The Big Picture On The Cheapest Real Estate In The United States:

-

- West Virginia tops the list of where the cheapest real estate in the US can be found.

- Real estate investors have a lot of reasons why they should consider investing in cheap real estate, like getting into a market that lacks affordable housing, taking advantage of demand, and riding out the income and employment growth of the chosen area.

- There are risks with investing in cheap real estate in the US—otherwise known as the reasons why real estate is cheap there in the first place. Investors need to be vigilant about these reasons and judge whether the low prices are worth the risks.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Not thrilled that the median U.S. home cost $417,700 in 2024?

Everyone loves a deal, a chance to get more for their money. Look no further than the hordes of stampeding shoppers every Black Friday.

Fortunately for real estate investors, cheap real estate in the U.S. is available year-round for those who understand the risks. Here’s what you need to know about buying cheap real estate and a map of cities with the cheapest real estate in the United States.

Cheapest Real Estate in the United States

Where can homebuyers and investors buy the cheapest real estate in the United States? Better yet, where’s the cheapest real estate in the U.S. that’s still attractive and worth buying?

Without further ado, let’s dive into the cheapest places in the United States to live.

Cheapest States to Buy a Home

Zooming out from the city level, where are the cheapest states to buy a home?

After all, not everyone wants to live in a city or even a town. And the cheapest places to live in the United States are rural areas, not cities.

So, we created an interactive map of the cheapest states to buy a home. Or rather, all 50 states, but color-coded so you can compare the cheapest real estate in the United States:

Not a lot of surprises among average housing prices by state. Don’t expect to find affordable homes just lying around in the Southwest, Pacific Northwest, or Mountain states. Or New England, for that matter.

Some of the cheapest land in the U.S. for sale can be found in the Midwest and Southeast, which is starting to sound like a repeating refrain. However, many analysts forecast the greatest growth in average home prices in these regions for the immediate future, as opposed to the largest housing markets.

Note that only one of the cheapest states to buy a home saw a quarterly price decline in the third quarter of 2023. In contrast, eight of the ten most expensive states have seen average home price declines over the last quarter.

| Rank | SizeRank | State | Median Home Price | 5 Year Change | 1 Year Change | 3 Month Price Change |

|---|---|---|---|---|---|---|

| 1 | 39 | West Virginia | $158,103 | 36.51% | 2.72% | 1.21% |

| 2 | 34 | Mississippi | $176,568 | 33.61% | -1.39% | 0.60% |

| 3 | 27 | Oklahoma | $199,221 | 51.44% | 2.95% | 0.72% |

| 4 | 24 | Louisiana | $200,146 | 16.84% | -3.65% | -1.46% |

| 5 | 25 | Kentucky | $200,645 | 48.32% | 3.70% | 0.81% |

| 6 | 33 | Arkansas | $200,795 | 42.80% | 1.83% | 0.33% |

| 7 | 31 | Iowa | $212,062 | 38.44% | 3.03% | 1.17% |

| 8 | 6 | Ohio | $218,488 | 50.84% | 4.27% | 2.21% |

| 9 | 35 | Kansas | $218,640 | 50.69% | 4.62% | 1.72% |

| 10 | 23 | Alabama | $223,447 | 49.63% | 1.30% | 0.24% |

Top 10 Cheapest States to Buy a Home

Curious about the cheapest states to buy real estate? Check out the top ten list (or bottom ten list, if you prefer).

1. West Virginia

With a median home price of just $158,103, West Virginia offers a bargain compared to, well, just about anywhere else in the country. Just don’t expect booming metropolises — the state lives up to its tagline “Wild and Wonderful.” But for outdoor enthusiasts, West Virginia has plenty to offer.

2. Mississippi

Unlike West Virginia, Mississippi does offer some coastline for ocean lovers (er, gulf lovers). If you want shoreside living on a budget, check out Biloxi or Gulfport Beach. You can also avail yourself of some classic Southern cooking, outstanding blues, and hiking in Tishomingo State Park.

3. Oklahoma

Oklahoma offers more than windy plains and great barbecue. Affordable real estate, high quality schools, and low crime rates attract movers from all over the U.S.

