by G. Brian Davis | Last updated Feb 13, 2026 | Personal Finance, Spark Blog |

The Short Version: The difference of approach between a seasoned investor vs a novice Why we’re psychologically wired to focus on upside and ignore risk. It’s why so many investors get burned by deals that looked great on paper. The 2008 crash and the 2022...

by G. Brian Davis | Last updated Feb 11, 2026 | Personal Finance, Spark Blog |

The Short Version: Most people don’t avoid passive real estate because of risk. They avoid it because they don’t want to feel uninformed. Confidence doesn’t come from knowing everything. It comes from understanding the key moving parts and following a clear process....

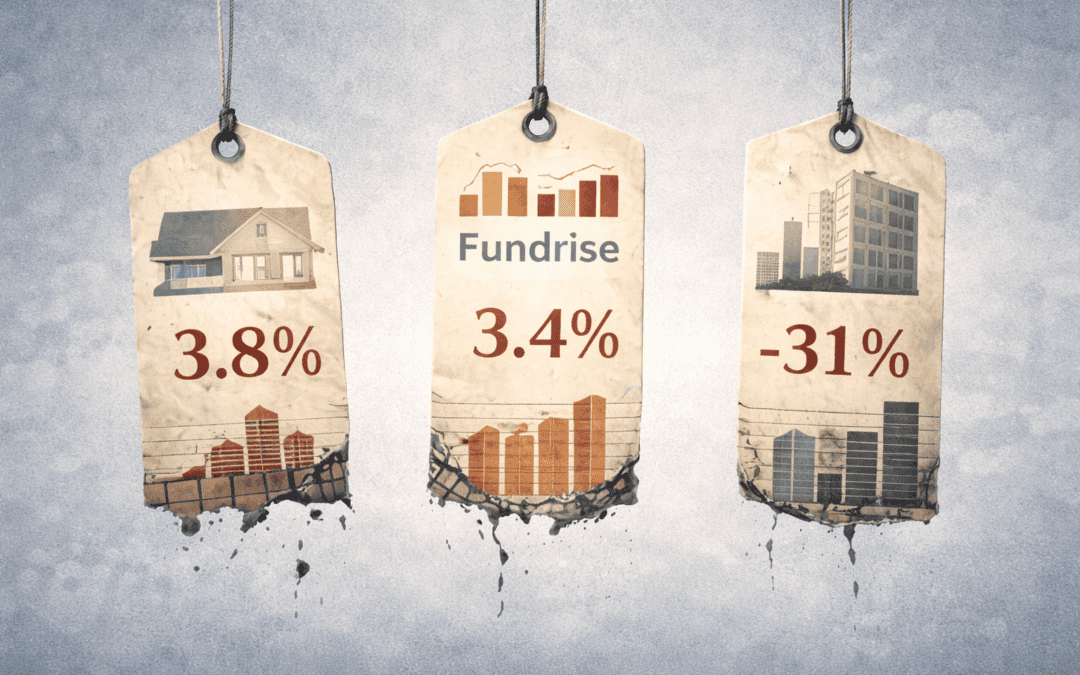

by G. Brian Davis | Last updated Feb 6, 2026 | Personal Finance, Spark Blog |

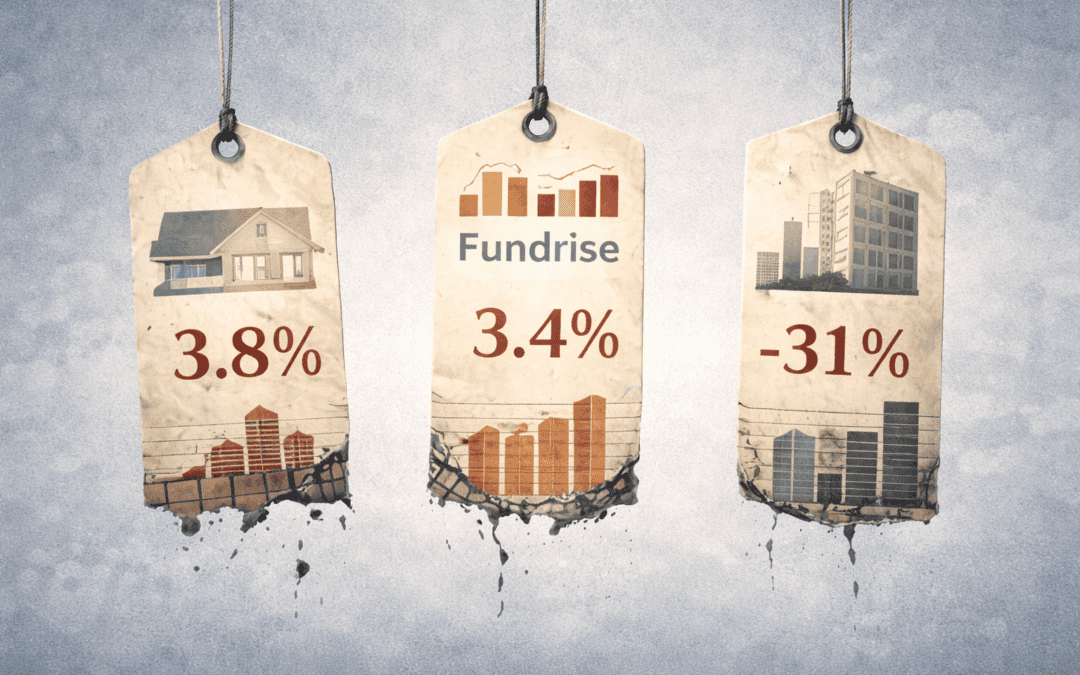

The Short Version: After years investing through crowdfunding platforms, I’ve shifted away due to high fees, limited liquidity, and better opportunities in direct real estate investments. Real estate crowdfunding promised passive income, but illiquidity,...

