Ever get sick of hearing people glibly spout “Location, location, location!”, whenever real estate comes up in a conversation?

Yet most real estate investors never look much further beyond their own backyard, when deciding where to invest. Which is why we wanted to bring you an updated list of the best cities for real estate investing in 2020.

Millions of Americans invest in rental properties, and they all have the same goal: to make money. And while they each have different skill levels and exact strategies, their end-of-year returns largely depend on the market where they invest.

Location is the only factor that you cannot change once you buy a rental property. While you can make updates and repairs to improve your rental property, you can’t pick your property up and move it ten blocks north.

All the kitchen and bathroom hacks in the world won’t matter if you buy in a neighborhood with low demand. Which is precisely why it’s better to buy a bad property in a good location than to buy a good property in a bad location, and why the cheapest real estate in the US doesn’t always deliver the highest returns.

The neighborhood where you invest will determine your return on investment based on:

- The rental demand and the types of tenants you can attract

- The best property types for rentals

- The property price

- The rental rate – i.e., how much rental income you can make per month or per year from your investment property

- The rental expenses including property tax, insurance, property management, etc.

- Your cash flow: the difference between the rental income and the rental expenses, or how much money you will be able to make as a real estate investor

- Your return on investment, whether you go for cap rate, cash on cash return, or any other measure of profitability in the real estate investing business

- Your rights and obligations as a landlord: local legislation regulating landlord-tenant relations can vary from one place to another.

How Granular Should You Get in Choosing the Best Markets for Real Estate Investing?

While we all agree on the importance of location in real estate investing, do we all know what location means in the real estate business? When we talk about location, many investors think about the country or state and wonder: “Should I buy an investment property in the US housing market or abroad?”

While we all agree on the importance of location in real estate investing, do we all know what location means in the real estate business? When we talk about location, many investors think about the country or state and wonder: “Should I buy an investment property in the US housing market or abroad?”

But beyond county and state, location also means the city or town, the neighborhood, and even the specific street within the neighborhood. When you choose where to buy a rental property, all these factors go into the location equation.

Where Should You Invest in Real Estate in 2020?

Now that you know what location is and why it is crucial when buying an income property, let’s have a look at the best places to invest in residential real estate this year.

