If you’ve been looking for a way to buy shares in single-family rentals, Ark7 offers a great option with low investment minimums.

A relative newcomer, Ark7 blends the fractional property ownership of Arrived with the liquidity and secondary market of Lofty. In fact, they do you one better: there’s no convoluted cryptocurrency involved, unlike Lofty’s real estate investing platform.

Here’s how Ark7 works and why over 30,000 investors have bought shares through the real estate company so far.

Ark7 Review at a Glance

Minimum Investment: $20

Prospective Returns: 5–15%+

Fees: 3% acquisition fee, 8–15% property management fee

My Take: An easy, polished, low-cost way for non-accredited investors to buy fractional shares in many different rental properties.

What Is Ark7?

Ark7 is a real estate crowdfunding platform that lets you buy fractional ownership in multifamily and single-family rental properties. That includes traditional long-term rentals, medium-term corporate rentals, and short-term vacation rentals. While Ark7 originaly restricted short- and mid-term rentals to accredited investors, they started opening them up to everyone in 2023.

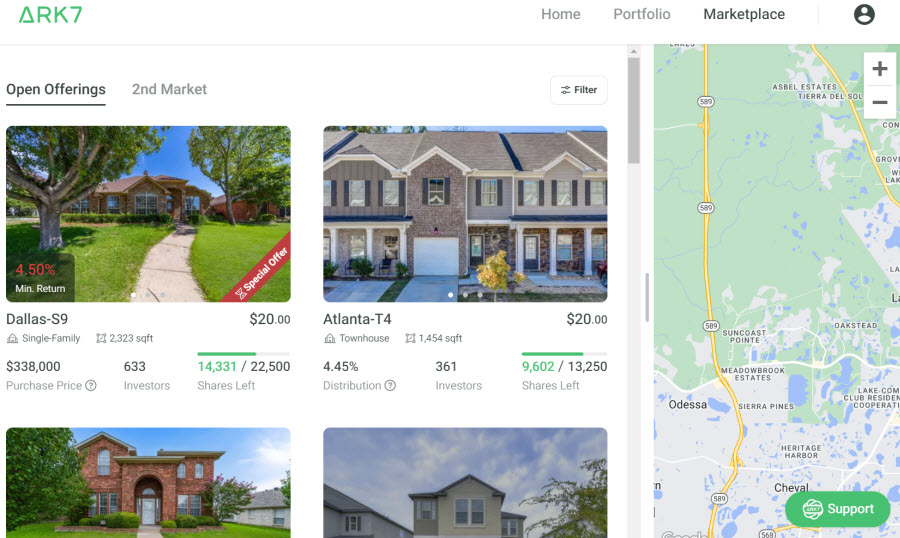

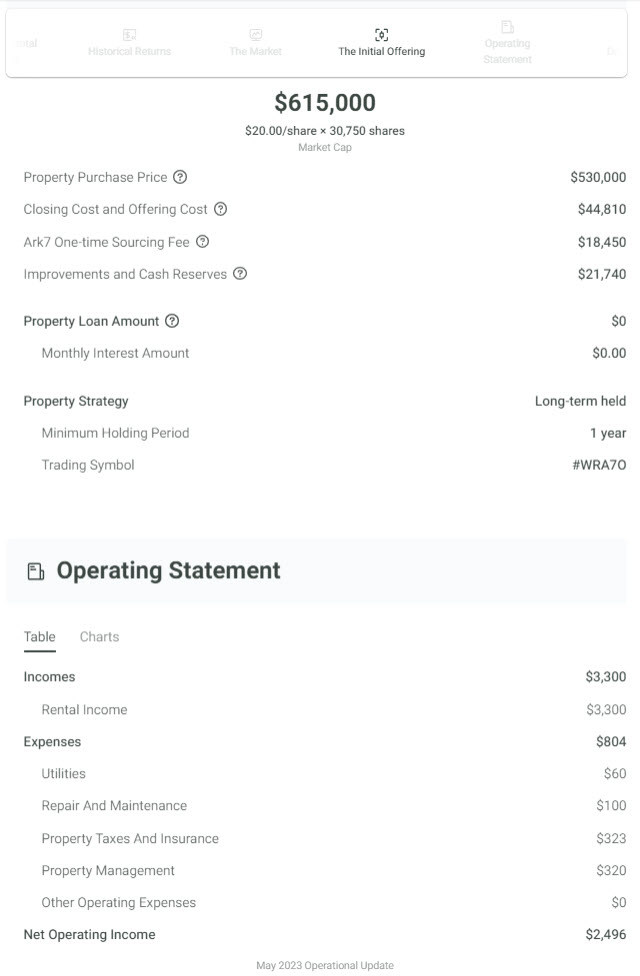

It starts with Ark7 finding and buying properties, leasing them out, and offering shares for sale on their marketplace. New property shares are priced at $20 per share. Ark7 retains a 1–10% ownership interest in each property, and sells the rest of the ownership in the form of shares.

