What are the best cities for real estate investing in the US?

Sure, it’s subjective. And yes, it depends on what kind of investing you’re doing.

But that doesn’t mean that some cities don’t have better fundamentals for rental investing.

In our hunt for the best cities for real estate investment in 2020, we analyzed eight different economic, social, and political indicators. Then we partnered with Venngage to present the data visually in fun, brightly-colored maps.

Here’s what we found.

The Data: Finding the Best Places for Real Estate Investing

Real estate returns, in the form of both increasing rents and property values, are driven by housing demand.

Thank you, Captain Obvious.

But what drives housing demand?

First, population growth. Faster population growth = more demand = faster appreciation and rising rents.

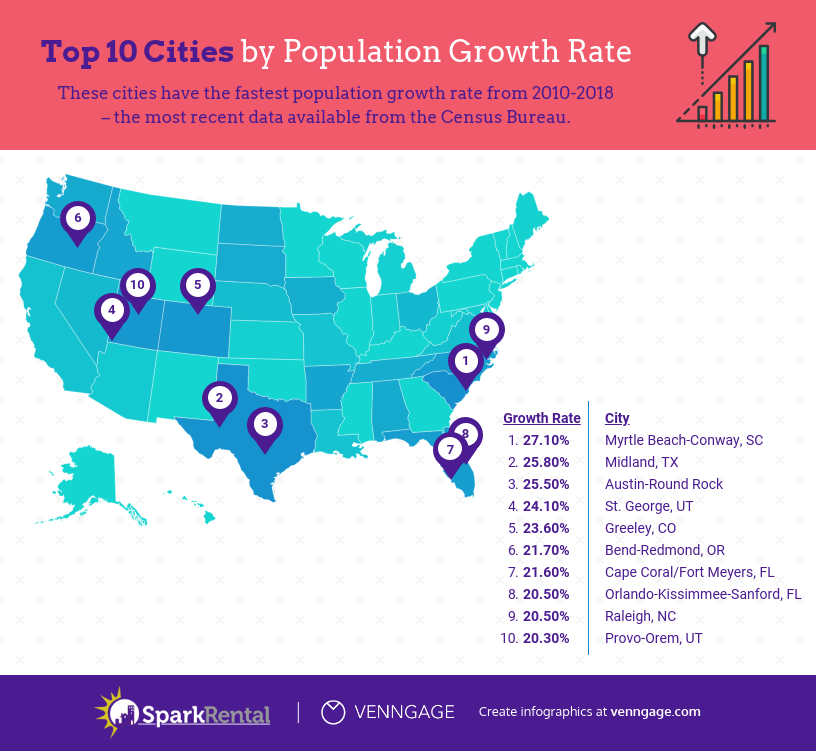

So, of course we looked at population growth. Specifically, population growth between 2010-2018 (the latest year available from the Census Bureau).

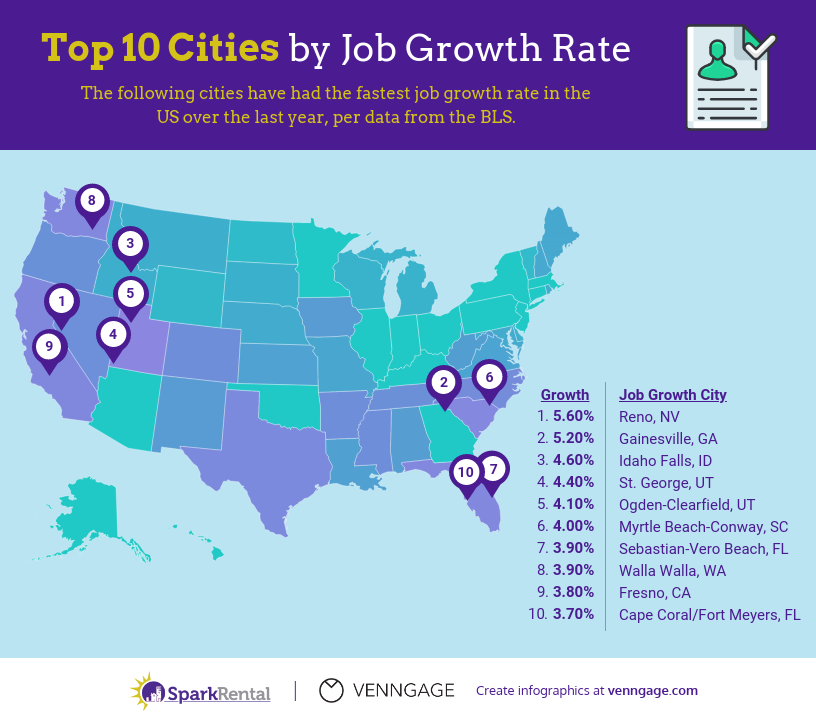

Population growth only forms the tip of the iceberg however. Because what drives population growth is largely job growth – so we measured that too, based on year-over-year data from the BLS.

