Unlike flipping, buying a rental property is a long-term investment. And long-term investments need long-term thinking and planning.

Real estate is an inherently illiquid investment – it costs several months and thousands of dollars to sell, unlike stocks or bonds or REITs. It could take six months and $15,000 to sell a rental property; a far cry from selling stocks instantly, at the cost of $4.95 commission to a broker.

That means that making a mistake when buying a rental property is not solved as quickly, easily, or cheaply as selling a stock you decided you don’t like.

So? Don’t make mistakes!

All right, so you’re bound to make some mistakes when you buy your first rental property. But if you do it right, your learning curve will involve minor missteps, rather than regret-induced migraines.

Here are nine questions to help you make rational, well-informed rental investing decisions, and ensure your next rental property is a winner.

1. When were the roof, furnace, AC unit, and hot water heater each last replaced?

There are other components to any house that you need to evaluate, of course. But some components, such as the framing, wiring, and plumbing have extremely long lifespans, and the cosmetic updates are obvious enough. You don’t need me to remind you to look at the kitchen and bathroom; you know how dated or chic they are.

But it’s not necessarily obvious how old the roof, furnace, air conditioning unit, and hot water heater are. These can be expensive to replace, and if they’ll need to be replaced within the next few years, you should know it before buying the rental property.

First, ask the seller. If they can’t give you a precise answer – preferably with documentation – get expert opinions. Ask your Realtor, ask contractors, ask your home inspector.

Which brings me to my second point: always get a home inspection. Even if you’re buying the property as-is, you need to know what you’re getting yourself into.

Here’s a quick-reference infographic showing how long each component in a property lasts so you can get a sense for how frequently you’ll need to replace them.

2. What is my competitive advantage as a real estate investor?

When you’re in business, you need a competitive advantage or three. And make no mistake: as a real estate investor, even a solo investor buying your first rental property, you’re in business.

You don’t have experience, so don’t count on that as your advantage. What about cash? Are you able to buy rental properties in cash, rather than taking out a rental property loan?

If you’re using a rental property loan to buy the property, how quickly can you settle? Speed can be a competitive advantage.

Perhaps you’re able to find good deals on rental properties – deals that other investors are missing. One way to do this is by finding properties that aren’t listed for sale and approaching the owner directly about selling. Try Propstream or DealMachine as powerful real estate tools to help you do this.

If you’re not familiar with it, here’s our full Propstream review, plus a two-minute overview of features:

Another competitive advantage can be your networks of off-market sellers, such as wholesalers and turnkey sellers. We include a directory of them, the Dealfinder Database, along with our FIRE from Real Estate course, but there are plenty of other ways to renovations network as well.

Your competitive advantage could be that you can do the renovation work yourself, or that you can move so fast on making offers that you get properties under contract within a few hours of them being listed. Whatever your competitive advantage, make sure you’re clear what it is!

3. What’s the property tax bill, and will it change when I buy the rental property?

The last thing you want is a nasty surprise, when you discover that the tax bill suddenly doubled from $2,000/year to $4,000/year upon the property’s sale.

Many jurisdictions update their tax assessment value of the property when it transfers. If the property is currently assessed at $100,000, and you buy it for $200,000, that can cause the tax assessment to jump to (you guessed it) $200,000. Read: double taxes.

