As a city dweller myself, I’m all too familiar with the challenges of urban living during the coronavirus pandemic. My family shares a small apartment with no outdoor space – and it certainly got harder to stay cooped up in it as the weeks and months of social distancing dragged by.

Indeed, residents in dense cities like New York experienced some of the worst that the COVID-19 pandemic had to offer. All while continuing to pay sky-high mortgage and rent payments.

For better or worse, it looks like the American urban renaissance is coming to an end.

The Data Behind De-Urbanization

Between the Great Recession and the mid-2010s, America’s cities saw a revival in popularity, culture, and safety. Words like “gentrification” and “hipsters” dotted every discussion about the changing renter demographics in US cities, driven largely by millennials. Crime rates in cities dropped and rents soared during this period of re-urbanization.

Then something changed. Millennials, the largest generation in America today, reached their 30s, started getting married and having children. Suddenly the loft apartment in the “up and coming” hipster neighborhood didn’t look as appealing, and the traditional suburban house with the white picket fence didn’t look so boring after all.

Even before the coronavirus pandemic, millennials had started abandoning America’s cities.

Baseline Data: Americans Were Already Leaving Major Cities

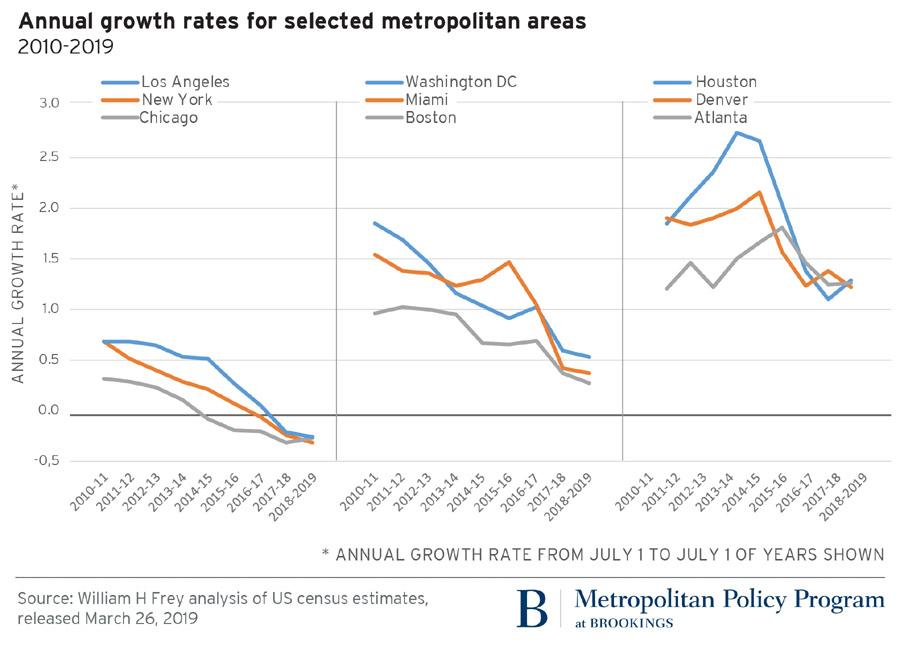

Large metropolitan areas saw significant population growth in the early 2010s. By the end of the decade, that growth rate had roughly cut in half.

In fact, America’s three largest cities – New York, Los Angeles, and Chicago – saw their populations actually shrink by the end of the 2010s. Take a look at this data from the Census Bureau, as analyzed by the Brookings Institute:

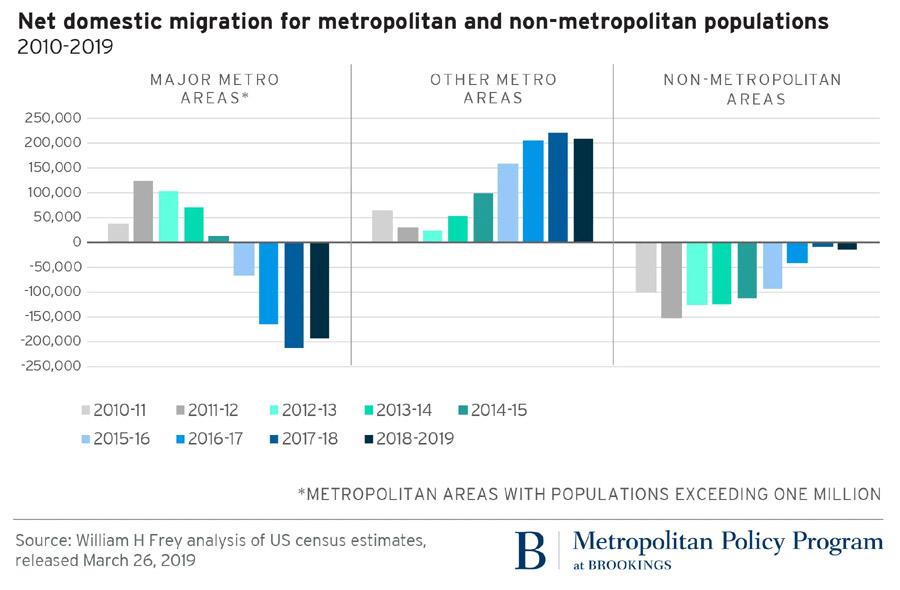

But population growth rates only tell half the story, as they include growth from birth rates. Looking solely at migration patterns into and out of America’s cities, the numbers look far more stark:

