You don’t always know when a killer real estate deal will come along. Sometimes you wait months or longer for the right deal.

Plus, it takes time to save up a down payment. Even if you borrow 80% with an investment property loan, you still need $100,000 for a $500,000 property.

All of which means real estate investors need places to park their money while they prepare to buy their next property.

So what are your best options for short-term investing? Start here in your search for the best short-term investments.

What You Want in Short-Term Investments

Your goals for short-term investments are different from long-term investments. Rather than chasing the highest possible returns, look for the following when investing short-term:

- Low Risk/Volatility: Imagine you set aside some money for a down payment on a rental property by investing it in the stock market. Then as soon as you find a good deal on a property, the stock market crashes, evaporating 25% of your funds. Suddenly you no longer have enough cash for the deal, and it slips through your fingers. For short-term investments, you need safe, secure investments, rather than counting on the high historical average returns on stocks.

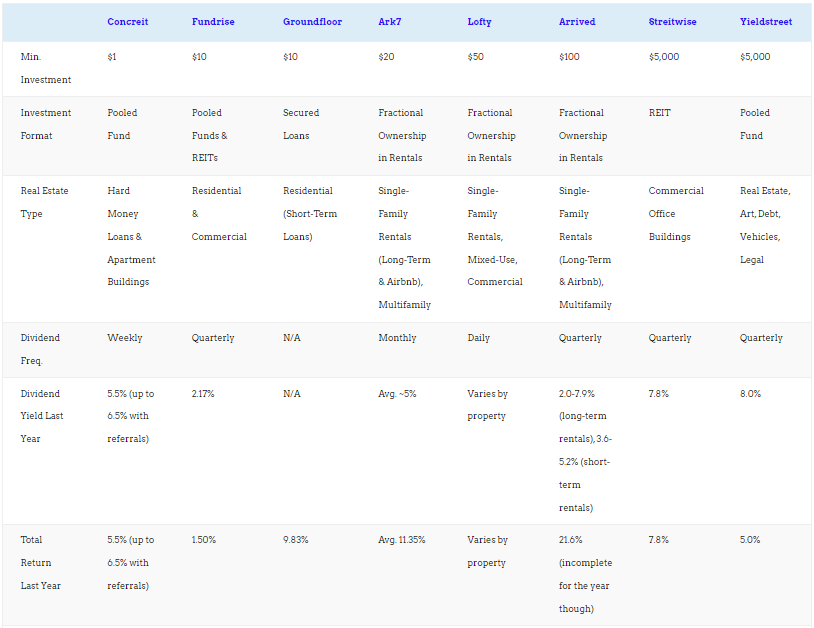

- Liquidity: With short-term investments, you often don’t know exactly when you’ll need to pull out your money. When the time comes, you may need to move fast. That means you need highly liquid investments that you can access easily as opposed to illiquid but high-return investments like Fundrise and Streitwise.

- No Transaction Costs: If you have to pay hefty fees to move money in and out of your investments, it defeats the purpose of short-term investments. For example, investment properties cost thousands of dollars to buy or sell, in addition to their poor liquidity — which is precisely why they’re long-term investments.

Best Short-Term Real Estate Investments

Real estate is notoriously illiquid. It costs a lot of money and time to buy or sell, which makes it a long-term investment.

If you buy properties directly, that is.

But in today’s world, you have plenty of passive real estate investing options. And not all of them require a long-term commitment.

Try these short-term real estate investing options if you want to invest for a year or less. I included the last two because you can access your money in under a year if needed, but they’re designed as longer-term investments.

1. Groundfloor Notes

I’ve personally invested tens of thousands of dollars through Groundfloor’s platform. If you’ve read our Groundfloor review, you know they’re my favorite real estate crowdfunding platform — and for good reason.

Groundfloor is a hard money lender, issuing short-term purchase-rehab loans. You can invest in individual loans on their platform (more on that shortly), but they also let you lend money directly to the company along with their full guarantee of repayment. You lend money to Groundfloor at a fixed interest rate for a set period of time, rather than funding a loan to a borrower.

Note terms range from one month up to two years, with options for three-month and one-year notes. The one- and two-year notes pay interest monthly, while shorter notes pay all interest upon maturity.

Expect to earn interest in the 6-10.5% range, with a minimum investment of $1,000.

2. Groundfloor LROs

Groundfloor also lets you pick and choose individual loans to fund, called LROs (“limited recourse obligation”). The minimum investment is only $10 per loan, although the minimum initial transfer to open an account with Groundfloor is $1,000.

When the borrower repays their loan, you get your original money back plus interest. When you browse loans to fund, it shows you the remaining term on the loan, and when the borrower has agreed to repay it in full. Most loans repay within 3-12 months, but borrowers don’t always repay the loans on time, and you don’t have any control over when you get your money back.