Once the initial shares have been sold, and after a one-year waiting period, the shares start trading on a secondary marketplace. You can buy or sell shares at pricing you set.

When you buy a share in a property, you’re entitled to receive both rental income as distributions and appreciation as the property rises in value.

How Ark7 Works

How Ark7 Works

After creating an account, you can browse available properties on Ark7’s marketplace. That includes both new property offerings and properties trading on the secondary market.

The platform features detailed information about each property, from the local real estate market to nearby schools to financials. The latter includes a breakdown of acquisition costs and fees, the cash flow numbers from rent to operating expenses, historical and projected appreciation, and more.

You collect passive income in the form of monthly distributions while you own shares. These fluctuate based on the property’s cash flow, but tend to be pretty consistent.

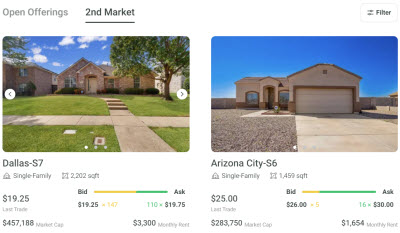

After a minimum holding period of a year, you can sell your property shares if you like. Ark7 offers a secondary market where buyers and sellers set the prices they’re willing to pay or accept for their shares.

You can invest in property shares on Ark7 through a self-directed IRA. In fact, Ark7 partnered with IRA custodian Millennium Trust Company to make IRA investing seamless (more details below).

Review of Ark7 Advantages

If it seems like Ark7 comes with plenty of pros, it does. Here are a few reasons I like Ark7 and have invested in properties on it myself.

Low Minimum Investment

Everybody has $20. And if you don’t, you have bigger problems than wondering how you’ll add real estate to your investment portfolio.

Snark aside, the low minimum investment makes it easy to diversify your real estate portfolio. You can invest as little as $20 apiece in many different properties, which helps spread and reduce risk.

Ark7 currently owns properties in seven different real estate markets, and continues to expand.

Non-Accredited Investors Allowed

You don’t have to be rich to invest in property shares on Ark7. (If you did, they’d set the minimum investment a lot higher than $20.)

Non-accredited investors can invest in long-term single-family rentals, and increasingly in the multifamily rental properties and short-term Airbnb rentals that previously only accredited investors could access.

Liquidity & Secondary Market

Investors can buy and sell shares on Ark7’s secondary market, so you’re not stuck holding properties for five or more years like so many real estate investments. The secondary market works like a stock exchange: sellers set an asking price and buyers offer a bid price. When the two overlap, a transaction takes place at that share price.

However, shareholders do need to hold them for at least one year before they can list shares for sale on the secondary market. But a one-year hold still makes Ark7 a rare short-term real estate investment.

Minimum holding period aside, this liquidity lets you diversify your real estate investments without the strong correlation to the stock market that REITs have. Read: true diversification.

Transparent Fee Structure

Ark7 charges a 3% sourcing fee to cover their expenses when they buy a new property.

After that, they only charge for in-house property management fees. These vary from 8–15% depending on the property, with long-term rentals typically costing 8–10% for property management and short-term rentals costing more.

Built-In IRA Investing

You can open a self-directed IRA on Ark7’s platform, as either a traditional IRA or Roth IRA account.

To serve as your IRA custodian, Ark7 partnered with Millennium Trust Company, the same custodian that powers Fundrise IRAs. For their IRA custodian service, Millennium charges $100 per year per property, capped at a maximum of $400 per year. They waive this fee if your total IRA account balance exceeds $100,000.

With a self-directed IRA, you can invest in almost any other type real estate investment as well. Read more on investing in rental properties with an IRA, and on how to invest in real estate with a 401(k).

Polished Web Interface & Mobile App

Polished Web Interface & Mobile App

When you log into the Ark7 dashboard, it’s clean and simple. You can easily browse properties and click on each to view the details about it.

For mobile-first users, Ark7 offers a mobile app with full functionality. It’s intuitive and easy to use.

Bank-Level Security & Encryption

Ark7 is quick to boast about their digital security features. As well it should keep a close eye on security, given that you connect your bank account to it for funding investments and receiving payouts.

As real estate investment platforms go, it’s extremely secure.

Short-Term Rentals & Multifamily Available

Beyond long-term rental properties, Ark7 also offers short-term Airbnb rentals and multifamily rental properties. In late 2023 they started adding medium-term furnished corporate rentals for travel nurses and other stays of three-to-nine months. That adds more ways to diversify your investments.

Ark7 Downsides

For all those advantages, Ark7 comes with its fair share of cons, too. Make sure you understand all the risks and disadvantages before investing on Ark7’s platform.

Limited Track Record

Founded in 2018, Ark7 has bought less than 30 properties to date.

But that’s the beauty of the secondary market — they don’t have to sell any properties, ever. Whenever you want to liquidate your shares, you can do so, regardless of Ark7’s plans to list the property for sale.