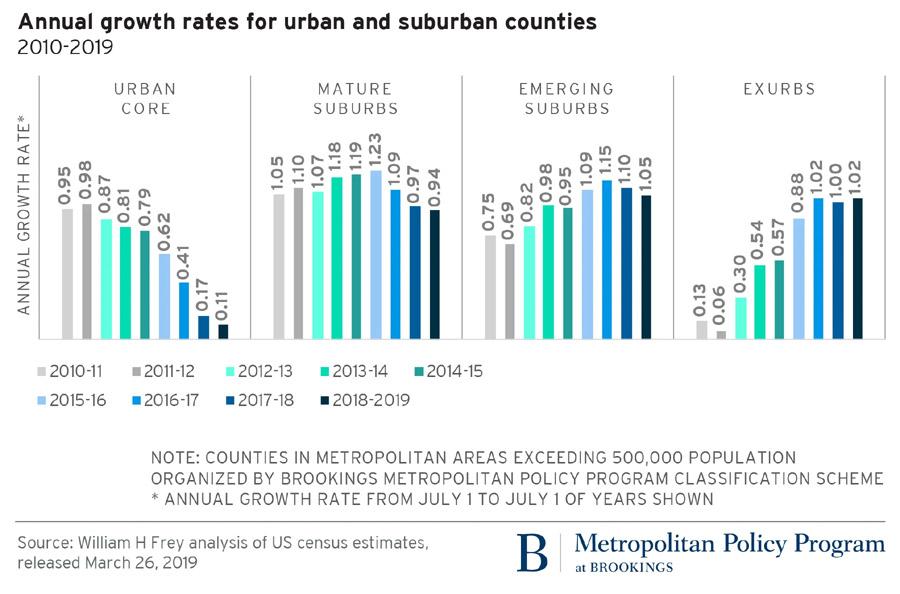

In a particularly telling statistic, population growth rates for urban core areas fell by 86% from 2015-2019, dropping from a growth rate around 0.8% to just over 0.1%:

Americans were already leaving major cities in favor of smaller cities and towns, even before the pandemic turned the urban dream into a nightmare.

Enter: The Coronavirus Pandemic

If there’s one refrain I’ve heard continuously over the last few months, it’s this: the COVID-19 pandemic has accelerated trends that were already happening, albeit slowly. It goes for telecommuting (more on that shortly), for online learning, for telemedicine, and it goes for de-urbanization.

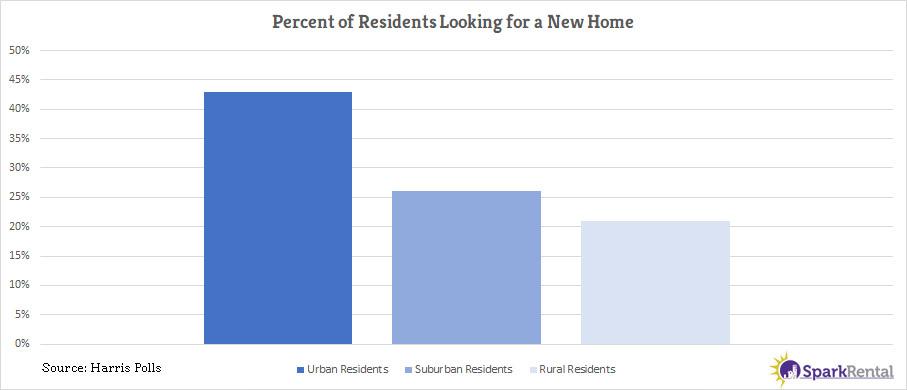

In late April, Harris Poll ran a survey on housing searches. They found that city dwellers were more than twice as likely to be browsing real estate listings to find a new home than their rural counterparts. Fully 43% of urban residents were looking for a new place to live, compared to 26% of surburbanites and 21% of rural residents.

The data is clear: far more urban dwellers are looking to move than suburban and rural residents.

(article continues below)

Free Masterclass: How to Reach Financial Independence in Under 5 Years

Renters Less Likely to Renew Lease Agreements

The last few months have created great uncertainty in stock markets, real estate markets, job markets, and the economy at large. No one knows when – or if – a vaccine will arrive. No one knows if a second wave will come bearing down on the country and the world at large. No one knows how long the economic recovery will take.

