The Short Version:

-

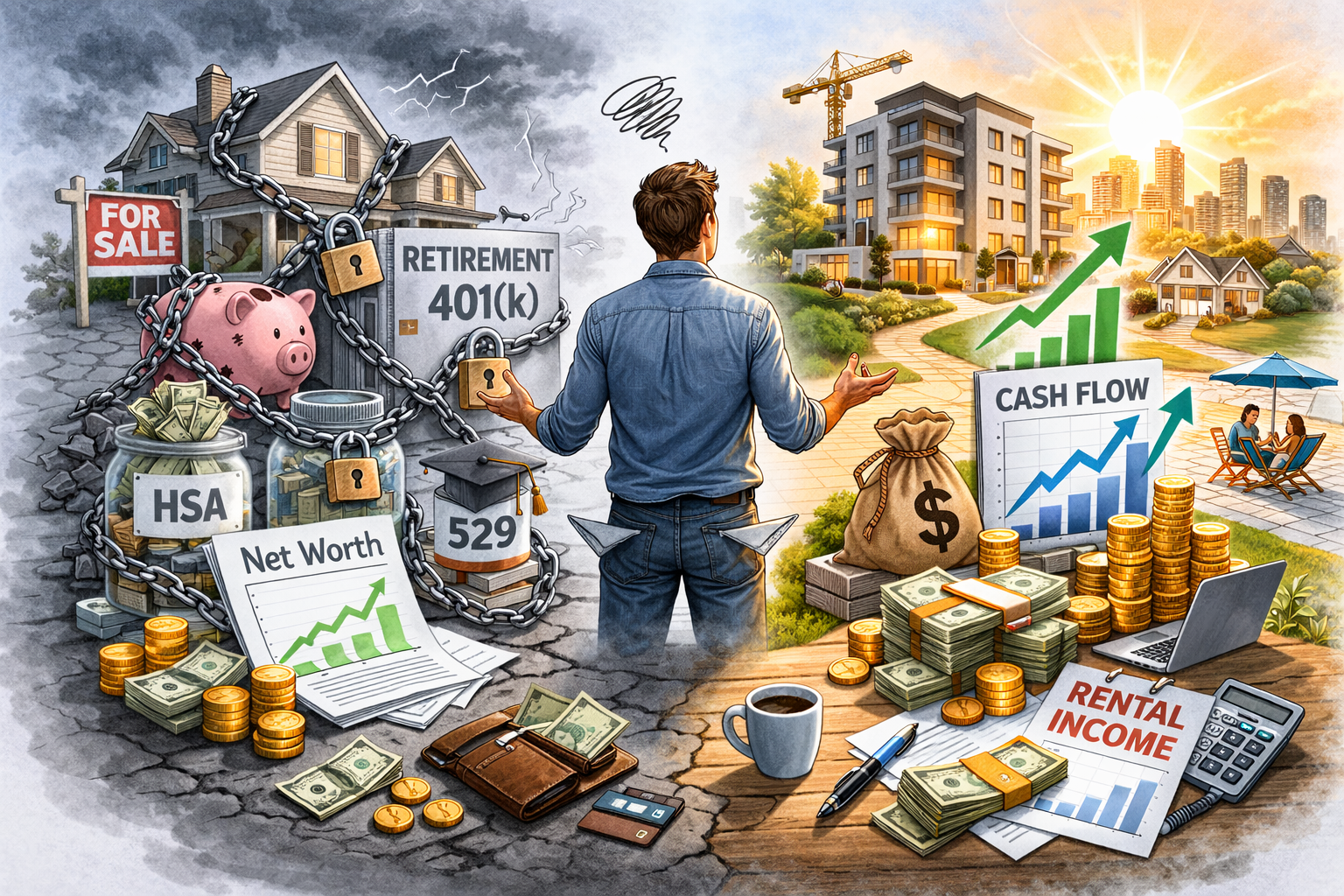

- You bought a house, maxed out your 401(k), funded the HSA and 529. On paper, you’re doing great. But when you actually need money… you can’t touch any of it.

- Most middle-class wealth is locked in illiquid assets, retirement accounts with penalties, and home equity you can’t easily access.

- The trap is optimizing for a retirement decades away while sacrificing flexibility today.

- There are ways out: Roth accounts, HELOCs, house hacking, and building income streams that pay you now instead of later.

On paper, you’re doing everything right.

You bought a house, you’re maxing out your 401(k), you’ve got money in an HSA, maybe a 529 for the kids. Your net worth looks solid when you add it all up.

But when you actually need money… for an opportunity, an emergency, or just to take a break from work… you realize something uncomfortable, and it’s that you can’t touch any of it.

This is the middle-class trap. You’ve accumulated assets but you’ve lost access to them. You’re wealthy on paper and broke in reality.

How the Trap Gets Set

Nobody sets out to lock up all their money. It happens gradually, one “responsible” decision at a time.

- You buy a house because that’s what adults do

- You fund an HSA because it’s triple tax-advantages

- You open a 529 because you want your kids to have options

- You put money in your 401(k) because your employer matches and the tax break is too good to pass up

Each of these decisions makes sense in isolation. They’re the things you’re supposed to do. Financial advisors recommend them and your parents validate it. Society rewards you for being responsible.

