Looking to invest in commercial office real estate, but don’t have several million dollars lying around?

Real estate crowdfunding platform Streitwise makes it easy to add commercial office buildings to your investment portfolio. I’ve invested my own money with them.

But as with any other investment, Streitwise comes with its own pros and cons. As you explore investing in Streitwise, keep the following risks and rewards in mind.

Streitwise Review At a Glance

Minimum Investment: $3,505 (500 shares)

Prospective Returns: 5.1-8.4% annual dividends, no appreciation to date

Fees:

-

- One-Time Fee: 3% of investment goes to Sponsor

- Annual Management Fee: 2% goes to the Sponsor

My Take: Streitwise prides itself on its dividend yield and low risk factors, including low LTVs on loans, high levels of skin in the game by the owners, and high-end corporate tenants. But the current dividend yield, the high investment minimum, and five-year commitment make many investors wary.

What Is Streitwise?

Streitwise operates a private real estate investment trust (REIT) that owns three large commercial properties. Retail investors (not just accredited investors) can buy shares in this REIT, for fractional ownership in these office space properties.

These properties include the Allied Solutions Building (142,000 square feet) and Midtown III building (77,248 square feet) in Indianapolis, and the Streitwise Plaza office park. The latter is a corporate campus in St. Louis with three buildings, totaling 290,000 square feet. Streitwise added the Midtown III building in the fourth quarter of 2023.

All five buildings owned by the Streitwise REIT (called 1st Streit Office Inc.) cater to high-quality tenants. These include the Panera Bread headquarters, New Balance’s regional headquarters, Wells Fargo, Edward Jones, Nationwide Insurance, and, of course, Allied Solutions.

Streitwise was founded by the team behind Tryperion Partners. And in fact, Tryperion serves as the Streitwise Sponsor: the real estate investor team in charge of buying and managing the REIT’s properties. Tryperion Partners has owned and managed over $750 million in commercial buildings since 2013, and earned an average return of 25.4% per year.

How Streitwise Works

You buy shares in Streitwise’s private REIT, the shares pay you dividends (more on them shortly), and, hopefully, the shares rise in value.

As with most real estate crowdfunding investments, you buy shares directly from the company. To sell shares, you also redeem them with the company directly.

However real estate is an inherently illiquid, long-term investment. Crowdfunded real estate companies don’t want much share turnover, so they often put a minimum holding time on when you can sell back shares. Streitwise doesn’t let you sell back shares within the first year of buying, and they impose decreasing penalties for early buyback for the next four years after that. If you sell in the second year of ownership, they buy back shares at a 10% discount, then a 7.5% discount in Year 3, a 5% discount in Year 4, and a 2.5% discount in Year 5.

After five years, they will buy back shares for the full net asset value (NAV) share price at that time. Which hopefully has risen handsomely!

But appreciation isn’t the only way investors make money with Streitwise shares. In fact, Streitwise is best known for its dividend yield of 5-6% annually. They pay quarterly dividends, and have done so consistently since inception.

Streitwise Fees

Streitwise does charge both a 3% upfront fee and 2% ongoing annual fees. These fees go to the Sponsor (Tryperion Partners).

However, the distributions are net of fees — you collect 5-6% of the money you invested in annual dividends. Streitwise explains the fee structure like this: “If you invest 500 shares at $10/share ($5,000), $4,850 (97%) goes towards the REIT and $150 (3%) goes to the Sponsor. You will still own 500 shares.” Read more about Streitwise’s fees here.

Individual investors new to crowdfunded real estate investment platforms often fixate on fees. But the cynical truth is the stated fees just don’t mean very much, because these platforms can jigger the expense numbers behind the scenes to pad their profits if they choose. In light of that, I virtually ignore the stated fees of these investment types, and focus on their returns. I consider both their past returns and my confidence level that they can continue producing those returns in the future.

Streitwise Advantages

There’s a lot to like about Streitwise. I’ve invested money with them myself for the following reasons.

Moderately High Dividend Yield

As someone pursuing financial independence at a young age, I build up many streams of passive income. That includes rental income from properties I own myself, but it also includes dividends from both stocks and real estate crowdfunding investments.

As of the first quarter of 2024, Streitwise pays a dividend yield of 5.1%. That marks a sharp drop from the original 10% dividend yield.

Streitwise hasn’t avoided the shudders in commercial real estate markets.

Diversification from Stocks

Publicly-traded REITs tend to swing wildly in price, right alongside stock markets. After all, they trade on the same stock exchanges.

That makes public REITs a poor way to diversify into real estate investments. They share too much correlation with stock prices to offer real protection against stock market crashes.

But crowdfunded real estate investments like Streitwise don’t trade on stock exchanges. You buy and sell shares directly with the company, which can make share prices far more stable.

Non-Accredited Investors Allowed

Many real estate crowdfunding investments only allow wealthy accredited investors to participate. They do that because the SEC doesn’t impose the same regulation on them if they don’t service the hoi polloi like you and me.

Streitwise, on the other hand, allows both accredited and non-accredited investors to buy shares. That makes it an affordable way to diversify into commercial real estate investments, without needing a seven-figure net worth or enormous annual income.

