I met Ashley Thompson in a Facebook group of Mustachians.

No, she doesn’t have a mustache. She, like tens of thousands of people around the world, has embraced the financial discipline and minimalism preached by Mr. Money Mustache. (His blog remains one of the best in the personal finance realm, check it out if you’re not familiar with it). Peter Adeney, AKA Mr. Money Mustache, never had a six-figure income or a trust fund, but he nonetheless retired at 30.

Just like Ashley is on track to do.

In a conversation about personal finance, I mentioned that my wife and I currently live in Abu Dhabi for her job as a school counselor, while also owning rental properties in the US. Ashley messaged me that she and her husband Kevin also own rental properties, and that she too teaches internationally! I liked her already.

But as she began telling me her and Kevin’s story, I realized that theirs was a tale that needed to be shared.

Here is that story, from how they began with nothing six years ago yet have now reached financial independence and retired early (commonly referred to as “FIRE” among personal finance circles).

Moving Overseas

“Since I was 12 years old, it was always my dream to teach abroad,” Ashley explains. “After graduating from my University, I accepted a position to teach English in Japan and Kevin quit his job to join me for the adventure.”

It’s worth noting that Ashley graduated with a degree in global studies, not in teaching; it goes to show that you don’t necessarily need a teaching certification or degree to teach English abroad.

Kevin, who had been working a “normal” middle-class job at a civil engineering firm, took a leap of faith in quitting his job and moving across the world with Ashley. He had no cushy job waiting for him in Japan. Instead, he picked up tutoring work and other odd jobs, all while studying and learning everything he could about real estate investing.

Most people who move abroad spend every penny they earn in side trips and traveling, but not the Thompsons. Despite having generous benefits from her teaching job, including free housing and no U.S. income taxes, Ashley and Kevin buckled down even further. “We lived extremely frugally. Our evenings and weekends were spent working side jobs and studying investments and real estate.”

How frugally? They shared a car of course, but they also shared a cell phone, and rarely ate at restaurants. In fact, they managed to save 100% of Ashley’s income, and live entirely off Kevin’s odd jobs and pickup work.

Kevin & Ashley Thompson, getting traditional in Japan

I asked Ashley what kicked off this aggressive savings and investment planning, and she didn’t hesitate to credit a familiar name. “When I was 18, my boyfriend (now husband) Kevin introduced me to Robert Kiyosaki’s Rich Dad Poor Dad. Soon after graduating from university I came across Mr. Money Mustache and we took some extreme measures to save as much as possible in order to reach our outrageous financial independence goals.”

Takeaway: Preparing for financial independence takes a combination of offense and defense. Yes, Ashley pursued a job that offered nice perks like free housing, but while her friends were traveling and dining out, she was working on the weekends and saving every penny she could. She was a teacher, not an investment banker with a six-figure income, but she was able to put aside significant savings through aggressive budgeting.

“I think it’s a brilliant way to travel the world and financially prepare for the future at the same time. Unfortunately, the majority of teachers I know live paycheck to paycheck.”

The Thompsons’ First Rental Properties

Their discipline paid off. After four fun-but-frugal years in Japan, the Thompsons moved back to their home town in Northeastern Ohio, and set about creating a portfolio of income properties from scratch. They bought five single-family rental properties.

“All of our properties are single-family homes in working class/middle class neighborhoods. But we’re currently interested in expanding into multi-unit housing and apartment buildings.”

Sound familiar? That’s exactly what we urge in our free mini-course on passive income from your first four rental properties.

Then Ashley took a job teaching English in Korea. Kevin stayed behind in the U.S., to finalize a few more deals, manage the properties, and assemble a team of support services. But the separation didn’t last long: “Once we had a good team in place, he began traveling back and forth, spending months at a time with me in Korea or on travel adventures around Asia.”

Takeaway: Plan your work then work your plan. While in Japan, the Thompsons had voraciously consumed real estate investing education. They outlined then detailed a rental investing strategy, and then moved home and executed it. Create a system, or better yet, follow someone else’s successful system!

Bumps in the Road?

Managing rental properties isn’t always a smooth ride. Just like any endeavor, sometimes $h!t happens.

“Occasionally we’ve had to chase down late payments, and we’ve had one eviction to date. It was difficult, and the tenants trashed the home.”

But Kevin moved quickly to clean out the property, repair the damage, and within two weeks of vacancy advertising and running tenant screening reports, they had a new and more reliable renter placed in the property.