Limited But Improving Access for Non-Accredited Investors

Historically, non-accredited investors could only buy shares in long-term residential properties, but not short-term rentals or multifamily properties. The latter were restricted to “Ark7+” members, who have verified their accreditation status.

That started changing in 2023, as Ark7 began filing all properties with the SEC to allow non-accredited investors.

1-Year Minimum Holding Period

Make no mistake: the one-year minimum holding period for property shares is far shorter than the usual length of time investors own real estate. That goes for owning rental properties directly, investing in real estate syndications, and other real estate crowdfunding platforms.

But it still removes liquidity for the first year, unlike other investing options like stocks, bonds, of Concreit.

Limited Property Selection

At any given moment, there are only a handful of new properties available for sale on Ark7’s marketplace.

At the time of writing this Ark7 review, there is only one initial property share offering available for non-accredited investors, plus five properties listed on the secondary market. There are four new share properties listed on Ark7+ for accredited investors, and seven properties listed on the secondary market for these investors.

That said, there are many properties that are still incubating in their first-year holding period, and are scheduled to hit the secondary market in the coming months.

No Automation

I’m a huge fan of automation in my savings and investments, where practical. Many real estate crowdfunding platforms, such as Fundrise, Groundfloor, and Streitwise, allow various forms of automated investing. That includes recurring transfers and automatic investments.

Ark7 does not offer this automation, which I understand – you want to be able to pick and choose specific properties based on their financials and the market. But it’s still worth mentioning.

Ark7 Review: How It Compares

The two most direct competitors are Arrived and Lofty, which also offer fractional real estate investing in rental properties.

Both have a longer track record, with more properties on their platforms. Arrived prices shares at $100, and Lofty prices them at $50.

But each comes with a significant drawback compared to Ark7. Arrived does not offer a secondary market for buying and selling shares – you’re stuck with your property shares until Arrived sells the property. Arrived also doesn’t maintain any equity interest in properties; they sell off all of it in the form of shares.

Lofty does offer a secondary market, but when you sell property shares, you get paid in a cryptocurrency. That means you have to go through the laborious process of converting that niche cryptocurrency into a more mainstream crypto coin, and then convert it again to U.S. dollars. Talk about friction.

Technically, you can buy fractional ownership in properties on Roofstock and Fundrise, although both restrict that access to accredited investors. Read our full Fundrise review for more details.

And, of course, you can buy fractional ownership in apartment complexes and other commercial properties through real estate syndications. The minimum buy-in is dramatically higher: $50–100K if you invest by yourself, or $5K if you invest through a real estate investment club like ours. Bear in mind that real estate syndications also don’t offer any liquidity. But you can typically earn much higher returns, often 15–30% instead of the 5–15% you’re likely to earn on Ark7, Arrived, and Lofty.

Should I Invest in Ark7?

If you like the idea of investing small amounts to buy fractional ownership in individual properties, Ark7 is in many ways the perfect platform.

It offers monthly income and strong liquidity, at least after the first year. It’s open to non-accredited investors, and you can invest with as little as $20. That makes it easy to diversify and spread your money across a wide range of properties.

But if you’d only consider a real estate investing platform that’s been around for a decade and done hundreds of property deals (like Fundrise), you may not feel comfortable with Ark7’s limited track record. Others may prefer the instant diversification of buying shares in real estate funds, rather than individual real estate properties.

Personally, I started small with Ark7, but I like the platform and am gradually growing my portfolio of properties there. Consider it one more option for passive investment in real estate, offering solid potential returns with none of the headaches of property management.♦

Does Ark7 appeal to you as a real estate investor? How do you find the range of investment options — enough to build a diversified portfolio?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.

To build a diversified portfolio, look for a variety of investments across different types like stocks, bonds, real estate, and commodities. Then consider risk tolerance and goals. Next, search for platforms or services that offer different investment options. Like you mentioned about REITs in another article, there’s too much of a correlation with stock markets for them to provide any real diversification benefit. You have to go further afield to crowdfunding platforms like Arrived and Ark7 for that.

Very true Kevin!

I’m all about diversifying investments through platforms like Ark7. With low minimum investments, accessibility for non-accredited investors, and transparent fees, Ark7 checks most of my boxes for real estate crowdfunding investments.

Agreed Bellie!

I’ve heard Ark7 mentioned once or twice before. Seems like a great platform, going to invest a few buck with them and see what happens.

Keep us posted about your experiences Ginger!

I love investing in Ark7 because it gives me the freedom to buy and sell rental property shares whenever I want. I don’t have to worry about being stuck in a long-term deal or missing out on better opportunities elsewhere.👍

Agreed Jules!

Love the low entry price. Makes it easy to test out the platform with small amounts before committing more.

Absolutely Duke!

This is exactly what I’m searching for; an effortless and sleek platform that lets me invest in real estate without any special requirements.

It’s a great platform!