Of course, population and job growth alone don’t indicate the best cities for real estate investing. To find the best cities for landlords, we also looked at gross rent multiplier (GRM), cap rates, home price affordability, year-over-year rent growth, and state law friendliness toward landlords.

We also focused on lesser-known cities, to showcase “undiscovered” best cities for real estate investment in 2020.

Because different cities shined in different metrics, we separated them by some of the top metrics, to provide a series of “best cities” lists according to whichever metric you choose to prioritize. Then we picked 15 cities that we find the most promising places for real estate investing at the moment, based on all of the data taken as a whole.

Without further ado, here’s what we found.

Context: Nationwide Numbers

Individual cities’ data mean little without the context of how they compare to nationwide figures.

So, before showcasing the best cities for real estate investment based on the metrics outlined above, we wanted to show you how the nation as a whole is doing. We’ll keep it brief so you can get to the good stuff below.

Population Growth 2010-2018: 6.0%

Job Growth 2018-2019: 1.6%

Unemployment Rate: 3.3%

Median Home Price (per Zillow): $226,800

Gross Rent Multiplier (GRM): 12.7

Cap Rate: Data not accurate nationwide

Rent Growth 2018-2019: 3.1%

With us so far? Awesome. Let’s get cracking!

Best Cities for Real Estate Investing by: Population Growth

Population growth makes a great all-around indicator of growing demand for housing. Cities that saw a bump in population growth over the last decade are likely to see even more – particularly smaller cities that are just starting to catch the attention of the public at large.

All of the top ten cities saw population growth of more than 20% from 2010 to 2018, more than triple the national average. The top city grew 4.5 times faster than the nationwide average!

Here are the fastest growing cities in the US:

Now let’s pivot and look at one of the main drivers of future population growth.

Best Cities for Real Estate Investment by: Job Growth

Business-friendly cities attract existing companies to relocate, and encourage entrepreneurs with tax and other incentives. And as companies from tiny startups to mega-corporations grow and add jobs, they attract talented workers from all over the country and even the world.

These are typically higher-skill, higher-paid workers. Read: the kind of people willing and able to pay for decent housing.

All of which is a dumbed-down Economics 101 way of saying that job growth is often a leading indicator of population growth and more demand for housing. Your mission, should you choose to accept it, is to buy into smaller, growing cities before they become the next Austin or San Jose.

In other words, while prices are still affordable.

Here’s what we found:

(article continues below)