“We also had a situation where a tenant was late paying rent and disappeared altogether. They skipped from the property without informing us.”

I asked what other bumps came along on their road; after all, life rarely goes perfectly to the plan.

“At one point we miscalculated the rehab costs for one of the properties that turned out to have a lot more structural damage behind the drywall than we had anticipated. We ended up having to spend about $10,000 more than expected, but the house currently appraises for twice what we have invested into it, and we have a pending offer to purchase the property from us.”

Takeaway: Prepare (and budget) for the unexpected. Problems do arise, and you need to be ready for them, but a problem is not the same thing a catastrophe. Ashley sums it up beautifully: “All of the issues to date have been great learning experiences or blessings in disguise.”

The Home Stretch to Financial Independence

The Thompsons kept saving aggressively, and kept investing to grow their passive income. “While I was in Korea we accumulated another three properties and successfully completed our first flip.”

After two years in Korea, the Thompsons owned eight rental properties, with roughly $3,300/month in net cash flow. That’s nearly $40,000/year in passive income!

They moved back to Ohio, and looked over their finances. With a modest lifestyle, they could live the rest of their lives on their current passive income. But Ashley was only 28 years old, likes teaching, likes Asia, and likes traveling. Why not make one more push to boost their rental income and portfolio even further?

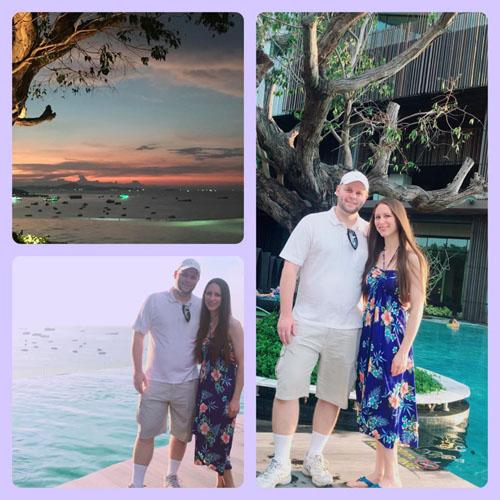

The Thompsons celebrating retirement in Thailand

Ashley took a temporary teaching position in China, planning on a final year or two of salaried income before retiring from full-time work. But life is funny with its twists and turns; even as Kevin bought several more properties back in Ohio, Ashley found the air and water pollution in China so toxic that she put in notice to leave after the fall term.

After a six-year career as a teacher, Ashley Thompson officially retired.

Takeaway: As you build passive income, it gets easier to save and invest to build your portfolio even bigger, but only if you can avoid the temptations of lifestyle inflation. Ashley and Kevin could have taken their first rental income and used it to buy a fancier car, or move into a bigger house, or stay at five-star resorts when they travel. Instead they kept investing every penny.

Early retirement isn’t about luck, it’s about discipline and hard work.

(article continues below)

Life After FIRE

What thoughts flow through your mind when you retire before turning 30?

“We would like to travel around the world and live seasonally in locations such as Thailand in the winters, as Ohio is very cold and snowy. We will have the option to work or not work, to travel and volunteer without negatively impacting our financial situation.”

In the 21st Century, retirement doesn’t have to mean moving to a golf course community in Florida or Arizona. Sometimes, it just means you move on to another job! Albeit a job that you choose more for fun and fulfillment than because you need a fat paycheck. Start playing around with your own numbers for financial independence and retiring early with our free FIRE calculator.

Ashley sums up their goal as “having the time and the means to volunteer or take meaningful positions helping less fortunate children abroad.” Coming from someone who has spent her career teaching children in Asia, that answer rings a lot truer than when it’s blithely spouted by some spoiled, PR-conscious celebrity in Hollywood.

Kevin adds: “Sometimes we work 10 hours a week, sometimes we work 50 hours a week, but it’s our choice. We can do manage our rentals from home, or while sitting on a beach. We can work or not work. That’s freedom.” It’s exactly why we created our automated landlord software: to help landlords manage their rental properties from anywhere with minimal work.

“We now earn six-figures income, that we can realistically work 5-10 hours a week to sustain.”

Takeaway: Dramatic dreams take dramatic commitment and discipline. If you want to retire young, it usually requires earning as much money as you can, while living on a small fraction of that income. It means sacrificing the luxuries that your peers indulge in. Keep the big picture of financial independence and your dreams in mind, while investing all that hard work up front.

Read about rental property calculator.