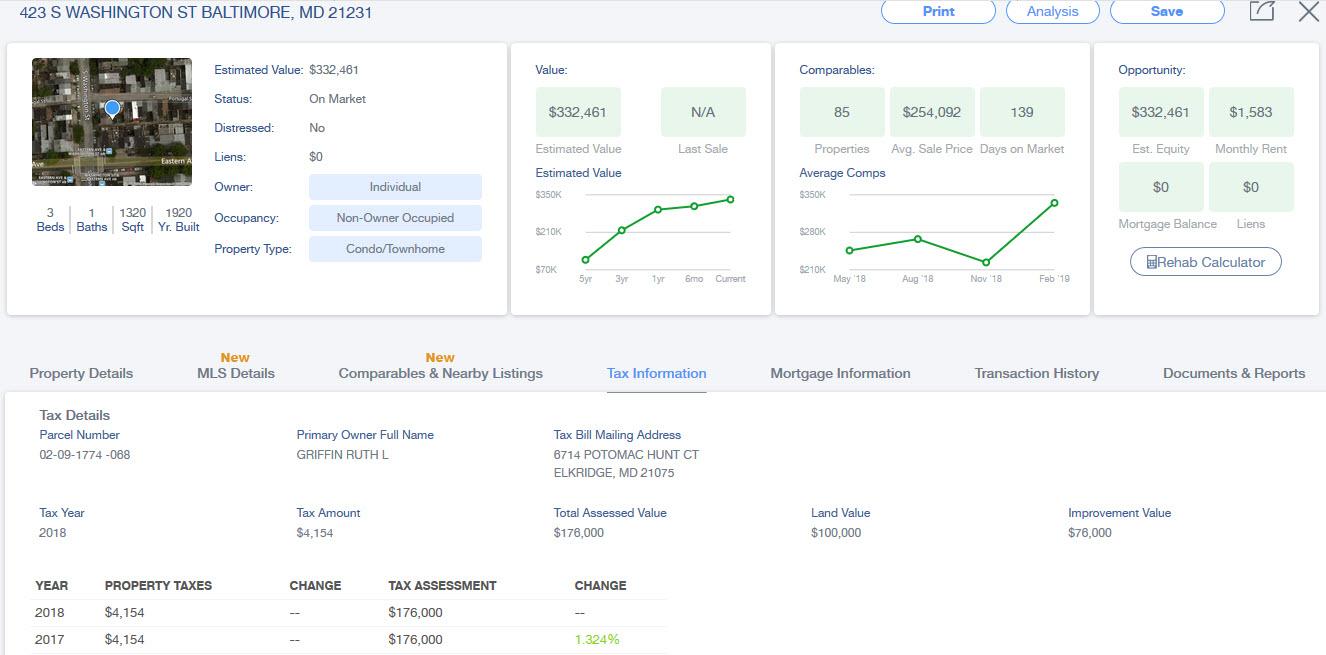

So, you need to check on the current tax bill and assessment. One way to gather this intelligence is through Propstream, which displays it for you:

If the tax assessment value is significantly lower than your price to buy the rental property, calculate the potential property tax bill based on your purchase price. A quick Google search will reveal property tax rates in the property’s jurisdiction.

Use that new, higher property tax bill when you calculate the rental property’s cash flow.

4. What’s the neighborhood vacancy rate?

Just as you need an accurate number for the property’s tax bill, you also need an accurate estimate for its vacancy rate.

Vacancy rate is an expense that all too many new rental investors ignore. But over time vacancies will eat into your average cash flow, making it a very real expense.

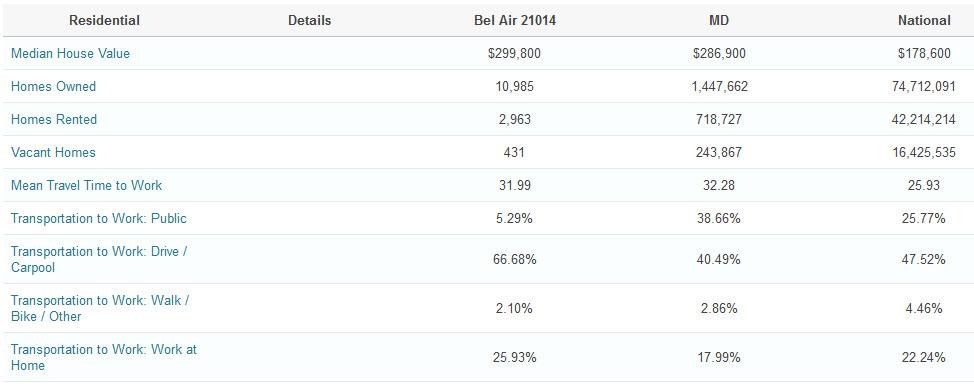

Talk to other neighborhood landlords and property managers to get a sense of the local vacancy rate. For online resources, Moving.com (shown below) provides some insights into local vacant properties, and Propstream displays vacant properties based on your search parameters.