Groundfloor offers the best returns on this list, paying interest ranging from 6.5-14%. But once invested, you can’t access your money until the borrower repays their loan.

Sadly, Groundfloor ended their Stairs program in 2023. Fortunately, the competitor that Groundfloor mimicked with Stairs continues going strong.

3. Concreit

Like Groundfloor, Concreit lets you invest in investment property loans. Specifically, they use a pooled fund to buy short-term fix-and-flip loans (hard money loans).

As a financial investor, you buy shares in this pooled fund. Last I checked, Concreit’s fund owns around 155 loans across the country.

Because these loans come with such short terms (6-12 months), they turn over quickly. That in turn lets Concreit offer far greater liquidity than most real estate crowdfunding investments. You can pull out your money at any time, with no penalty on your principal. However, they do ding your dividend payout by 20% if you pull out your money within the first year of investing.

Still, they pay a 6.5% annual dividend, far higher than most government bonds or high-yield savings accounts. Even if you pull out your money within the first year, you earn a 5.2% dividend yield — not too shabby.

Oh, and you don’t have to be a wealthy accredited investor either: anyone can invest with as little as $1. I myself park my short-term money with Concreit to earn a decent dividend yield on money I might need to pull out quickly for a real estate deal.

Just beware that it can take a few weeks for withdrawn money to land back in your checking account. Concreit says it can take up to two-to-four weeks.

4. Other Real Estate Notes

Some real estate private equity funds or general partners also offer short-term notes. These may or may not be backed by property equity or secured debts.

For example, in our Co-Investing Club we invested in a nine-month note to Norada Capital, the private equity arm of Norada Real Estate. The note wasn’t backed by properties, but rather by the businesses owned and operated by Norada. It’s been paying us 15% interest every month like clockwork.

Similarly, EquityMultiple and 7e Investments also offer notes, although theirs are backed by properties. Expect lower interest rates given the lower risk.

5. Ark7 Property Shares

You can buy fractional ownership in rental properties on Ark7, which prices initial shares at just $20. It works similar to Arrived, but instead of forcing you to hold for 5-7 years, Ark7 features a secondary market for buying and selling shares.

After a one-year minimum hold period, you can sell your shares at any time on the secondary market. Read our full Ark7 review for more details, but it makes for a rare way to invest in rental properties short-term.

5. Arrived Rental Property Fund

Arrived was the first real estate crowdfunding platform to offer fractional ownership of single-family rental properties. They let you buy shares for $100, but once you buy in, you’re stuck holding the property until they sell.

In late 2023 however, they launched a fund owning many rental properties. After a six-month minimum holding period, you can redeem your shares.

That said, they still want you to treat the fund as a long-term investment. If you sell your shares within 6-12 months of buying, they hit you with a 2% penalty. That drops to 1% if you sell within one-to-five years.

Still, it’s another option on the table that offers a short-term exit if you choose.

6. Fundrise

While they too want you to hold your investment long-term, Fundrise also lets you redeem shares early if you must.

They don’t charge you for redeeming shares of their flagship fund, but they do ding you 1% for selling shares of their eREITs and other funds. They do impose some restrictions however, such as only reviewing redemption requests once a quarter.

Again, don’t plan on it being a short-term investment, but you can generally access your money in under a year if you need to.

Best Short-Term Investments (Non-Real Estate)

As a general rule, higher returns require a higher level of risk. So if you want low-risk investments with strong liquidity, don’t expect massive returns.

But that doesn’t mean every single short-term investment option pays out weak returns.

The following list starts with the lowest risk and returns, with rising risk and returns as the list goes on. Know your needs and risk tolerance and invest accordingly!

1. High-Yield Savings Accounts

The Federal Deposit Insurance Corporation (FDIC) insures all bank accounts and money market accounts, up to $250,000. In other words, these accounts come with virtually no risk, short of a zombie apocalypse.

And they pay accordingly.

Even high-yield savings accounts and money market accounts only pay 1-2% interest currently, maybe 2.5% if you find a unicorn deal. You’ll still lose money to inflation, but that’s the cost of being conservative.

2. Treasury Bills (T-Bills)

The US Treasury Department issues short-term bonds called Treasury Bills, or T-Bills among the cool crowd.

They range from a few days up to a year to count as “T-Bills” rather than “Treasury bonds.” The longer the term, the higher the interest rate, but don’t get excited. Even the longest don’t pay well.

At the time of this writing in June 2022, 4-week T-Bills pay around 1.2% annual rate of return, and interest ranges up to around 2.8% for a 52-week T-Bill. Again, you’ll lose money to inflation in the current environment.