Read about what cities have rent control in california?

The Thompsons’ Final Advice

I asked Ashley what advice she has for others interested in creating financial independence through real estate. Unsurprisingly, she emphasized the importance of taking action.

“Reading and taking courses is great but meaningless without taking action.” She went on to add how critical it is to find someone to show you how to invest, and how to avoid common mistakes. “Find mentors or meetup groups, and ask questions to experienced investors.”

For financing, “having a good credit score and history really helps. Starting with strong cash reserves for down payments, rehabs and emergencies can really make a difference.” Start with these investment property lenders that we’ve vetted, to compare their lending terms.

Stay capitalized! One of the most common (and catastrophic) mistakes of new landlords is not keeping enough of a cash cushion to cover unexpected costs as they arise.

And of course, real estate investing is a team sport. “Find partners who compliment your strengths and weaknesses. Create a trusted and skilled team that will help your realize your goals as a real estate investor.”

Managing rental properties becomes less passive the more you own. “If you plan on spending a lot of time away from your rental properties, you’re going to need a reliable property management company or trusted partners or employees to manage your properties.”

Always, always include property management fees in your cash flow calculations! (And try our free rental property calculator if you haven’t already.)

Ashley wrapped up our interview with her own takeaway: “Working towards financial independence has allowed us to provide housing and jobs in our neighborhood while helping to improve real estate values. Financial independence also gives us the time and resources to volunteer and take meaningful positions without negatively affecting our finances. Being successful not only benefits you but can benefit family, friends and the community around you.”

Amen.

Ever considered moving abroad? Or maybe early retirement is more your speed? Now for the hard question: What sacrifices are you willing to make in order to achieve your goals?

Read about low down payment investment property loans.

Related Article Read : How to avoid paying capital gains tax on property?

This is awesome! I want to do this. Need to cut back on the happy hours and start saving more, but this really is my dream, to reach financial independence and see more of the world!

I loved her story too Nancy! Enough to make anyone want to pursue financial independence and early retirement. Not to mention the travel itch!

Oh man this is exactly what I needed to hear, to rein in my budget some. It’s hard to stay so disciplined without a concrete goal in mind, but this is a great goal to work toward!

Sometimes that extra kick of motivation is all it takes 🙂

I now have a new 5-year plan. May be a little on the aggressive side though… but a girl can dream, can’t she?

I’m going to try to cut back on my expenses. Right now my savings rate is only 5-10% tops, which clearly isn’t going to be enough to retire any time soon. It’s not easy to find things to cut back on though, while still keeping a roof over my son’s head, food on the table, etc. But this story is wonderful inspiration to live leaner and keep my big-picture financial goals in focus!

I hear you Rachel, living lean is not easy at first! But it’s worth it in the long term, when you can quit your job and retire at 45, and your friends are still clocking in at the office every day!

Thank you Brian. This is exactly what I needed!

Glad it was helpful Jodi! Please let me know if there’s anything we can do to support you as you get into real estate investing!

absolutely amazing story

Right? I love it too, huge inspiration.

I see many of these articles online but there is always something missing. What I mean is there seems to be something missing between “After four fun-but-frugal years in Japan and “They bought five single-family rental properties.”

Even assuming that they were extremely frugal, I don’t think a teacher’s salary for 4 years can afford 5 single-family rentals. That’s buying 1 & 1/4th of a house every year!

Every other blog says buy real estate, make money. Sure, but no one ever writes about how to get enough money to buy real estate!

As Ashley was an international teacher, their housing was provided for free. They had no car, shared one cell phone, and cooked nearly every single meal at home. Their only costs were food and entertainment, so their savings rate was around 75%.

If you want to get enough money to buy real estate, start learning how to live on a LOT less than you earn, and be prepared to make sacrifices that your friends and family aren’t making.

What an inspiring story. Goals for me for sure. I am working on becoming financially independent and would love to travel.

So glad it was inspiring for you Ankita! You’re in the right place – I’m all about travel and financial independence as well!

Great story, I am also 30 wold like to plan the same for me :-p. HopE I will do the same.

I’m not 30 anymore, but absolutely building passive income brick by brick and enjoying the journey!

I love the story and maybe someday I will also be in that level. Thanks for the very inspirational story!

Glad you got something out of it MJ, keep us posted on your progress!

Splendid story! I wonder when I can fulfill my Cinderealla story? Probably 5 to 10 years from now!

Keep investing and working at it Ria and it will happen faster than you think!