5. What direction are economic and social indicators trending?

Never buy a rental property without understanding the local economic trends.

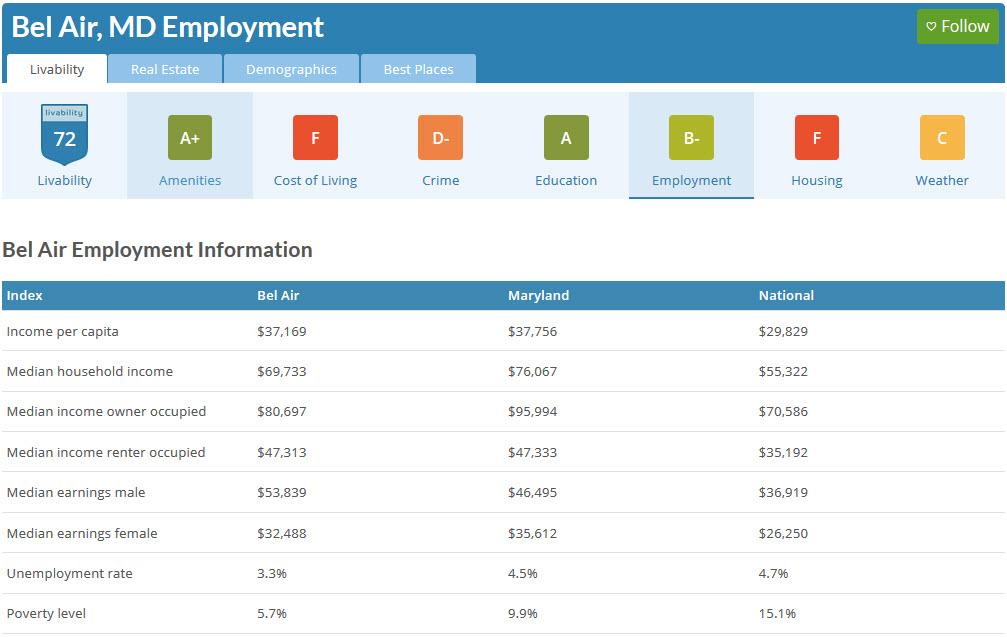

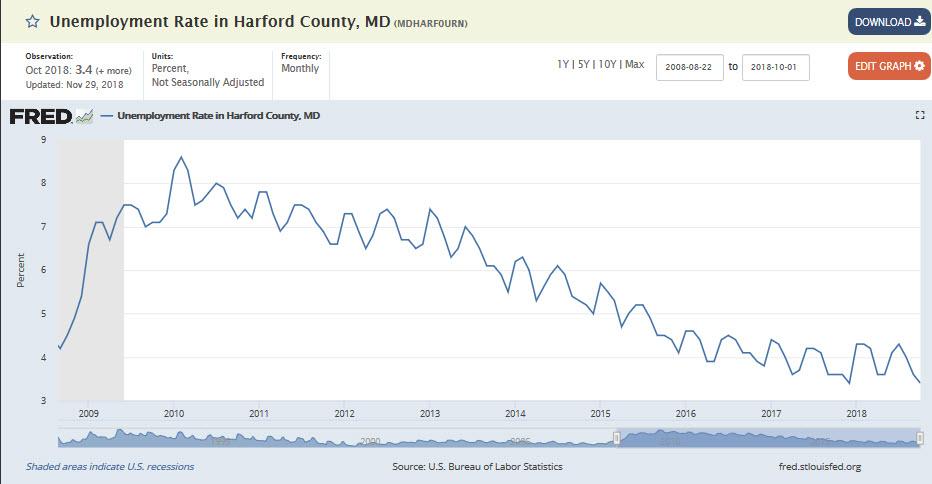

Most notably, these include crime rates, unemployment rates, population, and income. Check crime rates and unemployment rates on the local level using AreaVibes:

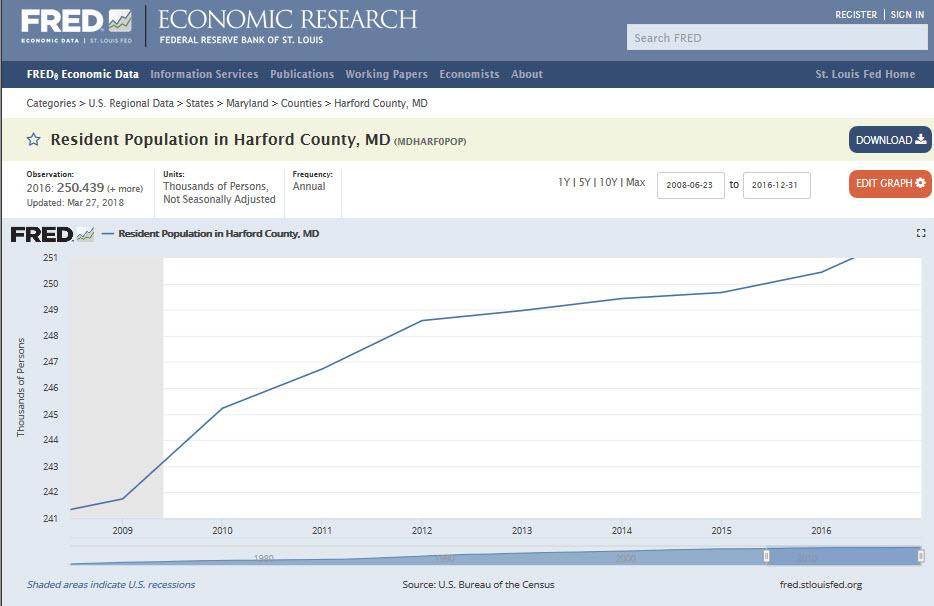

For county-level data, check the Federal Reserve:

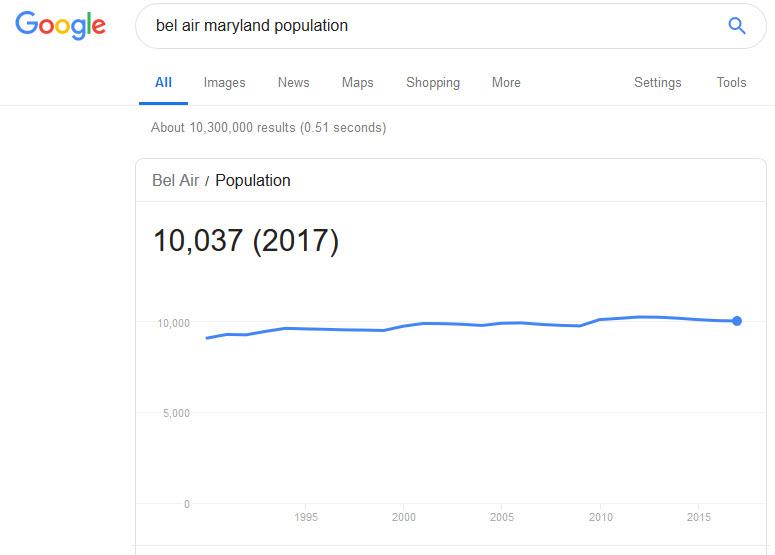

You can find town-level population growth on Google:

And county-level population growth on the Federal Reserve:

Rising population and income are a promising sign, as are shrinking unemployment and crime rates (thank you Captain Obvious). Make sure you have your pulse on the local economy, and that goes beyond looking up data online.

Go walk the neighborhood, talk to local business owners. Get a true gut-level feel for what’s going on in the area, and only invest in neighborhoods and towns that are on the rise.

6. Who’s going to manage the property?

There’s no wrong answer here. But you do need an answer, and a good reason for it.

If you manage the property yourself, you can avoid paying a property manager – but managing a rental property is still a labor expense, even if you do the labor yourself. Include property management as an expense either way, when you calculate the rental property’s cash flow.

Managing your first few rental properties can be an excellent education, and I highly recommend it. It makes you a better rental investor because it forces you to develop a better sense for what tenants look for, how to buy rental properties that will attract good tenants, and the job of being a landlord.

You can always outsource property management later, after you’ve gotten the hang of being a landlord.