4. Louisiana

Catching on to the theme here? Southern states offer better housing affordability than the rest of the country. And arguably better cuisine, if you ask Paula Deen. Louisiana offers a long coastline along the Gulf of Mexico for shore lovers, for some of the most affordable “seaside” real estate in the country.

5. Kentucky

With a low cost of living across the board, Kentucky also offers a rich cultural history from music (especially bluegrass and country) to architecture to art. And that says nothing of the bourbon. Kentucky is blessed with natural beauty as well, with its rolling hills, virgin forests, and glittering lakes. Plus, it shares a border with seven other states, making for easy travel across the region.

6. Arkansas

Beyond cheap housing, everything costs less in Arkansas. Healthcare, groceries, transportation, and utilities all cost less than the national average. It also taxes its residents less than most states, another welcome change from the high cost of living across most of the country. For mountain lovers, Arkansas offers two ranges: the Ozarks and the Ouachitas, for great hiking, camping, and lake escapes.

7. Iowa

Breaking the pattern of Southern states, Iowa may be best known for its rich agriculture, but it also features several mid-size cities with surprisingly vibrant art scenes. With plenty of jobs and a friendly population, don’t overlook this underpriced Midwestern gem.

8. Ohio

Ohio boasts several major metropolitan cities, including Cincinnati, Cleveland, and Columbus. These cities offer everything from excellent sports teams to rich art scenes to high-end dining and microbreweries. For people who want vibrant downtown living without the corresponding price tag, Ohio offers a wealth of options.

9. Kansas

Kansas offers cities and rural farmland, affordability and a plush country club scene. Cost of living remains low despite plenty of modern amenities (at least in urban areas). And hey, it’s the other haven for barbecue, which certainly doesn’t hurt.

10. Alabama

Like Mississippi and Louisiana, Alabama too offers some shoreline along the Gulf of Mexico for cheap seaside living. Many people move there for the warm weather as well, along with friendly locals, great food, low cost of living across the board, and of course affordable housing.

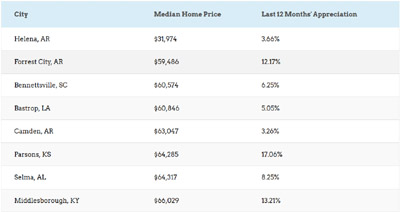

Cheapest Cities in the U.S.

Using raw data from Zillow, we compiled a list of the 100 most affordable cities and towns in the country. We then created an interactive map of them, including median home sales price, year-over-year appreciation, and quarterly appreciation. We added the latter since some housing markets reversed course and saw declining home prices in 2022 and 2023.

Below are the 100 cheapest cities to buy a home in the United States:

Surprising no one, the cheapest real estate in the United States is typically found in rural areas and smaller towns, not major cities. It's also concentrated in the Midwest and Southeast.

As you scout these cities with the cheapest real estate in the U.S., just be careful of cities with declining real estate values, high crime rates, high unemployment, and high vacancy rates.

Some cities make great bargains. Others are cheap for a good reason.

Top 10 Cheapest Cities in the U.S.

All right, so the word "city" is a stretch for these small- and mid-size towns. But you get the idea.

Here are the cheapest towns in the country, at least of the 900 or so cities that Zillow tracks.

| Rank | SizeRank | State | Median Home Price | 1 Year Change |

|---|---|---|---|---|

| 1 | 927 | Helena, AR | $46,118 | -9.17% |

| 2 | 889 | Clarksdale, MS | $48,697 | -20.10% |

| 3 | 648 | Greenville, MS | $67,167 | -19.77% |

| 4 | 707 | Selma, AL | $75,434 | -3.36% |

| 5 | 876 | Forrest City, AR | $75,517 | 1.55% |

| 6 | 803 | Coffeyville, KS | $81,218 | -2.85% |

| 7 | 830 | Kennett, MO | $81,223 | -10.06% |

| 8 | 911 | Parsons, KS | $81,356 | -5.34% |

| 9 | 846 | Bennettsville, SC | $81,841 | -14.32% |

| 10 | 472 | Danville, IL | $82,974 | 8.22% |

Average Home Prices by County

Wondering how real estate prices look when mapped by county?

Cue Captain Obvious: the coasts cost far more than inland areas and Middle America. Still, it's fun to see average property prices mapped by county:

Pretty nifty, eh?