But again, they’re guaranteed by Uncle Sam, so they come with zero risk.

3. Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities, which also come with their own nifty nickname of “TIPS,” are Treasury bonds with a unique trick up their sleeve. The face value adjusts based on the Consumer Price Index (CPI), so the value adjusts by the inflation rate.

These bonds also pay a small interest rate as well, on top of adjusting in value for inflation. For example, imagine you buy a TIPS bond for $1,000, paying 1.5% interest on the face value of the bond. After a year, inflation has risen at 5%, so the face value of your TIPS bond adjusts upward to $1,050, and you collect 1.5% interest on that higher $1,050 face value ($15.75) rather than your original $1,000 purchase price. Upon maturity, the Treasury pays you back the current face value, or your original face value in the unlikely scenario we had deflation.

In high-interest environments like today’s, they’re not a bad place to hold your money.

4. Short-Term Bond Funds

You can buy shares in exchange-traded funds (ETFs) that specialize in owning short-term bonds. That keeps the volatility — and, therefore, risk — low, but it also keeps the returns low.

These funds offer instant liquidity, however, as you can buy and sell shares instantly through your brokerage account.

5. Municipal Bonds

Municipal bonds come with a higher risk of default than federal government bonds, but that doesn’t mean much. Most cities in the US are good for the money, and you get some tax breaks on municipal bonds that boost their effective returns compared to taxable investments (more on short-term investment taxes later).

Specifically, you pay no federal taxes on municipal bond interest, and in most cities and states, you also pay no state or local income taxes either. If you would otherwise have paid 20% in total income taxes on your bond interest, and the municipal bonds pay 4% in interest, that means you walk away with the same net interest as a taxable investment paying 5% returns.

The risk doesn’t come from default so much as changes in interest rates. When interest rates rise, the value of existing (lower-paying) bonds goes down on the secondary market. You can dodge this bullet by buying short-term bonds that mature in under a year, but they also pay lower interest yields.

6. Corporate Bonds

Sensing a theme here?

Bonds make good short-term investments for the same reason they make good retirement investments: they’re relatively safe and stable. And while they’ve paid miserably low interest rates for decades now, corporate bonds tend to pay better than government bonds.

Because, of course, they come with a higher risk of default. Any given business is a lot more likely to declare bankruptcy than the average city government. Do your due diligence, but if you invest in blue chip companies, your default risk remains extremely low.

But rate risk remains, just as with government bonds. When interest rates go up, existing bond prices go down. Buyer beware.

Short-Term Investments Tax

How are short-term investments taxed?

Unfortunately, you pay your ordinary income tax rates on your short-term investments owned for less than one year. That goes for interest, dividends, and profits from selling assets owned less than one year.

In contrast, you pay the lower long-term capital gains tax rate on investments held longer than one year.

The IRS isn’t the only bogeyman treating your short-term investment returns as taxable income either. Most states and some cities also charge income taxes on your short-term investment returns. For a list of states with no income taxes, check out our interactive maps of the states with the lowest tax burden.

Final Thoughts

Real estate investing requires you to save up huge amounts of money and deploy it at a moment’s notice when a good deal comes along.

In other words, you need to find places to park your money short-term, and hopefully earn a return on it until you need to pull it out. That’s easier when inflation isn’t raging over 9% like it did in 2022, but even with today’s elevated inflation, you can still beat the inflation rate with a few of the options above, including TIPS and Groundfloor.

And, of course, the ultimate hedge against inflation is real estate.♦

What’s your short-term investment strategy? How does short-term investing fit into your larger financial goals and investment portfolio?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Groundfloor is the best on the list. I flip houses, however, when I don’t have a project, I focus on crowfunding. Concreit is good too!

Yeah I love Groundfloor myself!

I’m building up my short term investment portfolio and it has been a good addition to my rentals!

It’s definitely a crucial piece of your portfolio, that most investors ignore.

Agreed! I appreciate it most for the past two years. My active income frozed, my passive income was unstable, but short-term investments were stable!

Great article. It’s always one of those things I don’t think about until I’m stuck sitting on some cash waiting to reinvest. Will bookmark this and come back to these ideas when I’m in between projects!

Glad you found it useful Doug!

I will consider investing short-term. Mediocre yield is better than no return at all. Plus, the risk is low!

Very true Leandra!

I was into short term cryptocurrency investing but the risk is too high. No wonder it’s not on the list! I stopped crypto a few months ago and started investing in T-Bills. It’s better!

Haha, better a small positive return than a negative one!

Nice to see a variety of short-term investment options laid out so clearly.

Glad it was helpful Shari!