As Baron Rothschild famously put it, “the time to buy is when there’s blood in the streets.”

And as bad as the bleeding has been over the last month, it’s going to get much, much worse before the COVID-19 crisis passes. Which raises the question: Should real estate investors buy rental properties right now, with all the blood in the streets?

Even for those who can afford to buy right now, the current crisis presents as many challenges as it does opportunities. Real estate investors will undoubtedly find more good deals on properties than usual. You better believe there are plenty of motivated sellers out there right now. But what about the risks that landlords face in the current coronavirus pandemic?

As you evaluate the market and decide whether to invest during the COVID-19 pandemic, consider the following opportunities and risks carefully, and make your own personal risk/benefit analysis.

The Opportunity for Real Estate Investors

Early data from the National Association of Realtors (NAR) shows that far more buyers have withdrawn from the market than sellers. By late March 2020, fully 48% of Realtors reported buyers pulling back, while only 16% of sellers said they wanted to pull their listings.

So, housing markets are already seeing the balance between supply and demand tilt dramatically to favor buyers. Demand is disappearing, while supply is remaining relatively stable.

Some home sellers can afford to wait this out, of course. But others face some urgent need to sell, and can’t afford to sit on the sidelines. They need to sell now, even if it means a sharply lower sales price than they hoped.

According to Darren Robertson of Northern Virginia Home Pro, those motivated sellers create an enormous opportunity for real estate investors. Motivated sellers have always made up the bread and butter for off-market deals, and in the coming months, many sellers will find themselves forced to accept lower offers, given the dearth in homebuying demand.

That makes this a perfect time for investors to pursue distressed sales, using tools like Propstream (full Propstream review here). It’s a great time to aggressively negotiate real estate deals.

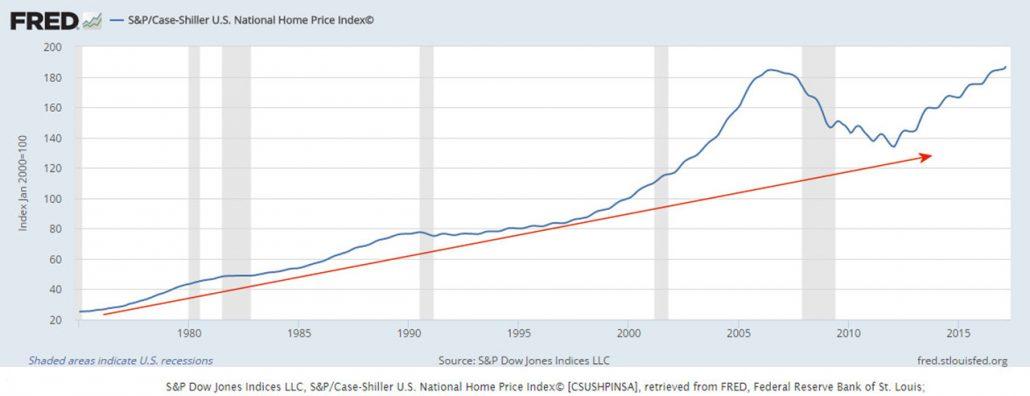

Stock owners don’t need to keep their stocks. But everyone still needs a place to live, which is why real estate tends to do just fine even in recessions. See this graph, showing the Case-Shiller Home Price Index over the last 50 years.

In only one recession — the Great Recession — did home prices drop significantly. And that recession was largely caused by a housing bubble in the first place.

In short, real estate makes a great asset to hold during recessions, with far less volatility and losses than stocks and other paper assets.

The Risks of Buying Real Estate During the Coronavirus Pandemic

Despite the clear upside, real estate investors and landlords face very real risks and challenges in the current crisis as well.

Before shelling out hundreds of thousands of dollars on an investment property, make sure you fully understand the impact of the coronavirus pandemic on real estate investors.

Limited Exit Options

Word to the wise: you don’t want to become one of those motivated sellers yourself. The last place you want to find yourself is forced to sell during this crisis.

That spells trouble for house flippers, and for any rental investors who occasionally raise capital by selling off a property.

As you prepare to navigate the troubled waters of the next few months (and possibly years), bear in mind that your exit options will prove far fewer than usual.

