved, and it doesn’t hurt to know people at the local housing authority either. Thanks for sharing!

I have recently started helping an aging relative (who I will refer to as the landlord) manage a property with a Section 8 tenant. It’s a 2BR house, but the tenant only qualifies for Section 8 at the 1BR rate, which, all things considered, is acceptable to the landlord. The property is in good nick, has an outbuilding and its own yard, and has, I’ve been told, passed its recent inspection. Notably, the landlord replaced the heat pump this summer – sadly only 6 years after the last heat pump was replaced – and voluntarily will be making some additional smaller improvements, which the tenant is happy about.

It’s my understanding that the Section 8 payment standard (if that’s what you call the contribution from Section 8) and the total monthly rent paid to the landlord have only been increased ONCE – probably around 5 years ago – in the decade that the landlord has owned the property. Even then getting an increase required intervention at the state level.

The local public housing authority (PHA) is holding its cards close to its chest, but based on a conversation with the PHA administrator (and thanks to some high school algebra), I believe that the total/combined rent paid to the landlord is 85% of the 2020 Fair Market Rent for the county that the property is located in and that the tenant might be currently paying 27% of their adjusted income in rent. When I broached the subject of a rent increase in 2020, the PHA outright refused to explain their calculations, told me that under no circumstances would they increase the Section 8 contribution, and that 100% of any increase in the rent would have to be born by the tenant. The tenant is experiencing serious health problems and lives on a modest income, so we will not be increasing their rent if it means they have to pay it. However, the landlord would like to be treated fairly and achieve a rent (albeit at the 1BR rate) that both meets the mandated minimum for a property of its quality.

Do you have any advice for me on how to resolve this or could you point me in the direction of legislation that states that the landlord must receive the fair rent as standard or whether the PHA is expected to publish its payment standards or be more transparent in general? I hate to be cynical, but based on the history above and anecdotal evidence, the local PHA doesn’t appear to be applying the rules and payments fairly and equitably. Could I get away with writing the PHA a letter acknowledging all the above and let them know that if the landlord is not being paid the minimum amount from Section 8, they should (have the decency) to adjust Section 8’s contribution accordingly?

Hi Jennifer,

We would like to join the section 8 renting train….You said the key has been learning the Section 8 system and there are a lot of tips and tricks. Can I ask where do I start? Where did you start learning the system? Website, books, meetings…etc?

Thank you.

I am currently thinking of becoming a Section 8 landlord. I had heard in the past that Section 8 covers damages caused by the tenant? Also, I had a bad tenant who took all the appliances with him when he moved…I got a judgement but was never able to collect….would I have the same problem with a Section 8 tenant?

No Section 8 doesn’t pay for tenant damage, but you can and should collect a security deposit, and screen the tenants thoroughly. As for whether your Section 8 tenant will steal your appliances, anything could happen of course, but if you conduct thorough tenant screening (including speaking with current and former landlords) you can avoid the bad apples.

Best of luck Barbara!

I have to say that I am not a fan of Section 8. In Erie County NY my tenant stopped paying rent. We have been attempting to evict since September 2020. Due to covid courts are closed. Belmont representatives attempted to inform tenants that their lease was not renewed and are now holdover and we can evict. They are now squatting and not leaving. I honestly don’t think that I will be jumping into section 8 again.

Charlene, I get it! Section 8 can prove to be great or not so great. Unfortunately, if it turns out not so great, the eviction process is much more complicated and takes much longer time.

If we have multiple properties can we chose to accept sction 8 on only one or two? Or must we accept Section 8 for all of the properties?

Assuming your rental properties aren’t in a city or state that requires landlords to accept Section 8 tenants, you should be OK. Just be careful to avoid Fair Housing violations.

I just renewed my lease back in May BEFORE I found out that my complex is now renting to section 8 tenants. Looks like that is ALL that is moving in. This complex used to one of the better ones in the area. Now, there is garbage everywhere. People riding motorcycles around the parking lot at all hours. Kids throwing rocks and running around til midnight or later. in my lease it says no charcoal/gas grills or open flame. New tenants have a giant cookout with grills (with flames 2-3 feet high) and Tiki torches so close to the building it blackened it. Property management told me to “deal with it” when I listed my numerous complaints. It is so bad that I can’t even get a decent nights sleep without wearing headphones.

I’m so sorry to hear that Steve!

Thank you for this great article, it covers most of Section 8 questions I had in my mind as landlord getting inquiries from Section 8 qualified tenants for my 2BR apartment I just listed in Boston suburbs. I currently live on second unit in same house, and I am seriously considering Section 8 tenant. So, one question I have is that how having Section 8 tenant may effect selling a property and its price? Is it more difficult to sell a property with Section 8 tenant living in it? Would it also effect the property price in good or bad way? The reason I asked because I am planning to sell my property within 5 years.