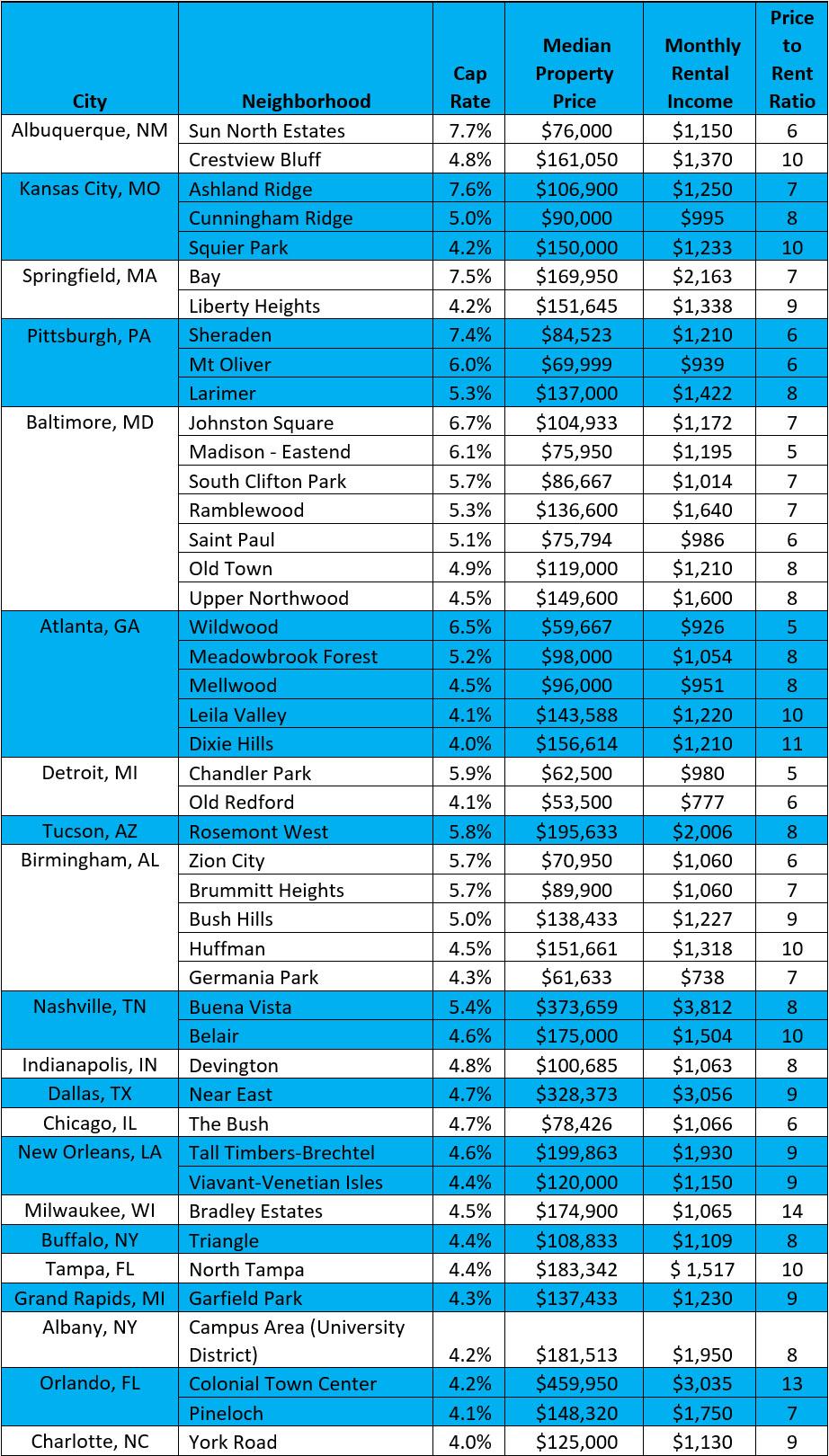

Following is a list of the top cities and the top neighborhoods within these cities for buying a traditional rental property (as opposed to a short-term rental) in the US housing market in 2020. These are the locations which offer the highest capitalization rate (or cap rate, for short) for traditional rentals based on data from Mashvisor, an advanced real estate analytics tool which helps real estate investors find the most profitable long-term and short-term rental properties in the US real estate market.

Best Cities for Real Estate Investing by Cap Rate

Data Source: Mashvisor, March 2020

So, the table above summarizes the best real estate markets for landlords in 2020 for return on investment based on data from Mashvisor. If you were to look at the city-level average cap rate, many of these locations would not reach a cap rate of even 2-3%. Which is why you need to drill down to the specific neighborhoods, as they deliver dramatically different returns for real estate investors.

Before we have another look at the top places for investing in real estate, let’s have a brief word about the capitalization rate. The cap rate is a measure of return on investment in real estate, which is calculated by dividing the net operating income (NOI) of the property by the property asset value.

(article continues below)

Cap Rate Formula

The formula for calculating cap rates is simple:

The free rental property calculator on SparkRental calculates cap rate for you for any property, in addition to monthly cash flow and ROI.

The cap rate has one major disadvantage as a profitability metric over the cash on cash return – that it doesn’t take into consideration the financing method. However, this disadvantage can also work as an advantage as it allows future investors to compare the return on investment across various locations regardless of how they plan to pay for their property.

When it comes to good cap rate for investment properties, most real estate experts agree that you should aim for properties with 8% or more of cap rate. Maybe this was true a few years ago. However, the real estate investing world has become so competitive that investors should be happy to score anything above 4-5% as big data shows. Also, when you look at the cap rates for the top real estate investment cities in the US in 2020, keep in mind that these are neighborhood level averages, while specific properties within these neighborhoods could perform significantly better.

Read about property values dropping.

Read does california have rent control?

What Are the Best Cities for Real Estate Investing?

So where should you invest in real estate in 2020?

Variety is indeed one of the beauties of real estate investing. There is no geographical focus of the top real estate markets for investors, so no matter what your personal preferences are, you are bound to find something which matches your taste and investor needs. Whether you prefer to aim for booming markets like Tampa, FL, or to maximize cap rate in markets like Albuquerque, NM, you’ll find plenty of diversity on the list of best cities by cap rates.

