At a Glance:

-

-

-

Social Security is projected to be insolvent by 2032.

-

Expect benefit cuts, a higher retirement age, higher taxes, and means-testing as possible fixes.

-

I’m personally preparing for Social Security reform by savings and investing in high-yield investments.

-

-

The Social Security Administration now forecasts that its OASI Trust Fund will become insolvent in 2032 – just seven short years from now.

Of course, it won’t actually run out of money. The government will make changes to keep it afloat.

And none of those changes are good news for you and me.

Proposed Changes to Social Security

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

We don’t yet know what form Social Security reforms will take. But here are a few of the most likely ones being floated currently:

-

-

Cutting Benefits: The most obvious and simplest choice, albeit one that will piss off millions of workers who have paid far more into the system than they’ll ever get back.

-

Slowing COLA Increases: Actually, the SSA has been doing this for years already. By raising the cost of living adjustment slower than real inflation, they’ve managed to delay Social Security’s insolvency.

-

Raising the Retirement Age to 69: Congress representatives from both sides of the aisle have proposed raising the Full Retirement age from 67 to 69.

-

Means-Testing Recipients: The government could reduce or deny Social Security benefits for seniors above a certain income or net worth.

-

Raising FICA Taxes: Currently, workers and employers pay a combined 15.3% toward Social Security and Medicare taxes, which could of course rise.

-

Removing the Cap on FICA Taxes: Retirees are capped at how much they can receive in benefits, so the government also caps how much they tax workers. That cap could disappear for higher earners, so they pay an unlimited amount into the system despite being capped on what they could ever receive.

-

Fun reading, right?

Let’s get real: the government will likely end up combining several, if not all, of these proposals.

How I’m Preparing My Own Retirement

The short and depressing answer: I’m not counting on income from Social Security.

I’m sure I’ll get something. I’m just as sure it will be much, much less than what I’ve paid in over the decades.

So, I’m aiming to reach financial independence with my investments alone. I want to be able to live on investment income, and long before I reach retirement age.

What Those Investments Look Like

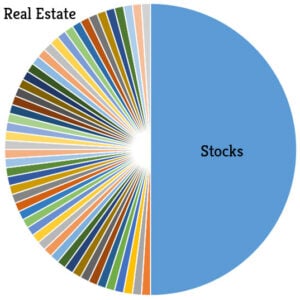

If you’ve ever hopped on a webinar with us, you’ve seen my nerdy pie chart showing half of my net worth in stocks, and the other half in diverse passive real estate investments.

(article continues below)

On the stock side, I invest in index funds, plain and simple. Large and small cap, US and foreign. Check out VTI for broad exposure to US stocks and VEU for broad exposure to foreign stocks. Or try Charles Schwab’s free robo-advisor (I use it myself).

The real estate side is more interesting, but still hands-off and passive.

High-Yield Real Estate Investments

The Co-Investing Club just met two days ago to vet a bonus investment for this month: a shorter-term syndication projected to sell in two more years. It’s currently paying an 8% distribution yield, rising next month to a projected 9.3% yield for the next year and 9.8% yield for the year after that.

When it sells and pays out profits, the operator forecasts a 22.36% annualized return.

That’s not atypical either.

We’ve invested in notes that pay 15% interest, funds that pay a 16% distribution yield, syndications projecting 15-28% annualized returns.

If you earned a 16% yield on an investment, you’d collect $16,000 a year for every $100,000 you invested. It wouldn’t take an enormous investment to create very real income for retirement.

What About Risk?

Risk is real. Every investment comes with risk, and you should never for a moment forget that as you vet any investment.

Risk comes in different forms however. People love to wave away bond risks, simply because many bonds have low default risk. But bonds still come with high inflation risk and interest rate risk, for example.

Stocks and real estate come with market risk and management risk. The more of these investments you vet alongside other investors, the better you get at assessing these risks.

That’s why we meet once or twice a month as an investment club: to assess risk together and to learn from one another.

Curious about the Co-Investing Club and how we vet deals together? Join as a free member to get notified about our next deal discussion!

And like we do every Thursday, we’ll host an Open Office Hours Zoom call tomorrow at 3:30 EST. Show up and ask us about anything that’s on your mind!

Hope to chat with you tomorrow,