But add them all up and you’ve got a problem. Your entire net worth is tied up in places you can’t reach.

Want to retire early? You can’t access your retirement accounts without penalties. Want to take a year off to switch careers? Your money is locked behind tax walls. Want to invest in an opportunity that could accelerate your wealth? You’d have to liquidate something and pay through the nose to do it.

The trap is that you’ve optimized for a retirement that’s decades away while sacrificing flexibility today.

The Liquidity Problem

Liquidity is one of those financial concepts that doesn’t feel important until you need it.

Liquidity just means how easily you can convert an asset into cash you can actually use. A savings account is highly liquid. A retirement account is not. Home equity is somewhere in between. Meaning you can access it but it takes time and costs money.

Most middle-class wealth is illiquid. It’s trapped in homes that would need to be sold or borrowed against. It’s trapped in retirement accounts that penalize early withdrawals. It’s trapped in assets that are optimized for tax efficiency, not accessibility.

This creates a weird situation where people with substantial net worths live paycheck to paycheck. They’ve got $500,000 in home equity and $300,000 in retirement accounts but they’re stressed about cash flow. They can see their wealth on a spreadsheet, but they can’t use it to change their lives.

The “Hidden Cost” of Net Worth

You can’t retire early, even if your net worth would support it. You can’t take extended time off or jump on investment opportunities that require capital.

But there’s a deeper cost and that is… you stay dependent on your job longer than you need to.

Financial independence isn’t just about a big number on a spreadsheet. After all… what is it actually worth if you can’t cover your expenses without working. If all your wealth is locked up, you’ve just accumulated assets you can’t use.

I’ve talked to people in their 50s who have seven-figure net worths but feel trapped in jobs they hate. They could technically retire, but they can’t access their money without massive tax penalties. So they keep working, waiting for some magic age when the doors finally open.

That’s not financial freedom.

Escaping the Trap

The good news is there are ways out. Some of them involve restructuring how you save. Others involve building income streams that exist outside the traditional retirement account model.

- Roth Accounts Offer More Flexibility

If you’re going to use tax-advantaged accounts, Roth accounts are more flexible than traditional ones. Because you’ve already paid taxes on Roth contributions, you can withdraw your contributions (not the earnings) at any time without penalties.

This doesn’t solve the liquidity problem entirely, but it creates an escape hatch. If you need money before retirement age, you can pull out what you put in.

- Tap Into Home Equity Strategically

If you’ve got significant equity in your home, a HELOC (home equity line of credit) can provide liquidity without selling. It’s like a credit card tied to your house, but with much lower interest rates.

The key is using it strategically. Not for lifestyle inflation but for opportunities that generate returns higher than the interest cost. Accessing home equity to invest in income-producing assets can actually accelerate your path to financial independence.

- House Hack to Reduce Expenses

This one’s more hands-on, but it works. If you have extra space in your home, renting it out can dramatically reduce your housing costs.

I know someone who rented out the upstairs suite of her apartment on Airbnb. Two long weekends a month covered almost her entire rent. She was a renter herself but she got creative and turned her housing expense into something close to free.

Less money going out means less income you need to cover your lifestyle. That’s a direct path to flexibility.

- Build Income Streams Outside Retirement Accounts

This is the approach I’ve focused on personally. Instead of locking up all my investments in accounts I can’t touch, I invest in assets that generate income now.

Passive real estate is a big part of this. When you invest in real estate syndications, private notes, or debt funds, you’re not locking money away until you’re 60. You’re building income streams that pay distributions monthly or quarterly. That cash flow is accessible today, not decades from now.

Not to mention, private equity real estate comes with its own tax advantages. Depreciation can shelter much of the income you receive. You’re not giving up the tax benefits… you’re just getting them in a different structure, one that doesn’t trap your money.

Rethinking “Responsible” Investing

I’m not saying you should abandon retirement accounts entirely. They have their place and the employer match on a 401(k) is free money. Tax-deferred compounding is powerful over long time horizons.

But the conventional wisdom of maxing out every tax-advantaged account isn’t always the right move. If it leaves you with zero liquidity and zero flexibility, you’ve traded today’s freedom for a retirement that may or may not arrive when you expect it.

The smarter approach is balance. Put enough in retirement accounts to capture the obvious benefits (employer matches, tax deductions you actually need). Then direct the rest toward investments that give you flexibility and income now.

Build wealth you can actually access. Build income streams you can actually use. Don’t wait until 60 to start living the life you want.

(article continues below)

What’s The Point of Money?

Money is a tool. Its purpose is to give you options. If all your money is locked away where you can’t use it, you’ve defeated the purpose.

The middle-class trap is real and a lot of people fall into it while trying to do the responsible thing. They buy houses, fund retirement accounts and check all the boxes… only to realize they’ve built a prison out of their own assets.

The way out is to think differently about how you save and invest. Prioritize liquidity alongside growth. Build income streams that pay you now and not just when you retire. Give yourself the flexibility to make choices TODAY.

That’s what we focus on in the Co-Investing Club… building passive income through real estate investments that generate cash flow you can actually use. If you’re tired of watching your net worth grow while feeling broke, it might be worth a look.

Life’s too short to be wealthy on paper and stuck in reality.

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-25% on Fractional Real Estate Investments.