At a Glance:

-

-

- Invest in Recession-Resilient and Inflation Proof Assets – Focus on real assets like real estate, commodities, and affordable housing projects that hold or increase value even during downturns. These provide stability when markets are volatile.

- Diversify with Niche Real Estate Strategies – Explore non-traditional strategies such as property tax abatements, Section 8 overhang, and industrial sale-leasebacks. These offer steady returns and lower competition compared to mainstream real estate investments.

- Expand Globally and Build Contingency Options – Protect your wealth from political or economic instability by investing internationally and maintaining backup residency or business plans in stable markets.

-

In an uncertain real estate market, investors are seeking alternative, high-performing strategies. Today, we explore five niche investment opportunities that have proven to generate strong returns, reduce risk, and provide diversification without relying on traditional value-add or renovation-heavy approaches.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

1. Property Tax Abatements: Boosting Value Without Renovation

Property tax abatement deals are becoming a favorite among savvy multifamily investors.

Here’s how they work:

An operator purchases a multifamily property like an apartment complex and partners with the local municipality to set aside a portion of units for affordable housing. These units are rented to tenants earning below a certain percentage of the area’s median income.

In exchange, the operator receives a partial or full property tax exemption, drastically reducing operating expenses.

Benefits:

-

- Immediate increase in net operating income (NOI)

- Higher property valuation without construction risk

- Greater occupancy stability

- Reduced exposure to economic downturns

This strategy delivers instant value creation without swinging a hammer or pulling permits.

2. Section 8 Overhang: A Creative Low-Income Housing Strategy

This ultra-niche strategy combines Low-Income Housing Tax Credits (LIHTC) with Section 8 vouchers to unlock hidden value.

Here’s the play:

Operators buy LIHTC properties that restrict tenant out-of-pocket rent payments. These properties typically underperform because they collect below-market rents. However, by working with tenants to obtain Section 8 vouchers, operators can collect full market rents (or higher) from government payments, while the tenant’s share remains within LIHTC limits.

Why It Works:

- Higher cash flow and property valuation

- Guaranteed government rent payments

- Reduced vacancy risk

- Recession resilience due to stable demand

It’s a smart way to turn affordable housing restrictions into an advantage, a true win-win for investors and tenants.

3. Mid-Range Land Flips: The Sweet Spot Between Small and Institutional Deals

Land flipping isn’t new but this refined, mid-tier approach is.

Instead of buying ultra-cheap lots ($500–$25,000) or competing with large institutional players, this strategy focuses on parcels between $25,000 and $250,000.

Operators purchase land for 35–60% of market value, then create instant equity through simple subdivisions splitting one parcel into up to five buildable lots without needing rezoning or special permits.

Sometimes they’ll make minor improvements (like adding a dirt access road) to boost appeal.

Why It’s Profitable:

- Low competition zone (too big for hobbyists, too small for institutions)

- Quick turnaround through subdivisions

- Strong 16%+ returns from steady distributions

This “middle-ground” strategy is both scalable and surprisingly low-risk.

4. Prefab Home Placements: Affordable Housing, Reinvented

Another innovative land-based investment involves installing manufactured or modular homes on buildable vacant lots.

These aren’t the outdated trailers of the past, modern prefab homes are permanent, high-quality structures affixed to foundations, often indistinguishable from site-built homes.

Investors buy lots with existing utility hookups (water, sewer, electricity), install a prefab home, and then sell to first-time buyers often at half the market’s median home price.

Example:

- Market median home price: $460,000

- Prefab home sale price: $230,000

Demand remains strong, even in recessions, because these homes provide quality and affordability in one package.

5. Industrial Sale-Leasebacks: Stability Through Strategic Partnerships

Finally, a powerful niche for passive investors industrial sale-leasebacks.

Here, an operator purchases industrial properties directly from companies that occupy them. The company sells the property to free up capital for expansion, then leases it back long-term.

Why It’s Smart:

- Reliable tenants with strong business models

- Immediate rental income and low vacancy risk

- Stable returns due to long-term leases

Example: One deal involved a metalworking company serving the U.S. Navy, with a backlog of orders through 2028. Even if no new orders arrive, their business (and rent payments) are secure for years making this a recession-resilient opportunity.

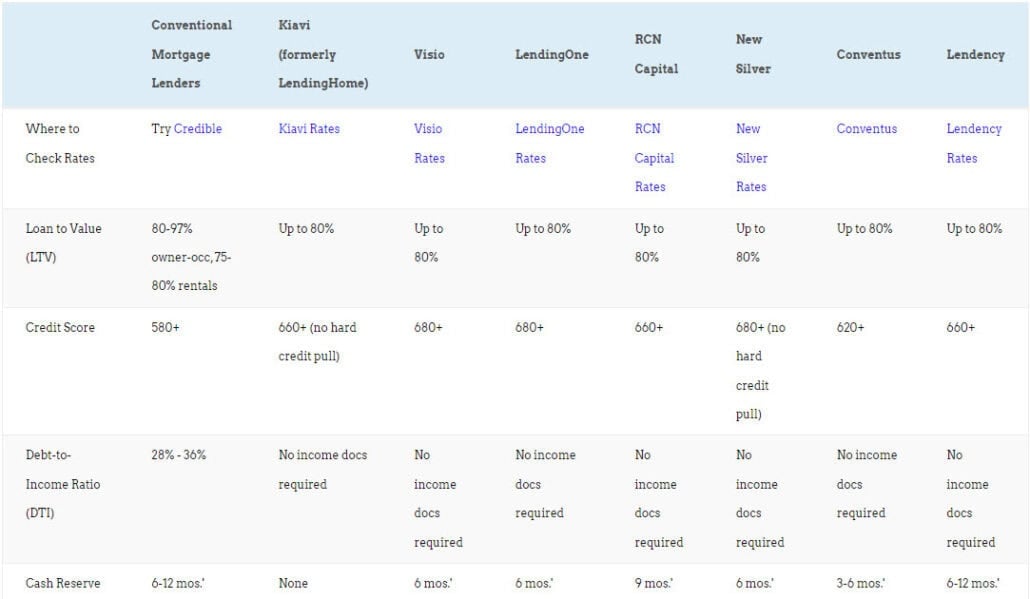

Want to compare investment property loans?

What do lenders charge for a rental property mortgage? What credit scores and down payments do they require?

How about fix-and-flip loans?

We compare the best purchase-rehab lenders and long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Final Thoughts: Diversify Deep and Wide

Each of these five niche strategies offers a different path to reliable returns and portfolio diversification.

-

- Property Tax Abatements

- Section 8 Overhang

- Mid-Range Land Flips

- Prefab Home Placements

- Industrial Sale-Leasebacks

The key is diversifying widely across multiple markets, operators, and asset types while investing deeply in niche operators who master one strategy exceptionally well.

In today’s unpredictable market, niche real estate investments like these provide not just returns but resilience.

Ready to Learn More?

If you’re new to passive real estate investing, check out our free passive real estate investing course covering syndications, funds, partnerships, and more in short, easy-to-understand lessons.

Stay curious, stay unconventional, and keep investing smart.