With more workers able to work from anywhere, these stark differences may not last forever. But for now, average real estate values remain over ten times higher in some areas than others.

What Constitutes Cheap Real Estate?

Many connect the word "cheap" with poor quality. However, workmanship has nothing to do with comparing average home prices across cities and towns.

In the context of the cheapest real estate in the United States, we're simply referring to the average price to buy a property in each city. Compare them to the national median U.S. home price of $417,700 in the first quarter of 2024.

Low housing costs don't necessarily mean that these real estate markets are bargains. These towns may never see ballooning median incomes or job growth, and may never see median prices rise faster than inflation, no matter how many centuries go by.

Or someone could discover natural resources in one of these towns tomorrow, skyrocketing the cheapest land to surpass the national median. My crystal ball is no clearer than yours.

But the cheapest cities in the U.S. do have a few advantages over their overpriced peers for savvy real estate investors.

Reasons to Invest in Cheap Real Estate

As inflation roars in the wake of the coronavirus pandemic, many Americans have looked to move for a lower cost of living.

Here are a few reasons investors should consider buying some of the cheapest real estate in the United States.

1. Lack of Affordable Housing

The housing crash and Great Recession slashed housing starts from over 2.27 million in January 2006 to 478,000 in April 2009. While construction has increased since 2009, housing starts remain lower than in the 2000s, at 1.46 million in December 2023.

With developers building fewer homes over the last decade, the average sales price of a new home exploded from $265,100 in 2013 to $413,200 in December of 2023.

Over that time, the percentage of American households who rent their homes increased by more than 20%, according to Pew Research. More than one in three families live in a rental unit today.

2. Strong Employment & Rising Incomes

The U.S. has recovered to full employment levels with an unemployment rate of 3.7%, among the lowest in decades and below the 5% healthy market target. Wages have risen sharply, especially for lower-wage workers. The US faces a labor shortage, with too many jobs courting too few workers.

Since renters with lower incomes are the largest group, the trend is favorable for landlords of cheap rental real estate.

3. Finance with Low Down Payments

Low median sales prices mean low down payments—if you don’t buy outright in cash.

And yes, you can take out an investment property loan on cheap real estate. Lenders from traditional mortgage lenders to portfolio lenders like Visio and Kiavi to hard money lenders like New Silver all lend against low-cost properties. Better yet, have our friend Jason Forman comparison loan shop for you through Forman Loans, although minimum loan amounts do range from $50,000 to $100,000, depending on the lender.

That means more options than ever before for using real estate leverage and getting a loan for a rental property, even if you’re self-employed or looking for a mortgage on a rental property owned by an LLC.

See our comparison chart of investment property loans and terms for various options and pricing.

4. Avoid Rising Interest Rates

While the average interest rate on 30-year fixed-rate mortgages has fallen from a high of 18.37% in 1981 to around 7.03% in January 2024, it's still far higher than the roughly 3% interest rates borrowers were scoring in early 2022.

But with cheap real estate, you don't necessarily need a loan. You may be able to afford to make cash offers and negotiate a lower purchase price as a result.

For more, read up on today’s interest rates when getting a loan for a rental property.

5. Mistaken Public Perceptions

By definition, cheap real estate is priced below other properties due to perceived problems, such as poor location, condition, or tenants. Investors willing to investigate specific properties often find "diamonds in the rough"—excessively discounted real estate.

For example, a low income is not an indication of character and future tenant defaults. Successful landlords employ low-cost, proactive tenant screening to identify and avoid potential problem tenants.

6. Flexible Financing Alternatives

Buyers of cheap real estate have multiple financing methods to acquire property, including an all-cash payment.

While loan-to-value ratios (LTV) for investment real estate are generally 70%-80%, buyers have several options to minimize their down payment. Investors interested in property selling in the lowest price ranges should know that many lenders require minimum loan amounts of $50,000-$75,000.

7. Easy Diversification

Owning multiple small assets versus a single high-value asset is a recommended strategy to reduce risk, whether buying stocks or cheap real estate. Investors can easily acquire several lower-priced properties varying by location, tenant mix, and condition for the cash outlay required for a single premium property.

To illustrate, an investor with $100,000 might acquire a single home costing $400,000 (75% LTV) or four individual homes, each valued at $100,000 in different locations, for the same out-of-pocket costs.