Free Masterclass: How to Reach Financial Independence in Under 5 Years

Best Cities to Buy Investment Properties by: Affordability

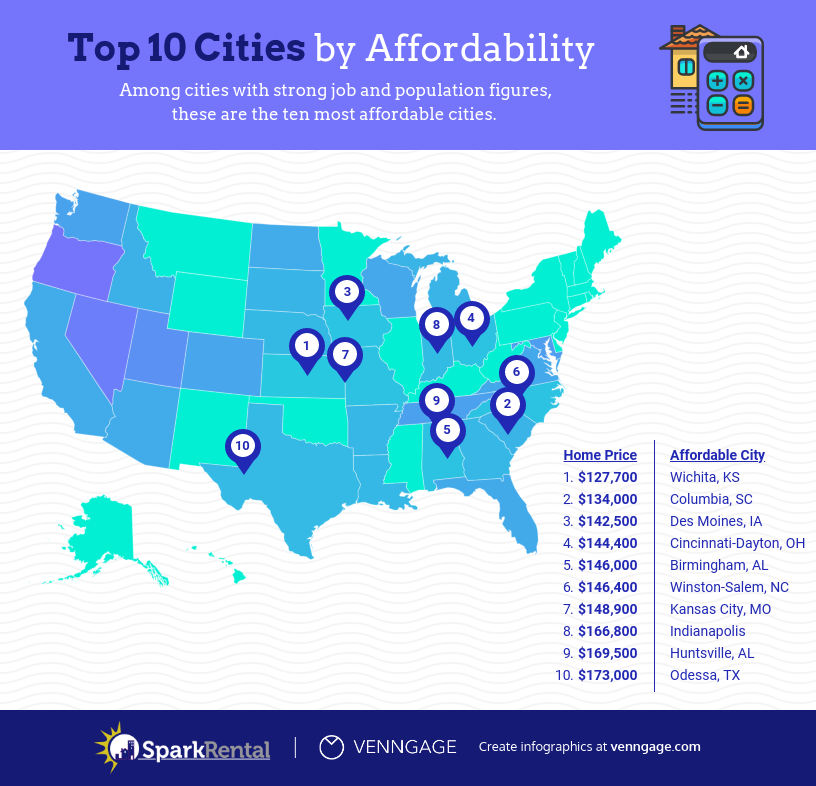

Even if the cap rates and GRM were great in San Francisco, it wouldn’t do you any good if you couldn’t afford the $200,000 down payment on a $1,000,000 rental property. (Cap rates and GRM in San Francisco suck, by the way. Just illustrating a point about affordability.)

So, you want high-quality housing serving solid middle-class renters in a growing city – that’s still affordable. A tall order? Maybe. But not impossible, because we found some solid cities with great affordability.

To weed out cheap-but-crappy cities, we only allowed cities with unemployment rates at or below the nationwide average. We further screened for population growth, barring any cities with growth slower than 2%. Most of the cities below beat the nationwide average, some by as much as triple.

Finally, all of them saw year-over-year rent growth of at least 2.5%. Not too shabby!

Here are our top ten cities for real estate investing based on affordability:

Best Cities to Buy Rental Properties by: Rent Growth

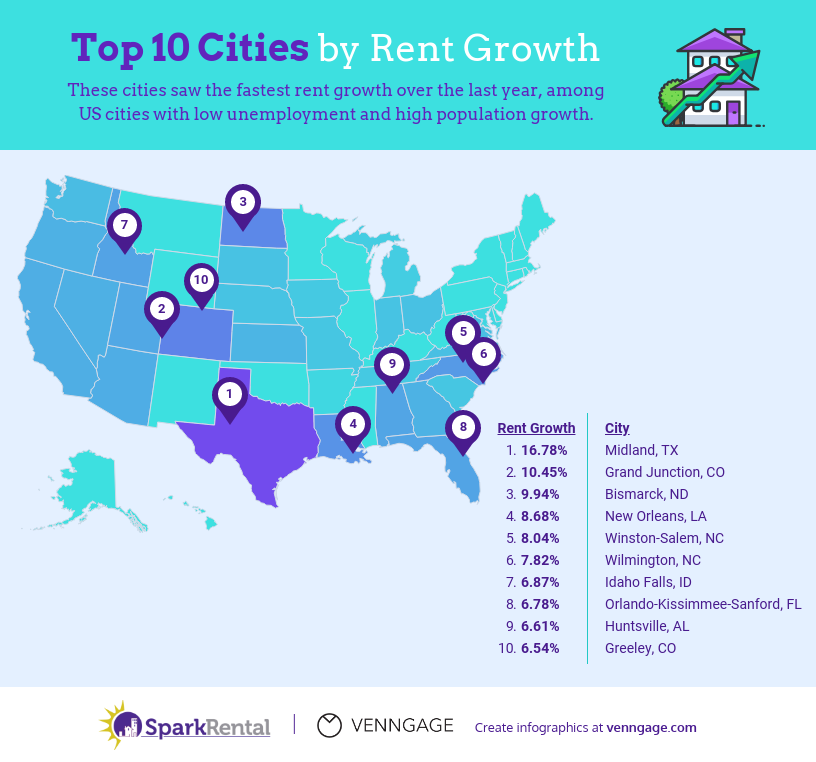

Stagnant rent growth doesn’t exactly do landlords any favors. One of the great advantages of rental investing is that returns automatically adjust for inflation, since rents are a primary driver of inflation.

The slowest growing of these top ten cities, Greeley, still more than doubled the nationwide rent growth average. The fastest, Midland, saw rents skyrocket at roughly 5.5 times the national average!

Granted, these cities also saw faster-than-average price appreciation. Which, of course, impacts the cap rates and GRM – but I’m getting ahead of myself.

