At a Glance:

-

-

Political instability è economic instability

-

Protect yourself with recession-resilient investments and inflation-resilient investments

-

Also look into international investments and contingency option

-

Oops, they did it again: Congress failed to pass a funding bill, and the government shut down.

And let’s be real: that’s just the latest example of political instability in the US. There’s a laundry list of other examples you can point to – which I won’t, because people will inevitably accuse me of partisanship for one side or the other, even if I include examples of both parties contributing to the problem.

Regardless of who you think is to blame, political instability causes economic instability. Read: threat to your money.

So how can you protect your portfolio from political risk?

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Recession-Resilient Investments

A 16-day shutdown in 2013 cost the economy an estimated 120,000 jobs. And that’s just continuing to harp on the shutdown, and ignoring regulatory uncertainty, tariff uncertainty, government overspending, tax hike risk, and other politically-driven risk.

The point: politicians can and sometimes do mess up the economy. The more politically polarized the country becomes, the greater the risk.

No investment is completely “recession-proof,” but many investments are recession-resilient likely to continue performing well even in a downturn.

For example, earlier this year the Co-Investing Club partnered with a land investor. Beyond flipping land, he also installs new manufactured homes on land parcels to sell as starter homes. In the county where he operates, the median home sells for $460,000, but he sells his homes for $230,000 on average.

There will always be demand for half-priced homes. Even or perhaps especially in a recession.

Inflation-Resilient Investments

Poorly-conceived government policies can absolutely drive up inflation. Look no further than 2022.

Fortunately, some investments just ride the wave of inflation. People pay the going price, regardless of the current value of the currency.

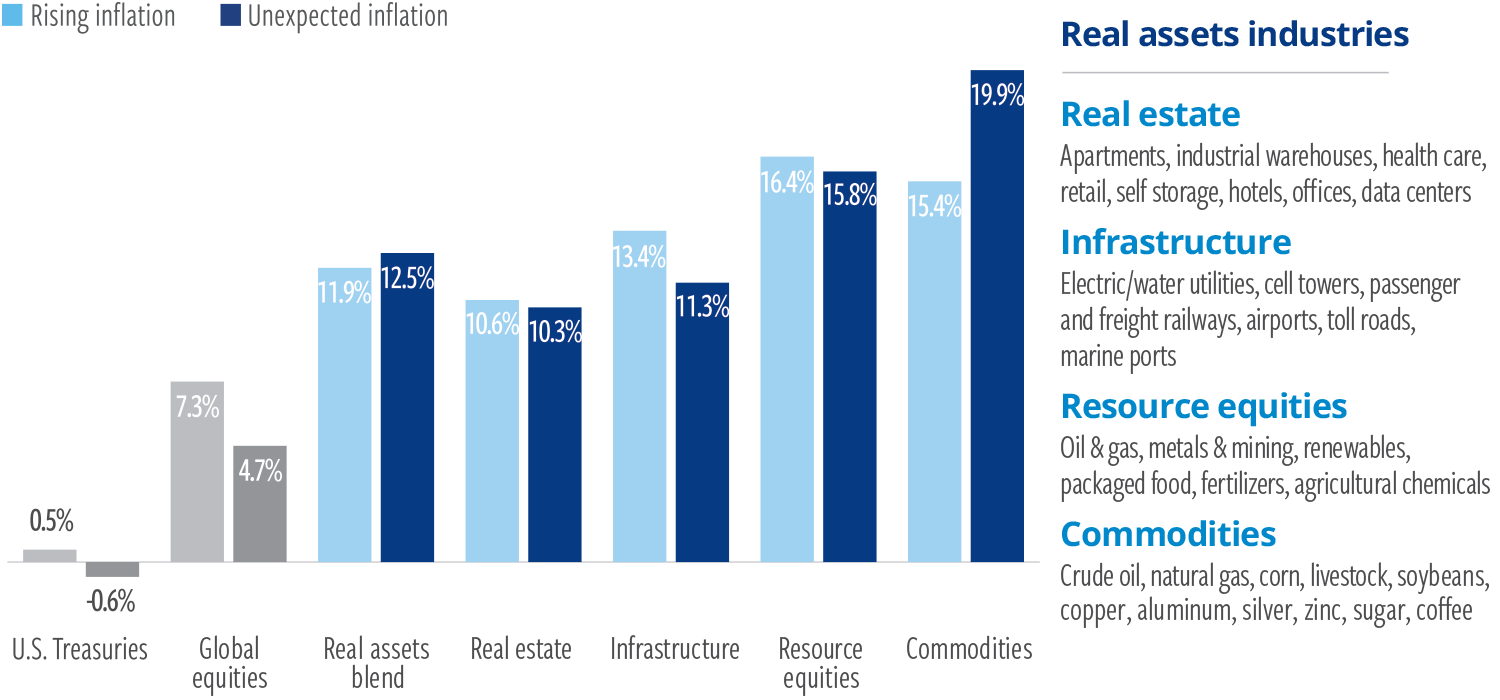

That particularly applies to real assets like commodities, precious metals, and real estate. See for yourself:

Invest Internationally

In today’s world, investing in another country is easy.

Well, for stocks anyway. That’s less true for real estate, outside of REITs.

But you get the idea: when one country’s politics get hairy, you can simply invest more money in more stable ones.

For that matter, you can move there yourself.

Form a Contingency Escape Plan

Having lived overseas for ten years, I can tell you right now that there are plenty of easy, fun places to live around the world.

And yes, they have great healthcare, and yes, they’re safe.

You don’t need an expensive golden visa or citizenship by investment program. You just need a digital nomad visa: you prove you have income from another country, and they let you move in.

Here’s a list of 73 countries with digital nomad visas. I’ve lived long-term in three of them (the UAE, Brazil, and Peru). And I’ve lived short-term in others (Italy, Czech Republic, Argentina).

Granted, most digital nomad visas only let you stay for 1-5 years. After that, you’ll need to apply for long-term residency (or move somewhere else).

Sometimes right-leaning friends ask me “What happens if a socialist administration takes over and doubles tax rates?”

Sometimes left-leaning friends ask me “What happens if the current administration makes the US an authoritarian country?”

My answer to both is “Then my family will vote with our feet and leave.” It’s that simple.

(article continues below)

Expand Your Investing Options

No matter what you’re investing in currently, it never hurts to add more options. Come check out what the Co-Investing Club meets to vet together each month. Sometimes it’s a secured note with a fixed interest rate, sometimes it’s a private partnership, sometimes it’s a syndication.

The more options you have, the more control you have over your investments and your money. And that gives you more options in your life at large.

Curious about the Co-Investing Club and how we vet deals together? Join as a free member to get notified about our next deal discussion!

And like we do every Thursday, we’ll host an Open Office Hours Zoom call tomorrow at 3:30 EST. Show up and ask us about anything that’s on your mind!