Hi Alex, ordinarily I would say no a Section 8 tenant wouldn’t affect the value of a rental property, but if you live there yourself and plan to sell retail to a homebuyer, rather than “wholesale” to an investor, it might. That said, five years is a long time, and you could simply choose not to renew their lease before selling in five years if you choose.

Oh wow, I am on section 8 housing choice vouchers…I have lived in the same condo for 20 plus years 9-10 owners( not mangers owners) every inspection time I strived to pass, every problem that arose I strived to fix. I have put in 3 ceiling fans, changed out the electrical plugs, switched to window a/c because none of the owners wanted to actually fix the central unit and only did patches on it. Have had to do my own painting when I had extra money along with tearing up the carpet( put tile in) down stairs because the nieghbor had plumping problems that left the carpet and the owner at the time would not fix it. I am not allowed to do anything plumping since they control the shut off valve…so I went months with leaking sinks destroying the sinks in which they have not replaced after 3 plus years…a tub that works but shower doesnt..and a shower that works but the tub needs refinished( we are talking 20 years of neglect on the landlords part) Oh lets not forget the flooding from the other neighbors washer that has the one walls cabinets hanging from a thread…plus the hole in the carport ceiling leading to my bathroom. replaced fridge, replaced stove and replaced washer and dryer..which I am still paying for..not all at same time but over the years because temp fixes instead of replacement or actual repairs done to them. So when talking about low income and housing voucher users…not all are bad and many people who rent without them go from one place to another leaving destruction in their path every 6 to 12 months…I know because I watch craigslist for when they do the emptying of the units…so please stop stereo typying based on the use of vouchers and income…

Thanks for adding a Section 8 renter’s perspective Lorrie Lee!

I am currently a woman receiving a section 8 voucher. I have been living in an Villa Condominium with HOA, in a very nice community for the past seven years on my section 8. I am a quiet tenant who does like to get to know my neighbors and in fact we all watch out for each other as my neighbors nextdoor go out of town quite a bit, I watch their place to make sure no one is snooping around, I collect their mail if they ask and pick up the newspaper from their drive. They do the same for me. I am a good neighbor!! And no one here even knows I’m on section 8 as it is none of their business how my rent is paid.

Before I was on section 8 I ALWAYS left my apt’s cleaner than when I moved in and have continued to do so SINCE being on section 8. Believe me, when I had to look for a new place, I saw some really nasty places that were left from tenants NOT on section 8 and it floored me. I’m guessing the reason for this is

they paid a deposit so they don’t have to clean when they leave? ??

I am also a very responsible section 8 tenant as I call if an appliance is no longer working, if the air conditioner breaks, and most recently the water heater. It was 22 yrs old!! And the realty company I rented through had the audacity to complain because they had to buy a new water heater! I used to sell water heaters and the Premier Rheem water heater only has a 12 yr warranty and these people got 22 yrs out of the one in my unit!

This is why most people rent, ON housing or NOT as those types of repairs are the landlords responsibility. Most of the complaints from landlords as I had been apt. searching was that the tenants NEVER called them when something wasn’t working or they had a leak, or something major so it could be fixed before it got worse. So I always make sure to call them when that something goes wrong and it is something that I as a tenant am NOT responsible for fixing. Small things that are easily repairable I have always taken upon myself to fix at my own expense.

I also own two small dogs(under 8 lbs together), and as a RESPONSIBLE pet owner , I own a carpet cleaner. Yes I take my dogs out to do their business, but accidents happen sometimes and I make sure to clean it up with my carpet cleaner immediately, because that’s what RESPONSIBLE pet owners do.

I have made my condo, home for 7 yrs and was just told 2 days ago they would not be renewing my lease. Due to the extremely outrageous housing market, they have decided to cash in and sell my condo. They didn’t even offer for me to purchase it, which if they had, my brother would have helped me to do so.

So now I have to move, I have to face the scrutiny of trying to find another place in a safe respectable neighborhood and because I’m om section 8, most will PRESUME that I’m trash or not worthy to live in a nice home, which is far from the truth. I am an educated woman with a Bachelors degree.

Pre section 8, I had paid my rent sometimes 6 months in advance and let me tell you, if you think because you pay your rent in advance NOT being on section 8 and think you will get better treated or things repaired sooner, you are sadly mistaken. Landlords typically think that appliances, carpet, and anything they have in their units will last forever!! That they don’t have to fix anything when they need fixing. I have been on both sides and what gets me is if you choose to own rentals then you should not go into it thinking you are NOT going to have expenses to repair things, then MAYBE you shouldn’t choose to be a landlord, because you are living in a false reality if you think things aren’t going to happen

The only thing I have going for me as I sadly have to look for a new home is my current landlords, and past love(D) me and have hated seeing me go.

What’s the old adage? Never judge a book by its cover.

As section 8 people from what I have been told, you don’t leave your place a mess. So I assume most are like me and take special care to leave our dwellings in good condition. Because from what I have seen, those who are not on section 8 leave their places a mess.