by G. Brian Davis | Last updated Feb 4, 2026 | Personal Finance, Spark Blog |

The Short Version: AI is already cutting entry-level and mid-level knowledge jobs. A Harvard study found a 22% reduction in entry-level postings at companies using AI. Some careers are more exposed than others. The jobs that survive require human judgment,...

by G. Brian Davis | Last updated Feb 2, 2026 | Personal Finance, Spark Blog |

The Short Version: “Your network = your net worth” sounds like a cliché. But there’s real research backing it up. The people around you shape your financial beliefs, behaviors, and access to opportunities, whether you realize it or not. The best...

by G. Brian Davis | Last updated Jan 28, 2026 | Passive Real Estate Investing, Personal Finance, Spark Blog |

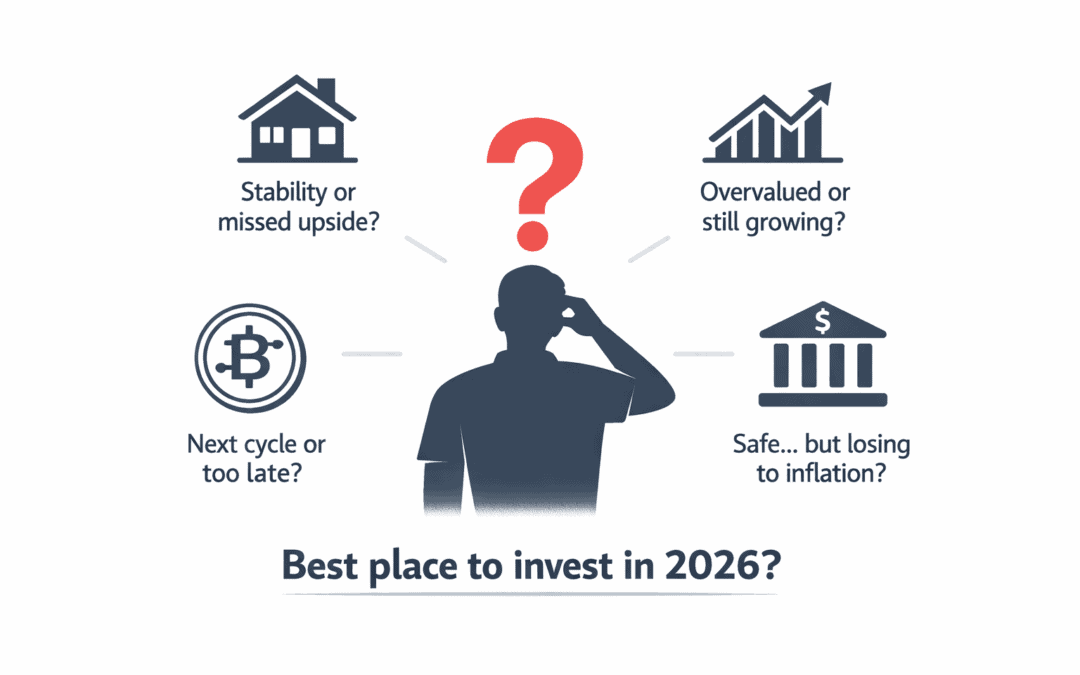

The Short Version: Most people default to stocks, crypto, or savings accounts without considering the trade-offs of each. The “safe” option might actually be costing you money every year. There’s a way to invest in real estate without becoming a...