Amidst that uncertainty, most renters don’t want to commit to another year-long lease agreement. A survey conducted by HousingWire found that only 26.1% of renters say they are likely to renew their lease agreement when it comes up for renewal. More renters (35.9%) say they don’t plan to renew their lease agreement, and the remainder remain undecided.

Predictably, the trend is worse among more expensive rental units. For tenants paying $1,750 or more in rent, only 18.7% say they plan to renew their lease agreement, while 41.6% say they plan to non-renew.

We recommend that landlords double down on tenant retention efforts, for their good renters.

Rents Already Dropping in Largest US Cities

It’s already happening.

In June, rents for one-bedroom apartments in the nation’s most expensive housing market, San Francisco, fell 9.2% year-over-year according to Zumper. Rents for two-bedroom apartments fell 6.4%.

Nor is San Francisco an outlier. Other expensive cities, including New York, Boston, Washington DC, Los Angeles, Seattle, San Diego, and Miami all saw rents decline.

Here’s the raw data from Zumper, for the 20 most expensive cities in the country:

| Pos. | City | 1 BR Price | M/M % | Y/Y % | 2 BR Price | M/M % | Y/Y % |

| 1 | San Francisco, CA | $3,360 | -2.60% | -9.20% | $4,420 | -1.80% | -6.40% |

| 2 | New York, NY | $2,950 | 0.00% | -1.00% | $3,220 | -1.20% | -2.40% |

| 3 | Boston, MA | $2,450 | -2.00% | -2.00% | $2,900 | 0.00% | 1.80% |

| 4 | San Jose, CA | $2,420 | -1.60% | -0.40% | $2,950 | -3.00% | 1.00% |

| 5 | Oakland, CA | $2,350 | 0.40% | 4.90% | $2,850 | 0.40% | 4.80% |

| 6 | Washington, DC | $2,220 | -1.30% | 0.50% | $2,940 | -1.30% | -0.70% |

| 7 | Los Angeles, CA | $2,170 | -1.40% | -3.60% | $2,980 | -0.70% | -1.70% |

| 8 | Seattle, WA | $1,800 | 0.60% | -4.30% | $2,270 | 0.40% | -4.60% |

| 9 | San Diego, CA | $1,770 | -0.60% | 3.50% | $2,300 | -2.10% | -1.30% |

| 10 | Miami, FL | $1,750 | -1.10% | -2.20% | $2,300 | 0.00% | -0.40% |

| 11 | Santa Ana, CA | $1,690 | -0.60% | -5.10% | $2,200 | 0.50% | 0.90% |

| 12 | Fort Lauderdale, FL | $1,650 | -1.80% | 1.90% | $2,150 | 0.00% | 2.90% |

| 13 | Honolulu, HI | $1,640 | 2.50% | -1.80% | $2,000 | 0.00% | -13.00% |

| 14 | Anaheim, CA | $1,610 | 0.60% | -5.30% | $1,960 | 0.50% | -7.10% |

| 15 | Long Beach, CA | $1,570 | -1.90% | 1.90% | $2,000 | 0.00% | 0.00% |

| 16 | Chicago, IL | $1,510 | -2.60% | -3.80% | $1,810 | -0.50% | -4.20% |

| 17 | Philadelphia, PA | $1,500 | 0.00% | 11.10% | $1,700 | 0.00% | 0.00% |

| 18 | Denver, CO | $1,440 | 0.00% | -6.50% | $1,860 | 0.00% | -4.60% |

| 19 | Atlanta, GA | $1,420 | 0.00% | -0.70% | $1,810 | -0.50% | 0.60% |

| 19 | Scottsdale, AZ | $1,420 | -3.40% | 7.60% | $1,930 | -4.90% | -4.00% |

But not all cities are seeing rents decline. Smaller cities such as Boise, Buffalo, and Richmond saw rents rise. Expect a reshuffling of the deck, as Americans look for cheaper real estate outside the most expensive “gateway” cities.

The Logic Behind De-Urbanization

It doesn’t take a demographer to understand why Americans are leaving major cities in the wake of the coronavirus pandemic.

But the reasons are as numerous as they are compelling, and it’s worth pausing to understand them in full.

Pandemic Problems in Major Cities

Pandemic Problems in Major Cities

Urban residents simply have less living space. Less indoor space, less outdoor space (if any), less room to get away from one another, to exercise, to find privacy.

And when you’re trapped inside for months on end, that wears on you.

But major cities inherently have a higher population density, which has driven contagion, transmission rates, case numbers, and deaths. Many residents have no choice but to enter crowded elevators in order to reach their apartment. So not only did urban dwellers suffer more mentally and emotionally, but they also suffered more direct exposure to the virus.