Eviction Challenges

Some states and cities have temporarily suspended evictions entirely. Others have closed civil courts, preventing landlords from scheduling a rent hearing, a necessary step in the eviction process. In those jurisdictions, landlords have no legal recourse to enforce their lease agreements. Eviction remains the only legal option available to landlords when their renters breach the lease agreement. Without it, landlords could face months of unpaid rents during the pandemic — even as their own expenses keep coming. They still have to make their mortgage payments, still have to cover repairs and maintenance, and still have to pay for property taxes, insurance, property management fees, and all the other costs that landlords incur.Looming Global Recession: Higher Default Rates

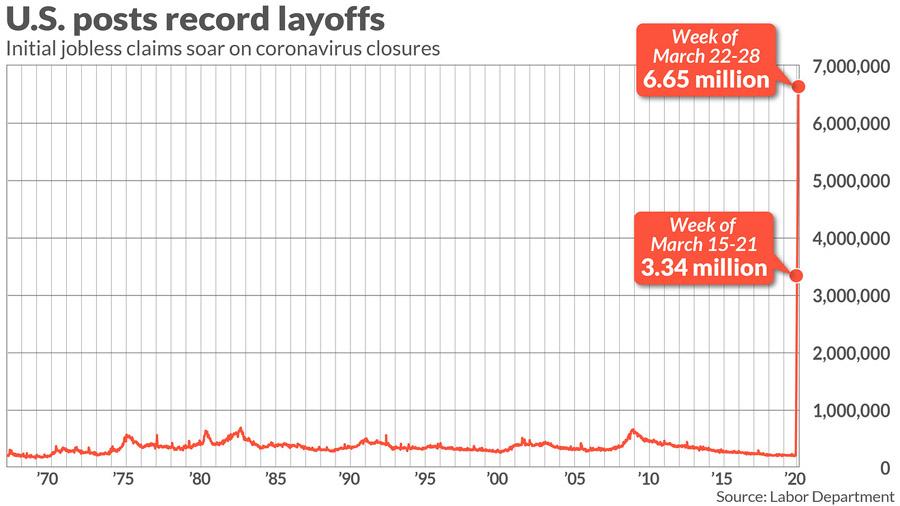

With unemployment skyrocketing at unprecedented rates (see the chart below), many renters simply won’t be able to afford rent payments. So even in jurisdictions where landlords can complete the eviction process, they’ll still see higher default rates, higher eviction rates, and higher vacancy rates. All of which mean sharply higher expenses and lower returns. For a truly terrifying graph, check out first-time unemployment claims over the last half century: (courtesy of MarketWatch)

The United States has never seen unemployment claim numbers like these.

With most economists predicting a deep global recession, strap in for an extended period of high unemployment rates, high rent defaults, and high vacancy rates.

(courtesy of MarketWatch)

The United States has never seen unemployment claim numbers like these.

With most economists predicting a deep global recession, strap in for an extended period of high unemployment rates, high rent defaults, and high vacancy rates.

Financing Challenges

While largely ignored in the press to date, the nation faces a serious credit crunch. With debt investors sitting on the sidelines and adopting a wait-and-see approach, mortgage lenders simply don’t have many outlets for selling their loans. Many portfolio lenders have stopped issuing rental property loans altogether. They see the rent default rate spiking, and the mortgage default rate close on its heels. At the time of this writing, we know of two sources of investor financing still operating normally: Lending Home and Fund & Grow. Lending Home offers both purchase-rehab loans and long-term rental mortgages. Fund & Grow is a rotating credit concierge service: they help real estate investors get $150,000–$250,000 in rotating credit lines and unsecured business cards, which they then show you how to use to fund settlements directly with low or no fees. But many of the other real estate investment lenders we work with have temporarily suspended new loans entirely, given the uncertainty in the market. No matter what kind of financing you look to, expect tighter loan requirements. It’s going to be much, much harder to get approved for financing right now.How Real Estate Investors Can Mitigate Those Risks

It’s a time of greater opportunities and greater risks. So how can real estate investors protect themselves, as they buy amidst all the blood in the streets? You don’t need to follow all of the risk management techniques outlined below, but consider each of them as you continue operating in today’s higher-risk market.Invest in Landlord-Friendly Jurisdictions

It should come as no surprise that tenant-friendly jurisdictions are the ones that declared eviction moratoriums earliest and for the longest periods. Far too many landlords underestimate the role of the legal environment where they invest. But now more than ever, the legal environment matters. Even when the immediate public health crisis passes and businesses start reopening, expect tenant-friendly jurisdictions to leave plenty of restrictions in place against landlords. To protect your properties and your investments, focus on buying in states and cities with landlord-friendly laws. We take the legal environment into account when we create lists of the best cities for real estate investing each year. Check out this map, for a state-level overview.Wait Until Evictions Resume Before Investing in New Rental Properties

It’s hard to get excited about buying a rental property when you can’t enforce your lease agreement, where tenants can live for free indefinitely.