That’s my two cents worth. Take it as you will. And don’t assume everyone on section 8 are bad people. Misfortune can happen to the best of us and we are all just trying to do the best we can with what we have and maybe even find a place to call home.

I will be lucky to find another GREAT place as the one I now have to leave, but with the housing prices being what they are and MOST places stating NO SECTION 8, my chances are slim.

What gets me about those who refuse section 8 is, is that, I’m a sure thing!!! If I lose my job, they are GAURENTEED the rent will be paid!! They are taking a higher risk renting to someone who is NOT on housing, because if THEY lose their job, good luck seeing the rent anytime soon, especially with the economy what it is today. I just don’t understand this magnitude of thinking.

Thanks for sharing your perspective Laura, and best of luck with your house hunt!

Laura, your narrative had me thinking and wishing that you were in my area. I would with out hesitation, rent to you. Best of luck finding your next new home.

Thank you for sharing this info.

I am a landlord who takes section 8. I pride myself in providing safe, clean housing to tenants. My lease is 18 pages long. I spell out everything I expect from my tenants. They know upfront that I WILL call the police if any illegal activity takes place on my property. I also make a point to visit my properties on a regular basis to see for myself how things are being maintained. I have security cameras outside and in all common areas that I can access at anytime.

I make sure I build a rapport with my tenants so they are comfortable talking and reporting issues to me. I show them respect and in return I, and my property, receive it back. I ‘ve had more issues with non section 8 tenants. I think the landlords who complain don’t do their due diligence on vetting their tenants and making the expectations clear.

There are bad and tenants out there regardless of whether or not they receive assistance.

Low income does not mean low quality when it comes to people.

Thanks for sharing the ground-level experiences A.L.! Very true that there are a good and bad tenants out there who pay with cash and who pay with Section 8 vouchers.

I have been a landlord for 35 years in Georgia and have accepted vouchers for the past 10 years. Unfortunately, I will not be renewing the leases for my voucher tenants. No fault of the tenants and my maintenance team has no problem with the stringent inspections. The problem is with the PHA . Months after a tenant vacated (with proper notice), I received a letter stating they have evidence this tenant actually vacated 15 months prior to her official vacate date(due to tenant privacy, I am not privy to this evidence). I know someone was living in the house and maintaining the lawn, perhaps her adult daughter or relative. The notice clearly stated the tenant breached her voucher contract by moving without notice and since HUD funds can only pay for housing for the approved participant, they will be recouping 15 months from my landlord account. They confiscated $21,200 from my account from the rent payments for my other rental houses. They claim that although the tenant breached (landlord did not breach), they will recoup the rent from me and I have the legal right to pursue the tenant for repayment. Countless voicemails, emails and certified letters without any response. There is no avenue for landlords to appeal or be heard. My only recourse is to file a lawsuit. This situation of “recouping” rent would never happen with non-voucher tenants. The Admin Plan is over 500 pages and one Program Director has the power to interpret and implement the policy however she desires. Please beware of the power the PHA has over your livelihood!

Great point Judy – it’s much easier to collect money from landlords than tenants, so that’s what government agencies do. I’m so sorry you’re going through this though, $21K is no small sum!

I have a section 8 tenant. Month to month. Can I tell section 8 I know longer want to participate with them

Hi A.L.! Thanks for your perspective. We are considering renting out our first home to a Section 8 applicant. Would you be open to sharing you lease? It seems you have this process figured out. Thought I would give it a shot as I am doing my best to put together a comprehensive rental application and lease agreement.

Thank you for this! It’s encouragement for me and my family as we have been tenants for over 14 years with a great landlord and we are expecting to find that again in a bigger home for our family. Blessings to you.

I will have a new construction ready in a couple of months, thinking about to to join the section 8 program, not sure if it is good to do it with a new house. any suggestions?

Some of it depends on your local market and the quality of Section 8 renters there. I haven’t had great experiences wit Section 8 tenants, but some landlords swear by them. Keep us posted!

I own a single family residence that my parents to live in at no cost to them. My mother will soon be moved permanently to a care facility. I would like to have a family friend move in permanently to help care for my 91 year old father. In return, she would live in my home at no cost. When I asked her about this, she thought it was a great idea. She then told me she is on a waiting list for Section 8. She asked if I was ok with accepting the Section 8 voucher. I know nothing about this other than having read the info on this website. I do not need the money. Is there a down-side to accepting it? Would it impact the value of the home when I sell it after my father passes away? Assuming she is approved, would it be unethical to take her Section 8 voucher?

Hi G., I can only think of one downside to accepting the Section 8 voucher: the inspections. They’ll do an initial inspection and come up with some repairs that need to be made (even if the property is in perfect condition). Then they’ll do it again every year, again giving you a punch-out list of often unnecessary repairs. The inspectors come up with repairs for every property they visit, to prove to their supervisor that they actually visited each property. That said, the total repairs will likely cost far less than the rent you’ll receive.

Personally, I would accept that deal. Just my two cents.

This is very useful. Thanks for sharing.