Check out these cities with the fastest growing rents over the last year:

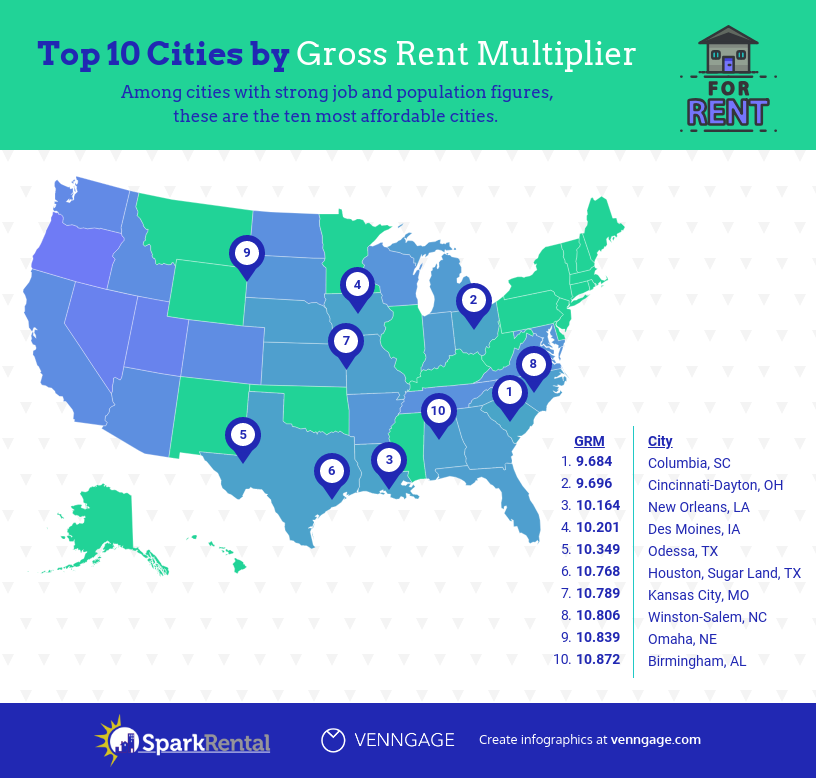

Top Real Estate Investment Cities by: Gross Rent Multiplier (GRM)

All right, ten-second pause to define gross rent multiplier. It’s the purchase price of a property – or in this case the median purchase price of a city – divided by the annual gross rental income.

Put another way, it’s the number of years it would take for a property’s total rental income to pay for the purchase price.

For example, a $100,000 property with $10,000 in gross annual rents has a GRM of 10. Easy enough, right?

In some ways, GRM is not as useful as analyzing cap rates. After all, GRM doesn’t include expenses like vacancy rate, repairs, property taxes, and so on.

But that also makes GRM a “purer” figure: it’s just a ratio of price to rents. As anyone who’s ever owned low-end rental properties can tell you, cap rates can be deceptive.

Here are our top picks for US cities by price-to-rent ratio, better known as GRM. If they seem high (which is bad for gross rent multipliers), that’s because they’re citywide; they include high-end neighborhoods where nearly everyone is a homeowner. Working- and middle-class neighborhoods will have significantly more attractive GRMs in each of the cities below.