Alternatively, go beyond cap rate and see our other lists of the best cities for real estate investing in 2020. From jobs growth and population growth to gross rent multipliers and more, we run the numbers on America’s cities from all angles.

There’s no property price which makes for the best real estate investments locations. On the contrary, there is a wide range of median property prices as Mashvisor’s data shows: from $53,500 in Old Redford, Detroit to $459,950 in Colonial Town Center, Orlando. So, depending on your budget and your rental property loan options, you can find a market among those which will offer you the ideal rental property.

So, if you were not sure whether you were ready to take up on your journey as a residential real estate investor, you are one step closer now: You know where to look for the best rental properties this year. Now just get yourself the right real estate investing tools for investment property analysis, and you are good to go!

Daniela Andreevska works with Mashvisor, a platform that helps real estate investors quickly find traditional and Airbnb investment properties. A research process that’s usually 3 months now can take 15 minutes. Mashvisor provides all the real estate data and information in easy-to-understand visualizations. Use this link to receive 25% off Mashvisor’s platform: https://www.mashvisor.com/checkout#?plan=Mashvisor_Professional_Quarterly&coupon=SPARK25.

Related Article Read : How to get free background check for renters?

Read about rental property calculator.

I think it would also be safe to say that these neighborhood average cap rates are suppressed due to the current competitive climate of real estate investing. With so many people jumping into the game, the supply/ demand curve has shifted towards higher prices and thus lower cap rates. Many of the new investors are likely making poor deals and will end up losing money. Couple that with inevitable housing market corrections (many believe we are on the brink of another) and average cap rates will probably go up again.

Fair point Ben! Cap rates certainly fluctuate, and we may well see higher cap rates in the not-too-distant future.

Thanks for the perspective!

Ben and Brian, I am finding that the cap rates have plunged in the Northwest, I have 2 fairly good CAP rate properties but now I am having problems finding anything similar. With that in mind, is it better right now to just sit tight and pay down debt and increase savings until they come up again? Or should I start looking out of state?

Depends on what you’re most comfortable with Jason. Investing out of state is a bit of a different animal – many investors do it successfully, but there’s a little more involved. So it’s a judgment call on your end.

Love the data. We’re always looking for new markets to invest, and while I know cap rates don’t tell the whole story, it’s still nice to see this kind of neighborhood-level rental market data.

I love the top cities list. I agree that it’s not just the country or even the state that determines a good location. It can be a specific neighborhood, especially when it comes to investing in a city. Most cities can be block to block, and develop at fast rates.

So true Samantha! Different neighborhoods offer wildly different cap rates and returns. Thanks for the comment!

Really love the location capitalization rate spreadsheet. Thanks for the helpful read!

Glad to hear it was useful John!

So many variables need to be considered when measuring utility of rental property ownership. Cap rate is important but also over-rated. What are property taxes in city/county? Probable deferred maintenance expenses (is property new and well-constructed or old and dilapidated?)?Net, net… are Jobs flowing in or out? Is property address near to a stable jobs center? Good locally sourced water supply? And *on* my utility curve… would you (as landlord/owner) consider living in the property? If NOT, then rethink your investment.

All true Dan. But it’s not as practical to incorporate each of those variables into one number to compare cities 🙂

I like the list of cities that you provided. I agree with Samantha that location doesn’t matter if something matters in the neighborhood. Moreover, I would also like to know about the platform that provides homes for sale in Hawaii.

Hi, I am from Canada. I would like to invest in real estate @ a 10+ cap rate. In Canada that seems to be unheard of. My area is a 4 cap rate.

Can you help me?

Hi Paul, we’re in the process of putting together a real estate co-investing program that any of our subscribers can opt into. If you’re on our mailing list, we’ll let you know when we start opening properties for investment!

I just created an account and would like to get on your mailing list. I’m interested in learning more about the “co-investing program” that you are putting together.

Glad to hear it Nathan! If you’ve created an account you should be automatically added to our mailing list.

As for the co-investing program, we only offer it to subscribers on our list, so you’re in the right place. We’ll send out an email when we have a property lined up that we’ll offer co-investment in, it’s first-come first-served when we make the announcement. We’ll keep you posted!

Don’t bother yourself for investing near to your location if you are unable to find a good deal there. Always remember to invest where it makes sense

Absolutely – if your market doesn’t make sense for investing, invest elsewhere!