Consider only buying new rental properties in markets that currently allow evictions. In some cases, that means waiting until that jurisdiction lifts its eviction moratorium and reopens civil courts.

Keep in mind that many jurisdictions will face a lengthy backlog of eviction cases, once courts reopen. It will take far longer than usual to remove non-paying tenants.

Maintain Deep Cash Reserves

Investors with deep pockets will come out ahead in this crisis. Those with little cash on hand will find themselves both unable to participate in the market dip and strapped when they face rent defaults or vacancies.

Set aside enough cash to cover several months of unpaid rent for each rental unit you own. During times of crisis, always keep a wary eye on your emergency fund.

You may well need it in the coming months, because no one knows how deep or long the coronavirus-induced recession will last.

(article continues below)

Conduct Intensive Tenant Screening for Vacant Units

It’s a tough time to fill vacant rental units, no question.

If you do find yourself with a vacancy, run your usual tenant screening reports of course, but take your screening further than usual. Ask probing questions of applicants’ employers, about their current plans for keeping employees, furloughing, etc. The employer has no legal obligation to answer your questions, but they often will anyway.

As best you can, get a sense for the applicant’s odds of continued employment.

Bear in mind that some industries are weathering this pandemic better than others. That means some jobs are inherently safer right now than others.

Also make sure to speak with current and former landlords to get a sense of the applicant’s reliability. Some people are fundamentally responsible and take pride in paying every bill on time. Others never saw a bill they wanted to pay on time in their lives.

Now more than ever, find those fundamentally reliable people to put in your vacant rental properties.

Report Rents to the Credit Bureaus

As an added incentive, report your tenant’s rent payments to the credit bureaus.

It’s a feature we’re in the process of adding, and wish we had it live now. But we’re hoping to launch it in June 2020, to allow landlords who use the online rent collection feature of our landlord software.

After all, with eviction moratoriums in much of the US, some tenants feel no compulsion whatsoever to make their rent payments on time, even if they continue earning a paycheck. Incentivize with better credit if they pay on time, and a penalized credit score if they stop paying rent.

Ask About Loan Deferral Options

While you should of course continue making your monthly mortgage payments if at all possible, many landlords will face the pinch of defaulting tenants and no eviction recourse. If that happens, make sure you understand your options.

Contact your mortgage lender to ask about forbearance, loan modifications, and other payment plan options. Understanding your options will take some of the fear out of the current market.

Buy Rent Default Insurance

Unfortunately, some insurance companies have suspended all new policies for rent default insurance. By the time you know you need insurance, it’s too late to buy it. It goes to show exactly why an ounce of prevention always beats a pound of cure.

But at least one company still issuing policies. Get a price quote from Steady Insurance to protect against rent defaults during the COVID-19 pandemic and beyond.

Final Thoughts

Is now a good time to invest in real estate?

Yes and no. It’s a more dangerous time for real estate investors, especially less experienced investors unfamiliar with the nuances of accurately calculating rental cash flow and conservatively estimating expenses. With mass rent defaults, unemployment, and vacancies looming, landlords face very real risks and challenges.

But with those challenges will come some extraordinary opportunities to buy low. When everyone else panics, investors can scoop up deals at rare prices — provided they can afford to weather the coming storm.

Are you planning to buy during the coronavirus pandemic and the ensuing recession? What are you doing to protect yourself as a real estate investor and landlord?

More Unconventional Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Thank you for the thoughtful take on this timely topic. So many articles I’ve been reading about real estate investing during COVID-19 have been either BUY NOW or DON’T TOUCH ANYTHING, with no middle ground or nuanced analysis.

You guys really do have the best real estate investing content on the web!

Thanks Chelsea! Very much appreciated!

Great analysis of the potential risks and rewards of investing in real estate right now. And I loved the webinar you guys had on the coronavirus impact on real estate investors, super helpful.

I’m planning on holding off until the courts start reopening, then snapping up as many investment properties as I can. I think there are going to be some great deals available.

Thanks again!

Glad it was useful for you Mike! Best of luck with your COVID-19 investments.

I also feel buying an investment property at this hour can be a good investment. During this time of crisis, there will be lot of properties ready for foreclosure and there will be a lot of distressed sellers motivated to sell their property. The best thing you can do this time is to keep an eye on people who are short selling the properties or wait for sometime to get the properties into foreclosure.

There will definitely be opportunities for distressed sales!

Thanks for sharing your thoughts with us .such an informative article and really I would like to appreciate you for taking your time to share this information with us.