To make your life easier as a solo landlord, we offer free landlord software that helps you automate your property management. Here’s a quick overview of exactly what you can do with our landlord app:

Before you buy a rental property, make sure you have a plan in place for who’s going to manage it day-to-day. Once you buy a rental property, someone needs to be on the front lines managing it, and you don’t want any confusion as to who that is.

(article continues below)

7. How does my cash-on-cash return compare to other potential investments?

You have a limited amount of money. You want to invest it where it will go reproduce fastest for you.

Buying a rental property can deliver excellent returns, especially in the form of passive income. But every property is different, every market is different, and you need to be able to quickly compare returns not just between different rental properties but against other types of investments.

Say you run the numbers on a property on a rental property calculator and determine it will pay an 8% cash-on-cash return in rental income, not including appreciation. (For reference: “cash-on-cash return” means the return not on the property’s total purchase price, but on your own cash investment, if you’re financing it with a rental property loan.)

So, you can earn 8% a year on rental income from Property A, plus any appreciation. What about an alternative Property B? Or buying stocks? Or a REIT, or investing in a crowdfunding website, or something else entirely?

One of the great advantages of buying rental properties is that you can accurately calculate their returns. Not their appreciation necessarily, but their rental income returns, because they’re based on today’s numbers. You don’t have to wonder how fast home values or rents or stock values will go up; you know your expenses, and you know the market rent.

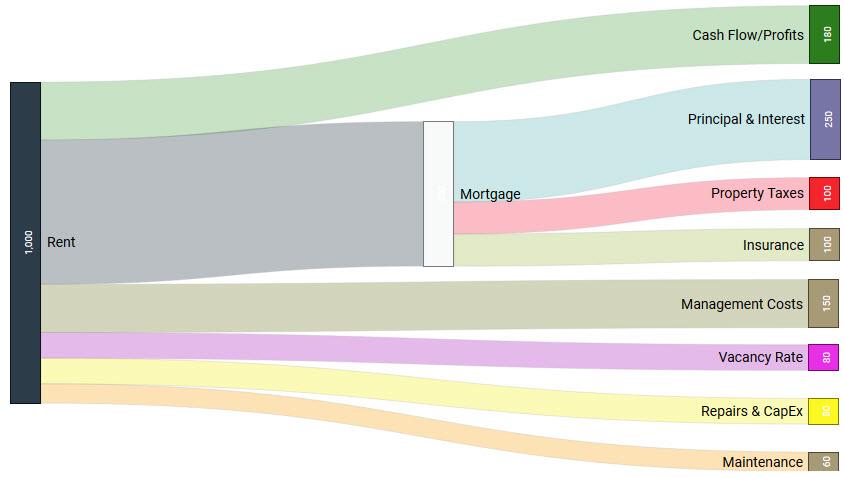

I’ll leave you with this Sankey diagram to help you visualize how real estate cash flow looks:

8. How transitory is the neighborhood?

Turnovers are where most of the work and expenses lie for landlords. To earn more and work less, you want to minimize your rental property turnovers.

Unlike many of the questions above, this one can’t be answered with an app or a handy real estate investing tool. You need to talk to other local landlords, property managers, Realtors. Talk to local business owners and residents.

Do people set down roots and raise children in this neighborhood? Or do they hang out for a few years in their early-mid 20s, before moving out to the suburbs, when they get sick of the crime and high taxes? (Sadly, that was the case in the downtown neighborhood where I lived for much of my 20s and early 30s.)

High turnover rates will kill your profits, as a long-term rental landlord. But they won’t hurt you if you rent the property short-term on Airbnb.

9. How do the cash flow numbers compare as a short-term rental?

Some properties earn more as long-term rentals. Others earn more as short-term rentals, even accounting for greater management expenses and labor.