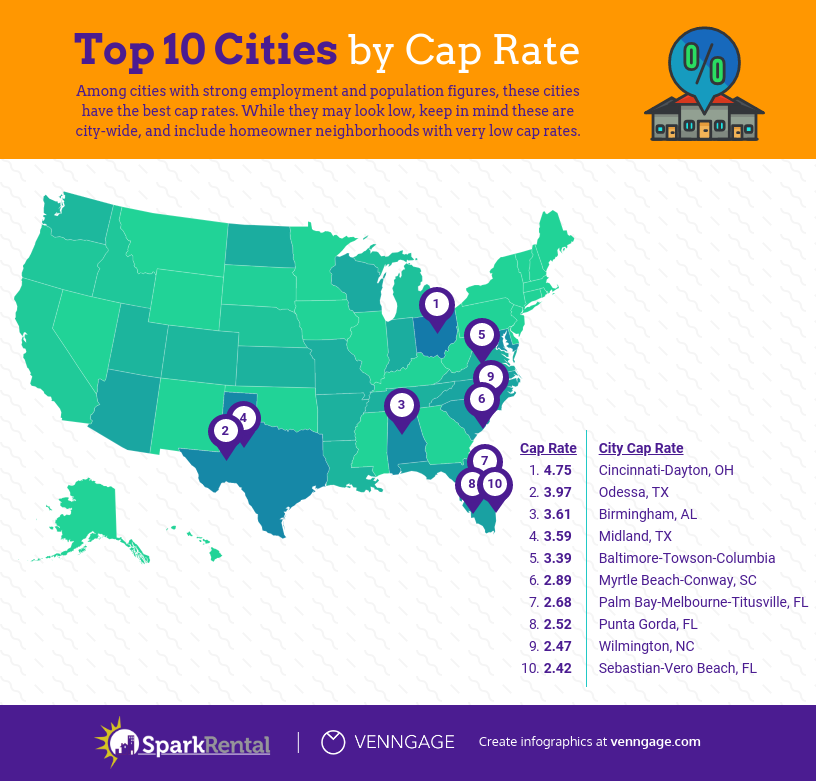

Best Cities for Real Estate Investing by: Cap Rates

To gather cap rate data, we partnered with our friends over at Mashvisor.

I’ll be honest: these cap rates don’t look great on paper. But like GRM, the cap rates are citywide, and include all the high-end suburban homeowner neighborhoods that inherently have terrible cap rates.

So, don’t get caught up in the numbers themselves – they’re meaningless. What matters is the relative cap rates: how cities across the country compare to one another.

Here are the best cities for real estate investing based on long-term tenancy cap rates. Keep in mind that we filtered the list of eligible cities by several of the metrics above, such as population growth rate and job growth rate. There are some cities in the US that offer higher cap rates (I’m looking at you, Flint Michigan), but that doesn’t mean we recommend investing there, because they didn’t meet our criteria.

Now, because we love you, we’re including a bonus list, based on the best Airbnb/vacation rental cap rates in the US:

| City | Airbnb Cap Rate | Job Growth YoY | Unemployment Rate | Population Growth 2010-2018 | Home Price |

|---|---|---|---|---|---|

| Birmingham, AL | 8.94 | 1.9% | 3% | 2.1% | $146,000 |

| Cincinnati-Dayton, OH | 8.63 | 2.1% | 2.9% | 3.6% | $144,400 |

| Odessa, TX | 8.49 | 2.7% | 2% | 18.2% | $173,000 |

| Winston-Salem, NC | 7.62 | 1.2% | 3.4% | 4.8% | $146,400 |

| Columbia, SC | 7.36 | 0.8% | 2.8% | 8.5% | $134,000 |

| Milwaukee-Waukesha-West Allis | 6.72 | 0.8% | 2.7% | 1.3% | $232,300 |

| Grand Rapids-Wyoming, MI | 6.31 | 0.8% | 2.5% | 8.1% | $194,100 |

| Fargo | 6.25 | 0.5% | 2.5% | 17.2% | $224,000 |

| Auburn-Opelika, AL | 6.14 | 3.4% | 2.9% | 16.9% | $194,500 |

| Greenville-Anderson-Mauldin, SC | 5.91 | -0.7% | 2.7% | 7% | $176,800 |

Just make sure you double check the local laws and restrictions before launching a short-term vacation rental business as an Airbnb landlord!

(article continues below)

SparkRental’s Picks: Overall Best Cities for Real Estate Investing in 2020

Isolating individual data points is all well and good, but when you combine all that data, which cities emerge as great overall places to invest?

Adding the human element to the equation, I reviewed the data myself. Before I spill the beans, I want to caution you that I’ve never actually visited most of these cities, I don’t know them personally, and I don’t own investment properties there.

In other words, this list is not based on personal investing experience. It’s based on manually reviewing the nationwide data.

All right, enough with the caveats and a$$-covering. Here are the 15 cities that jumped out to me as the best cities to buy rental properties in 2020, based on the data:

Because we’re all about transparency around here, I also wanted to share the underlying data. It’s too big to fit on one on-page spreadsheet, so here’s where you can download the full spreadsheet. But here are some select data points to whet your appetite:

Read about investment property mortgage rates today.

Related Article Read how to invest in real estate?

Bonus Map: State Law Friendliness to Landlords

We didn’t make this map ourselves – that honor goes to the good folks over at RENTCafé, who we occasionally team up with for fun content.

I used their assessment of state landlord-tenant laws to help me choose my picks for the best cities for real estate investment. New rental investors rarely realize it, but landlord-tenant laws make a huge difference in your experience and returns as a landlord. Don’t ignore them. Seriously.