Combining these trends presents a rare opportunity to build a portfolio of cheap real estate assets. Carefully selecting a diversified group of affordable rental properties (single-family homes to fourplex units) in the right locations, attracting stable, credit-worthy tenants, and taking advantage of low-interest mortgage loans can produce a steady cash-on-cash return with favorable tax treatment and the possibility of significant long-term capital gains.

Risks of Cheap Real Estate

No investment is risk-free; cheap rental real estate includes unique risks in addition to everyday economic and environmental hazards. Potential investors may confront some or all of the following:

- Lower demand. Cheap real estate is often located in the less desirable areas of the cities with poor schools, inadequate public transportation, and deteriorating public services. As a result, crime increases so that newcomers avoid the area, and residents seek to move if possible.

- Population & economic decline. You don't need to be an expert on real estate markets to know that shrinking populations spell lower average home prices. As demand and property values fall, wealthier residents and business owners often move elsewhere, or at least stop investing in their property or community. This cycle of urban decay can continue until the area becomes a wasteland.

- Low incomes. Average home prices in any region reflect median household incomes. Low median incomes often correlate with low education levels and socioeconomic problems such as crime and high unemployment rates.

- Troubled tenants. Those who reside in the cheapest rental properties in deteriorating neighborhoods typically earn a low income, are unemployed, or depend on public welfare programs such as Social Security and HUD's Housing Choice Vouchers (Section 8).

- Landlord-tenant disputes. Public agencies and interest groups actively intervene between landlords and tenants as a result of past discrimination and abusive property owners. Anyone who acquires cheap rental real estate should be aware of the local political environment, zoning requirements, and state and local ordinances that might affect a rental contract or dispute.

Beware of property damage, equipment thefts, and high tenant turnover unless anticipated by the new owners.

Fortunately, many of the above issues can be avoided or alleviated with diligent research before purchase combined with on-going, active site management; implementation of a comprehensive, non-prejudicial tenant screening process; and proactive landlord-tenant communications.

Final Word

If you opt to invest in real estate long-distance, you have plenty of options, from Roofstock to Asset Column to local wholesalers and turnkey property sellers.

In fact, nearly two-thirds of transactions on Roofstock involve buyers who live over 1,000 miles from the property!

One factor to be considered before you purchase cheap real estate long-distance is property management. Who will deal with tenants, collect rents, and maintain the property? Many investors prefer to manage their properties personally, and we're happy to help with our online landlord software.

But if you prefer to hire a property manager, start with Roofstock's list of certified property managers as a good starting point. In more populous cities, you'll have more options to choose among, for property managers.

Happy investing!♦

What have your experiences been in investing in cheap real estate? Have you ever invested in any of the cities listed above as the cheapest real estate in the United States? Share your thoughts below!

Good info, I would like more.

Glad you found it interesting Andrew! What other info are you looking for?

fantastic

Thanks Sarah!

So many cities where average income earning people can invest. Thank you for helping us.

Glad you found it useful Layla!

Good decision if you invest in Real Estate!

Love this blog. Really cool visuals and information!

Thanks Oran, much appreciated!

Very Helpful. More power to you Brian!

Thanks Geneva!

Great article! I hope to find an investment in one of those cities.

Awesome! I’m on track. Thanks for the update! 👍

Glad to hear it Alvin!

Be careful with cheap real estate! Do thorough research. Risks are very important to consider. Cheap may seem good, but be financially ready. Believe me. I’ve been through plenty of bad experiences with cheap real estate so be cautious and watch out for hidden costs like higher turnover rates, higher crime rates, higher rent default rates, and worse property management.

Great points Lionel!

The information on financing options and how to avoid rising interest rates is also very valuable. Thanks for providing a comprehensive view of the possibilities in the world of affordable real estate.

Very true – great financing terms can be more valuable than scoring a great price on a property.

Great post, yea I live in a formally ‘cheap real estate’ state, Tennessee. But nowadays lots of people are moving to Nashville, Knoxville, and Chattanooga (and surrounding areas) and driving the prices up. But, that is ok cause we still have no state income tax. Thanks for sharing this great info!

Seems like property values have shot up in TN cities!

Great info, thanks for sharing.