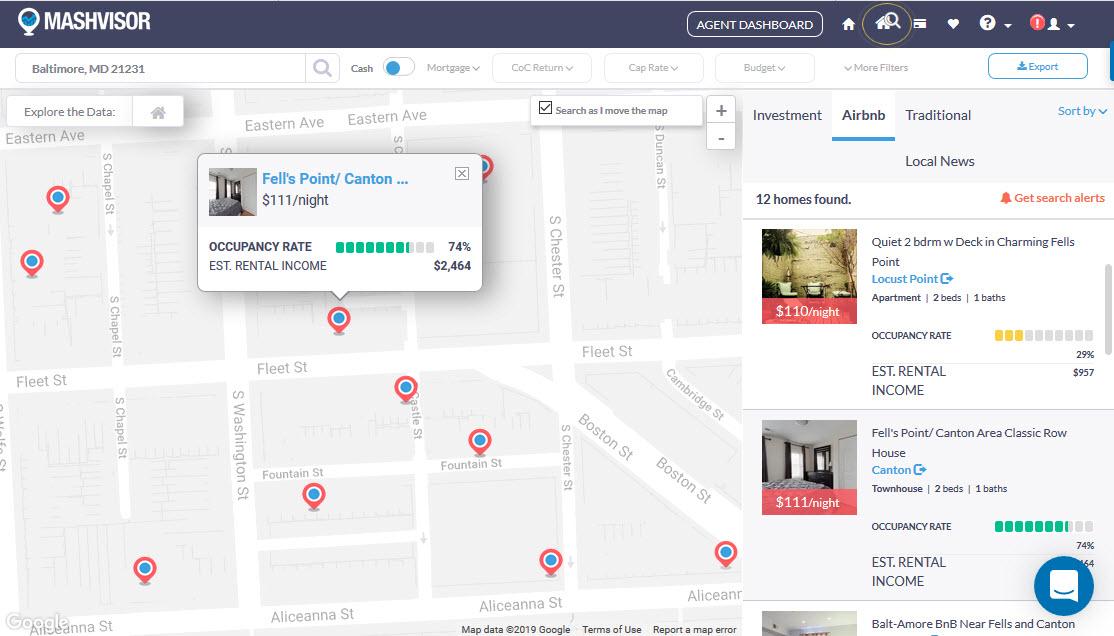

Check out Mashvisor as a tool to help you compare long-term and short-term rental property returns. Mashvisor analyzes occupancy rates as a factor when they run the local numbers for you since occupancy rates have such an impact on landlord returns.

Here’s how it looks:

You can click on individual properties for more details, or to view the full listing on Airbnb.

While you’re making up your mind, check out these Airbnb success tips for new Airbnb landlords, or you can check out this masterclass we held with Airbnb expert Al Williamson.

Final Word

Buying a rental property is nothing like buying a stock. It takes time, it takes effort, it takes a lot more money to come up with a down payment, and you can’t sell it on a whim.

But for all that, rental properties come with some unique advantages. You can accurately forecast your cash flow and returns, before buying a rental property. You have a degree of control over those returns, in your approach to property management. Rental properties are far less volatile than stocks, both in property values and rents.

And speaking of rents, they almost never decrease.

Before you buy your first rental property, make sure you know what you’re getting yourself into. We offer plenty of free education, from our rental income blog to our webinars to our free rental investing course, but we’re not the only source of education out there. Read everything you can, join webinars, listen to podcasts, because the more you know before buying a rental property, the more likely you are to earn good money doing it.

More for New Real Estate Investors:

I want to know more about…

Great roundup of questions new real estate investors should ask before sinking hundreds of thousands of dollars into a property!

Wish I’d read something like this before I started investing, would have saved me a lot of money…

Thanks Eddie! And better late than never 🙂

Awesome….great contents, very very informative.

I am new like a new born baby, have no knowledge of REI.Ih

I have a question, if i see a sale by owner sign, how do you approach to owner, how to start conversation or how to talk to them what ask ,what to say, etc is there is script or something…pl. advise.

Thanks Sam! I’d simply call and ask simple follow-up questions about the property’s condition and the seller’s urgency, and if you like what you hear, schedule an appointment to walk through the property. There’s no one-size-fits-all script, just get a sense for whether the deal is worth pursuing before investing the time to walk through in person.

Keep us posted on how we can help!

Great article guys!Thanks for sharing with us 🙂

Much appreciated!

Greate article guys, Thank you for giving me this information.

Glad you found it helpful RPM!