As a quick example, the last eviction I filed (in Baltimore, Maryland) took 11 months, because the local and state landlord-tenant laws are so tenant-friendly. The tenant took advantage of every loophole and trick in the book to delay the eviction process. Which worked specifically because the laws are so tilted in tenants’ favor there.

In RENTCafé’s map, red = landlord-friendly and blue = tenant-friendly. Give it a look-see:

Quick Tips for Long-Distance Real Estate Investing

I can already hear the wheels turning in your head:

“This list of best cities for real estate investing is great and all, but I don’t live in any of these cities. How the heck am I supposed to invest in them from halfway across the country?”

Glad you asked. It turns out it’s easier than ever to invest in real estate long-distance, with the tools available to you in today’s world.

First of all, there’s Roofstock’s platform for turnkey rental properties. It’s like Amazon for rental properties, with a slew of data and information about each property, from value history to forecast appreciation to neighborhood details and local school information.

Roofstock also requires sellers to order title and a home inspection, for your review. They’re big on transparency, too!

One last perk to Roofstock before I stop gushing: they include two guarantees for buyers. The first is a 30-day money back guarantee, if you don’t like the property after buying. The second, for vacant properties, is a rent guarantee that you’ll place a new tenant within 45 days. If you fail to do so, they pay 90% of the rent to you until you do.

Beyond Roofstock, you can also buy from a private turnkey seller. These are often local, mom-and-pop operators, but you can check out larger regional turnkey firms like Howard Hanna, American Real Estate Investments, Norada Real Estate Investments, and Maverick Investor Group.

We also include a directory of wholesalers and turnkey rental sellers as part of our FIRE from Real Estate program. It’s called the Dealfinder Database. Just sayin’.

Or, of course, you can hire a good ol’ fashioned local real estate agent. Just make sure you find a good one who specializes in working with investors!

Final Thoughts

It’s a complicated balance, deciding where to invest in real estate. Ask ten different investors across the country, and you’ll get ten different answers about the best places for real estate investing.

And, of course, it’s constantly evolving. We all wish we could go back in time and invest in San Francisco rental properties in 2000. But the best cities for real estate investing in 2020 are not necessarily the same cities that were great in 2010, or 2015, or what will be true in 2025.

Do your homework before deciding where to invest, and remember you’ll make tradeoffs. Cities experiencing fast growth may have lower cap rates, while cities with slow growth may be more affordable but less certain to thrive in the long term.

And as always, stay in touch with us about what you’re up to investing-wise, and how you’re using real estate to build passive income and work toward financial independence!

Related Article Read: how to get a loan for a rental property with no money down?

Read the rental property depreciation calculator.

Where are you investing currently? What are your picks for the best cities for real estate investment in 2020?

More Top Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

What a great breakdown of rental growth and best cities to buy. I really enjoyed the info-graphics. I will definitely be sharing this information, Thanks.

Thanks Lisa! Much appreciated, we definitely put a lot of work into it!

The map with tenant vs. landlord friendly is wrong for Arizona. I have evicted tenants in less than ten days. So your data is questionable from your Cafe people. Yes, next door is CA and they are not landlord friendly.

Thank you for sharing. Well explained, probably it will easier the way of investing in real estate.

Thanks Jyoti! Glad to hear you found it useful 🙂

This is all helpful information. However as a long term rental investor there are some key items missing from this forecast :

One which do not fit nicely into spread sheets of data.

IT IS CLIMATE CHANGE!

There is a huge plethora of overbuilt properties along SE coastal areas and cities. True for FLA., SC, NC , etc.

These properties are overvalued from where they will shortly be

Due to the now annual hurricane , and flood damage.

Many properties will be uninsurable.

Thanks for adding your perspective Josie!

So I take it you are not investing in any coastal cities, and only investing inland?

Thank you for this insight; value add in each section presented. Thanks for being so thoughtful we’ll be sharing these details.

Glad to hear you found it useful Christine!

Fantastic content! Very very helpful indeed! I live in San Jose, CA, so not sure if I am willing to invest so far out cross-country. Any pointers to who can guide me would be appreciated!

Thanks Subhechhu! And I hear you about investing long-distance, it can be nerve-racking. I’d start with a turnkey property if I were you. Alternatively, Deni and I are preparing to launch a co-investing program where you can join us on our property investments, but it’s only available for our email community, and it’s first-come first-served. Sign up for our email list if you’re interested!

Thank you! Just sent you a note through the contact us form to sign me up to your email list.

Looking for investment property