In normal times, city living comes with plenty of perks. You may not have a large living room, but you have your favorite pub down the block where you can watch the game and meet with friends. You can walk to grocery stores, restaurants, retail shopping, entertainment, and other amenities. Most of which closed down for months during the peak of the pandemic, leaving urban residents with all downside and no upside.

(article continues below)

Telecommuting: Decoupling Where You Live from Where You Work

When you have to physically commute to work, closer is inherently better. In happiness studies, researchers routinely find commuting to have an enormous impact on happiness, health, and wellbeing. One study found that an extra 20 minutes of commute had the same negative impact as a 19% pay cut.

So people like to live closer to where they work. But what happens when people no longer need to physically travel to their employer?

When you can work from anywhere, it removes one of the fundamental reasons to live in a major metropolitan area rich with employers. Suddenly urban and even satellite suburban living becomes a lifestyle choice, having nothing to do with work and everything to do what kind of neighborhood you prefer.

And more Americans are telecommuting. According to Zapier, over half of American workers now telecommute full-time.

I telecommute and still live in a city. But we chose this city intentionally based on low crime rates, walkability, and low cost of living, and I’m just as open to living in a smaller town or city.

Some workers will return to physical commuting. But many will continue telecommuting, and will move to areas with cheaper real estate, lower cost of living, lower crime, and better access to nature. And, for that matter, lower taxes: Americans were already fleeing high-tax states, and I expect that trend to also accelerate in the wake of COVID-19.

The Risks & Opportunities for Real Estate Investors

What do these social and demographic changes mean for real estate investors?

First, it means a resettling of rents around the country. As outlined above, rents are already dropping in the largest, most expensive cities as people move to areas with lower housing costs and lower taxes.

Many smaller “Tier 2” cities will see an uptick in rents. In fact, even before the pandemic when we ran the numbers, the best cities for real estate investing were smaller cities.

As an investor, explore new markets and consider out-of-state real estate investing. Research cities with the best cap rates, for example, and cities seeing population growth. When you invest out of state, consider buying turnkey properties rather than fixer-uppers or the BRRRR method.

Landlords in major cities with declining rents should boost efforts at tenant retention, especially right now as the economy gradually staggers to its feet again. Selling is, of course, an option. But before selling, landlords should also consider converting their units to short-term rentals and becoming Airbnb landlords. When the dust settles after the pandemic, tourism in major cities will rise again, even if fewer residents want to live there full-time.

And investors may find real estate bargains in the aftermath of the pandemic. Between foreclosures and “tired landlords” who just can’t handle the headaches any more, look for motivated sellers who just want out.

Final Thoughts

A decade’s worth of social change has taken place in the first half of 2020. It’s a period of upheaval, and during these times of turmoil there are inevitably winners and losers.

Make sure you come out a winner, by staying on top of the changing social and housing trends. With our world changing so fast, it’s easy to blink and miss these rapid transformations.

There are plenty of risks to investing right now, but also plenty of opportunities. Keep one eye on each, and protect yourself even as you look for ways to invest your money for predictable real estate cash flow.

How are you investing right now? Have you seen a slowdown in rental demand in major cities, or perhaps an uptick in demand in smaller cities or rural areas?

Learn More, Earn More:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

This is all so very true! Who knows if and when things go back to normal. If people start to move out of our cities that also might affect small businesses, restaurants and bars since a source of their profits came from people who work in the city.

Absolutely Stephanie, I think we’ll some population reorganization over the next couple years.

It’s too early to know definitively how many people will leave cities. It could be months or years before we know the pandemic’s impact on urban areas. While many states and counties are loosening their lockdown orders, there is the chance of new outbreaks and restrictions. And the protests over police brutality that have spread across cities throughout the United States could galvanize some residents’ commitment to their cities and push others to quieter areas. For those able to do their jobs away from populated areas might find less of a reason to stay.

Agreed Martin! It’s early days yet, and for all the prognostication on how the coronavirus pandemic will change our society, only time will truly tell.

I can’t speak for other areas of the country, but I see a lot of activity in my little area. Sure seems like people are coming and mainly from larger cities.

Thanks for the ground-level perspective Gabe!

It sure does seem like many people are fleeing the big cities. Though, we really won’t know if this trend will continue once this pandemic ends.

Very true Gabe! Although I found it interesting that the three largest cities were already seeing population loss before the pandemic.

Why would you advise against Brrr method? Is this not one of the best ways to reach financial freedom especially during these times?

Hi Don, the BRRRR method works great, but it’s harder to do long-distance given the challenges of managing contractors from afar. You can do it, it’s just harder.

The other risk with the BRRRR method is overleverage. So while I love the BRRRR method, I recommend it more for investors with a few deals under their belt, rather than a tactic for new investors desperate to get started without enough capital.