International Investors Allowed

Likewise, most real estate crowdfunding platforms only allow US citizens and permanent residents to invest. Streitwise, however, allows foreign investments.

In fact, Streitwise is the only crowdfunded real estate investing platform I know of that allows them.

Low Leverage, High Skin in the Game

When Streitwise bought its two massive commercial properties, it took out investment property loans for only 55% of the cost (loan-to-value or LTV). Today, they’ve reduced that LTV to 51%.

The owners — who are the original founders, by the way — have committed to leaving $5 million of their own cash invested in the properties as well. That shows higher skin in the game than most real estate crowdfunding owners.

Further reducing risk, Streitwise rents to brand name creditworthy tenants like New Balance and Wells Fargo. It doesn’t get much safer than that.

Real Estate Tax Benefits

Real estate investments come with plenty of tax benefits, from depreciation to landlord tax deductions.

Many of those tax advantages pass along to you through the Streitwise REIT. Read up on Streitwise’s real estate tax benefits here.

Streitwise Disadvantages

All investments come with downsides and risks. Make sure you understand Streitwise’s disadvantages before investing.

Little Liquidity

Unlike publicly-traded REITs, you can’t sell shares instantly. In fact, you can’t sell shares at all within the first year.

If you sell shares back within five years of buying them, Streitwise hits you with an early redemption penalty between 2.5-10%. Woof.

In other words, only invest money you don’t mind parking for at least five years.

High Minimum Investment

Once upon a time, Streitwise let you invest with $1,000. Nowadays, they require a minimum initial investment of around $3,500.

Why? Because they don’t want the riff raff constantly trying to sell back shares early. They’d rather sell fewer shares and only work with stable, experienced investors. I know because I asked them about it.

I can’t say I blame them, but for the average investor, investing $3,500 in an unfamiliar real estate platform can be daunting even if they have it. If you don’t have $3,500 to invest, start by plucking some low-hanging fruit with these ideas to score free money. Or try these ways to invest $1,000 in real estate.

Shrinking Dividends

In late 2022, Streitwise lowered their dividend yield to 7% based on the current NAV, and 6.8% based on the original NAV of $10 per share. Then they dropped it even further to 5.1% in mid-2023, where it remains in early 2024.

That’s a far cry from the original 10% yield they paid.

Why did they pull a “Honey I Shrunk the Dividend”? Because one of their larger tenants, Panera Bread, non-renewed their lease agreement starting in 2024. That’s a double whammy: greater uncertainty and risk for the future of shares, and lower returns.

And that says nothing of the lack of share price growth.

Loss of Value

When Streitwise launched shares to the public in 2017, the initial share price cost $10.

In the first quarter of 2024, that share price has reached (drum roll please…) $7.03.

Yes, it’s dropped in the seven years since Streitwise launched. Most of that loss came in 2023, after their primary tenant, Panera Bread, announced they don’t plan to renew. Don’t blow all the confetti at once.

Even so, Streitwise’s properties have plenty of room to appreciate in value. As they add properties to the portfolio, that could send share prices soaring. We’ll see how the addition of the Midtown III building in late 2023 helps the NAV price.

It will also help when they sign new lease agreements to cover the office space being vacated by Panera Bread.

Few Properties, 1 REIT

Unlike Fundrise, with its dozens of REITs and hundreds of properties, Streitwise only owns three properties (five buildings). They are huge commercial properties to be sure, but it doesn’t offer much diversification across many properties and real estate markets.

Streitwise also only offers one current offering: their REIT. You can’t pick and choose among many different options; it’s one size fits all.

How Streitwise Compares

How does Streitwise stack up against their competitors?

When it comes to diversification of options and properties, not well. Most competing crowdfunded platforms offer far more of both, from Fundrise to Groundfloor to Arrived to CrowdStreet.

Still, Streitwise pays a solid dividend and owns higher-end commercial office space properties. They suffered in the wake of the pandemic, and the emptying of office space to remote work. However many investors, myself included, believe that the office real estate market will recover. That could spell an opportunity for investors willing to “be greedy while others are fearful.”

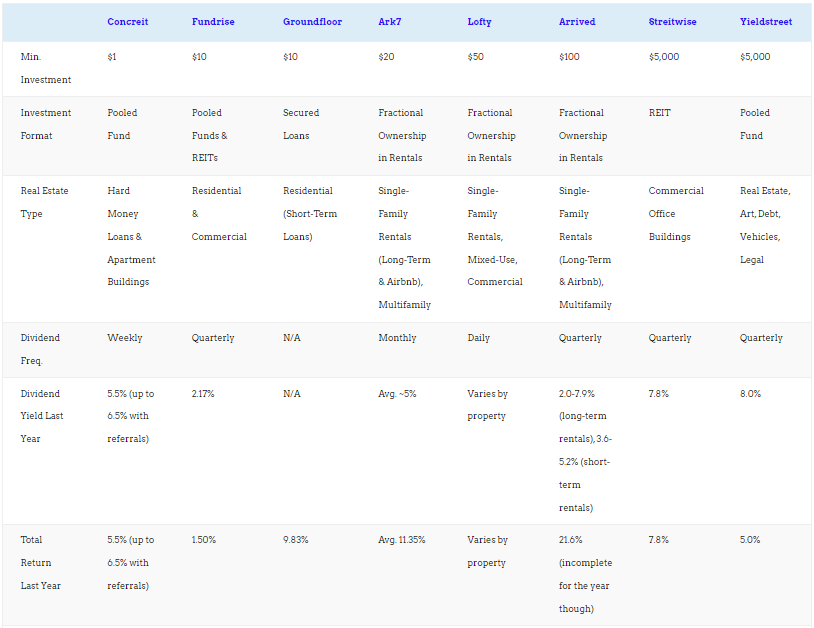

Check out how Streitwise compares to competing crowdfunded platforms open to non-accredited investors:

| Concreit | Fundrise | Groundfloor | Ark7 | Lofty | Arrived | Streitwise | Yieldstreet | |

|---|---|---|---|---|---|---|---|---|

| Min. Investment | $1 | $10 | $10/loan ($1,000 minimum opening transfer) | $20 | $50 | $100 | $5,000 | $10,000 |

| Investment Format | Pooled Fund of Loans, Fractional Ownership in Rentals | Pooled Funds & REITs | Secured Loans | Fractional Ownership in Rentals | Fractional Ownership in Rentals | Fractional Ownership in Rentals | REIT | Pooled Fund |

| Real Estate Type | Hard Money Loans & Apartment Buildings | Residential & Commercial | Residential (Short-Term Loans) | Single-Family Rentals (Long-Term & Airbnb), Multifamily | Single-Family Rentals, Mixed-Use, Commercial | Single-Family Rentals (Long-Term & Airbnb), Multifamily | Commercial Office Buildings | Real Estate, Art, Debt, Vehicles, Legal |

| Dividend Freq. | Weekly | Quarterly | N/A | Monthly | Daily | Quarterly | Quarterly | Quarterly |

| Dividend Yield Last Year | 5.5% (more with referrals) | 2.17% | N/A | Avg. ~5% | Varies by property | 2.0-7.9% (long-term rentals), 3.6-5.2% (short-term rentals) | 7.8% | 8.0% |

| Total Return Last Year | 5.5% (more with referrals) | 1.50% | 9.83% | Avg. 11.35% | Varies by property | 21.6% (incomplete for the year though) | 7.8% | 5.0% |

| Hold Time w/o Penalty | 1 Year (but no principal penalty) | 5 Years | 2-18 Months | 3 Months | None | 5 Years | 5 Years | 3+ Months |

| Built-In IRA | No | Yes | Yes | Yes | No | No | No | Yes |

| Year Launched | 2018 | 2012 | 2013 | 2019 | 2018 | 2021 | 2017 | 2014 |

| Brian Invests Personally | Yes | Yes | Yes | Yes | Not Yet | Yes | Yes | Not Yet |

| Learn More | Concreit | Fundrise | Groundfloor | Ark7 | Lofty | Arrived | Streitwise | Yieldstreet |

If you’re interested in exploring further, check out our review of Fundrise and review of Arrived.

As a last note, Streitwise openly identifies as a real estate investment firm first, and a fintech company second. They use a third-party company, Securitize, for users to log into an online platform and manage their investments. It’s not sleek and modern like their competitors, but I also respect that they focus on real estate properties, not slick user interfaces.

Final Thoughts

I like Streitwise’s commitment to a strong dividend payout, high level of skin in the game from the owners, low real estate leverage, upmarket tenants, and focus on “non-gateway markets” (read: smaller cities). As real estate crowdfunding investments go, I consider them moderate risk.

I also like the flexibility to set up recurring investments and dividend reinvestment plans. You can invest with Bitcoin or through a retirement account, although that requires a self-directed IRA.

But Streitwise share prices have lost money to date, and only owns three properties — hardly a diversified portfolio. As they add more properties and investments, I’ll consider investing more money with them; in the meantime, I’ll enjoy collecting the relatively high dividends.♦

Where do alternative investments like Streitwise and other real estate crowdfunding platforms fit in your investment strategies? Why do (or don’t) you pursue these types of investments?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-50% on $5K in Real Estate Syndications.

$5,000 minimum investment seems high but when you start to know how good the dividend is, you’ll start to find ways to invest. I also like the flexibility, investing through bitcoin only means they are good in what they are doing!

Yeah it’s a great dividend, and the low risk factors make me confident they’ll be able to sustain it long term.

It seems like a great investment opportunity. I might give it a try!

Come back and let us know how your experience with Streitwise goes!

I am thinking twice because the minimum is pretty huge… However, in comparison to other platforms, Streitwise is promising!

Yeah they intentionally set it high to only work with more advanced investors. But I’ve had good experiences with them so far.

That’s what I want to hear; firsthand experience from investors like you. I trust your words and I will invest there soon.

I will give it a try! The numbers looks promising.

Keep us posted on how you like Streitwise Jonathan!

I started investing to Streitwise 3 years ago and now it’s my top passive stream of income!

Glad to hear it Gan! Yeah I’ve had good experiences with Streitwise as well.

Good review!

Thanks Stefanie!